The westside of South Gate has experienced explosive growth in the past three years, with over 3,000 new residents. Area businesses are starting to catch up with this opportunity. Tsunami Pizza is opening a new pizza delivery service focusing on the westside area.

Currently, the closest pizza restaurant takes up to 45 minutes to deliver. Tsunami will deliver pizzas within 20 minutes.

Tsunami will offer a better and cheaper pizza, delivering it hot to the customer’s door faster than the closest competitor.

Contents

1.1 Objectives

- Capture majority of the pizza delivery business in the westside area.

- Offer customers a superior product at a low price and provide exceptional customer service.

1.2 Mission

Tsunami Pizza’s mission is to provide the best pizza delivery service to residents of the westside.

1.3 Keys to Success

- A high-quality product to foster customer loyalty.

- An ideal location for quick delivery.

- Delivery personnel with excellent customer skills.

Company Summary

Tsunami Pizza is a new pizza delivery service in the westside area. Owner John Lindsay has seven years of experience in the restaurant industry. The focus is on satisfying customers’ demand for a quality pizza delivered promptly with a smile. Tsunami Pizza will serve a seven-mile area with over 25,000 residents and keep overhead low to offer competitive prices. Delivery personnel will utilize their own vehicles instead of the business purchasing dedicated delivery vehicles.

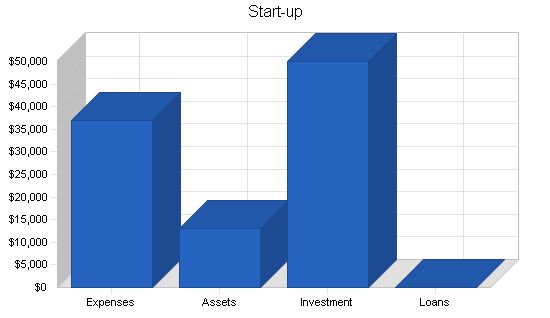

2.1 Start-up Summary

The start-up cost for Tsunami Pizza will primarily cover kitchen equipment. John Lindsay will invest $50,000.

2.1.1 Company Ownership

Tsunami Pizza is owned by John Lindsay.

Start-up Expenses

Legal: $1,000

Kitchen Inventory: $5,000

Delivery Paper Products: $3,000

Leased Kitchen Equipment: $20,000

Insurance: $1,000

Rent: $1,000

Promotional Signs for Delivery Cars: $2,000

Expensed Equipment: $0

Business Sign: $4,000

Other: $0

Total Start-up Expenses: $37,000

Start-up Assets

Cash Required: $5,000

Other Current Assets: $0

Long-term Assets: $8,000

Total Assets: $13,000

Total Requirements: $50,000

Start-up Funding

Start-up Expenses to Fund: $37,000

Start-up Assets to Fund: $13,000

Total Funding Required: $50,000

Assets

Non-cash Assets from Start-up: $8,000

Cash Requirements from Start-up: $5,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $5,000

Total Assets: $13,000

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

John Lindsey: $50,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $50,000

Loss at Start-up (Start-up Expenses): ($37,000)

Total Capital: $13,000

Total Capital and Liabilities: $13,000

Total Funding: $50,000

2.2 Company Locations and Facilities

Tsunami Pizza will be located at the corner of 11th and Tyler, which provide easy access to our service area.

Products

Tsunami Pizza will offer New York style pizzas, sodas, and fruit juices.

Market Analysis Summary

The westside is a growing middle-class area with 25,000 residents, primarily families of four or more. The average income for the area is $38,000. The area’s growth is in response to employment opportunities in the city’s Westside Industrial Park. Tsunami Pizza has potential as businesses like Magic Videos, a neighbor, have seen a sales growth of 40% due to its location and lack of direct competition.

Strategy and Implementation Summary

Tsunami Pizza will use advertising to promote the business, including the local westside flyer, people holding signs at the corner of 11th and Tyler, and door handle flyer promotion in westside neighborhoods. The business will also collaborate with Magic Video to offer coupons that can be used at both establishments.

5.1 Competitive Edge

Tsunami Pizza’s competitive edge lies in its location at the busiest corners of 11th and Tyler, providing faster delivery compared to competitors. Additionally, as a delivery-only pizza place, it has lower overhead costs and can offer lower prices.

