PT. Rekayasa Tambang Indonesia (RTI) meets the needs of clients – private and government-owned mining companies – in every sphere of geological interpretation and modeling, mine design and engineering, and mining productivity improvement. RTI is a subsidiary company of Mining Engineering Software Development and Technical Assistance (MINER DELTA), a U.S. software manufacturer that provides engineering software for full-service mining design and geological engineering, offering the managerial and technical resources vital to solving complex geological interpretation and modeling, mine design, mining optimization, mine scheduling, and dump design and rehabilitation in Indonesia and Southeast Asia.

Products

RTI will offer five distinct products and services. The first is geological interpretation and modeling software systems, providing a comprehensive geological database, innovative interpretation tools, advanced modeling techniques, and resource reporting for most types of deposits. Mine design and engineering software systems, mining optimization and scheduling software systems, and dump design and rehabilitation will also be offered, performing analysis on environmental impact, mine waste dump design, acid drainage design, ground water drainage design, and environmental rehabilitation.

Market

The total market value for open pit, underground, and quarry mining software technologies has grown at an average rate of 22% over the past five years. Since there is no local engineering software producer in Indonesia, imported software technologies account for 100% of all mining engineering and geological software technologies in Indonesian mining industries. Total imports of mining software technologies totaled $75 million last year, 23.7% greater than the previous year’s levels of $60.6 million, and 26.3% greater than the year before’s imports, valued at $48 million.

Competitive Advantages

The key factors for RTI to create and maintain competitive advantages include its access to intangible capital, such as business networks, leadership, talent, entrepreneurs, intellectual property, and brand, as well as advanced technology. These two advantages are interrelated. RTI captures intellectual capital, which is a huge advantage as employees contribute and move on to new companies. This captured knowledge and contributions fuel the advanced technology.

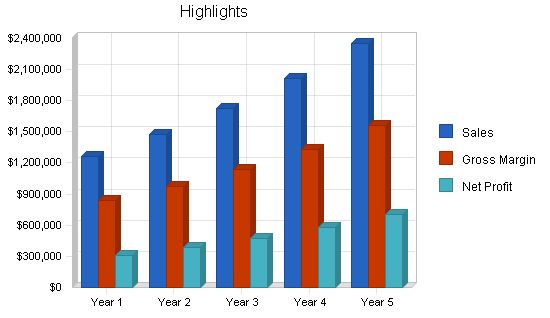

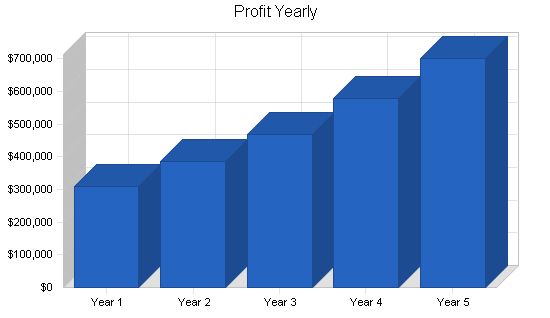

RTI is an exciting company that combines advanced technology in the form of software and consulting services serving the mining industry. RTI has forecasted strong revenue numbers for year one, growing steadily through year five, with high gross margins and improving net profits.

RTI’s mission is to implement the MINER DELTA mission statement and become the leading provider of mining and geology software and consulting services in Indonesia. This will be achieved by developing optimal image analysis techniques and exceeding customer expectations.

The objectives of RTI are to achieve healthy sales in the first year, growing steadily through the fifth year of implementation. To earn gross margin and sales revenue targets, the company must set a high average profit margin on sales and establish customer awareness goals. This includes proactively approaching potential clients, partnering with technology providers, contractors, and equipment suppliers to reduce competition and improve pricing.

The keys to RTI’s success include access to intangible capital and advanced technology, as well as customization options. The company excels in software performance, flexibility, and ease of use. To maintain a competitive advantage, RTI will continue to refine and improve the system with future software versions.

RTI’s personalized service is only available from them, and their ability to operate in a "turn key" fashion is highly valued. The company’s location in Jakarta allows for close proximity to the target market. Additionally, RTI’s distribution is aided by its presence in major mining provinces in Indonesia.

RTI focuses on providing value to customers by targeting the primary activity of mining operations. Their systems monitor operations and guide customers in improving their operational performance.

As a subsidiary of MINER DELTA, RTI offers geological interpretation and modeling, mine design, mining optimization, mine scheduling, and dump design and rehabilitation services. These systems are user-friendly, accurate, and portable among computer platforms. The company aims to expand customer awareness over the planning period.

RTI was incorporated in Jakarta as an Indonesian "Perseroan Terbatas" (PT) corporation. Majority ownership belongs to MINER DELTA, with one minority owner from Jakarta.

