Self-Storage Business Plan

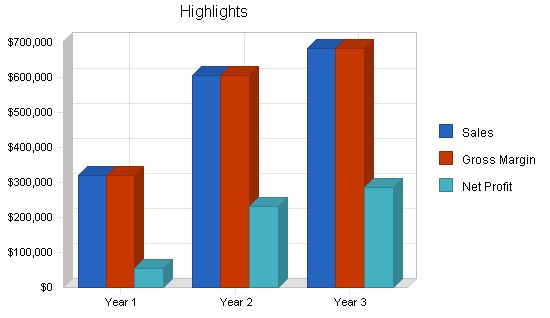

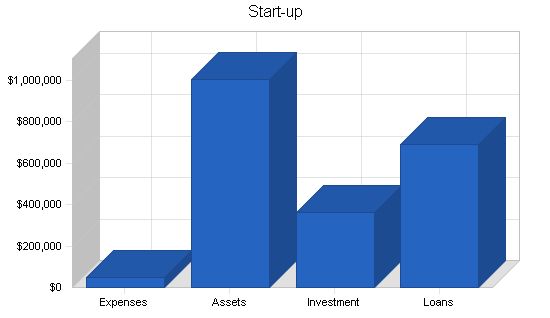

This business plan outlines a proposed self-storage facility in Westbury, New York. The plan involves converting an existing building, with total project costs estimated at $1,054,487 (including purchase price, conversion costs, and pre-opening expenses – see Start-up Summary). Rental revenue is projected to grow rapidly, from $320,000 in the first year to $684,000 by year three, based on current and projected high demand for self-storage units.

After achieving success in their present self-storage facility in Plainview, New York, the principals aim to establish a strong presence in Westbury. With the assistance of Stote Moving, the goal is to rent 50% of the proposed 300 unit spaces within the first six months of Year 1. An additional 25% will be rented in the second half of Year 1, with the remainder filled in Year 2.

The mission is to serve the Long Island community’s local storage and moving needs.

The keys to success in the self-storage business are:

1. Provide dry, secure, and clean facilities with convenient access.

2. Have good connections in the moving industry to direct customers needing temporary storage space.

3. Adapt as storage and market needs change.

Westbury Storage is a start-up project located in Westbury. The owners have experience in the moving and storage field, owning a moving company (Stote Movers) and a self-storage facility in Plainview (Plainview Storage). The building to be purchased for this project is a large brick building constructed as a bleachers around 1910. The building contains three floors of heavy-duty wood and steel beam construction suitable for self-storage units. It is estimated that the conversion into storage units could be completed and ready for occupancy by the end of the year. Demand for the units is strong, as evidenced by the market survey of existing self-storage facilities.

The company will be owned by three individuals: Roger Black, Sebastian Stote, and Daley Thompson. Each will own 1/3 of the stock. Roger Black and Sebastian Stote are 50-50 owners of Plainview Storage, a 110 unit self-storage facility converted in 1993 from a former piano factory. Sebastian Stote also owns Stote Movers, a family business providing residential and commercial moving since 1917.

Westbury Storage will be located in Westbury, about 1/2 mile from the monument in the center of Westbury. The owners’ present self-storage facilities are located in Plainview, with additional storage capacity in trailers in Roslyn.

Advertising and promotion will rely heavily on ads in the Yellow Pages and local newspapers. The start-up costs include property taxes, building maintenance, utilities (water, sewer, electricity, fuel oil, and trash removal), insurance (property and liability), telephone expenses, and bookkeeping/auditors/legal fees.

Start-up

Requirements

Start-up Expenses

Legal – $3,000

Stationery, etc. – $500

Brochures – $1,500

Consultants – $2,000

Insurance – $4,000

Rent – $0

Guard/Supervision – $15,000

Other – $23,739

Total Start-up Expenses – $49,739

Start-up Assets

Cash Required – $18,000

Other Current Assets – $0

Long-term Assets – $986,748

Total Assets – $1,004,748

Total Requirements – $1,054,487

Start-up Funding

Start-up Expenses to Fund – $49,739

Start-up Assets to Fund – $1,004,748

Total Funding Required – $1,054,487

Assets

Non-cash Assets from Start-up – $986,748

Cash Requirements from Start-up – $18,000

Additional Cash Raised – $0

Cash Balance on Starting Date – $18,000

Total Assets – $1,004,748

Liabilities and Capital

Liabilities

Current Borrowing – $0

Long-term Liabilities – $691,487

Accounts Payable (Outstanding Bills) – $0

Other Current Liabilities (interest-free) – $0

Total Liabilities – $691,487

Capital

Planned Investment

Roger Black – $121,000

Sebastian Stote – $121,000

Daley Thompson – $121,000

Additional Investment Requirement – $0

Total Planned Investment – $363,000

Loss at Start-up (Start-up Expenses) – ($49,739)

