Dog Kennel Business Plan

The Creature Nannie is a doggie foster family arrangement in Sara Sloth’s home. When customers leave their dog at the Sloth’s home, it is surrounded by people all day, has its own bed, is taken for walks twice a day, and has a one acre fenced-in backyard to explore. The Creature Nannie is a superior alternative to a kennel because the dogs receive attention all day, have plush facilities, and have ample opportunities to exercise. The guest dogs can even sleep in the children’s rooms (in the bed under the sheets if they choose). Basically, the dogs become temporary members of the household. The Creature Nannie is equipped to handle only four dogs at a time.

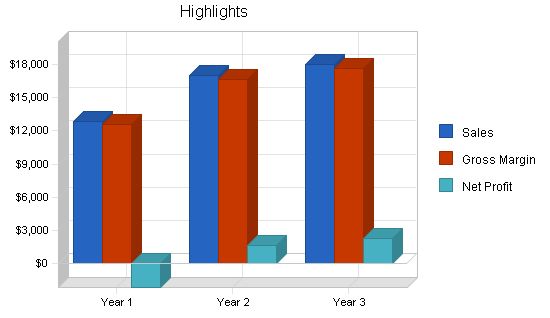

The Creature Nannie will compete directly with kennels but offer a superior service. Once word gets out about The Creature Nannie, the schedule is forecasted to reach near capacity within the first eight months. The Creature Nannie will reach profitability quickly and generate revenues of $18,000 by year three.

1.1 Objectives:

The objectives for the first three years of operation include:

– Create a service-based company that exceeds customer expectations.

– Increase the client base by 20% annually through superior performance and word-of-mouth referrals.

– Develop a sustainable home business that relies on its own cash flow.

1.2 Mission:

The mission of The Creature Nannie is to provide customers with the finest foster care service for their dogs. We exist to attract and retain customers, knowing that everything else will fall into place when we adhere to this maxim. Our services will exceed customer expectations.

1.3 Keys to Success:

The key to success for The Creature Nannie is building a loyal and vocal customer base.

The Creature Nannie is a foster care service for dogs. Customers can simply drop off their dogs at The Creature Nannie when they go on vacation, and the dogs will be cared for by the Sloth family in their own home. The dogs are treated like family, receiving playtime, exercise, and all-round care.

Sara’s home and The Creature Nannie are located in Eugene, OR.

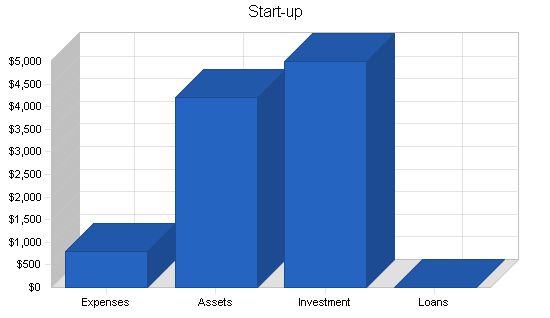

2.1 Start-up Summary:

The following are the start-up costs for The Creature Nannie:

– Computer system with CD-RW, printer, Microsoft Office, and QuickBooks Pro.

– Four large dog cages.

– Four dog beds.

– Eight water/food bowls and various dog toys.

– Variable room gates.

– Two dog leashes.

– Doggie treats.

– Pooper scooper for waste cleanup.

Start-up Requirements

Legal – $500

Website development – $300

Other – $0

Total Start-up Expenses – $800

Start-up Assets

Cash Required – $4,200

Other Current Assets – $0

Long-term Assets – $0

Total Assets – $4,200

Total Requirements – $5,000

Start-up Funding

Start-up Expenses to Fund – $800

Start-up Assets to Fund – $4,200

Total Funding Required – $5,000

Assets

Non-cash Assets from Start-up – $0

Cash Requirements from Start-up – $4,200

Additional Cash Raised – $0

Cash Balance on Starting Date – $4,200

Total Assets – $4,200

Liabilities and Capital

Liabilities

Current Borrowing – $0

Long-term Liabilities – $0

Accounts Payable (Outstanding Bills) – $0

Other Current Liabilities (interest-free) – $0

Total Liabilities – $0

Capital

Planned Investment

Sara – $5,000

Investor 2 – $0

Other – $0

Additional Investment Requirement – $0

Total Planned Investment – $5,000

Loss at Start-up (Start-up Expenses) – ($800)

Total Capital – $4,200

Total Capital and Liabilities – $4,200

Total Funding – $5,000

Company Ownership

The Creature Nannie is a sole proprietorship founded and owned by Sara Sloth.