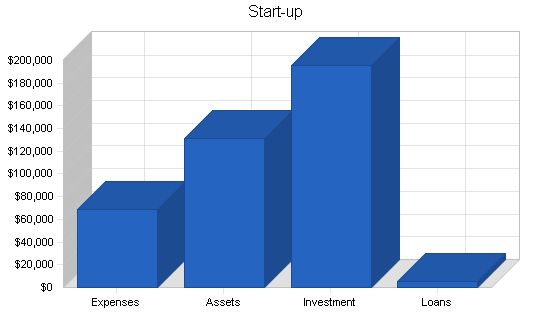

Start-up expenses for RTI include legal costs, logo design, and stationery, as well as assets and cash to cover initial consulting operations. Details can be found in the chart and table below.

Start-up Requirements

—

Legal: $5,500

Stationery etc.: $3,000

Brochures: $5,000

Consultants: $48,000

Insurance: $1,588

Rent: $3,000

Expensed equipment: $3,000

Total Start-up Expenses: $69,088

Start-up Assets

—

Cash Required: $100,000

Other Current Assets: $31,588

Long-term Assets: $0

Total Assets: $131,588

Total Requirements: $200,675

Start-up Funding

—

Start-up Expenses to Fund: $69,088

Start-up Assets to Fund: $131,588

Total Funding Required: $200,675

Assets

—

Non-cash Assets from Start-up: $31,588

Cash Requirements from Start-up: $100,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $100,000

Total Assets: $131,588

Liabilities and Capital

—

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $5,000

Other Current Liabilities (interest-free): $0

Total Liabilities: $5,000

Capital

Planned Investment

Investor 1: $70,000

Investor 2: $100,000

Other: $25,675

Additional Investment Requirement: $0

Total Planned Investment: $195,675

Loss at Start-up (Start-up Expenses): ($69,088)

Total Capital: $126,588

Total Capital and Liabilities: $131,588

Total Funding: $200,675

2.3 Company Locations and Facilities

—

The initial office will be established in the Kebayoran Baru area of South Jakarta, Indonesia, the heart of the Indonesian business area.

Products and Services

—

The company management team is capitalizing on the lucrative business opportunity of creating compliance analysis and modeling, design and engineering, and productivity improvement software systems to aid mining companies. RTI’s products and services will help companies gain competitive advantage in the marketplace since its products and services will shorten the time-to-market cycle for its clients. This, combined with the management team and business opportunity, has generated tremendous interest in RTI’s compliance systems in the Indonesian mining industry.

3.1 Competitive Comparison

—

Deposits and excavation images analysis is a developing technology and, as such, the industry lacks standardization. In this digital image analysis market, no market leader exists, and only three other major players in Asia have developed and begun to market similar products and services. These companies are all in Australia: ECS International of Bowral, Runge Mining, and Mincom of Brisbane. RTI’s sustainable competitive advantages are its patentable advanced technology and custom system design/installations, human capital, and strategic location.

3.2 Product and Service Description

—

Geological interpretation and modeling software systems: This product and service provides the most comprehensive geological database, innovative interpretation tools, advanced modeling techniques, and resource reporting for most types of deposits ranging from simple vein, stratiform, and massive deposits to complex and highly deformed orebodies.

3.3 Fulfillment

—

The key fulfillment and delivery will be provided by the principals of the business. The real core value is professional expertise, provided by a combination of experience, relationships and connections in the market (quangxi), discipline, smart work, hard work, confidence, and education. RTI will work with computer hardware, peripherals, accessories, and add-ons manufacturers and platform developers on a project-by-project basis. RTI will not exclusively represent any of these companies to maintain its position as a partner for every supplier and technology provider.

3.4 Technology

—

MINER DELTA is a recognized leader in supplying integrated geological and mining software technologies and computerized consulting services to the mining industries. As the commercial arm of MINER DELTA in Indonesia, RTI will focus on providing its clients with rapid, non-disruptive, and accurate analysis of deposits and excavation images using the integrated software technologies developed by the parent company. The technologies employ digital image analysis to calculate deposits’ size, orientation/position, and distributions, as well as provide options of mining methods, create value through monitoring mine works-in-progress, and empower mining engineers with crucial operational data.

3.5 Services and Supports

—

RTI’s services and support are done at the client’s site. The service begins with the technical presentation and on-site demonstration of the technology. Through these initial communications with the potential buyer, RTI will assign its Vice President of Sales and Marketing to conduct an analysis on the client’s operation and begin to customize the system to fill their needs and solve their problem. Once it knows what the prospective client wants, it will send a technical proposal and draft contract. A commercial meeting schedule will be arranged with the prospective client to open negotiations with the client’s decision board, and then to close the selling cycle by having the client sign the contract. Within one working week after contract signing, RTI will submit a project design proposal to the client for approval. Upon project design approval, it will then go to the mine and install the site-specific system. Along with the installation, it will provide one month of on-site training of MINER DELTA to the supervisors/engineers selected by the client. Besides providing a one-year warranty, RTI will offer the client long-term technical support called “Project Perpetuation Assistance.” It will keep in close contact with all clients and solicit ideas on improvements and necessary changes.