5.2 Sales Strategy

Tsunami Pizza’s sales strategy is to offer superior pizzas at low prices, deliver them quickly, and focus on creating customer loyalty.

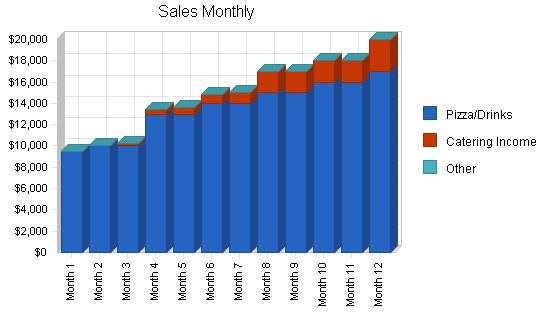

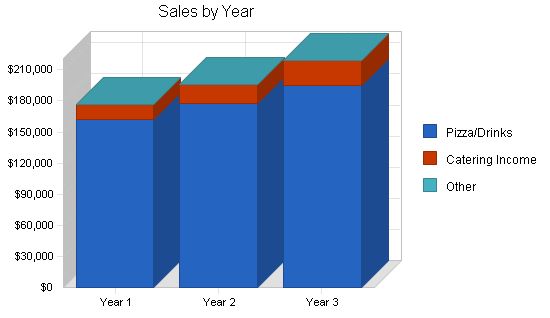

5.2.1 Sales Forecast

Here is the sales forecast for three years.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Pizza/Drinks | $162,500 | $178,000 | $195,000 |

| Catering Income | $14,000 | $18,000 | $24,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $176,500 | $196,000 | $219,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Pizza/Drinks | $24,500 | $30,000 | $36,000 |

| Catering Income | $1,400 | $1,800 | $2,400 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $25,900 | $31,800 | $38,400 |

Management Summary

John Lindsay will be the manager of Tsunami Pizza. John started as a waiter at Sweetwater restaurant and graduated from Robertson University in 1995 with a BA in history. He has been the shift manager at Sweetwater for five years.

6.1 Personnel Plan

The Tsunami Pizza staff will consist of:

- Manager

- One kitchen staff

- Two delivery staff

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $30,000 | $34,000 | $38,000 |

| Kitchen Staff Member | $24,000 | $25,000 | $29,000 |

| Delivery Staff (2) | $36,000 | $37,000 | $38,000 |

| Other | $0 | $0 | $0 |

| Total People | 4 | 4 | 4 |

| Total Payroll | $90,000 | $96,000 | $105,000 |

Here is the financial plan for Tsunami Pizza.

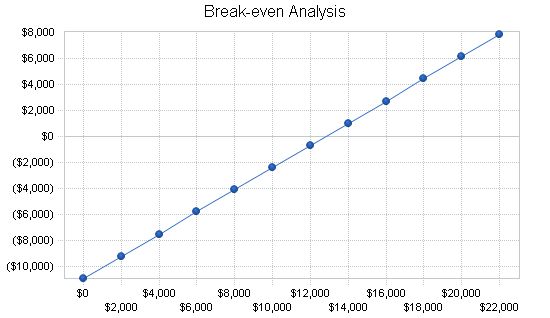

The following table and chart display the Break-even Analysis.

Break-even Analysis

Break-even: $12,803

Assumptions:

– Average Variable Cost: 15%

– Estimated Monthly Fixed Cost: $10,925

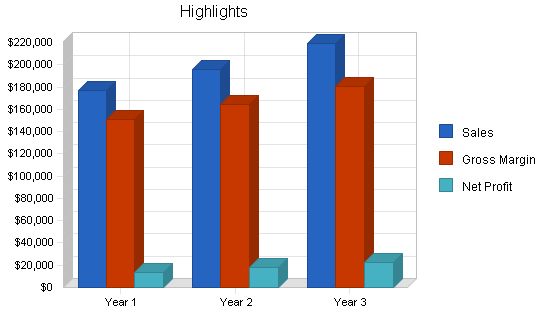

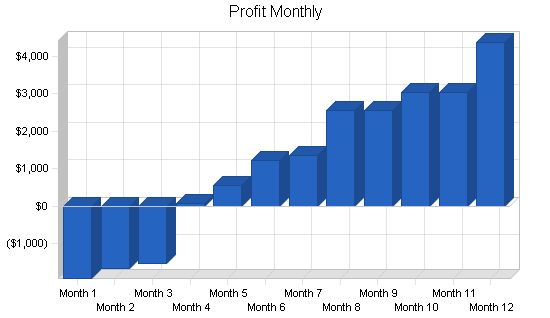

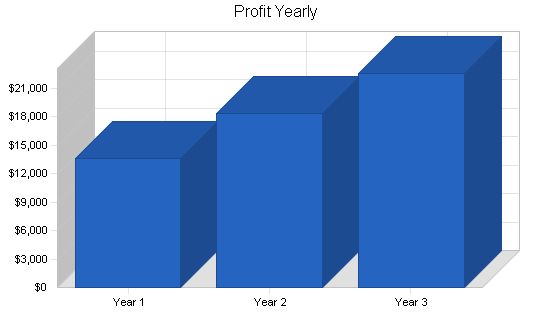

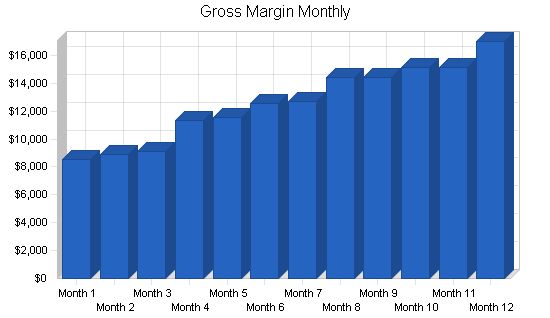

Projected Profit and Loss:

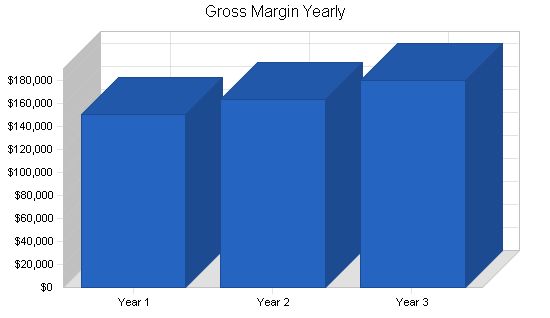

The table and charts below display the projected profit and loss for three years.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $176,500 | $196,000 | $219,000 |

| Direct Cost of Sales | $25,900 | $31,800 | $38,400 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $25,900 | $31,800 | $38,400 |

| Gross Margin | $150,600 | $164,200 | $180,600 |

| Gross Margin % | 85.33% | 83.78% | 82.47% |

| Expenses | |||

| Payroll | $90,000 | $96,000 | $105,000 |

| Sales and Marketing and Other Expenses | $8,000 | $8,000 | $8,000 |

| Depreciation | $1,596 | $1,600 | $1,600 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $6,000 | $6,000 | $6,000 |

| Insurance | $0 | $0 | $0 |

| Rent | $12,000 | $12,000 | $12,000 |

| Payroll Taxes | $13,500 | $14,400 | $15,750 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $131,096 | $138,000 | $148,350 |

| Profit Before Interest and Taxes | $19,504 | $26,200 | $32,250 |

| EBITDA | $21,100 | $27,800 | $33,850 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $5,851 | $7,860 | $9,675 |

| Net Profit | $13,653 | $18,340 | $22,575 |

| Net Profit/Sales | 7.74% | 9.36% | 10.31% |

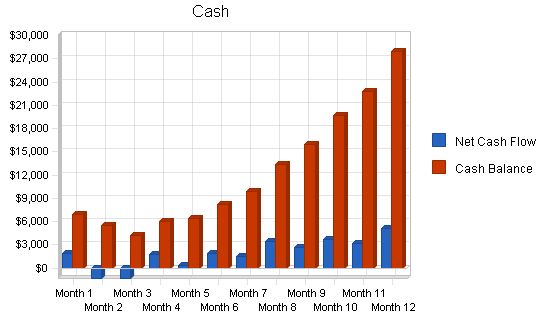

Projected Cash Flow

7.3 Projected Cash Flow

The table and chart below show the projected cash flow for three years.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $176,500 | $196,000 | $219,000 |

| Subtotal Cash from Operations | $176,500 | $196,000 | $219,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $176,500 | $196,000 | $219,000 |

