Veterinary Clinic Business Plan

The Southwest Veterinary Clinic will be located in southwest Richmond. It will offer a full range of medical services to the area’s pet owners. Southwest Richmond is a mix of industrial and residential property, with approximately 20,000 moderate-income residents, many of whom are elderly with multiple pets.

Currently, the three nearest veterinary clinics are a fifteen-minute drive from most southwest Richmond residents. The Southwest Veterinary Clinic, however, will be just a five-minute drive away.

Edward Anderson, DVM, and Michelle Johnson, DVD, have a combined seven years of veterinary experience. Edward has four years of experience at the Richmond Emergency Veterinary Hospital, while Michelle has served as a staff veterinarian at Blue Cross Hospital for three years.

Both Richmond Emergency and Blue Cross Hospitals cater to southwest Richmond residents. Edward and Michelle have treated numerous pets from this area over the years, earning praise for their service. Thirty customers have already confirmed their intention to use the new hospital’s services.

#### 1.1 Mission

Our goal is to help pets live long, healthy lives. We believe a key element to pet health is a great relationship with your veterinarian. Everyone at Southwest Veterinary Clinic is committed to professional, personalized care. We pride ourselves in our dedication to the highest standards in veterinary medicine. We have a full-service clinic with state-of-the-art technology.

#### 1.2 Keys to Success

– We treat our patients like our own pets and strive to provide the service customers desire and deserve.

– We take an individualized approach to long-term care for each patient, providing clients with enough information to make appropriate healthcare decisions for their animals.

#### Company Summary

Southwest Veterinary Clinic will be located in southwest Richmond and will offer a full range of medical services to the area’s pet owners.

#### 2.1 Company Ownership

Edward Anderson, DVM, and Michelle Johnson, DVD, are co-owners of Southwest Veterinary Clinic.

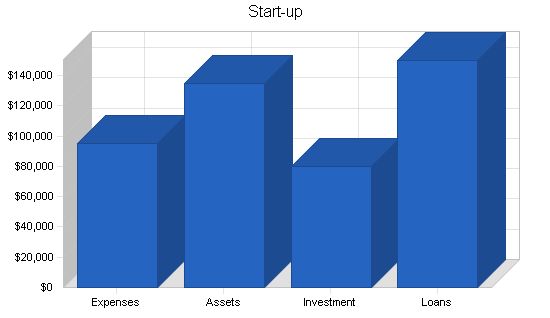

#### 2.2 Start-up Summary

Southwest Veterinary Clinic’s start-up costs include medical, surgical, and lab equipment. Additionally, there will be a $30,000 interior remodeling cost for the clinic. Edward Anderson and Michelle Johnson will invest $80,000. To secure funding, they will also obtain a $70,000 SBA loan.

Start-up Requirements:

– Legal: $2,000

– Stationery etc.: $1,000

– Medical/Surgical Equipment: $40,000

– Lab Equipment: $30,000

– Insurance: $2,000

– Rent: $3,000

– Clerical/Bookkeeping Setup: $2,000

– Kennel Equipment: $5,000

– Waiting Room/Examination Rooms Setup: $10,000

– Total Start-up Expenses: $95,000

Start-up Assets:

– Cash Required: $25,000

– Other Current Assets: $0

– Long-term Assets: $110,000

– Total Assets: $135,000

Total Requirements: $230,000

Start-up Funding:

– Start-up Expenses to Fund: $95,000

– Start-up Assets to Fund: $135,000

– Total Funding Required: $230,000

Assets:

– Non-cash Assets from Start-up: $110,000

– Cash Requirements from Start-up: $25,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $25,000

– Total Assets: $135,000

Liabilities and Capital:

– Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $150,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $150,000

– Capital

– Planned Investment

– Michelle Johnson: $40,000

– Edward Anderson: $40,000

– Additional Investment Requirement: $0

– Total Planned Investment: $80,000

– Loss at Start-up (Start-up Expenses): ($95,000)

– Total Capital: ($15,000)

Total Capital and Liabilities: $135,000

Total Funding: $230,000

2.3 Company Locations and Facilities

Southwest Veterinary Clinic will be located on the corner of 7th and Stewart, two of the busiest streets in southwest Richmond.

