Contents

How Plan Vs Actual Comparison Helps Manage Your Business

Planning isn’t just about the plan — it’s about management. Plan vs. actual analysis, also known as variance analysis, is essential for effective business management. It involves tracking results, reviewing progress, and making necessary adjustments based on performance.

At the core of this is a quote from former president and military strategist Dwight D. Eisenhower:

"The plan is useless, but planning is essential."

Planning entails comparing actual results to the original plan and managing any discrepancies.

What is Plan Vs Actual?

In simple terms, plan vs actual is the active review and adjustment of financial forecasts based on real-world financial results. It also involves reviewing actions taken during that period to provide context for the results. In accounting, this is also referred to as variance analysis.

It’s all about comparing what really happened to what was anticipated. The plan outlines strategy, tactics, important figures, and execution. Monitoring progress and results allows for a better understanding of what actually occurred. Addressing the differences between the plan and actual results leads to better and more direct business management.

Example of Plan Vs Actual

Comparing predictions to results may seem simple, but let’s examine an example to truly grasp the benefits of plan vs actual comparison.

Start with Your Plan

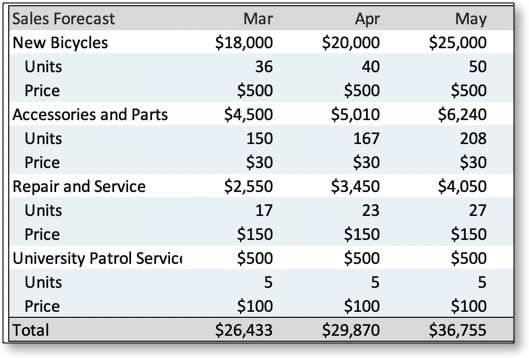

The illustration below presents a sales forecast for a bicycle store. It’s an educated guess made by the owner, considering past results and expected changes. The forecast estimates sales by predicting units, the average price per unit, and multiplying these figures to calculate total sales.

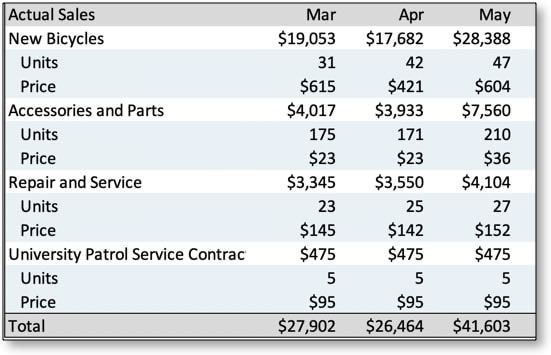

The illustration below displays the actual results from the accounting reports of the bicycle store mentioned above. Even without a detailed comparison, noticeable differences are evident.

Review: Compare the two financial statements

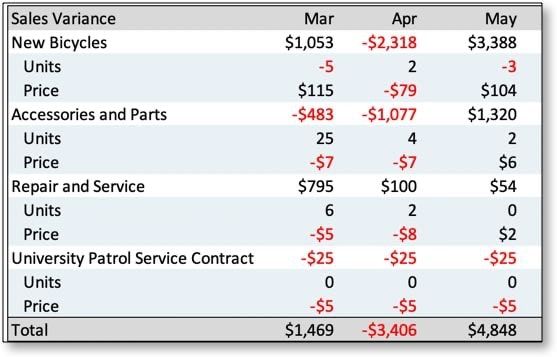

In this case, regarding sales, more is considered favorable – more units, higher price, or higher sales. Conversely, less is unfavorable – fewer units, lower price, or lower sales. Favorable variance is referred to as positive variance, while unfavorable variance is referred to as negative variance. The results can be observed in the following illustration.

Comparing your forecasts with actual accounting data should be straightforward. Specifically, when reviewing individual line items, you can subtract the actual results from your forecasts. The key is to maintain up-to-date documents and automatically generate the variance between them.

Positive and negative variances work in different ways. Let’s compare the plan, results, and variance for New Bicycles sales in March. The unit sales had a negative variance of 5 because the plan was 36 and actual sales were only 31 units. However, there was a positive $115 variance for the average price because the plan was $500 per bicycle sold, and actual sales brought in $615 per unit. Overall, the sales variance is a positive $1,053, with estimated total sales of $18,000 and actual sales of $19,053.

In all the examples above, more sales are generally seen as good, and less sales are seen as bad. However, in the March example, it’s a bit complicated. While fewer units were sold than anticipated, they were sold for a higher price. Ideally, you would have also sold more units at that higher price point and saw positive variance across the board, but it was just a tradeoff for that month.

On the other hand, the analysis of costs, expenses, and spending shows a different scenario. Spending more than planned is considered bad, so it is viewed as negative variance. Conversely, spending less than planned is considered good, so it is seen as positive variance.

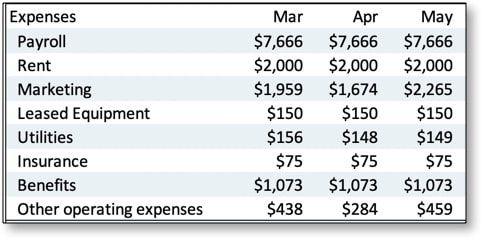

Let’s consider another example using the expenses of the same bike shop. First, let’s look at the expense budget, also known as the expense forecast.

We see the actual expenses from your accounting statement.