Total Capital – $313,261

Total Capital and Liabilities – $1,004,748

Total Funding – $1,054,487

Services

Westbury Storage will provide short- and long-term self-storage services in the North Shore community. The company owners have extensive experience in the storage business and good connections in the moving business, which will help maximize the use of storage space. Westbury Storage will offer 45,000 square feet of well-maintained self-storage units for residential and small business renters.

Competitive Comparison

All self-storage facilities in Westbury and the surrounding area were surveyed with the following results:

Name – Size – Price

Oliver St. Mini Storage – 5X10 – $48

– 10X10 – $75

E-Z Mini Storage – 5X5 – $37

S. Centreport – 5X10 – $67 +$25 deposit

Extra Space Storage – 5X5 – $49 + $9 fee

– 10X10 – $106 (second floor)

– – – $139 (ground floor)

Washington – 8X6 – $50

47 State – 9X9 – $50 (second floor)

Public Storage – 5X5 – $35

Merrick Road. – 5X10 – $55

– 10X10 – $95

– 10X15 – $129

– 10X20 – $147

North Shore Self Storage – 5X5 – $45 + $5 fee

– 5X10 – $70 (second floor)

– 10X15 – $130

U-Haul – 5X10 – $42.95

– 10X10 – $95

Prices average at $1.20 per sq. ft. per month. Mean price is closer to $1.40.

Market Analysis Summary

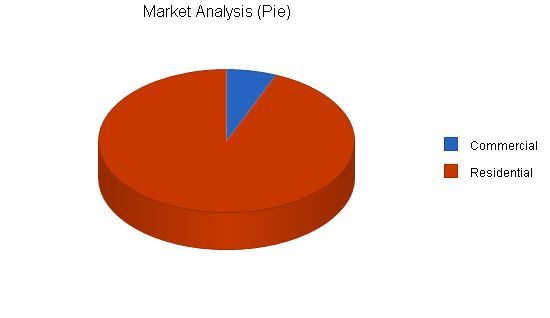

Westbury Storage is expecting to rent 70% of its units to non-commercial renters and 30% to the commercial sector. A total of 300 self-storage units will be created in downtown Westbury to meet the demand of both residential and commercial customers. The existing units in the area are priced more than double the national average.

Market Segmentation

70% of the planned units will be taken up by residential customers, while 30% will be directed towards the commercial segment. The commercial segment consists of small businesses, many of which operate from people’s homes and require additional storage space. The market potential for the commercial self-storage service in the Westbury area is estimated to be 10,000 customers per year. The residential segment has a potential of 150,000 customers per year. Both segments are expected to grow at a 5% annual rate.

[Edited for conciseness and clarity]

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Commercial 5% 10,000 10,500 11,025 11,576 12,155 5.00%

Residential 5% 150,000 157,500 165,375 173,644 182,326 5.00%

Total 5.00% 160,000 168,000 176,400 185,220 194,481 5.00%

Target Market Segment Strategy

Since the demand for local self-storage services exceeds the local supply, Westbury Storage will market its services to residential and small business customers. The company will not pursue large business segment due to the limited service scope at the existing facilities.

The market analysis shows that local self-storage rates are higher than national averages. Westbury Storage will position itself as a conveniently located and affordable self-storage facility. Both customer segments will be reached via Yellow Pages ads and referrals from Stote Movers, owned by one of Westbury Storage’s co-owners.

Market Needs

Customer needs in the self-storage industry have similarities across segments. The underlying need is for a reliable, safe, dry, and accessible self-storage facility. Customers are less price sensitive and consider convenience as the major buying decision criterion.

Residential customers use self-storage facilities temporarily while moving. They typically rent 25 to 100 square feet, depending on household size, on a weekly or monthly basis. Another cluster of residential customers rents for longer periods to store oversize property.