Services

The Creature Nannie offers foster canine care service in the home of Sara Sloth. The dogs remain at Sara’s house and are never left home alone for more than three hours. They receive two walks a day and have access to a one acre fenced-in back yard. The dogs can sleep in a family member’s bedroom or in the basement. Each dog has their own doggie bed.

Sara can care for up to four dogs at once and charges $20 a day or $100 a week.

Market Analysis Summary

The Creature Nannie will develop a loyal customer base through a simple initial advertisement in the Human Society newsletter, strategic alliances with veterinarians, and a word-of-mouth referral system. While this approach might seem egotistical, based on the current service offerings for canine care, The Creature Nannie is justified in being proud and assuming. Their service offering is unique and superior, and they will quickly develop a loyal customer base.

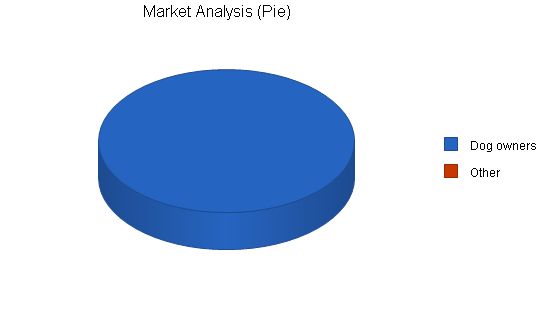

Market Segmentation

The Creature Nannie’s target market consists of people who prioritize their dog’s best interests and can afford a pet foster family. Dog kennels are sufficient for dog care while on vacation, but the dogs are never truly happy in this environment. The Creature Nannie offers an alternative for those who want better care for their dogs.

The target market also includes customers who can afford the higher cost compared to kennels, up to 80% more per day. The typical customer will have a household income above $60,000.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Dog owners 9% 17,876 19,485 21,239 23,151 25,235 9.00%

Other 0% 0 0 0 0 0 0.00%

Total 9.00% 17,876 19,485 21,239 23,151 25,235 9.00%

4.2 Target Market Segment Strategy

The Creature Nannie believes their service is distinct and valuable, with no competition, that little will be needed to build a customer base other than providing their service. The Creature Nannie will work with respected veterinarians and place an advertisement in the Human Society newsletter to communicate their availability to the general public. These are the only strategies used to develop a loyal customer base.

Strategy and Implementation Summary

The Creature Nannie will rapidly build a loyal customer base as their service exceeds customer’s expectations. The Creature Nannie will leverage their special program that allows dogs to stay in the Sloth’s home receiving constant attention to build a strong word-of-mouth referral system that will develop a strong demand.

5.1 Competitive Edge

The Creature Nannie’s competitive edge is the ability to have the dog stay at a person’s home who will be around most of the day to exercise the dog, take them on walks, and allow the pet to wander around a one-acre yard. All other alternatives do not provide anything close to the amount of personal time spent with the dog. Dogs leave The Creature Nannie content. They are rarely upset about being left with a foster family.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

The Creature Nannie’s marketing approach will use guerrilla marketing tactics to be as cost-effective as possible. The Creature Nannie will run an advertisement in the local chapter’s newsletter of the Humane Society.

In addition to this, Sara will speak with well-respected veterinarians and provide them with free day coupons to develop business that will report back to the veterinarian. Once a good review is passed back to the veterinarian, this will become a good source of customers for two reasons: 1) people typically ask their veterinarian for referrals for pet-related service providers, and 2) veterinarians are likely to recommend a foster care setup as they recognize its benefit relative to other service offerings.

Once The Creature Nannie has received initial business, very little marketing will be needed to fill up Sara’s schedule.

Lastly, a website will be developed as a tool to communicate information about The Creature Nannie to information seekers.

5.3 Sales Strategy

The sales strategy will be to develop a list of happy past customers who are willing to act as referrals for The Creature Nannie. Once this list is developed, their names will be given out when a prospective client calls. The advantages of pet foster care are so obvious relative to kennels that it will not be difficult to sign people up. The flip side to this demand is that in order to maintain all of these advantages, the operation must stay small (maximum of four dogs) so there will not be the possibility of growing the operation beyond its capacity.