3.6 Sales Literature

—

The business will begin with general corporate and technical brochures establishing the positioning and defining the company’s intangible capital to be transformed into clients’ benefits. Literature and mailings for the initial market forums will be important.

Market Analysis Summary

—

The total market value for open pit, underground, and quarry mining software technologies has grown at an average rate of 22% over the past five years. Imported software technologies account for 100% of all open pit, underground, and quarry mining engineering and geological software technologies in Indonesian mining industries.

Total imports of mining software technologies totaled $75 million in 2000, 23.7% greater than 1999 levels of $60.6 million, which were in turn 26.3% greater than 1998 imports, valued at $48 million.

The demand for open pit, underground, and quarry mining software technologies is projected to grow at an average rate of 16.89% annually over the next five years. Growth will result from the expansion programs of existing mines and establishment of new mines, particularly for coal, gold, and quarry products.

In addition to the coal sector, there is continuous growth in civil construction activities, which requires increased production of building materials such as cement, sands, stones, and various products made from kaolin, limestone, and other quarry materials.

Future growth in the mining and geology software technologies market will depend on continued growth in coal consumption and government policies supporting the mining industry through investment incentives and lowering tariffs on technologies and equipment imports.

4.1 Market Segmentation

—

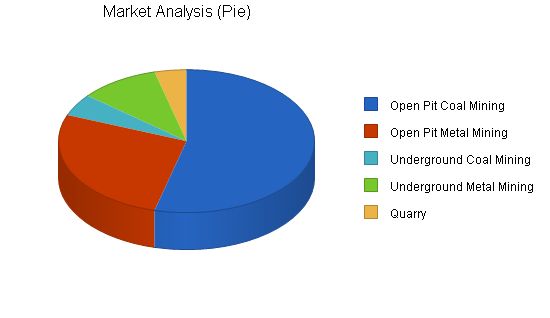

During its first five years of operations, RTI will target large domestic coal, base metal, precious metal, and quarry mines. After five years of operations, it will expand to service smaller coal, metal mines, and quarries. This industry is comprised of local companies within every province.

RTI will operate regionally in the Southeast Asia region but will initially focus on the Indonesian mining market.

The target market is comprised of open pit coal mines, open pit metal mines, underground coal mines, underground metal mines, and quarry mines.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Open Pit Coal Mining 20% 49,410,000 59,292,000 71,150,400 85,380,480 102,456,576 20.00%

Open Pit Metal Mining 13% 24,705,000 27,793,125 31,267,266 35,175,674 39,572,633 12.50%

Underground Coal Mining 15% 4,575,000 5,261,250 6,050,438 6,958,004 8,001,705 15.00%

Underground Metal Mining 12% 9,150,000 10,248,000 11,477,760 12,855,091 14,397,702 12.00%

Quarry 15% 3,660,000 4,209,000 4,840,350 5,566,403 6,401,363 15.00%

Total 16.89% 91,500,000 106,803,375 124,786,214 145,935,652 170,829,979 16.89%

4.2 Target Market Segment Strategy

In its first five years, RTI will focus on large, domestic open pit metal mines, underground coal mines, underground metal mines, and quarry mines.

4.2.1 Customer Benefits

Clients buy benefits, not just features. RTI will demonstrate its capability in delivering benefits rather than presenting the company’s marketing mix. Mining companies are interested in cutting costs to improve the bottom line. They prefer a vendor to operate in a turnkey fashion. However, customers have the choice to procure their own equipment and have a say in designing and installing the system.

4.3 Service Business Analysis

The mining and geology software market in Indonesia is one of the fastest growing segments in the computer industry, totaling $91.5 million in 2001. The mining industry is experiencing pressures to further automate and increase efficiency, providing RTI with an advantageous position. The MINER DELTA program is early in its development life cycle, indicating promising revenue growth. The industry’s rapid innovation and high gross margins contribute to this.

4.3.1 Main Competitors

Three major players in the Indonesian mining industry, ECS International Pty Ltd, Runge Mining, and Mincom, have developed and marketed similar products and services.

4.3.2 Competition and Buying Patterns

Mining companies, operating in large volumes, are interested in mechanisms that generate value through increased mineral recovery or decreased operating costs. RTI must compete against the idea that mining companies should only buy mining and geology software and can get trained to operate it quickly. RTI’s MINER DELTA system provides real-time data and operational data logs, saving money and increasing mineral recovery.

