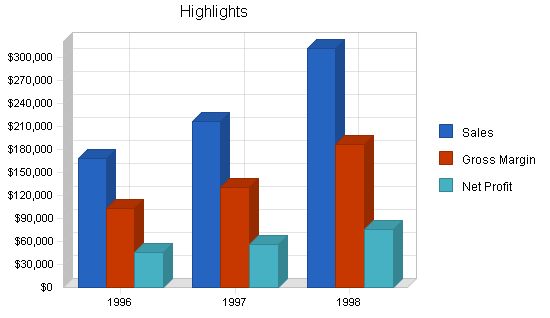

Salvador’s is a manufacturer of Hispanic foods, specializing in salsa and chips. They position themselves as high-quality and high-priced. Over the past three years, Salvador’s has gained popularity and expanded beyond the Hispanic community.

Salvador’s has several objectives for the next three years: increasing sales to two million dollars by Year 5, maintaining gross margins above 55%, establishing 40 outlets for distribution, and becoming the premier Hispanic food producer in the area.

Currently, Salvador’s offers two main product lines: their renowned salsa, known for freshness and quality, and fresh chips in both yellow and blue corn.

Salvador’s targets three customer groups: grocery stores, wholesale distributors, and restaurants. These segments are growing at 75%, 100%, and 45%, respectively. Originally targeting the Hispanic community, Salvador’s products have gained broader appeal.

At their high price point, Salvador’s faces few direct competitors, which gives them an advantage in establishing themselves as the premier brand of authentic Hispanic food.

Salvador’s management team, led by Ricardo and Pat Torres, ensures sustainable growth. Pat, the President, has 12 years of food industry experience, and Ricardo brings six years of financial control experience as a CPA.

Salvador’s expects to reach profitability in three years, with a modest net profit achieved through sales. The financials reinforce the exciting nature of this business.

1.1 Objectives:

– Increase sales significantly in the next three years.

– Improve gross margin % on the current product line and maintain that level.

– Add products and services to meet market demand at a high gross margin.

– Improve inventory turnover and reduce the cost of goods sold while maintaining product quality.

– Provide rewarding and fulfilling jobs to the Hispanic community.

1.2 Mission:

Salvador’s was built on offering high-quality and valuable authentic hot salsa, infused with the history of the Hispanic community. Family recipes, rich in ethnic heritage, have been passed down generations. Knowledgeable consumers sought authentic products with the best ingredients. Salvador’s answered this call by introducing hot, mild, and extra hot salsa, as well as yellow and blue corn chips. We constantly review the market to improve on what’s available and meet consumer demands.

1.3 Keys to Success:

– Deliver high-quality products that stand out in taste and value.

– Provide exceptional service, support, and margin to our dealers.

– Increase gross margin %.

– Introduce new products to drive sales volume.

Salvador’s is in its third year, with sales increasing five-fold in the second year and projected to repeat this growth in the third year. We have established a strong reputation, a talented team, and an expanding presence in the local market. We also have opportunities to expand into other states. Currently, we have over 40 outlets, with two major grocery chains in the approval process to carry our full product line. Additionally, a large distributor plans to sell over $100,000 worth of our products annually.

See enclosed copies of letters from Moctezuma Foods, Inc., Meijer, Inc., and others.

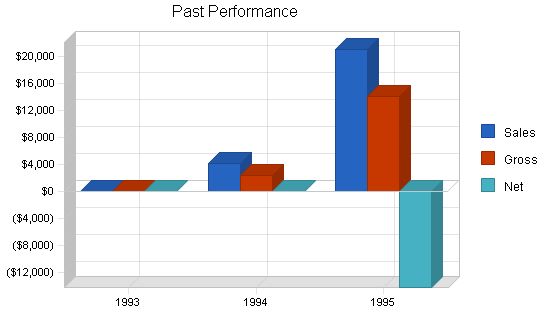

2.1 Company History:

Salvador’s faced initial challenges due to a lack of working capital during its setup and early operations. However, sales are steadily growing, and the cost of goods sold is consistently decreasing. To make significant progress, additional capital is required to purchase ingredients and increase processing volumes, resulting in a 32% reduction in costs of goods sold overall.

