Movie Theater Restaurant Business Plan

The number of movie theaters is decreasing as major chains create megaplexes, leaving downtown theaters vacant. Second Run Pizza is a theater/restaurant business that believes there is a significant number of theater-goers craving a more satisfying way to catch a movie and eat. Second Run Pizza is renovating the downtown Majestic Theater to show second-run movies that are still popular. We will offer a unique dining and movie experience at an affordable price that will attract repeat customers.

The owners of Second Run Pizza, Robert Williamson and Judy Fillmore, stress two factors that assure the success of the business:

– Judy’s 15 years of experience managing four of the city’s most successful restaurants and Robert’s experience as manager of the Lighthouse Theater, which has recently returned to profitability.

– Robert’s strong seven-year working relationship with Premiere Film Distributors, providing second-run films for Second Run Pizza.

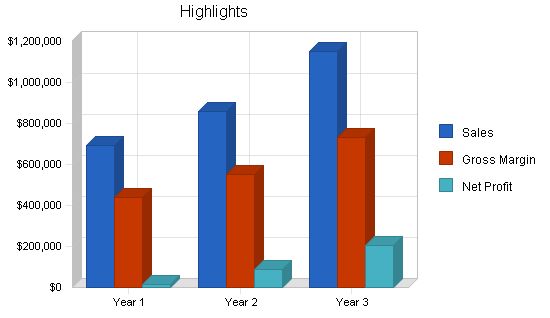

Our market and financial analyses indicate that with a start-up expenditure of $300,000, we can generate $600,000 in sales by the end of year one and high net profits by the end of year three.

Contents

1.1 Objectives

Sales over $600K in the first year, exceeding $1 million by the third.

Personnel costs under $300K in the first year.

Profitable first year, with increasing net profits annually.

1.2 Mission

Second Run’s mission is to create an enjoyable and satisfying theater experience that encourages customers to return and recommend to others. We aim to delight customers with exceptional service, quality food, and an unmatched theater environment. We believe that after experiencing Second Run, customers will choose us over overcrowded Megaplex theaters.

1.3 Keys to Success

- Select popular films suited for group viewing, such as comedies, scary movies, or adventure films.

- Provide exceptional service that leaves a lasting impression.

- Maintain a consistent and high-quality entertainment atmosphere and product.

- Manage finances and cash flow for upward capital growth.

- Exercise strict control over costs at all times.

Company Summary

Second Run Pizza is a medium-sized restaurant located downtown near major shopping centers and evening entertainment establishments. We specialize in pizza and offer unique Italian dishes.

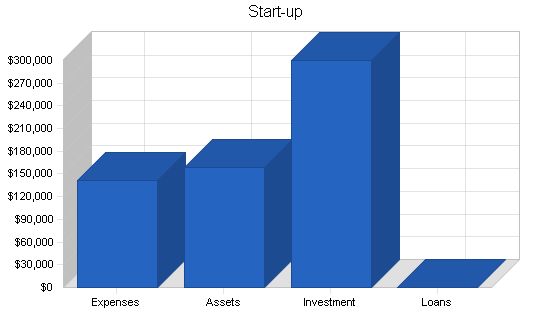

2.1 Start-up Summary

The company is founded by Robert Williamson and Judy Fillmore. Robert oversees personnel matters while Judy handles financial issues. Judy earned her undergraduate business degree from the University of Berkeley. A lease for the location has been secured for $2,000 per month. The restaurant will be fully equipped in time to turn a profit by the end of the eleventh month and continue profitability in the second year. Both Robert and Judy are investing $150,000 each to start the company.

Start-up Funding

Start-up Expenses to Fund: $140,800

Start-up Assets to Fund: $159,200

Total Funding Required: $300,000

Assets:

Non-cash Assets from Start-up: $10,000

Cash Requirements from Start-up: $149,200

Additional Cash Raised: $0

Cash Balance on Starting Date: $149,200

Total Assets: $159,200

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital:

Planned Investment:

Investor 1: $150,000

Investor 2: $150,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $300,000

Loss at Start-up (Start-up Expenses): ($140,800)

Total Capital: $159,200

Total Capital and Liabilities: $159,200

Total Funding: $300,000

Start-up

Requirements

Start-up Expenses:

Legal: $1,000

Stationery etc.: $1,000

Insurance: $1,800

Rent: $2,000

Projection Equipment: $40,000

Kitchen: $40,000

Initial Marketing: $15,000

Dining Products: $5,000

Interior Refit: $35,000

Total Start-up Expenses: $140,800

Start-up Assets

Cash Required: $149,200

Other Current Assets: $10,000

Long-term Assets: $0

Total Assets: $159,200

Total Requirements: $300,000

2.2 Company Ownership

The restaurant will start out as a simple sole proprietorship owned by its founders.