Small business customers require self-storage facilities to temporarily store stock or merchandise. They benefit from convenient loading areas, extended operating hours, and well-equipped storage units.

Service Business Analysis

The national industry average rental income for self-storage units is $6.00 per square foot per year, or $.50/sq. ft. per month. Local self-storage rates are more than double that. Westbury Storage’s rates will be even higher. Availability in the market is limited.

The self-storage industry started in the late 1960’s and has doubled in size each decade. Returns on investment are impressive, often twice that of other real estate investments. The industry is relatively easy to financial model.

The higher than national average rates enjoyed by local self-storage facilities may not continue indefinitely, but there is no indication of any downward pressure. The industry does not suffer as much during economic downturns.

Business Participants

The self-storage market is fairly dispersed with many small companies taking part.

Competition and Buying Patterns

Convenience is the most important factor in choosing a self-storage unit. Residents rent in nearby towns based on proximity to their commute. Ground floor units are favored, especially if no elevator is available.

Main Competitors

Competition plays a weak role in the present market situation.

Strategy and Implementation Summary

The sales and marketing strategy is simple due to the shortage of self-storage facilities. Westbury Storage will inform the public through local newspaper ads and Yellow Pages ads.

Competitive Edge

Westbury Storage will establish a strong foothold in the local community by providing excellent service and offering extra features like heated and well-lit rental units.

Sales Strategy

Most inquiries will come through Yellow Pages ads. Proper telephone manners and professional handling of on-site inquiries are essential. Sales are directed through Stote Movers, who are in contact with people on the move.

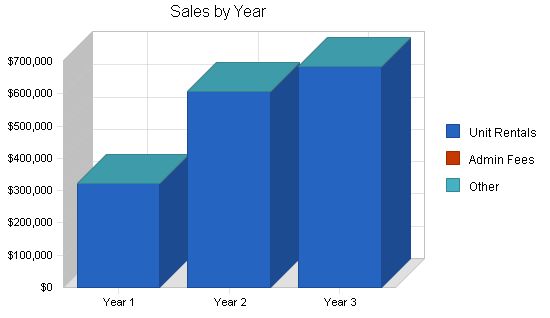

Due to high demand, Westbury Storage may rent out all of its new units within the first year of operation. Ground floor units will rent at $1.40 per sq. ft. per month and upper floors will rent for $1.20/sq. ft. per month. The growth will be assumed to be straight line, with half of the units rented in the first six months.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Unit Rentals | $320,625 | $605,625 | $684,000 |

| Admin Fees | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Sales | $320,625 | $605,625 | $684,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Unit Rentals | $0 | $0 | $0 |

| Admin Fees | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

Contents

Strategic Alliances

An important strategic alliance is the ownership connection to Stote Movers. Stote Movers directs a lot of storage business to Westbury Storage due to its contact with people changing addresses.

Milestones

The table below shows the milestones established by Westbury Storage.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Purchase Building | 6/1/1998 | 6/1/1998 | $550,000 | Black/Stote | Mngmt |

| Elevator Contract | 7/1/1998 | 7/1/1998 | $89,760 | Black/Stote | Mngmt |

| Conversion Contract | 7/1/1998 | 7/1/1998 | $300,000 | Black/Stote | Mngmt |

| Opening Ads | 12/15/1998 | 12/15/1998 | $1,000 | Black/Stote | Mngmt |

| Brochures/Stationery | 12/15/1998 | 12/15/1998 | $6,000 | Black/Stote | Mngmt |

| Totals | $946,760 | ||||

Management Summary

Roger Black and Sebastian Stote, successful in the moving and self-storage industries, will manage Westbury Storage.

Personnel Plan

Operating hours are planned to be 7 a.m. to 7 p.m. Monday through Friday and 9 a.m. to 5 p.m. on Saturdays. Westbury Storage will be closed on Sundays.

The manager will work a normal 40-hour week at an annual salary of $35,000. A maintenance man will be employed at a salary of $24,000, and a night watchman will be employed at a salary of $24,000.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $35,000 | $35,000 | $35,000 |

| Maintenance Man | $24,000 | $24,000 | $24,000 |

| Night Guard | $24,000 | $24,000 | $24,000 |

| Other | $0 | $0 | $0 |

| Total People | 3 | 3 | 3 |

| Total Payroll | $83,000 | $83,000 | $83,000 |

Financial Plan

A commercial loan needs to be negotiated to finance approximately 70% of the total project costs. A 15-year mortgage will be applied for with an 8.5% interest rate. The first drawdown will occur upon agreement of the seller and buyer regarding the terms of building sale. The last drawdown will occur around the end of the year when all conversions to self-storage units are completed. The first repayment of principal is planned for April 1999, with monthly installments of interest and principal to continue until the loan is fully repaid in 2013.