| Past Performance | |||

| 1993 | 1994 | 1995 | |

| Sales | $0 | $4,224 | $21,050 |

| Gross Margin | $0 | $2,451 | $14,160 |

| Gross Margin % | 0.00% | 58.03% | 67.27% |

| Operating Expenses | $0 | $12,028 | $20,719 |

| Collection Period (days) | 0 | 0 | 0 |

| Inventory Turnover | 0.00 | 6.00 | 5.00 |

| Balance Sheet | |||

| 1993 | 1994 | 1995 | |

| Current Assets | |||

| Cash | $0 | $0 | $126 |

| Accounts Receivable | $0 | $0 | $0 |

| Inventory | $0 | $0 | $3,492 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $0 | $0 | $3,618 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $23,368 |

| Accumulated Depreciation | $0 | $0 | $9,792 |

| Total Long-term Assets | $0 | $0 | $13,576 |

| Total Assets | $0 | $0 | $17,194 |

| Current Liabilities | |||

| Accounts Payable | $0 | $0 | $0 |

| Current Borrowing | $0 | $0 | $16,207 |

| Other Current Liabilities (interest free) | $0 | $0 | $0 |

| Total Current Liabilities | $0 | $0 | $16,207 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $0 | $0 | $16,207 |

| Paid-in Capital | $0 | $0 | $25,000 |

| Retained Earnings | $0 | $0 | ($9,755) |

| Earnings | $0 | $0 | ($14,258) |

| Total Capital | $0 | $0 | $987 |

| Total Capital and Liabilities | $0 | $0 | $17,194 |

| Other Inputs | |||

| Payment Days | 0 | 0 | 0 |

| Sales on Credit | $0 | $0 | $0 |

| Receivables Turnover | 0.00 | 0.00 | 0.00 |

Contents

- 1 Products

- 2 Market Analysis Summary

- 3 Strategy and Implementation Summary

- 3.1 5.1 Marketing Strategy

- 3.2 5.1.1 Promotion Strategy

- 3.3 5.1.2 Distribution Strategy

- 3.4 5.1.3 Pricing Strategy

- 3.5 5.2 Sales Strategy

- 3.6 5.2.1 Sales Programs

- 3.7 5.2.2 Sales Forecast

- 3.8 5.3 Strategic Alliances

- 3.9 5.4 Milestones

- 3.10 7.3 Break-even Analysis

- 3.11 Projected Cash Flow

- 3.12 7.6 Projected Balance Sheet

- 3.13 7.7 Business Ratios

- 4 Business Plan Outline

2.2 Company Ownership

Salvador’s is a privately-held C Corporation owned by its co-founders, Ricardo and Pat Torres.

2.3 Company Locations and Facilities

We currently have one location in suburban Perrysburg, which includes the production area, offices, and warehouse. We are considering expanding the warehouse and adding a store front to improve sales practices and provide a high-quality outlet for Hispanic foods.

Products

Salvador’s sells authentic Hispanic salsa and chips to a growing clientele. Originally targeted at the local Hispanic community, our market has expanded geographically and attracted a broad consumer response.

We provide quality and unique products in a competitive market. We aim to elevate our product image due to our rich heritage and unwavering commitment to quality. This approach allows us to identify gaps in the market and develop products to fill them. We have studied and analyzed other ethnic food organizations to position ourselves similarly.

Salvador’s is known for high quality and value, offering authentic Hispanic flavors. We treat our dealers as family, going above and beyond to provide them with top-notch products and the opportunity for on-site product demonstrations at no cost. We plan to continue offering this service, but at a minimal cost in the future to reduce expenses.

3.1 Product Description

We offer two main product lines:

- Our original product, Salsa, is available in hot, extra hot, and mild flavors.

- We also offer yellow corn and blue corn chips.

3.2 Competitive Comparison

To differentiate ourselves, we emphasize the quality and authenticity of our ingredients and the heritage of our family recipe.

We offer more than just a jar of salsa. Our masterfully blended ingredients create a taste and true Hispanic authenticity that cannot be matched.

Our simple products need to be presented in a way that encourages consumers to give us a chance. Once they try our product, we aim to establish a long-term relationship with them.

Compared to other well-known brands, we can charge a premium for our salsa due to its rich and authentic taste.