Products and Services

Southwest Veterinary Clinic will offer the following services:

– Internal medicine and surgery

– Orthopedics

– Dental care

– Skin disorders

– Geriatric care

– Endoscopy

– Reproductive services

Market Analysis Summary

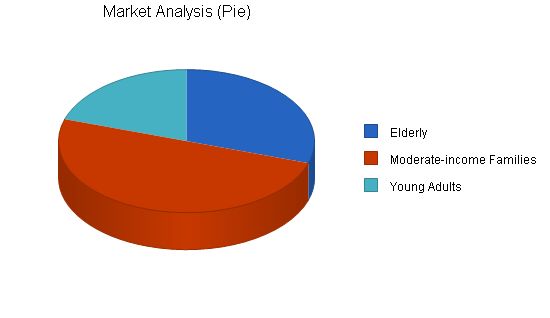

Southwest Richmond is a section of the city that has become primarily industrial. There are approximately 20,000 residents in the area who are currently underserved in basic services. The area’s residents can be put into three groups: elderly, moderate-income families, and young single adults. All three groups own pets but find it difficult to find local veterinary resources. Southwest Veterinary Clinic will fill the community’s need for reasonably priced local veterinary services.

4.1 Market Segmentation

Southwest Veterinary Clinic will focus on three customer groups:

– Elderly: This group is pivotal to the success of the clinic. They are proactive about their pets’ health and demand a strong relationship with their pet’s veterinarian. They will become loyal customers who will refer friends and neighbors.

– Moderate-income Families: This group is important for sustained growth. A veterinary service relationship with a family can last 10-20 years during which time the family can own numerous pets.

– Young, Single Adults: This group primarily visits the clinic for emergencies, reproduction services, and shots, but still represents a significant source of customers.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Elderly 5% 6,000 6,300 6,615 6,946 7,293 5.00%

Moderate-income Families 10% 10,000 11,000 12,100 13,310 14,641 10.00%

Young Adults 10% 4,000 4,400 4,840 5,324 5,856 10.00%

Total 8.57% 20,000 21,700 23,555 25,580 27,790 8.57%

Strategy and Implementation Summary

The clinic’s success relies on its visibility in the community. The location, on the corner of 7th and Stewart, two busy streets in southwest Richmond, is crucial. Being visible in the community and using the name “Southwest” will communicate the clinic’s local presence to residents seeking veterinary services.

Edward Anderson and Michelle Johnson will meet with the three Southwest Seniors Organizations and the five Southwest Neighborhood Associations to introduce the veterinary hospital. During these meetings, invitations to the clinic’s grand opening will be distributed.

Additionally, Southwest Veterinary Clinic will offer a 15% discount on pet’s next visit to customers who refer friends and neighbors to the clinic.

Competitive Edge

Southwest Veterinary Clinic’s competitive edge includes:

– Location: It is situated on the corner of 7th and Stewart, two streets with heavy traffic. The closest veterinary clinic to the Southwest area is a fifteen-minute drive away.

– Southwest Area Focus: Currently, there are no southwest-focused veterinary clinics in the area. Southwest Veterinary Clinic will be the only one.

To develop effective business strategies, perform a SWOT analysis. Use our free guide and template to learn how.

Sales Strategy

The sales strategy of Southwest Veterinary Clinic will focus on growing through referrals. Satisfied customers referring others will be critical to the clinic’s success. To encourage referrals, the clinic will offer a 15% discount on the next visit for each referral.

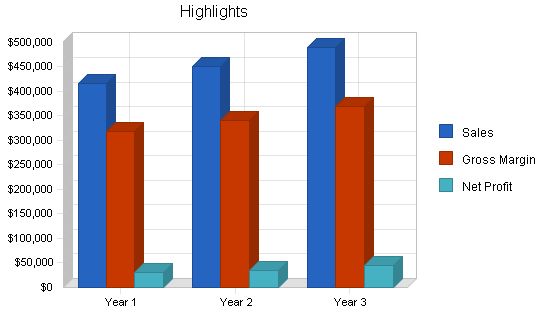

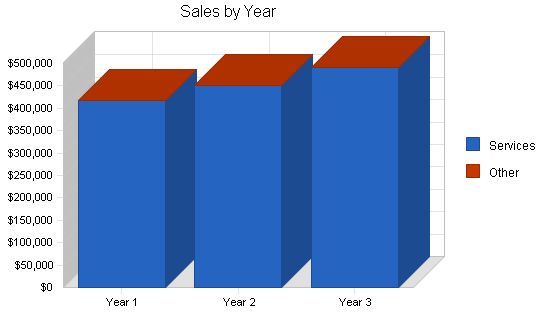

Here is the sales forecast for the next three years.