Important Assumptions

As of this writing, interest rates for commercial loans are 8.5% fixed for three years or 8.75% fixed for a five-year period. Beyond this time frame, rates are quoted at 1% above the Fleet Bank floating rate.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 8.50% | 8.50% | 8.50% |

| Long-term Interest Rate | 8.50% | 8.50% | 8.50% |

| Tax Rate | 37.33% | 38.00% | 37.33% |

| Other | 0 | 0 | 0 |

Key Financial Indicators

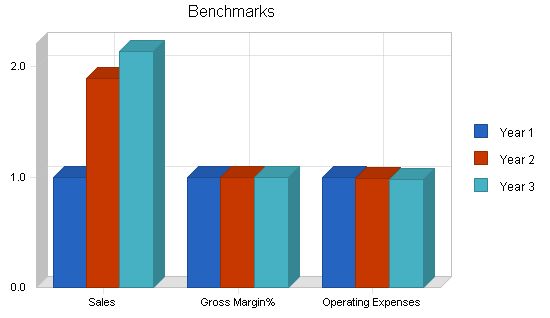

The chart below shows the benchmarks for Westbury.

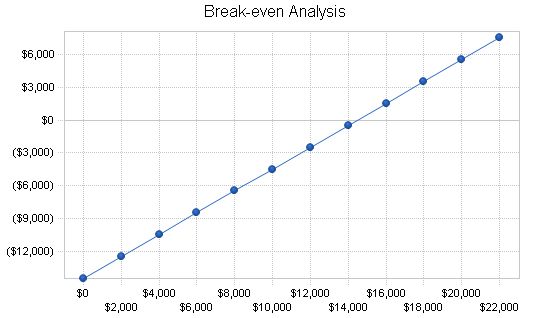

Break-even Analysis:

The table and chart below illustrate our Break-even Analysis.

| Break-even Analysis | |

| Monthly Revenue Break-even | $14,477 |

| Assumptions: | |

| Average Percent Variable Cost | 0% |

| Estimated Monthly Fixed Cost | $14,477 |

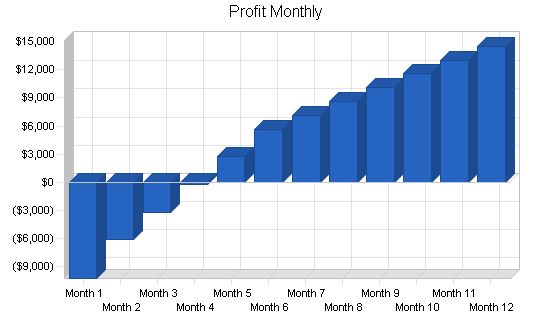

Projected Profit and Loss

Advertising and promotion will heavily rely on Yellow Pages ads and initial local newspaper ads at the time of opening. We assume three directories for Yellow Pages ads with 1/8th page ads costing $165/month each. The ads in the local papers (Springfield News and community newspapers) are estimated to cost $300 monthly for the first year only. They will be reduced to half this amount in the second year and eliminated in the third year.

Property taxes ($11,946) are projected at the actual rate of the tax year 7/1/96-6/30/97. Significant increases are not expected.

Building maintenance is normally a substantial item on a building of this size built in 1910. However, the roof has been recently redone and the building’s structure is robust. The start-up costs reflect adequate amounts to ready the building for opening. Additionally, expenditures for building maintenance would be larger if the building were used for offices rather than storage. We assume an annual amount for maintenance equal to 5% of the purchase price, which is $27,500.

Utilities:

- Water and sewer are assumed at historical levels of $262 per year.

- Westbury Municipal Light’s bills totaled $13,714 last year when the present tenant was operating production with full staffing. As a self-storage facility, electricity is needed only to power the rows of low-draw tube lighting. We estimate electricity to cost about $250/month.

- Fuel oil for heating cost $13,881 last year. Since as a self-storage facility, the level of heating does not need to be nearly as high, we estimate an annual bill of half this amount, or $7,000.