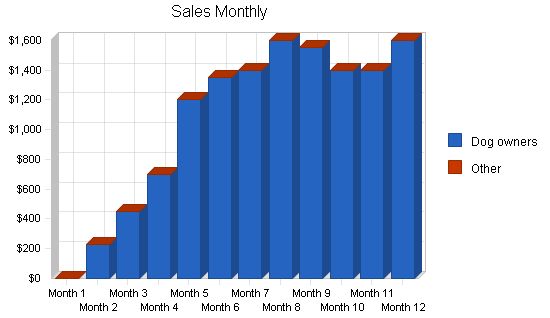

5.3.1 Sales Forecast

The first month will be used to set up the space for the dogs, submit the advertisement in the Humane Society newsletter, and form alliances with a few veterinarians. Beginning in month two, there will be some business. Things will grow for a few months until mid-year when the week will be at capacity.

Sales Forecast: Year 1 Year 2 Year 3

Sales

Dog owners $12,880 $17,000 $18,000

Other $0 $0 $0

Total Sales $12,880 $17,000 $18,000

Direct Cost of Sales: Year 1 Year 2 Year 3

Dog owners $258 $340 $360

Other $0 $0 $0

Subtotal Direct Cost of Sales $258 $340 $360

5.4 Milestones

The Creature Nannie will have several milestones early on:

– Business plan completion: roadmap for the organization, indispensable tool for ongoing performance and improvement.

– Facilities set up.

– Initial strategic development complete.

– Full capacity reached.

Milestones:

Milestone Start Date End Date Budget Manager Department

Business plan completion 1/1/2001 2/1/2001 $0 ABC Marketing

Set up the facilities 1/1/2001 2/1/2001 $0 ABC Department

Initial strategic development complete 1/1/2001 2/1/2001 $0 ABC Department

Full capacity reached 1/1/2001 8/31/2001 $0 ABC Department

Web Plan Summary

A website will be developed to provide information to prospective dog owners. It will serve as The Creature Nannie’s version of a brochure. Referrals are available on request. The site will include owners’ information, qualifications, licensing and bonding information, facilities, and services such as walks and medication disbursement.

6.1 Website Marketing Strategy

The website will be minimally marketed and mainly used as a resource.

6.2 Development Requirements

A student from the University of Oregon’s computer science department will develop the website.

Management Summary

Sara Sloth has a marketing degree from the University of Oregon. During her time at Oregon, Sara worked part-time (full-time in the summers) at a veterinary clinic. She chose this job due to her love for animals, especially dogs.

After graduating, Sara joined Funk & Associates, a local marketing/PR firm. She worked full-time for several years until she and her husband decided to have children. Sara now works part-time for Funk from home while raising her two children. Looking for a source of income to supplement her part-time work, Sara came up with the idea of offering dog foster services. This idea would allow her to generate income, pursue her passion for animals, and balance her family and work responsibilities. Thus, The Creature Nannie was born.

7.1 Personnel Plan

Sara will be the sole employee.

Personnel Plan: Year 1 Year 2 Year 3

Payroll $12,000 $12,000 $12,000

Other $0 $0 $0

Total People 1 0 0

Total Payroll $12,000 $12,000 $12,000

The following sections provide important financial information.

8.1 Important Assumptions

The table below outlines significant financial assumptions.

General Assumptions: Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00%

Other 0 0 0

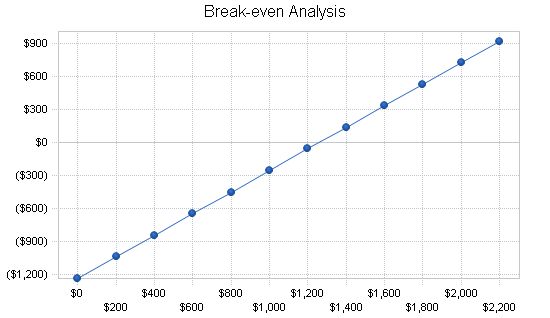

8.2 Break-even Analysis

The Break-even Analysis shows that approximately $1,400 in monthly revenue is needed to reach the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $1,259.

Assumptions:

– Average Percent Variable Cost: 2%.

– Estimated Monthly Fixed Cost: $1,233.