Sales Forecast:

Year 1 Year 2 Year 3

Sales:

Services $417,000 $450,000 $490,000

Other $0 $0 $0

Total Sales $417,000 $450,000 $490,000

Direct Cost of Sales:

Year 1 Year 2 Year 3

Services $98,700 $110,000 $120,000

Other $0 $0 $0

Subtotal Direct Cost of Sales $98,700 $110,000 $120,000

Management Summary:

Edward Anderson and Michelle Johnson will co-manage the clinics daily operation.

Personnel Plan:

The Southwest Veterinary Clinic will have a staff of three:

– Receptionist

– Veterinary assistants (2)

Year 1 Year 2 Year 3

Edward Anderson $45,600 $50,000 $55,000

Michelle Johnson $45,600 $50,000 $55,000

Receptionist/Clerical $24,000 $30,000 $33,000

Veterinary Assistants (2) $52,800 $53,000 $55,000

Total People 5 5 5

Total Payroll $168,000 $183,000 $198,000

The following is the financial plan for Southwest Veterinary Clinic.

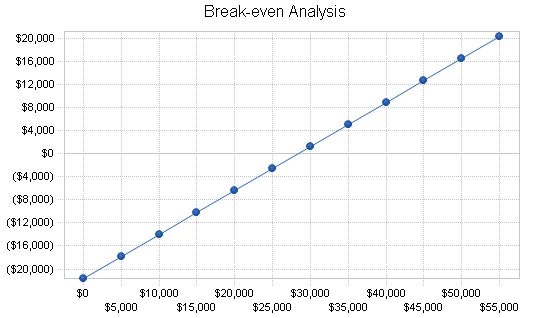

The monthly break-even point is $30,000.

Break-even Analysis

Monthly Revenue Break-even: $28,351

Assumptions:

– Average Percent Variable Cost: 24%

– Estimated Monthly Fixed Cost: $21,641

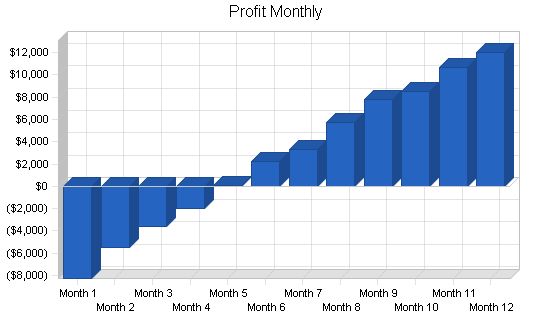

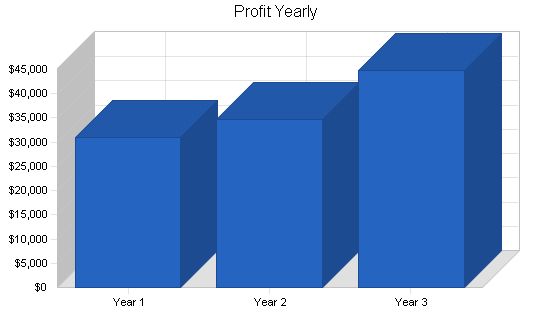

7.2 Projected Profit and Loss

The following is the projected profit and loss for three years.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $417,000 $450,000 $490,000