- Trash removal is projected at historical levels of $536 per year.

- The total for utilities is estimated to be $900 monthly.

Insurance:

Property and Liability Insurance amounted to $15,000 annually for the present tenant. We’ll assume the same annual cost.

Telephone:

Most of the telephone bill will be the charges for the Yellow Pages ads. These costs are already included in advertising and promotion. We assume the monthly telephone bill to amount to $150.

Bookkeeping/auditors/legal:

Bookkeeping and billing will be handled by the same system used at Plainview Storage and charged at a rate of $300 per month. Auditor charges will be about $4,000 annually.

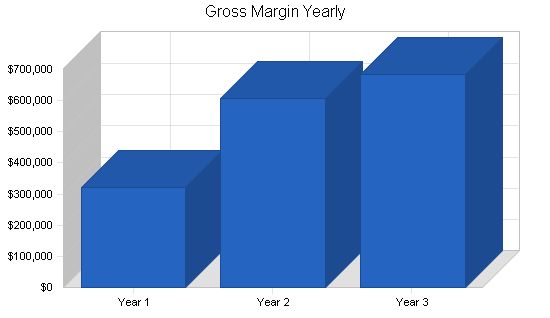

Pro Forma Profit and Loss

Sales:

Year 1: $320,625

Year 2: $605,625

Year 3: $684,000

Direct Cost of Sales:

Year 1-3: $0

Other:

Year 1-3: $0

Total Cost of Sales:

Year 1-3: $0

Gross Margin:

Year 1: $320,625

Year 2: $605,625

Year 3: $684,000

Gross Margin %:

Year 1-3: 100.00%

Expenses:

Payroll:

Year 1-3: $83,000

Sales and Marketing and Other Expenses:

Year 1: $54,422

Year 2: $52,622

Year 3: $50,822

Depreciation:

Year 1-3: $15,000

Rent:

Year 1-3: $0

Leased Equipment:

Year 1-3: $0

Utilities:

Year 1-3: $10,800

Payroll Taxes:

Year 1-3: $10,500

Other:

Year 1-3: $0

Total Operating Expenses:

Year 1: $173,722

Year 2: $171,922

Year 3: $170,122

Profit Before Interest and Taxes:

Year 1: $146,904

Year 2: $433,704

Year 3: $513,879

EBITDA:

Year 1: $161,904

Year 2: $448,704

Year 3: $528,879

Interest Expense:

Year 1-3: $58,776

Taxes Incurred:

Year 1: $34,658

Year 2: $142,472

Year 3: $169,905

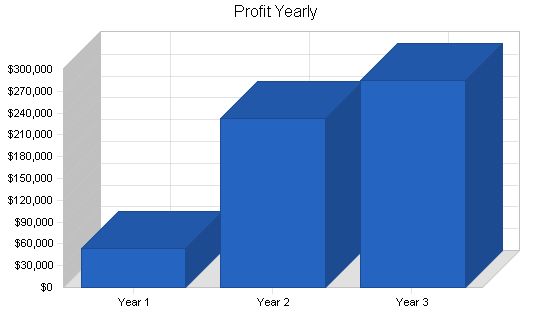

Net Profit:

Year 1: $53,469

Year 2: $232,455

Year 3: $285,197

Net Profit/Sales:

Year 1: 16.68%

Year 2: 38.38%

Year 3: 41.70%

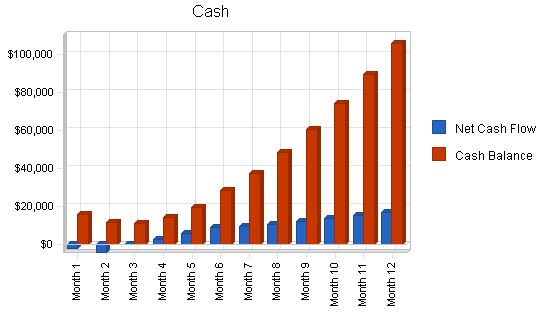

Projected Cash Flow

The following chart and table represent the cash flow for Westbury Storage.