3.3 Sales Literature

We are developing new brochures and sales materials to assist our marketing efforts, as well as those of our dealers. Our redesigned labels reflect our direction in this area (see appendix/attachment for a copy).

3.4 Sourcing

Our costs are a significant factor in our profit margin. As our orders increase, we need to increase production in a way that maintains our margin. We have found a local supplier who can handle larger batches of salsa while maintaining our high quality, reducing production costs by over 32% per jar.

We continue to seek opportunities to reduce production costs while preserving quality. Our outsourcing for corn chips has shown that we can contract for a high-quality product to meet our gross profit margin goals

3.5 Future Products

We are currently researching the addition of an authentic Hispanic Sauce, as well as other Hispanic food items, to expand our product offerings and generate more interest in Salvador’s, Inc.

In addition to new products, we are exploring other avenues for marketing our overall line, such as establishing a small store front and eventually a lunch counter or small restaurant setting.

Market Analysis Summary

We have been selling our products at a rate of $2,500 per month to local restaurants, small grocery stores, and Hispanic food distributors. We are awaiting approval from a large grocery chain to sell our products and have received a commitment from a large distributor to purchase $100,000 to $150,000 worth of product per year. We have also approached several other large grocery chains that are considering carrying the Salvador’s product line.

4.1 Market Segmentation

The Hispanic food industry is booming, offering a wide range of items from various vendors. Salvador’s approaches the market as a Specialty Retailer, providing authentic high-quality Hispanic salsa and chips.

We have made significant progress with several local restaurants and a small grocery store, establishing a market presence. We are now looking to develop our own store front to cater specifically to the Hispanic client and individuals who appreciate authentic Hispanic cuisine.

In addition to our current efforts, we are considering packaging our products for fundraising events, corporate promotions, and the possibility of a house restaurant to further promote our products.

| 1996 | 1997 | 1998 | 1999 | 2000 |

| Potential Customers | Growth | CAGR | ||

| Grocery Stores | 75% | 75.17% | ||

| Distributors | 100% | 100.00% | ||

| Restaurants | 45% | 45.20% | ||

| Other | 12% | 10.67% | ||

| Total | 67.32% | 67.32% |

4.2 Target Market Segment Strategy

We are initially focusing on the Hispanic community to emphasize authenticity and gain indirect promotion through their product choices.

4.2.1 Market Growth

The market analysis reveals a diverse range of potential clients. The mainstream American market is projected to grow at 12% per year, while the Hispanic segment is projected to grow at 22% per year.

4.3 Industry Analysis

The Hispanic food industry is gaining popularity, and Salvador’s stands out due to its authentic taste.

While the economy may impact various sectors, food items, especially specialty products, tend to fare well in the market.

4.3.1 Competition and Buying Patterns

There are numerous suppliers of salsa and similar products, yet there is still room for new products and companies.

Positioning ourselves in the higher end of the market allows us to consistently sell our product and expand our audience by entering larger grocery chains.

4.3.2 Main Competitors

Despite being compared to established market leaders such as Chi – Chi’s, El Paso, and Hunt’s, Salvador’s differentiates itself by offering a fresh approach to authentic taste and texture.

4.3.3 Industry Participants

Although there are several vendors offering competitive products, Salvador’s salsa and chips stand out with vibrant packaging and positioning that catches the consumer’s eye.

4.3.4 Distribution Patterns

While brand names carry weight in the marketplace, our unique marketing approach, displaying and demonstrating our products in local restaurants and grocery stores, builds consumer awareness at a fraction of the cost of traditional advertising methods.

In addition, participating in food fairs and festivals allows us to interact directly with consumers, gaining firsthand insight into their preferences.

Strategy and Implementation Summary

Our strategy focuses on serving niche markets effectively, meeting the needs of consumers who seek high-quality and authentic products. We utilize multiple avenues, including grocery stores and major distributors, to achieve continuous exposure for Salvador’s name.

5.1 Marketing Strategy

We prioritize consumer exposure through grocery stores and aim to expand our reach through restaurants and other food establishments.

Performing a SWOT analysis can help develop effective business strategies. Get a free guide and template to learn how.

5.1.1 Promotion Strategy

Our long-term goal is to gain enough visibility to expand into other distribution sites within our region and eventually move into new geographical regions as inquiries and distribution requests arise.