Services

The Menu:

The menu is extremely simple. Pizza is the perfect finger food for watching a movie. We will also include select Italian dishes that fit well in the viewing environment.

Movies:

The films will be chosen with two target audiences in mind. The first is the families that will come to Second Run Pizza to watch movies like Shrek and Spy Kids. These movies will be shown three times during the afternoon. The second group is young adults who will come to the evening shows to watch movies like Jeepers Peepers, the Fast and the Furious, and Rush Hour 2. There will be three evening showings of these films. In addition, there will be midnight movies for the college crowd on Friday and Saturday.

Market Analysis Summary

We believe that our unique dining environment will attract our target customers. The central location of Second Run Pizza to the downtown shopping and entertainment center makes the restaurant easily accessible. Once inside, the customer will find watching a movie at comfortable table seating, while enjoying great food, is an experience to repeat again and again with friends.

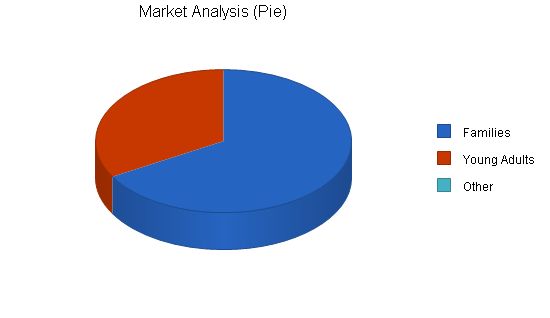

4.1 Market Segmentation

Families:

We are focusing on parents with children who want to catch a movie with pizza in the afternoon or early evening, before or after shopping at the downtown mall.

Young Adults:

The second group we are going to focus on is young adults ages 18-26 for the evening shows. We believe that this target group will enjoy this unique way to watch a film, and Second Run Pizza will become a common place for friends to have an affordable evening’s entertainment together.

Market Analysis:

Potential Customers:

– Families: 15% growth, 400,000 (Year 1), 460,000 (Year 2), 529,000 (Year 3), 608,350 (Year 4), 699,603 (Year 5), CAGR 15%

– Young Adults: 10% growth, 200,000 (Year 1), 220,000 (Year 2), 242,000 (Year 3), 266,200 (Year 4), 292,820 (Year 5), CAGR 10%

– Other: 0%, 0 (Year 1), 0 (Year 2), 0 (Year 3), 0 (Year 4), 0 (Year 5), CAGR 0%

– Total: 13.41% growth, 600,000 (Year 1), 680,000 (Year 2), 771,000 (Year 3), 874,550 (Year 4), 992,423 (Year 5), CAGR 13.41%

Strategy and Implementation Summary:

Our strategy is simple: provide target customers with great food and a relaxed, enjoyable environment for a memorable experience.

Competitive Edge:

Two-fold competitive edge:

– Robert and Judy’s experience in managing Second Run Pizza.

– Agreement with Premiere Film Distributors to supply Second Run Pizza with second run movies.

Co-owner Judy Fillmore has 15 years of experience in the restaurant scene, managing four successful restaurants and receiving industry accolades for operational excellence. She is now a sought-after consultant in restaurant operating efficiency and workflow.

Robert Williamson has 20 years of experience in the movie theater industry, managing the city’s largest multiplex for seven years and serving as a regional distribution coordinator for Premiere Film Distributors for six years. He successfully revitalized the failing Lighthouse Theater, increasing usage levels by 200% and making it a key feature in the city’s cultural community. Judy and Robert’s combined experience will make Second Run a unique competitive force.

The owners have negotiated an agreement with Premiere Film Distributors, ensuring access to the best available second run films. Second Run will receive 75% of admission revenue, a better return compared to the typical 50% for second run films. In exchange, Second Run will feature films popular with their target customers.