Strategy and Implementation Summary

Purchases will occur through direct sales. Mine engineers and geologists, who influence the purchase decision, require demonstrations or technical sales presentations. Initial contact will be made by telephone or a combination of telephone, email, and fax. The Sales Manager will arrange a technical presentation, delivering information in person. All promotion efforts will establish RTI’s quality reputation and brand image.

5.1 Competitive Edge

The President and Vice President Sales and Marketing of RTI have been working with prospective clients in the Indonesian mining industry for more than 14 years, maintaining effective relationships. MINER DELTA is a recognized leader in supplying integrated geological and mining software technologies and consulting services.

5.2 Sales Strategy

RTI’s sales strategy focuses on building the company’s identity with large domestic open pit metal mines, underground coal mines, underground metal mines, and quarry mines interested in cutting costs. The integration systems offered are unique and improve upon current methods due to their automatic, non-disruptive, and accurate characteristics. These systems save money and increase mineral recovery. The targeted monthly sales between January and May 2001 are the result of intensive direct sales approaches.

5.2.1 Sales Forecast

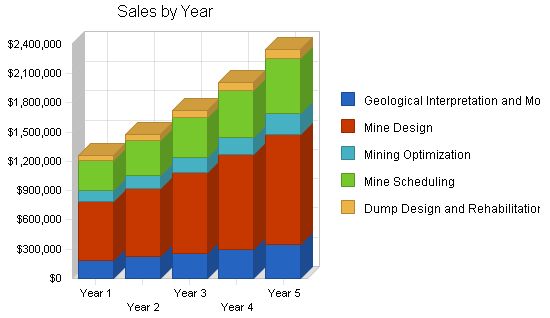

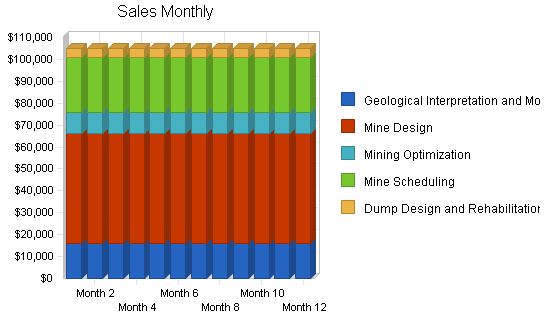

RTI has an ambitious sales forecast as shown in the yearly total sales chart.

Sales Forecast – Year 1 to Year 5

Geological Interpretation and Modeling: $189,000, $220,922, $258,236, $301,852, $352,835

Mine Design: $604,800, $706,951, $826,355, $965,926, $1,129,071

Mining Optimization: $113,400, $132,553, $154,941, $181,111, $211,701

Mine Scheduling: $302,400, $353,475, $413,177, $482,963, $564,535

Dump Design and Rehabilitation: $50,400, $58,913, $68,863, $80,494, $94,089

Total Sales: $1,260,000, $1,472,814, $1,721,572, $2,012,346, $2,352,231

Direct Cost of Sales – Year 1 to Year 5

Geological Interpretation and Modeling: $35,154, $41,092, $48,032, $56,145, $65,628

Mine Design: $112,493, $131,493, $153,702, $179,662, $210,007

Mining Optimization: $210,924, $246,549, $288,191, $336,866, $393,763

Mine Scheduling: $56,246, $65,746, $78,850, $92,168, $107,735

Dump Design and Rehabilitation: $9,374, $10,957, $12,808, $14,971, $17,500

Subtotal Direct Cost of Sales: $424,192, $495,837, $581,584, $679,812, $794,632

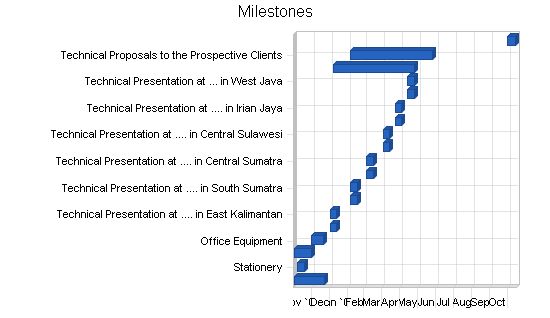

5.3 Milestones

The bar chart and table display milestones, assigned responsibilities, dates, and budgets. RTI is focusing on key milestones in this plan.