Our contacts with grocery chains extend beyond the local region due to their normal distribution channels. Our aim is to grow along with them.

5.1.2 Distribution Strategy

We constantly improve our packaging to enhance corporate identity, incorporating features like barcodes and nutritional information.

5.1.3 Pricing Strategy

We provide competitive pricing, allowing for generous mark-ups to benefit our dealers while ensuring a satisfactory experience for consumers. Our salsa retails for $2.79 to $3.05 per jar, positioning us in the mid-to-upper price range of the salsa market and offering a 33% margin for dealers.

5.2 Sales Strategy

Our main focus for the next five years is expanding our current distribution channels. We have successfully established sales partnerships with various enterprises:

- Barney’s (Perrysburg)

- Bassets IGA (Oak Harbor)

- Brinkman’s Country Corner (Findlay)

- Brownings (Whitehouse)

- Char’s Best Market (Toledo)

- Churchill Supermarkets

- Connie Mac’s (Toledo)

- D & D’s Carryout (Pemberville)

- Dels (Woodville)

- E & L Meats (Detroit)

- El Aguila Bakery (Fremont)

- Elmore Super Value (Elmore)

- Falls Crestview Market (Toledo)

- Gerrards (Rossford)

- Gift Baskets (Perrysburg)

- Grumpy’s (Toledo)

- IGA (Delta)

- Kazmaiers

- Kirwen’s (Gibsonburg)

- K.O.A. Campground (Stoney Ridge)

- La Bottelia (Detroit)

- LaColmena (Detroit)

- LaMexicana (Toledo)

- LaPeria (Toledo)

- Luna Bakery & Grocery (Detroit)

- Mad Anthony’s (Waterville)

- Markada (Ann Arbor)

- Moser’s Farm Market (Perrysburg)

- Ohlman’s Farm Market (Toledo)

- Ottawa Market (Toledo)

- Partners in Wine II (Ann Arbor)

- Pauken Wine & Liquor (Maumee)

- Schorlings (Toledo)

- South Point Carryout (Toledo)

- Stephen’s Restaurant (Perrysburg)

- Vernor Foods (Detroit)

- Wolfert’s (Toledo)

5.2.1 Sales Programs

We focus on generating sales through major names, including Meijer, Inc., Foodtown, Inc., Kroger’s, Moctezuma Foods, Inc., IGA, Churchill’s, and Ohlman’s.

We are currently interviewing distributors to enhance our marketing and distribution of salsa. Building strong relationships with buyers through regular sales calls and providing samples of new products is crucial to our success in this channel.

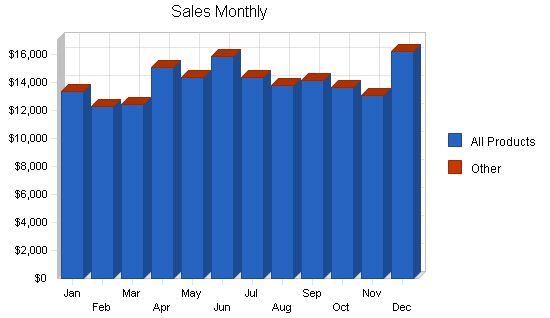

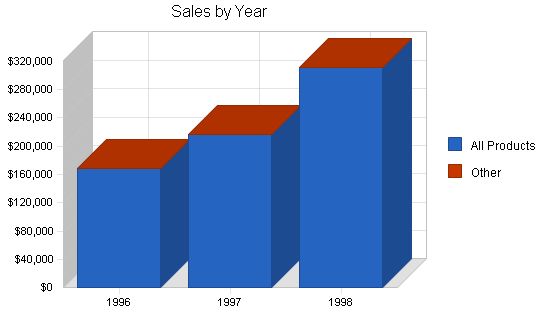

5.2.2 Sales Forecast

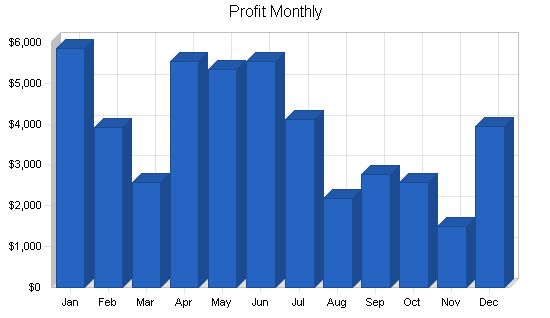

We project significant sales growth in the next 12 months due to commitments from distributors to increase volume in the future.