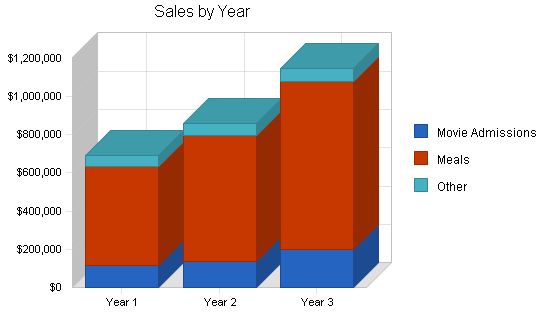

Sales Strategy:

The initial sales strategy is to distribute free movie coupons to target consumers for the first three months of operation. The coupon will waive the $1.50 film charge. These coupons will be included in the city’s daily and student newspapers.

Second Run’s profits will primarily come from food sales. Menu pricing will reflect this focus, with slightly higher prices compared to traditional pizza restaurants. The unique dining environment will justify these prices with customers.

On slow days (Monday and Tuesday), cheaper fare (spaghetti) will be offered and marketed as "spaghetti movie night" to college students. Additionally, there will be two-for-one date nights, where couples will only be charged for one admission.

Sales projections for this plan are presented below.

Income forecast on a monthly basis. Yearly sales projections are presented in the appendix.

| Sales Forecast | |||

| Unit Sales | Year 1 | Year 2 | Year 3 |

| Movie Admissions | 78,400 | 90,000 | 100,000 |

| Meals | 25,725 | 33,000 | 40,000 |

| Other | 12,000 | 13,000 | 14,000 |

| Total Unit Sales | 116,125 | 136,000 | 154,000 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Movie Admissions | $1.50 | $1.50 | $2.00 |

| Meals | $20.00 | $20.00 | $22.00 |

| Other | $5.00 | $5.00 | $5.00 |

| Sales | |||

| Movie Admissions | $117,600 | $135,000 | $200,000 |

| Meals | $514,500 | $660,000 | $880,000 |

| Other | $60,000 | $65,000 | $70,000 |

| Total Sales | $692,100 | $860,000 | $1,150,000 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Movie Admissions | $1.20 | $1.20 | $1.60 |

| Meals | $3.00 | $3.00 | $3.00 |

| Other | $0.50 | $0.50 | $0.50 |

| Direct Cost of Sales | |||

| Movie Admissions | $94,080 | $108,000 | $160,000 |

| Meals | $77,175 | $99,000 | $120,000 |

| Other | $6,000 | $6,500 | $7,000 |

| Subtotal Direct Cost of Sales | $177,255 | $213,500 | $287,000 |

5.3 Milestones

The following table lists important program milestones, with dates and budgets for each. The milestones schedule indicates our emphasis on planning for implementation.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Tables and Chairs | 11/4/2001 | 11/13/2001 | $3,000 | ABC | Marketing |

| Decorations | 11/4/2001 | 11/18/2001 | $2,000 | ABC | Marketing |

| Painting/reconstuction of Resturant | 11/1/2001 | 12/22/2001 | $25,000 | ABC | Web |

| Food for Opening | 12/28/2001 | 12/29/2001 | $1,000 | ABC | Web |

| Production of Menus | 11/13/2001 | 12/16/2001 | $400 | ABC | Department |

| Buying Supplies for Kitchen | 11/16/2001 | 12/20/2001 | $5,000 | ABC | Department |

| Set Up Projection Equipment | 12/20/2001 | 12/28/2001 | $40,000 | ABC | Department |

| Establish Film Schedule | 11/1/2001 | 12/28/2001 | $1,000 | ABC | Department |

| Staff Hiring | 12/4/2001 | 12/22/2001 | $0 | ABC | Department |

| Staff Schedules | 12/25/2001 | 12/28/2001 | $0 | ABC | Department |

| Distribution of Advertising | 12/5/2001 | 1/1/2001 | $0 | ABC | Department |

| Totals | $77,400 | ||||

Management Summary

Judy will be responsible for hiring, training, and supervising all restaurant staff. Judy is the best in her field and will have no trouble assembling a team that will be eager to participate in Second Run’s success.

Robert’s management focus will be marketing and responsibilities related to the film’s presentation. Robert’s marketing of the Lighthouse Theater turned it into a profitable business from being in the red.