Milestones:

– Business Plan: 11/1/2000 – 12/23/2000, $5,000, Managed by CEO, President

– Stationery: 11/6/2000 – 11/18/2000, $3,000, Managed by Administrative Officer

– Brochures: 11/1/2000 – 11/30/2000, $5,000, Managed by Administrative Officer

– Office Equipment: 12/1/2000 – 12/22/2000, $3,000, Managed by Administrative Officer

– Technical Presentation at … in East Kalimantan: 1/2/2001 – 1/12/2001, $1,700, Managed by Sales Manager – Mining

– Technical Presentation at … in East Kalimantan: 1/2/2001 – 1/12/2001, $1,700, Managed by Sales Manager – Geology

– Technical Presentation at … in South Sumatra: 2/5/2001 – 2/17/2001, $1,700, Managed by Sales Manager – Mining

– Technical Presentation at … in South Sumatra: 2/5/2001 – 2/17/2001, $1,700, Managed by Sales Manager – Geology

– Technical Presentation at … in Central Sumatra: 3/5/2001 – 3/17/2001, $1,700, Managed by Sales Manager – Mining

– Technical Presentation at … in Central Sumatra: 3/5/2001 – 3/17/2001, $1,700, Managed by Sales Manager – Geology

– Technical Presentation at … in Central Sulawesi: 4/2/2001 – 4/13/2001, $1,700, Managed by Sales Manager – Mining

– Technical Presentation at … in Central Sulawesi: 4/2/2001 – 4/13/2001, $1,700, Managed by Sales Manager – Geology

– Technical Presentation at … in Irian Jaya: 4/23/2001 – 5/4/2001, $1,700, Managed by Sales Manager – Mining

– Technical Presentation at … in Irian Jaya: 4/23/2001 – 5/4/2001, $1,700, Managed by Sales Manager – Geology

– Technical Presentation at … in West Java: 5/14/2001 – 5/25/2001, $1,700, Managed by Sales Manager – Mining

– Technical Presentation at … in West Java: 5/14/2001 – 5/25/2001, $1,700, Managed by Sales Manager – Geology

– Operations Analysis at the most Prospective Clients’ Site: 1/8/2001 – 5/25/2001, $12,000, Managed by VP Sales & Marketing

– Technical Proposals to the Prospective Clients: 2/5/2001 – 6/25/2001, $2,000, Managed by VP Sales & Marketing

– Participating in Indonesia Mining Exhibition: 11/1/2001 – 11/14/2001, $6,000, Managed by General Manager

– Totals: $56,400

Management Summary:

RTI is operated and managed by the President and Vice President of Sales and Marketing. Additional personnel and staff will be recruited as projects are secured.

6.1 Personnel Plan:

Initially, the start-up team consists of the President and VP Sales & Marketing. Once projects are secured, a VP Operations, General/Office Manager, and five employees will be recruited.

Personnel Plan:

– CEO, President and Managing Partner: $60,000 (Year 1), $66,000 (Year 2), $72,600 (Year 3), $79,860 (Year 4), $87,846 (Year 5)

– Vice President Operations: $36,000 (Year 1), $39,600 (Year 2), $43,560 (Year 3), $47,916 (Year 4), $52,708 (Year 5)

– Senior Field Engineer: $12,000 (Year 1), $13,200 (Year 2), $14,520 (Year 3), $15,972 (Year 4), $17,569 (Year 5)

– Senior Programmer/Researcher: $12,000 (Year 1), $13,200 (Year 2), $14,520 (Year 3), $15,972 (Year 4), $17,569 (Year 5)

– Vice President of Sales & Marketing: $36,000 (Year 1), $39,600 (Year 2), $43,560 (Year 3), $47,916 (Year 4), $52,708 (Year 5)

– Sales Manager – Mining Engineering: $12,000 (Year 1), $13,200 (Year 2), $14,520 (Year 3), $15,972 (Year 4), $17,569 (Year 5)

– Sales Manager – Geology: $12,000 (Year 1), $13,200 (Year 2), $14,520 (Year 3), $15,972 (Year 4), $17,569 (Year 5)

– General Manager: $24,000 (Year 1), $26,400 (Year 2), $29,040 (Year 3), $31,944 (Year 4), $35,138 (Year 5)

– Administrative Officer: $12,000 (Year 1), $13,200 (Year 2), $14,520 (Year 3), $15,972 (Year 4), $17,569 (Year 5)

– Total People: 9

– Total Payroll: $216,000 (Year 1), $237,600 (Year 2), $261,360 (Year 3), $287,496 (Year 4), $316,246 (Year 5)

The table displays the projected revenue of RTI from 2001 to 2005. The company aims to maintain a high gross margin for profitability.

7.1 Important Assumptions:

The table lists the main assumptions of RTI for financial projections. Collection days is a critical assumption, and RTI plans to improve collection times to ease working capital pressures.

7.2 Business Ratios:

The table provides essential business ratios for the prepackaged software industry (SIC Index 7372).