This growth will continue at a lower rate over the next few years. We expect the growth rate to level off within five years, remaining steady. If the Hispanic food market continues its current pace, we will keep pace with it. Although we anticipate a downturn in the product within three years, resulting in lower figures, we hope this forecast is overly cautious.

| Sales Forecast | |||

| 1996 | 1997 | 1998 | |

| Sales | |||

| All Products | $168,602 | $217,320 | $312,052 |

| Other | $0 | $0 | $0 |

| Total Sales | $168,602 | $217,320 | $312,052 |

| Direct Cost of Sales | 1996 | 1997 | 1998 |

| All Products | $64,916 | $86,928 | $124,821 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $64,916 | $86,928 | $124,821 |

5.3 Strategic Alliances

We have an opportunity to build strategic alliances with local restaurants, such as La Perla, Connie Mac’s, and Zingerman’s. By approaching them properly, they can not only serve our products in their restaurants but also sell them for carry-out.

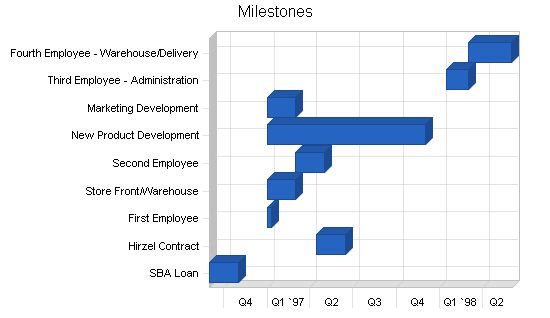

5.4 Milestones

The table below lists important program milestones, along with their dates and budgets. The milestone schedule emphasizes our focus on planning and ensures a methodical implementation process for each action.

Milestones

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| SBA Loan | 9/1/1996 | 11/1/1996 | $1,500 | Patricia | Finance |

| Hirzel Contract | 4/15/1997 | 6/15/1997 | $9,600 | Ricardo | Finance |

| First Employee | 1/1/1997 | 1/10/1997 | $9,600 | Patricia | Admin/Mgmt |

| Store Front/Warehouse | 1/1/1997 | 3/1/1997 | $12,000 | Ricardo | Sales |

| Second Employee | 3/1/1997 | 5/1/1997 | $25,000 | Ricardo | Production |

| New Product Development | 1/1/1997 | 12/1/1997 | $350 | Pat/Ric | Marketing |

| Marketing Development | 1/1/1997 | 3/1/1997 | $500 | Ricardo | Marketing |

| Third Employee – Administration | 1/15/1998 | 3/1/1998 | $18,500 | Patricia | Admin |

| Fourth Employee – Warehouse/Delivery | 3/1/1998 | 6/1/1998 | $24,500 | Ricardo | Warehouse |

| Totals | $101,550 | ||||

Management Summary

Salvador’s was founded by Ricardo & Patricia Torres and has operated without any payroll or salary expense.

Patricia Torres – President

Patricia is responsible for salsa preparation, maintaining inventories of raw materials, purchasing food ingredients, assisting with packaging and shipping, maintaining records, and communicating with the accountant and advisors.

Ricardo Torres – Vice President

Ricardo assists with salsa preparation and production, maintains finished product inventory, packs and ships products, assists with recordkeeping and cost containment, and shares in marketing and promotion.

The plan is to hire Patricia and Ricardo as paid employees on August 1st, 1997. Additional personnel will be hired as needed and as budget allows.

6.1 Organizational Structure

Salvador’s organization includes sales and marketing, product development, finance and administration. Production is currently outsourced.

6.2 Management Team

The management team consists of Ricardo and Patricia Torres, the founders of Salvador’s, Inc. They have a board of advisors with extensive administrative, financial, and sales management experience.

6.3 Management Team Gaps

Management team gaps are being addressed through the use of outside consultants. The identified gaps are in administration, finance management, and marketing.