6.1 Personnel Plan

The personnel plan shows that we expect to invest in a well-compensated, skilled team. The planned staff is in good proportion to the restaurant’s size and projected revenues.

| Personnel Plan | |||

| Manager | Year 1 | Year 2 | Year 3 |

| Hostess | $36,000 | $40,000 | $44,000 |

| Kitchen Staff | $60,000 | $64,000 | $68,000 |

| Cleaning | $36,000 | $38,000 | $40,000 |

| Servers | $72,000 | $72,000 | $72,000 |

| Projectionist | $36,000 | $40,000 | $44,000 |

| Total People | 12 | 15 | 18 |

| Total Payroll | $288,000 | $307,000 | $326,000 |

Financial Plan

We will invest $300,000 of our own capital to provide the required start-up financing.

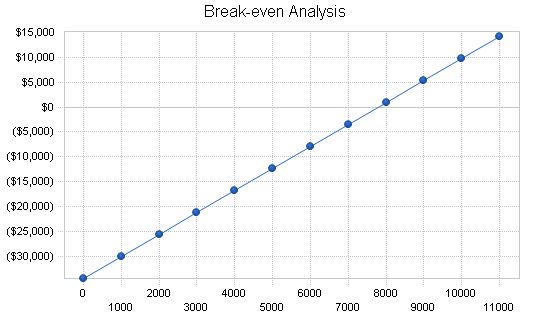

7.1 Break-even Analysis

Our break-even analysis is based on the first-year numbers for total sales, cost of sales, and operating expenses. These are presented as per-unit revenue, per-unit cost, and fixed costs. These conservative assumptions provide a better estimate of real risk.

Break-even Analysis:

Monthly Units Break-even: 7,778

Monthly Revenue Break-even: $46,356

Assumptions:

Average Per-Unit Revenue: $5.96

Average Per-Unit Variable Cost: $1.53

Estimated Monthly Fixed Cost: $34,483

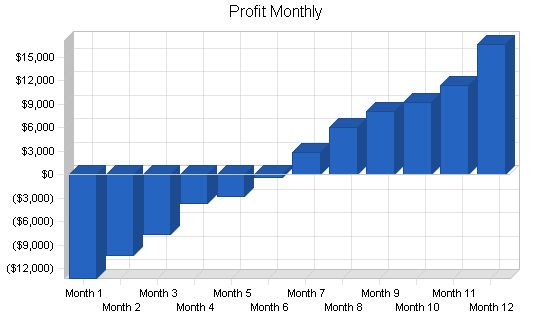

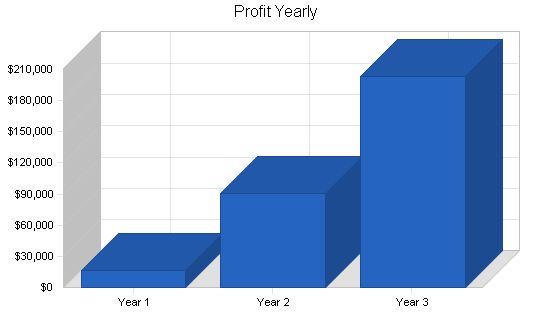

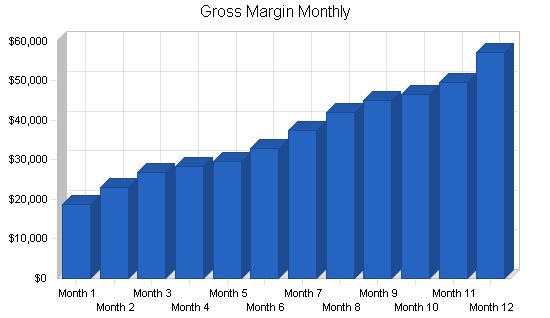

7.2 Projected Profit and Loss:

The table and chart below illustrate projected profit and loss.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $692,100 $860,000 $1,150,000

Direct Cost of Sales $177,255 $213,500 $287,000

Movie Screening Expenses $77,861 $96,750 $129,375

Total Cost of Sales $255,116 $310,250 $416,375

Gross Margin $436,984 $549,750 $733,625

Gross Margin % 63.14% 63.92% 63.79%

Expenses

Payroll $288,000 $307,000 $326,000

Sales and Marketing and Other Expenses $22,600 $8,000 $8,000

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Utilities $14,400 $14,400 $14,400