Pro Forma Cash Flow

Cash Received

Cash from Operations

Cash Sales

Subtotal Cash from Operations

Additional Cash Received

Sales Tax, VAT, HST/GST Received

New Current Borrowing

New Other Liabilities (interest-free)

New Long-term Liabilities

Sales of Other Current Assets

Sales of Long-term Assets

New Investment Received

Subtotal Cash Received

Expenditures

Expenditures from Operations

Cash Spending

Bill Payments

Subtotal Spent on Operations

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out

Principal Repayment of Current Borrowing

Other Liabilities Principal Repayment

Long-term Liabilities Principal Repayment

Purchase Other Current Assets

Purchase Long-term Assets

Dividends

Subtotal Cash Spent

Net Cash Flow

Cash Balance

Projected Balance Sheet

Pro Forma Balance Sheet

Assets

Current Assets

Cash

Other Current Assets

Total Current Assets

Long-term Assets

Long-term Assets

Accumulated Depreciation

Total Long-term Assets

Total Assets

Liabilities and Capital

Current Liabilities

Accounts Payable

Current Borrowing

Other Current Liabilities

Subtotal Current Liabilities

Long-term Liabilities

Total Liabilities

Paid-in Capital

Retained Earnings

Earnings

Total Capital

Total Liabilities and Capital

Net Worth

Ratio Analysis

Sales Growth

Percent of Total Assets

Other Current Assets

Total Current Assets

Long-term Assets

Total Long-term Assets

Total Assets

Current Liabilities

Long-term Liabilities

Total Liabilities

Net Worth

Percent of Sales

Sales

Gross Margin

Selling, General & Administrative Expenses

Advertising Expenses

Profit Before Interest and Taxes

Main Ratios

Current

Quick

Total Debt to Total Assets

Pre-tax Return on Net Worth

Pre-tax Return on Assets

Additional Ratios

Net Profit Margin

Return on Equity

Activity Ratios

Accounts Payable Turnover

Payment Days

Total Asset Turnover

Debt Ratios

Debt to Net Worth

Current Liab. to Liab.

Liquidity Ratios

Net Working Capital

Interest Coverage

Additional Ratios

Assets to Sales

Current Debt/Total Assets

Acid Test

Sales/Net Worth

Dividend Payout

Appendix

Sales Forecast

Unit Rentals

Admin Fees

Other

Total Sales

Direct Cost of Sales

Unit Rentals

Admin Fees

Other

Subtotal Direct Cost of Sales

Personnel Plan

Manager

Maintenance Man

Night Guard

Other

Total People

Total Payroll

General Assumptions:

Plan Month: 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate: 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50%

Long-term Interest Rate: 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50%

Tax Rate: 30.00% 38.00% 38.00% 38.00% 38.00% 38.00% 38.00% 38.00% 38.00% 38.00% 38.00% 38.00% 38.00%

Other: 0 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss:

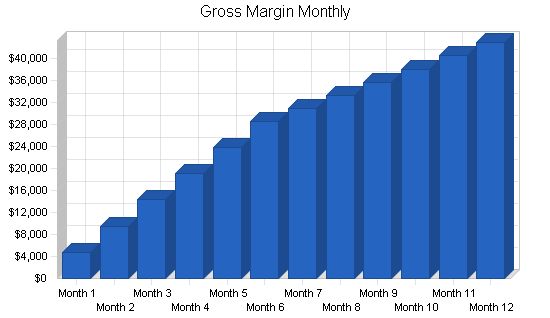

Sales: $4,750 $9,500 $14,250 $19,000 $23,750 $28,500 $30,875 $33,250 $35,625 $38,000 $40,375 $42,750

Direct Cost of Sales: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Gross Margin: $4,750 $9,500 $14,250 $19,000 $23,750 $28,500 $30,875 $33,250 $35,625 $38,000 $40,375 $42,750

Gross Margin %: 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Expenses:

Payroll: $6,916 $6,917 $6,916 $6,916 $6,917 $6,916 $6,917 $6,917 $6,917 $6,917 $6,917 $6,917 $6,917

Sales and Marketing and Other Expenses: $4,535 $4,535 $4,536 $4,535 $4,535 $4,535 $4,536 $4,536 $4,534 $4,535 $4,535 $4,535 $4,535

Depreciation: $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250

Rent: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Leased Equipment: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Utilities: $900 $900 $900 $900 $900 $900 $900 $900 $900 $900 $900 $900 $900

Payroll Taxes: 13% $875 $875 $875 $875 $875 $875 $875 $875 $875 $875 $875 $875 $875

Other: $0 $0 $0 $0 $0 $0 $0 $0 $0

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!