6.4 Personnel Plan

The personnel plan includes hiring Patricia as a paid employee on August 1st, 1997. Ricardo will also become a paid employee in early 1997 or with the approval of a Link Deposit Loan.

| Personnel Plan | |||

| 1996 | 1997 | 1998 | |

| Patricia Torres | $9,600 | $23,000 | $38,000 |

| Ricardo Torres | $0 | $20,500 | $34,800 |

| Other | $0 | $0 | $0 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $9,600 | $43,500 | $72,800 |

We are forecasting rapid growth for Salvador’s this year. This is due to large orders from distributors, commitments from Meijer’s and Kroger’s, and increasing orders from current clients.

7.1 Important Assumptions

The financial plan depends on important assumptions:

- We assume a slow-growth economy, without major recession.

- We assume that there are no unforeseen changes in the consumer market.

- We assume access to equity capital and financing.

| General Assumptions | |||

| 1996 | 1997 | 1998 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 5.00% | 5.00% | 5.00% |

| Long-term Interest Rate | 5.00% | 5.00% | 5.00% |

| Tax Rate | 25.00% | 25.00% | 25.00% |

| Other | 0 | 0 | 0 |

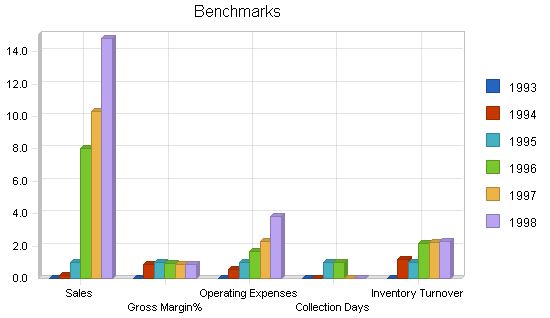

7.2 Key Financial Indicators

The ability to procure financing is crucial for our growth. The current orders exceed our production capacity. Purchasing from a local processor or acquiring production equipment are options. We aim to maintain high gross margins, limit marketing costs to 20% of sales, and pass on savings to customers.

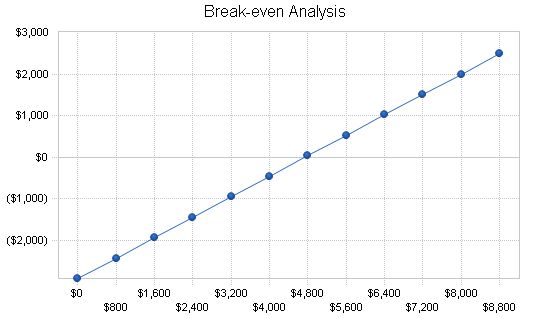

7.3 Break-even Analysis

The break-even analysis reveals Salvador’s balanced fixed costs and strong sales, ensuring its overall health. We have already surpassed the monthly break-even point, although last year’s loss can be attributed to high costs during the first half of the year.

We recently partnered with a new jar supplier, resulting in an 18% reduction in salsa jar costs for our next supply order. This will further decrease the break-even point and contribute to our goal of improving the salsa margin.

Break-even Analysis

Monthly Revenue Break-even: $4,747

Assumptions:

– Average Percent Variable Cost: 39%

– Estimated Monthly Fixed Cost: $2,919

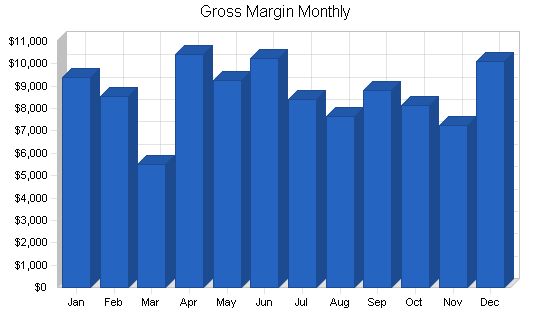

Projected Profit and Loss

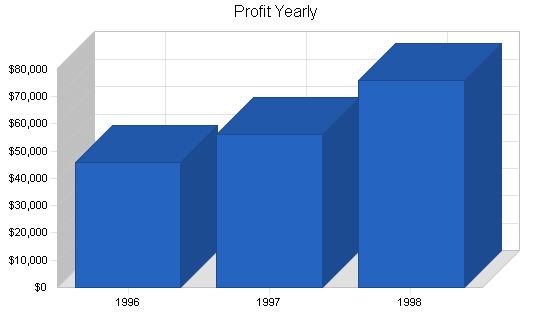

We anticipate strong sales growth this year and continued increases in sales annually until the end of the century, resulting in a comfortable net profit.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| 1996 | 1997 | 1998 | |

| Sales | $168,602 | $217,320 | $312,052 |

| Direct Cost of Sales | $64,916 | $86,928 | $124,821 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $64,916 | $86,928 | $124,821 |