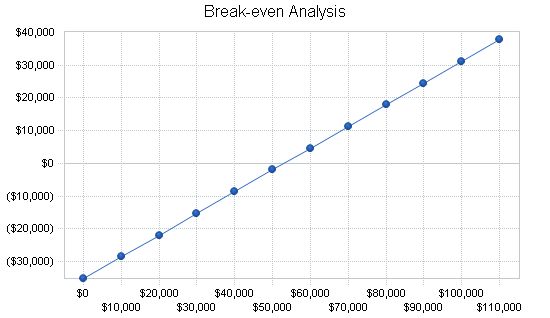

7.3 Break-even Analysis:

The table and chart summarize the Break-even Analysis, including monthly running costs and sales break-even points.

Break-even Analysis:

Monthly Revenue Break-even: $53,010.

Assumptions:

Average Percent Variable Cost: 34%.

Estimated Monthly Fixed Cost: $35,163.

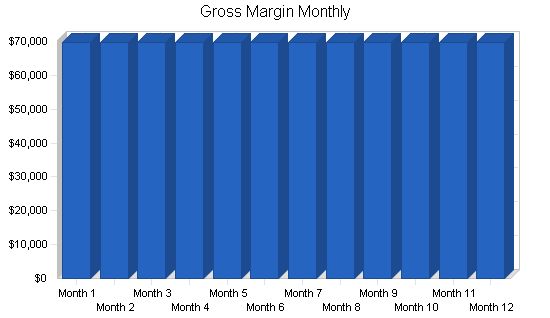

Projected Profit and Loss:

The net profit is the most crucial and strategic component in the Projected Profit and Loss statement. It is planned and targeted to increase. Month-by-month assumptions for profit and loss are included in the appendix.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3 Year 4 Year 5

Sales: $1,260,000 $1,472,814 $1,721,572 $2,012,346 $2,352,231

Direct Cost of Sales: $424,192 $495,837 $581,584 $679,812 $794,632

Other: $0 $0 $0 $0 $0

Total Cost of Sales: $424,192 $495,837 $581,584 $679,812 $794,632

Gross Margin: $835,808 $976,977 $1,139,988 $1,332,534 $1,557,599

Gross Margin %: 66.33% 66.33% 66.22% 66.22% 66.22%

Expenses:

Payroll: $216,000 $237,600 $261,360 $287,496 $316,246

Sales and Marketing and Other Expenses: $122,200 $134,420 $147,862 $162,648 $178,913

Depreciation: $0 $0 $0 $0 $0

Leased Equipment: $0 $0 $0 $0 $0

Utilities: $7,200 $7,920 $8,712 $9,583 $10,541

Insurance: $2,160 $2,376 $2,614 $2,875 $3,163

Rent: $42,000 $46,200 $50,820 $55,902 $61,492

Payroll Taxes: $32,400 $35,640 $39,204 $43,124 $47,437

Other: $0 $0 $0 $0 $0

Total Operating Expenses: $421,960 $464,156 $510,572 $561,629 $617,791

Profit Before Interest and Taxes: $413,848 $512,821 $629,417 $770,905 $939,807

EBITDA: $413,848 $512,821 $629,417 $770,905 $939,807

Interest Expense: $0 $0 $0 $0 $0

Taxes Incurred: $105,406 $128,205 $159,977 $192,726 $238,868

Net Profit: $308,443 $384,616 $469,440 $578,179 $700,940

Net Profit/Sales: 24.48% 26.11% 27.27% 28.73% 29.80%

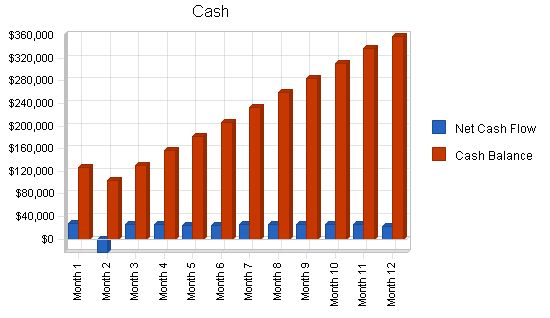

7.5 Projected Cash Flow:

Cash flow projections are critical to RTI’s success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month and the other representing the monthly balance. The annual cash flow figures are included in the following table. Detailed monthly numbers are included in the appendix.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Sales | $630,000 | $736,407 | $860,786 | $1,006,173 | $1,176,116 |

| Cash from Receivables | $526,750 | $718,968 | $840,402 | $982,346 | $1,148,264 |

| Subtotal Cash from Operations | $1,156,750 | $1,455,375 | $1,701,188 | $1,988,519 | $2,324,379 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $1,156,750 | $1,455,375 | $1,701,188 | $1,988,519 | $2,324,379 |

| Expenditures from Operations | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Cash Spending | $216,000 | $237,600 | $261,360 | $287,496 | $316,246 |