Insurance $21,600 $21,600 $21,600

Rent $24,000 $24,000 $24,000

Payroll Taxes $43,200 $46,050 $48,900

Other $0 $0 $0

Total Operating Expenses $413,800 $421,050 $442,900

Profit Before Interest and Taxes $23,184 $128,700 $290,725

EBITDA $23,184 $128,700 $290,725

Interest Expense $0 $0 $0

Taxes Incurred $6,955 $38,610 $87,218

Net Profit $16,229 $90,090 $203,508

Net Profit/Sales 2.34% 10.48% 17.70%

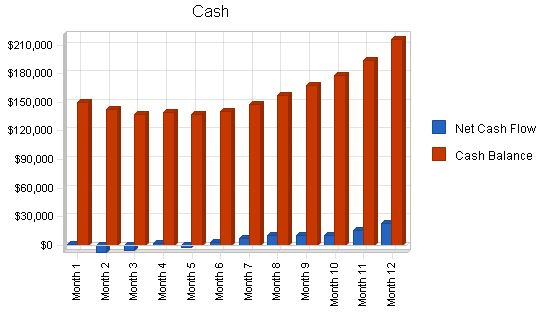

7.3 Projected Cash Flow

The table and chart show projected cash flow for the year.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $692,100 | $860,000 | $1,150,000 |

| Subtotal Cash from Operations | $692,100 | $860,000 | $1,150,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $692,100 | $860,000 | $1,150,000 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $288,000 | $307,000 | $326,000 |

| Bill Payments | $337,234 | $475,500 | $607,541 |

| Subtotal Spent on Operations | $625,234 | $782,500 | $933,541 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $625,234 | $782,500 | $933,541 |

| Net Cash Flow | $66,866 | $77,500 | $216,459 |

| Cash Balance | $216,066 | $293,566 | $510,026 |

Projected Balance Sheet

The table shows projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $216,066 | $293,566 | $510,026 |

| Other Current Assets | $10,000 | $10,000 | $10,000 |

| Total Current Assets | $226,066 | $303,566 | $520,026 |

| Long-term Assets | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $226,066 | $303,566 | $520,026 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $50,638 | $38,047 | $50,999 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $50,638 | $38,047 | $50,999 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $50,638 | $38,047 | $50,999 |

| Paid-in Capital | $300,000 | $300,000 | $300,000 |

| Retained Earnings | ($140,800) | ($124,571) | ($34,481) |

| Earnings | $16,229 | $90,090 | $203,508 |

| Total Capital | $175,429 | $265,519 | $469,026 |

| Total Liabilities and Capital | $226,066 | $303,566 | $520,026 |

| Net Worth | $175,429 | $265,519 | $469,026 |

Business ratios for the years of this plan are shown below. Industry Profile ratios based on the Standard Industrial Classification (SIC) code 5813, Eating Places, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 24.26% | 33.72% | 1.90% |

| Percent of Total Assets | ||||

| Other Current Assets | 4.42% | 3.29% | 1.92% | 44.60% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 52.30% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 47.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 22.40% | 12.53% | 9.81% | 28.20% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 23.10% |

| Total Liabilities | 22.40% | 12.53% | 9.81% | 51.30% |

| Net Worth | 77.60% | 87.47% | 90.19% | 48.70% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 63.14% | 63.92% | 63.79% | 42.30% |

| Selling, General & Administrative Expenses | 60.79% | 53.45% | 46.10% | 23.40% |

| Advertising Expenses | 3.27% | 0.93% | 0.70% | 2.40% |

| Profit Before Interest and Taxes | 3.35% | 14.97% | 25.28% | 2.80% |

| Main Ratios | ||||

| Current | 4.46 | 7.98 | 10.20 | 1.14 |

| Quick | 4.46 | 7.98 | 10.20 | 0.74 |

| Total Debt to Total Assets | 22.40% | 12.53% | 9.81% | 51.30% |

| Pre-tax Return on Net Worth | 13.22% | 48.47% | 61.98% | 5.20% |

| Pre-tax Return on Assets | 10.26% | 42.40% | 55.91% | 10.60% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 2.34% | 10.48% | 17.70% | n.a |

| Return on Equity | 9.25% | 33.93% | 43.39% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 7.66 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 35 | 26 | n.a |

| Total Asset Turnover | 3.06 | 2.83 | 2.21 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.29 | 0.14 | 0.11 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $175,429 | $265,519 | $469,026 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.33 | 0.35 | 0.45 | n.a |

| Current Debt/Total Assets | 22% | 13% | 10% | n.a |

| Acid Test | 4.46 | 7.98 | 10.20 | Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00% Long-term Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00% Tax Rate: 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00% Other: 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0 Pro Forma Profit and Loss |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $25,000 | $30,800 | $35,900 | $46,000 | $47,800 | $53,800 | $61,300 | $68,500 | $73,100 | $75,400 | $81,500 | $93,000 | |