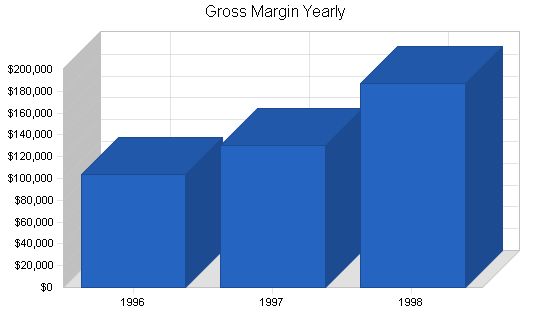

| Gross Margin | $103,686 | $130,392 | $187,231 |

| Gross Margin % | 61.50% | 60.00% | 60.00% |

| Expenses | |||

| Payroll | $9,600 | $43,500 | $72,800 |

| Marketing/Promotion | $6,763 | $0 | $0 |

| Depreciation | $5,520 | $0 | $0 |

| Rent | $3,500 | $0 | $0 |

| Utilities | $3,850 | $0 | $0 |

| Leased Equipment | $465 | $0 | $0 |

| Insurance | $1,044 | $0 | $0 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $4,290 | $4,225 | $6,275 |

| Total Operating Expenses | $35,032 | $47,725 | $79,075 |

| Profit Before Interest and Taxes | $68,654 | $82,667 | $108,156 |

| EBITDA | $74,174 | $82,667 | $108,156 |

| Interest Expense | $7,533 | $7,958 | $6,817 |

| Taxes Incurred | $15,280 | $18,677 | $25,335 |

| Net Profit | $45,841 | $56,032 | $76,004 |

| Net Profit/Sales | 27.19% | 25.78% | 24.36% |

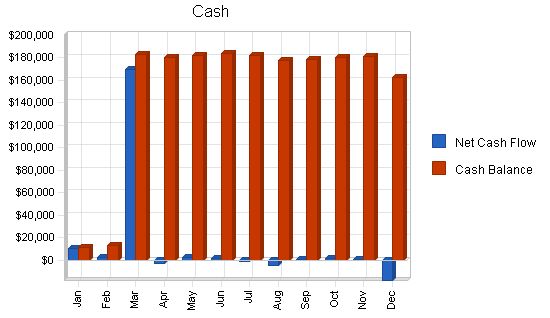

Projected Cash Flow

We expect to manage cash flow using a Small Business Administration supported loan. This financing will provide working capital to meet current needs and build the organization’s growth. After six months, we plan to request an open line of credit to further support sales projections, gross margin, and return on investment.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 1996 | 1997 | 1998 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $143,312 | $184,722 | $265,244 |

| Subtotal Cash from Operations | $164,267 | $216,067 | $309,616 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $165,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $329,267 | $216,067 | $309,616 |

| Expenditures | 1996 | 1997 | 1998 |

| Expenditures from Operations | |||

| Cash Spending | $9,600 | $43,500 | $72,800 |

| Bill Payments | $101,045 | $120,055 | $163,313 |

| Subtotal Spent on Operations | $110,645 | $163,555 | $236,113 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $3,650 | $5,555 | $6,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $7,100 | $17,042 | $17,042 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $45,000 | $0 | $0 |

| Subtotal Cash Spent | $166,395 | $186,152 | $259,155 |

| Net Cash Flow | $162,872 | $29,916 | $50,461 |

| Cash Balance | $162,998 | $192,913 | $243,375 |

7.6 Projected Balance Sheet

As shown by the balance sheet, we expect a healthy growth in net worth through the end of the plan period.