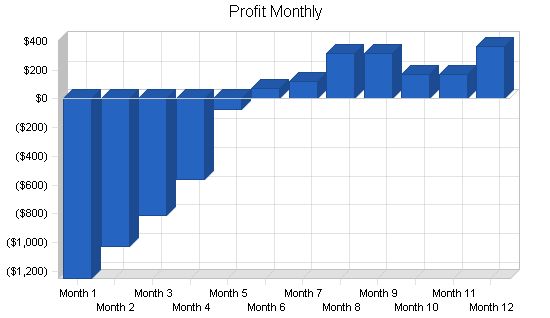

Projected Profit and Loss:

The table below shows the projected profit and loss.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $12,880 $17,000 $18,000

Direct Cost of Sales $258 $340 $360

Other Production Expenses $0 $0 $0

Total Cost of Sales $258 $340 $360

Gross Margin $12,622 $16,660 $17,640

Gross Margin % 98.00% 98.00% 98.00%

Expenses

Payroll $12,000 $12,000 $12,000

Sales and Marketing and Other Expenses $1,000 $600 $600

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Utilities $600 $600 $600

Insurance/ license/ bonding $1,200 $1,200 $1,200

Rent $0 $0 $0

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $14,800 $14,400 $14,400

Profit Before Interest and Taxes ($2,178) $2,260 $3,240

EBITDA ($2,178) $2,260 $3,240

Interest Expense $0 $0 $0

Taxes Incurred $0 $678 $972

Net Profit ($2,178) $1,582 $2,268

Net Profit/Sales -16.91% 9.31% 12.60%

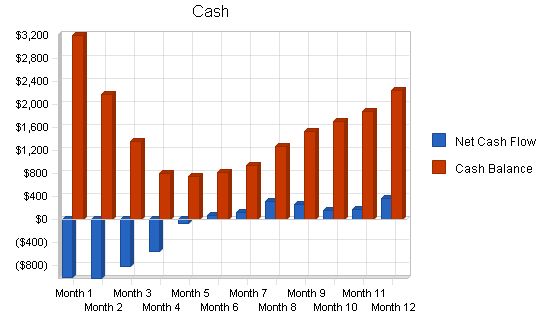

8.4 Projected Cash Flow

The following chart and table indicate projected cash flow.

Pro Forma Cash Flow

| Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $12,880 | $17,000 | $18,000 |

| Subtotal Cash from Operations | $12,880 | $17,000 | $18,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $12,880 | $17,000 | $18,000 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $12,000 | $12,000 | $12,000 |

| Bill Payments | $2,833 | $3,361 | $3,706 |

| Subtotal Spent on Operations | $14,833 | $15,361 | $15,706 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $14,833 | $15,361 | $15,706 |

| Net Cash Flow | ($1,953) | $1,639 | $2,294 |

| Cash Balance | $2,247 | $3,885 | $6,179 |

8.5 Projected Balance Sheet

The projected balance sheet is as follows:

| Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $2,247 | $3,885 | $6,179 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $2,247 | $3,885 | $6,179 |

| Long-term Assets | $0 | $0 | $0 |

| Total Assets | $2,247 | $3,885 | $6,179 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $224 | $281 | $307 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Total Current Liabilities | $224 | $281 | $307 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $224 | $281 | $307 |

| Paid-in Capital | $5,000 | $5,000 | $5,000 |

| Retained Earnings | ($800) | ($2,978) | ($1,396) |

| Earnings | ($2,178) | $1,582 | $2,268 |

| Total Capital | $2,022 | $3,604 | $5,872 |

| Total Liabilities and Capital | $2,247 | $3,885 | $6,179 |

| Net Worth | $2,022 | $3,604 | $5,872 |

8.6 Business Ratios

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 31.99% | 5.88% | -2.90% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 31.90% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 55.90% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 44.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable Turnover | 13.63 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 27 | 29 | n.a |

| Total Asset Turnover | 5.73 | 4.38 | 2.91 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.11 | 0.08 | 0.05 | n.a |

| Current Liabilities to Liabilities | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $2,022 | $3,604 | $5,872 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -16.91% | 9.31% | 12.60% | n.a |

| Return on Equity | -107.67% | 43.89% | 38.62% | n.a |

| Assets to Sales | 0.17 | 0.23 | 0.34 | n.a |

| Current Debt/Total Assets | 10% | 7% | 5% | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!