Direct Cost of Sales $98,700 $110,000 $120,000

Other Production Expenses $0 $0 $0

Total Cost of Sales $98,700 $110,000 $120,000

Gross Margin $318,300 $340,000 $370,000

Gross Margin % 76.33% 75.56% 75.51%

Expenses

Payroll $168,000 $183,000 $198,000

Sales and Marketing and Other Expenses $6,000 $6,000 $6,000

Depreciation $11,424 $11,424 $11,424

Leased Equipment $0 $0 $0

Utilities $3,600 $3,600 $3,600

Insurance $7,200 $7,200 $7,200

Rent $36,000 $36,000 $36,000

Payroll Taxes $27,465 $30,300 $32,400

Other $0 $0 $0

Total Operating Expenses $259,689 $277,524 $294,624

Profit Before Interest and Taxes $58,611 $62,476 $75,376

EBITDA $70,035 $73,900 $86,800

Interest Expense $14,242 $12,901 $11,502

Taxes Incurred $13,311 $14,872 $19,162

Net Profit $31,058 $34,702 $44,712

Net Profit/Sales 7.45% 7.71% 9.12%

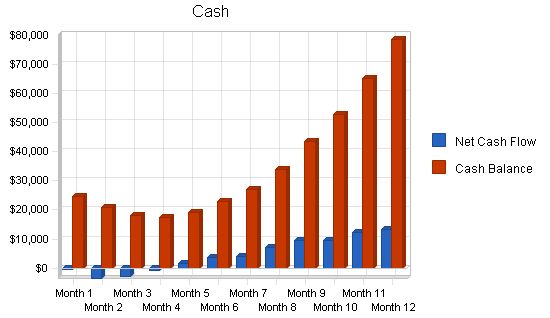

7.3 Projected Cash Flow

The following is the projected cash flow for three years.

Pro Forma Cash Flow

| Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $417,000 | $450,000 | $490,000 |

| Subtotal Cash from Operations | $417,000 | $450,000 | $490,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $417,000 | $450,000 | $490,000 |

Projected Balance Sheet

| Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $78,618 | $103,779 | $147,154 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $78,618 | $103,779 | $147,154 |

| Long-term Assets | |||

| Long-term Assets | $110,000 | $110,000 | $110,000 |

| Accumulated Depreciation | $11,424 | $22,848 | $34,272 |

| Total Long-term Assets | $98,576 | $87,152 | $75,728 |

| Total Assets | $177,194 | $190,931 | $222,882 |

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 7.91% | 8.89% | -2.90% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 32.60% |

| Total Current Assets | 44.37% | 54.35% | 66.02% | 59.90% |

| Long-term Assets | 55.63% | 45.65% | 33.98% | 40.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 14.18% | 9.51% | 8.70% | 31.10% |

| Long-term Liabilities | 76.76% | 63.91% | 48.47% | 21.50% |

| Total Liabilities | 90.94% | 73.41% | 57.16% | 52.60% |

| Net Worth | 9.06% | 26.59% | 42.84% | 47.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 76.33% | 75.56% | 75.51% | 40.00% |

| Selling, General & Administrative Expenses | 71.42% | 70.80% | 68.96% | 23.70% |

| Advertising Expenses | 1.44% | 1.33% | 1.22% | 0.50% |

| Profit Before Interest and Taxes | 14.06% | 13.88% | 15.38% | 3.60% |

| Main Ratios | ||||

| Current | 3.13 | 5.72 | 7.59 | 1.95 |

| Quick | 3.13 | 5.72 | 7.59 | 1.26 |

| Total Debt to Total Assets | 90.94% | 73.41% | 57.16% | 52.60% |

| Pre-tax Return on Net Worth | 276.30% | 97.66% | 66.90% | 5.50% |

| Pre-tax Return on Assets | 25.04% | 25.96% | 28.66% | 11.60% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 7.45% | 7.71% | 9.12% | n.a |

| Return on Equity | 193.41% | 68.36% | 46.83% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 8.22 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 36 | 29 | n.a |

| Total Asset Turnover | 2.35 | 2.36 | 2.20 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 10.03 | 2.76 | 1.33 | n.a |

| Current Liab. to Liab. | 0.16 | 0.13 | 0.15 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $53,490 | $85,625 | $127,768 | n.a |

| Interest Coverage | 4.12 | 4.84 | 6.55 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.42 | 0.42 | 0.45 | n.a |

| Current Debt/Total Assets | 14% | 10% | 9% | n.a |

| Acid Test | 3.13 | 5.72 | 7.59 | |

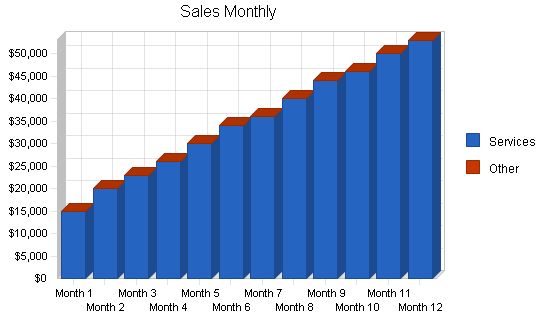

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Pro Forma Profit and Loss:

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Sales | $15,000 | $20,000 | $23,000 | $26,000 | $30,000 | $34,000 | $36,000 | $40,000 | $44,000 | $46,000 | $50,000 | $53,000 | |

| Direct Cost of Sales | $4,000 | $5,000 | $5,300 | $6,000 | $7,000 | $8,000 | $8,400 | $9,000 | $10,000 | $11,000 | $12,000 | $13,000 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $4,000 | $5,000 | $5,300 | $6,000 | $7,000 | $8,000 | $8,400 | $9,000 | $10,000 | $11,000 | $12,000 | $13,000 | |

| Gross Margin | $11,000 | $15,000 | $17,700 | $20,000 | $23,000 | $26,000 | $27,600 | $31,000 | $34,000 | $35,000 | $38,000 | $40,000 | |

| Gross Margin % | 73.33% | 75.00% | 76.96% | 76.92% | 76.67% | 76.47% | 76.67% | 77.50% | 77.27% | 76.09% | 76.00% | 75.47% | |

| Expenses | |||||||||||||

| Payroll | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | |

| Sales and Marketing and Other Expenses | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Depreciation | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Insurance | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | |

| Rent | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Payroll Taxes | 15% | $2,220 | $2,295 | $2,295 | $2,295 | $2,295 | $2,295 | $2,295 | $2,295 | $2,295 | $2,295 | $2,295 | $2,295 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $21,572 | $21,647 | $21,647 | $21,647 | $21,647 | $21,647 | $21,647 | $21,647 | $21,647 | $21,647 | $21,647 | $21,647 | |

| Profit Before Interest and Taxes | ($10,572) | ($6,647) | ($3,947) | ($1,647) | $1,353 | $4,353 | $5,953 | $9,353 | $12,353 | $13,353 | $16,353 | $18,353 | |

| EBITDA | ($9,620) | ($5,695) | ($2,995) | ($695) | $2,305 | $5,305 | $6,905 | $10,305 | $13,305 | $14,305 | $17,305 | $19,305 | |

| Interest Expense | $1,240 | $1,231 | $1,221 | $1,211 | $1,201 | $1,192 | $1,182 | $1,172 | $1,163 | $1,153 | $1,143 | $1,133 | |

| Taxes Incurred | ($3,544) | ($2,363) | ($1,550) | ($857) |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $15,000 | $20,000 | $23,000 | $26,000 | $30,000 | $34,000 | $36,000 | $40,000 | $44,000 | $46,000 | $50,000 | $53,000 | |

| Subtotal Cash from Operations | $15,000 | $20,000 | $23,000 | $26,000 | $30,000 | $34,000 | $36,000 | $40,000 | $44,000 | $46,000 | $50,000 | $53,000 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $15,000 | $20,000 | $23,000 | $26,000 | $30,000 | $34,000 | $36,000 | $40,000 | $44,000 | $46,000 | $50,000 | $53,000 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $25,000 | $24,557 | $20,999 | $18,234 | $17,357 | $19,079 | $22,908 | $26,878 | $33,950 | $43,399 | $52,975 | $65,238 | $78,618 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $25,000 | $24,557 | $20,999 | $18,234 | $17,357 | $19,079 | $22,908 | $26,878 | $33,950 | $43,399 | $52,975 | $65,238 | $78,618 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $110,000 | $109,048 | $108,096 | $107,144 | $106,192 | $105,240 | $104,288 | $103,336 | $102,384 | $101,432 | $100,480 | $99,528 | $98,576 |

| Accumulated Depreciation | $0 | $952 | $1,904 | $2,856 | $3,808 | $4,760 | $5,712 | $6,664 | $7,616 | $8,568 | $9,520 | $10,472 | $11,424 |

| Total Long-term Assets | $110,000 | $109,048 | $108,096 | $107,144 | $106,192 | $105,240 | $104,288 | $103,336 | $102,384 | $101,432 | $100,480 | $99,528 | $98,576 |

| Total Assets | $135,000 | $133,605 | $129,095 | $125,378 | $123,549 | $124,319 | $127,196 | $130,214 | $136,334 | $144,831 | $153,455 | $164,766 | $177,194 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!