| Pro Forma Balance Sheet | |||

| 1996 | 1997 | 1998 | |

| Assets | |||

| Current Assets | |||

| Cash | $162,998 | $192,913 | $243,375 |

| Accounts Receivable | $4,335 | $5,587 | $8,023 |

| Inventory | $6,745 | $9,032 | $12,970 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $174,078 | $207,533 | $264,367 |

| Long-term Assets | |||

| Long-term Assets | $23,368 | $23,368 | $23,368 |

| Accumulated Depreciation | $15,312 | $15,312 | $15,312 |

| Total Long-term Assets | $8,056 | $8,056 | $8,056 |

| Total Assets | $182,134 | $215,589 | $272,423 |

| Liabilities and Capital | 1996 | 1997 | 1998 |

| Current Liabilities | |||

| Accounts Payable | $9,849 | $9,869 | $13,741 |

| Current Borrowing | $12,557 | $7,002 | $1,002 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $22,406 | $16,871 | $14,743 |

| Long-term Liabilities | $157,900 | $140,858 | $123,816 |

| Total Liabilities | $180,306 | $157,729 | $138,559 |

| Paid-in Capital | $25,000 | $25,000 | $25,000 |

| Retained Earnings | ($69,013) | ($23,172) | $32,860 |

| Earnings | $45,841 | $56,032 | $76,004 |

| Total Capital | $1,828 | $57,860 | $133,864 |

| Total Liabilities and Capital | $182,134 | $215,589 | $272,423 |

| Net Worth | $1,828 | $57,860 | $133,864 |

7.7 Business Ratios

Standard business ratios are included in the table. The ratios show a plan for well-balanced, healthy growth. The industry comparisons are for the Perishable Prepared Food Manufacturing industry, NAICS classification code 311991.

| Ratio Analysis | |||||||||||||

| 1996 | 1997 | 1998 | Industry Profile | ||||||||||

| Sales Growth | 700.96% | 28.90% | 43.59% | 6.68% | |||||||||

| Percent of Total Assets | |||||||||||||

| Accounts Receivable | 2.38% | 2.59% | 2.94% | 15.95% | |||||||||

| Inventory | 3.70% | 4.19% | 4.76% | 13.45% | |||||||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 21.34% | |||||||||

| Total Current Assets | 95.58% | 96.26% | 97.04% | 50.74% | |||||||||

| Long-term Assets | 4.42% | 3.74% | 2.96% | 49.26% | |||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $126 | $11,110 | $13,595 | $183,257 | $180,139 | $182,436 | $183,864 | $182,617 | $177,785 | $178,627 | $180,401 | $180,896 | $162,998 |

| Accounts Receivable | $0 | $2,003 | $3,777 | $3,642 | $4,066 | $4,345 | $4,461 | $4,451 | $4,151 | $4,118 | $4,093 | $3,943 | $4,335 |

| Inventory | $3,492 | $4,379 | $4,099 | $7,616 | $5,125 | $5,602 | $6,177 | $6,518 | $6,790 | $5,844 | $6,050 | $6,463 | $6,745 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $3,618 | $17,492 | $21,471 | $194,516 | $189,330 | $192,383 | $194,502 | $193,585 | $188,726 | $188,589 | $190,544 | $191,302 | $174,078 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 | $23,368 |

| Accumulated Depreciation | $9,792 | $10,252 | $10,712 | $11,172 | $11,632 | $12,092 | $12,552 | $13,012 | $13,472 | $13,932 | $14,392 | $14,852 | $15,312 |

| Total Long-term Assets | $13,576 | $13,116 | $12,656 | $12,196 | $11,736 | $11,276 | $10,816 | $10,356 | $9,896 | $9,436 | $8,976 | $8,516 | $8,056 |

| Total Assets | $17,194 | $30,608 | $34,127 | $206,712 | $201,066 | $203,659 | $205,318 | $203,941 | $198,622 | $198,025 | $199,520 | $199,818 | $182,134 |

General Assumptions

| General Assumptions | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | |

| Long-term Interest Rate | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | |

| Tax Rate | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Business Plan Outline

- Executive Summary

- Company Summary

- Products

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Build a business plan that impresses lenders

Join 1 million entrepreneurs who plan, fund, and grow with LivePlan.

No thanks, I’ll pitch investors without business planning software.

“>

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!