| Direct Cost of Sales | $3,500 | $4,370 | $5,135 | $12,500 | $12,770 | $14,840 | $16,940 | $18,800 | $19,880 | $20,420 | $22,700 | $25,400 | |

| Movie Screening Expenses | $2,813 | $3,465 | $4,039 | $5,175 | $5,378 | $6,053 | $6,896 | $7,706 | $8,224 | $8,483 | $9,169 | $10,463 | |

| Total Cost of Sales | $6,313 | $7,835 | $9,174 | $17,675 | $18,148 | $20,893 | $23,836 | $26,506 | $28,104 | $28,903 | $31,869 | $35,863 | |

| Gross Margin | $18,688 | $22,965 | $26,726 | $28,325 | $29,653 | $32,908 | $37,464 | $41,994 | $44,996 | $46,498 | $49,631 | $57,138 | |

| Gross Margin % | 74.75% | 74.56% | 74.45% | 61.58% | 62.03% | 61.17% | 61.12% | 61.30% | 61.55% | 61.67% | 60.90% | 61.44% | |

| Expenses | |||||||||||||

| Payroll | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | |

| Sales and Marketing and Other Expenses | $5,000 | $5,000 | $5,000 | $1,000 | $1,000 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | |

| Insurance | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | |

| Rent | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Payroll Taxes | 15% | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $37,600 | $37,600 | $37,600 | $33,600 | $33,600 | $33,400 | $33,400 | $33,400 | $33,400 | $33,400 | $33,400 | $33,400 | |

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | $25,000 | $30,800 | $35,900 | $46,000 | $47,800 | $53,800 | $61,300 | $68,500 | $73,100 | $75,400 | $81,500 | $93,000 | |

| Subtotal Cash from Operations | $25,000 | $30,800 | $35,900 | $46,000 | $47,800 | $53,800 | $61,300 | $68,500 | $73,100 | $75,400 | $81,500 | $93,000 | |

| Expenditures | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | |

| Bill Payments | $475 | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Cash | $149,200 | $149,725 | $142,193 | $136,966 | $139,249 | $137,327 | $140,445 | $147,456 | $157,366 | $167,899 | $178,275 | $193,413 | $216,066 |

| Other Current Assets | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Total Current Assets | $159,200 | $159,725 | $152,193 | $146,966 | $149,249 | $147,327 | $150,445 | $157,456 | $167,366 | $177,899 | $188,275 | $203,413 | $226,066 |

| Long-term Assets | |||||||||||||

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $159,200 | $159,725 | $152,193 | $146,966 | $149,249 | $147,327 | $150,445 | $157,456 | $167,366 | $177,899 | $188,275 | $203,413 | $226,066 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $13,764 | $16,476 | $18,861 | $24,836 | $25,678 | $29,140 | $33,307 | $37,202 | $39,617 | $40,824 | $44,600 | $50,638 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $13,764 | $16,476 | $18,861 | $24,836 | $25,678 | $29,140 | $33,307 | $37,202 | $39,617 | $40,824 | $44,600 | $50,638 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $13,764 | $16,476 | $18,861 | $24,836 | $25,678 | $29,140 | $33,307 | $37,202 | $39,617 | $40,824 | $44,600 | $50,638 |

| Paid-in Capital | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 |

| Retained Earnings | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) | ($140,800) |

| Earnings | $0 | ($13,239) | ($23,483) | ($31,095) | ($34,787) | ($37,551) | ($37,895) | ($35,051) | ($29,035) | ($20,918) | ($11,750) | ($388) | $16,229 |

| Total Capital | $159,200 | $145,961 | $135,717 | $128,105 | $124,413 | $121,649 | $121,305 | $124,149 | $130,165 | $138,282 | $147,451 | $158,812 | $175,429 |

| Total Liabilities and Capital | $159,200 | $159,725 | $152,193 | $146,966 | $149,249 | $147,327 | $150,445 | $157,456 | $167,366 | $177,899 | $188,275 | $203,413 | $226,066 |

| Net Worth | $159,200 | $145,961 | $135,717 | $128,105 | $124,413 | $121,649 | $121,305 | $124,149 | $130,165 | $138,282 | $147,451 | $158,812 | $175,429 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

“>

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!