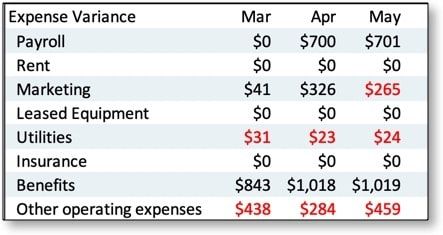

We compare the two to find the variance. Notice how spending more than budgeted creates negative variance and less than budgeted is positive variance. This is the opposite of what happens with sales.

Take the rows for marketing expense, as an example. Marketing spending was less than planned in March and April, so those variances are positive ($41 and $326, respectively). And marketing spending was more than planned in May, so that variance is negative. While on the surface this may seem complicated, thankfully you’ll look at each statement separately to avoid any confusion.

Why compare your plan to actual results?

This work is about better business management, not just accurate accounting. It’s about steering your business. Gathering the numbers and finding the variances is just the beginning. Next, you turn those differences in forecasting and performance into practical management strategy.

It may look like detailed accounting management, but it truly represents the lifeblood of your business.

A deeper look at your sales numbers

For example, in the plan vs. actual analysis for sales, we see we sold five units less than planned, which is bad. On the other hand, we got more per unit than expected, resulting in total sales that are over $1,000 above what we expected.

These numbers should be the starting point for thought and discussion. They generate important questions, such as: How did we get the price higher? Was it worth it? Should we refocus marketing to take advantage of this information? Should we revise the plan for future months to look for higher prices, even if that means lower units?

These discussions provide value in the planning process. They give managers a better understanding of ongoing results and often lead to course corrections.

A deeper look at your expenses

Now let’s look at the plan vs. actual analysis for marketing expenses. We can see that there was a positive variance in March and April ($41 and $326, respectively), meaning spending was less than budgeted. In May, there was a negative variance of $265, indicating overspending.

This should prompt questions to uncover the reasons for these variances. For example, was spending $326 less than planned a good thing? It’s positive variance, but what if the lower spending resulted from poor management and a failure to execute? What if the spending was down because ads and promotions weren’t done?

And the May spending of $265 more than planned? It’s a negative variance. It’s overspending. But maybe it was just catching up on the execution that fell short in April. The idea is to have a discussion that leads to better vision and better business management.

Insights between plan vs. actual comparisons

Some answers to these questions cannot be found within the analysis of just one financial statement. You’ll likely need to compare results between sales and expenses to uncover why certain things occurred.

Looking back at our examples, we saw diversions in sales and spending in April. Are those results related? Could the lack of spending on advertising have led to bikes needing to be sold at a lower price?

Objectively, it’s not clear, right? You need insights from each plan vs. actual review to determine where they do and do not connect.

What financial components can plan vs. actual help you review?

There are more financial elements of your business that you can review with this process.

Sales

You can easily compare your revenue and sales to identify specific buying trends month-to-month.

Expenses

Looking at your expenses across various departments can help you identify poor management processes, overly expensive projects, and the return you’re getting for your investment.

Comparing and updating your cash flow forecasts based on your cash flow statements is vital. Cash flow can tell you how healthy your business is, what your cash runway looks like, and any areas where you may be bleeding money.

Profit & loss

Looking at your overall profit or loss gives you a broader picture of your business’s performance. This moves beyond specific sales or costs and allows you to truly understand if your business is profitable.

What to look for in your plan vs. actual review

Strictly comparing your numbers isn’t enough. You need context to fully understand what any differences between actual results and your forecasts really mean. To guide your review process, these are the primary elements you should be looking for.

Positive variance

A positive variance is any situation where you outperformed what you planned. This can be an increase in sales, units sold, a decrease in expenses, or an influx of cash flow.

Keep in mind that depending on which statements you’re viewing, a positive variance can represent optimized performance instead of an increase. For example, a decrease in expenses.

Negative variance

A negative variance is any case where you underperformed compared to your projected plan. This can be a decrease in sales, units sold, cash flow, or an increase in expenses. Just like positive variance, this can be flipped into an increase depending on the statement you’re looking at, with an increase in expenses being the most obvious example.

Customer interest

Overall customer interest is crucial to consider. It spurs discussion, exploration, and provides context for any variance found between your plan and actual results.

This isn’t a straightforward numerical metric and is relatively complicated to define. To successfully understand how customers are reacting, analyze specific initiatives. Did you start a new advertising initiative? Change your pricing model or offer a discount? Introduce a new product line or feature?

Starting with what you executed, adapted, or changed and comparing your expectations versus reality can provide keen insight into how well you know your audience. It can also ensure that successful strategies or negative results are addressed quickly and help you adjust expectations moving forward.

Conducting a regular plan vs. actual review meeting is crucial

A plan vs. actual analysis must be done regularly. It’s worthless to do it once and expect positive results or a successful management strategy to emerge. Typically, you’ll do this once a month to make your forecasts for the following month more accurate. However, during times of growth or in a crisis, it may be necessary to do it more often.

To make this review process more efficient and easy, build out spreadsheets with specific equations and manually add up-to-date accounting information. You can get a headstart on building your own data sheets with our sales forecast and balance sheet templates. Alternatively, you can use a tool like LivePlan, which provides automatic financials and simplifies comparing your plan to actual by housing it all under one platform. Regardless of the method you choose, implement this process as soon as possible. It will help you take a deeper look at your results, predict performance more accurately, and better manage your business.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!