| Bill Payments | $682,028 | $839,215 | $979,251 | $1,133,858 | $1,319,563 |

| Subtotal Spent on Operations | $898,028 | $1,076,815 | $1,240,611 | $1,421,354 | $1,635,809 |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $898,028 | $1,076,815 | $1,240,611 | $1,421,354 | $1,635,809 |

| Net Cash Flow | $258,722 | $378,560 | $460,577 | $567,165 | $688,571 |

| Cash Balance | $358,722 | $737,282 | $1,197,859 | $1,765,024 | $2,453,595 |

7.6 Projected Balance Sheet

The Balance Sheet below shows Net Worth growth and a strong financial position. Monthly estimates can be found in the appendix.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash | $358,722 | $737,282 | $1,197,859 | $1,765,024 | $2,453,595 |

| Accounts Receivable | $103,250 | $120,689 | $141,073 | $164,901 | $192,752 |

| Other Current Assets | $31,588 | $31,588 | $31,588 | $31,588 | $31,588 |

| Total Current Assets | $493,559 | $889,558 | $1,370,519 | $1,961,512 | $2,677,934 |

| Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $493,559 | $889,558 | $1,370,519 | $1,961,512 | $2,677,934 |

| Current Liabilities | $58,529 | $69,912 | $81,433 | $94,247 | $109,730 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $58,529 | $69,912 | $81,433 | $94,247 | $109,730 |

| Paid-in Capital | $195,675 | $195,675 | $195,675 | $195,675 | $195,675 |

| Retained Earnings | ($69,088) | $239,355 | $623,971 | $1,093,411 | $1,671,590 |

| Earnings | $308,443 | $384,616 | $469,440 | $578,179 | $700,940 |

| Total Capital | $435,030 | $819,646 | $1,289,086 | $1,867,265 | $2,568,205 |

| Total Liabilities and Capital | $493,559 | $889,558 | $1,370,519 | $1,961,512 | $2,677,934 |

| Net Worth | $435,030 | $819,646 | $1,289,086 | $1,867,265 | $2,568,205 |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Geological Interpretation and Modeling | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | $15,750 | |

| Mine Design | $50,400 | $50,400 | $50,400 | $50,400 | $50,400 | $50,400 | $50,400 | $50,400 | $50,400 | $50,400Pro Forma Profit and Loss

Sales: – Month 1: $105,000 – Month 2: $105,000 – Month 3: $105,000 – Month 4: $105,000 – Month 5: $105,000 – Month 6: $105,000 – Month 7: $105,000 – Month 8: $105,000 – Month 9: $105,000 – Month 10: $105,000 – Month 11: $105,000 – Month 12: $105,000 Direct Cost of Sales: – Month 1: $35,349 – Month 2: $35,349 – Month 3: $35,349 – Month 4: $35,349 – Month 5: $35,349 – Month 6: $35,349 – Month 7: $35,349 – Month 8: $35,349 – Month 9: $35,349 – Month 10: $35,349 – Month 11: $35,349 – Month 12: $35,349 Other Expenses: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Total Cost of Sales: – Month 1: $35,349 – Month 2: $35,349 – Month 3: $35,349 – Month 4: $35,349 – Month 5: $35,349 – Month 6: $35,349 – Month 7: $35,349 – Month 8: $35,349 – Month 9: $35,349 – Month 10: $35,349 – Month 11: $35,349 – Month 12: $35,349 Gross Margin: – Month 1: $69,651 – Month 2: $69,651 – Month 3: $69,651 – Month 4: $69,651 – Month 5: $69,651 – Month 6: $69,651 – Month 7: $69,651 – Month 8: $69,651 – Month 9: $69,651 – Month 10: $69,651 – Month 11: $69,651 – Month 12: $69,651 Gross Margin %: – Month 1: 66.33% – Month 2: 66.33% – Month 3: 66.33% – Month 4: 66.33% – Month 5: 66.33% – Month 6: 66.33% – Month 7: 66.33% – Month 8: 66.33% – Month 9: 66.33% – Month 10: 66.33% – Month 11: 66.33% – Month 12: 66.33% Expenses: Payroll: – Month 1: $18,000 – Month 2: $18,000 – Month 3: $18,000 – Month 4: $18,000 – Month 5: $18,000 – Month 6: $18,000 – Month 7: $18,000 – Month 8: $18,000 – Month 9: $18,000 – Month 10: $18,000 – Month 11: $18,000 – Month 12: $18,000 Sales and Marketing and Other Expenses: – Month 1: $5,800 – Month 2: $9,800 – Month 3: $9,800 – Month 4: $11,500 – Month 5: $11,500 – Month 6: $9,400 – Month 7: $9,800 – Month 8: $9,800 – Month 9: $9,800 – Month 10: $9,800 – Month 11: $15,800 – Month 12: $9,400 Depreciation: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Leased Equipment: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Utilities: – Month 1: $600 – Month 2: $600 – Month 3: $600 – Month 4: $600 – Month 5: $600 – Month 6: $600 – Month 7: $600 – Month 8: $600 – Month 9: $600 – Month 10: $600 – Month 11: $600 – Month 12: $600 Insurance: – Month 1: $180 – Month 2: $180 – Month 3: $180 – Month 4: $180 – Month 5: $180 – Month 6: $180 – Month 7: $180 – Month 8: $180 – Month 9: $180 – Month 10: $180 – Month 11: $180 – Month 12: $180 Rent: – Month 1: $3,500 – Month 2: $3,500 – Month 3: $3,500 – Month 4: $3,500 – Month 5: $3,500 – Month 6: $3,500 – Month 7: $3,500 – Month 8: $3,500 – Month 9: $3,500 – Month 10: $3,500 – Month 11: $3,500 – Month 12: $3,500 Payroll Taxes: – 15% of Payroll Other: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Total Operating Expenses: – Month 1: $30,780 – Month 2: $34,780 – Month 3: $34,780 – Month 4: $36,480 – Month 5: $36,480 – Month 6: $34,380 – Month 7: $34,780 – Month 8: $34,780 – Month 9: $34,780 – Month 10: $34,780 – Month 11: $40,780 – Month 12: $34,380 Profit Before Interest and Taxes: – Month 1: $38,871 – Month 2: $34,871 – Month 3: $34,871 – Month 4: $33,171 – Month 5: $33,171 – Month 6: $35,271 – Month 7: $34,871 – Month 8: $34,871 – Month 9: $34,871 – Month 10: $34,871 – Month 11: $28,871 – Month 12: $35,271 EBITDA: – Month 1: $38,871 – Month 2: $34,871 – Month 3: $34,871 – Month 4: $33,171 – Month 5: $33,171 – Month 6: $35,271 – Month 7: $34,871 – Month 8: $34,871 – Month 9: $34,871 – Month 10: $34,871 – Month 11: $28,871 – Month 12: $35,271 Interest Expense: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Taxes Incurred: – Month 1: $11,661 – Month 2: $8,718 – Month 3: $8,718 – Month 4: $8,293 – Month 5: $8,293 – Month 6: $8,818 – Month 7: $8,718 – Month 8: $8,718 – Month 9: $8,718 – Month 10: $8,718 – Month 11: $7,218 – Month 12: $8,818 Net Profit: – Month 1: $27,209 – Month 2: $26,153 – Month 3: $26,153 – Month 4: $24,878 – Month 5: $24,878 – Month 6: $26,453 – Month 7: $26,153 – Month 8: $26,153 – Month 9: $26,153 – Month 10: $26,153 – Month 11: $21,653 – Month 12: $26,453 Net Profit/Sales: – Month 1: 25.91% – Month 2: 24.91% – Month 3: 24.91% – Month 4: 23.69% – Month 5: 23.69% – Month 6: 25.19% – Month 7: 24.91% – Month 8: 24.91% – Month 9: 24.91% – Month 10: 24.91% – Month 11: 20.62% – Month 12: 25.19% Pro Forma Cash Flow Cash Received: – Month 1: $52,500 – Month 2: $52,500 – Month 3: $52,500 – Month 4: $52,500 – Month 5: $52,500 – Month 6: $52,500 – Month 7: $52,500 – Month 8: $52,500 – Month 9: $52,500 – Month 10: $52,500 – Month 11: $52,500 – Month 12: $52,500 Cash from Operations: – Month 1: $52,500 – Month 2: $54,250 – Month 3: $105,000 – Month 4: $105,000 – Month 5: $105,000 – Month 6: $105,000 – Month 7: $105,000 – Month 8: $105,000 – Month 9: $105,000 – Month 10: $105,000 – Month 11: $105,000 – Month 12: $105,000 Additional Cash Received: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Net Cash Flow: – Month 1: $27,507 – Month 2: ($23,576) – Month 3: $26,153 – Month 4: $26,111 – Month 5: $24,878 – Month 6: $24,931 – Month 7: $26,443 – Month 8: $26,153 – Month 9: $26,153 – Month 10: $26,153 – Month 11: $26,003 – Month 12: $21,813 Cash Balance: – Month 1: $127,507 – Month 2: $103,931 – Month 3: $130,084 – Month 4: $156,195 – Month 5: $181,073 – Month 6: $206,003 – Month 7: $232,446 – Month 8: $258,599 – Month 9: $284,752 – Month 10: $310,905 – Month 11: $336,908 – Month 12: $358,722 |

|||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!