Projected Balance Sheet

The following table is the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $27,980 | $46,769 | $71,747 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $27,980 | $46,769 | $71,747 |

| Long-term Assets | |||

| Long-term Assets | $8,000 | $8,000 | $8,000 |

| Accumulated Depreciation | $1,596 | $3,196 | $4,796 |

| Total Long-term Assets | $6,404 | $4,804 | $3,204 |

| Total Assets | $34,384 | $51,573 | $74,951 |

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5812, Eating Places, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 11.05% | 11.73% | 7.60% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 35.60% |

| Total Current Assets | 81.37% | 90.69% | 95.73% | 43.70% |

| Long-term Assets | 18.63% | 9.31% | 4.27% | 56.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 7.31% | 6.58% | 7.38% | 32.70% |

| Current Borrowing | 0.00% | 0.00% | 0.00% | 28.50% |

| Other Current Liabilities | 0.00% | 0.00% | 0.00% | 61.20% |

| Total Liabilities | 7.31% | 6.58% | 7.38% | 61.20% |

| Net Worth | 92.69% | 93.42% | 92.62% | 38.80% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 85.33% | 83.78% | 82.47% | 60.50% |

| Selling, General & Administrative Expenses | 77.59% | 74.42% | 72.16% | 39.80% |

| Advertising Expenses | 4.53% | 4.08% | 3.65% | 3.20% |

| Profit Before Interest and Taxes | 11.05% | 13.37% | 14.73% | 0.70% |

| Main Ratios | ||||

| Current | 3.62 | 7.11 | 9.72 | 0.98 |

| Quick | 3.62 | 7.11 | 9.72 | 0.65 |

| Total Debt to Total Assets | 7.31% | 6.58% | 7.38% | 61.20% |

| Pre-tax Return on Net Worth | 73.18% | 58.23% | 47.73% | 1.70% |

| Pre-tax Return on Assets | 56.72% | 50.80% | 43.03% | 4.30% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 7.74% | 9.36% | 10.31% | n.a |

| Return on Equity | 51.22% | 40.76% | 33.41% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 9.22 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 33 | 28 | n.a |

| Total Asset Turnover | 5.13 | 3.80 | 2.92 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.29 | 0.15 | 0.11 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $20,249 | $40,189 | $64,364 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.19 | 0.26 | 0.34 | n.a |

| Current Debt/Total Assets | 22% | 13% | 10% | n.a |

| Acid Test | 3.62 | 7.11 | 9.72 | n.a |

| Sales/Net Worth | 6.62 | 4.36 | 3.24 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Pizza/Drinks | $9,500 | $10,000 | $10,000 | $13,000 | $13,000 | $14,000 | $14,000 | $15,000 | $15,000 | $16,000 | $16,000 | $17,000 | |

| Catering Income | $0 | $0 | $200 | $400 | $600 | $800 | $1,000 | $2,000 | $2,000 | $2,000 | $2,000 | $3,000 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Sales |

Month: 1 2 3 4 5 6 7 8 9 10 11 12 Plan Month: 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate: 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate: 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate: 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other: 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Month: 1 2 3 4 5 6 7 8 9 10 11 12 Sales: $9,500 $10,000 $10,200 $13,400 $13,600 $14,800 $15,000 $17,000 $17,000 $18,000 $18,000 $20,000 Direct Cost of Sales: $1,000 $1,100 $1,120 $2,040 $2,060 $2,280 $2,300 $2,600 $2,600 $2,900 $2,900 $3,000 Other Production Expenses: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales: $1,000 $1,100 $1,120 $2,040 $2,060 $2,280 $2,300 $2,600 $2,600 $2,900 $2,900 $3,000 Gross Margin: $8,500 $8,900 $9,080 $11,360 $11,540 $12,520 $12,700 $14,400 $14,400 $15,100 $15,100 $17,000 Gross Margin %: 89.47% 89.00% 89.02% 84.78% 84.85% 84.59% 84.67% 84.71% 84.71% 83.89% 83.89% 85.00% Expenses: Payroll: $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 Sales and Marketing and Other Expenses: $1,000 $1,000 $1,000 $1,000 $500 $500 $500 $500 $500 $500 $500 $500 Depreciation: $133 $133 $133 $133 $133 $133 $133 $133 $133 $133 $133 $133 Leased Equipment: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities: $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Insurance: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Rent: $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Payroll Taxes: 15% $1,125 $1,125 $1,125 $1,125 $1,125 $1,125 $1,125 $1,125 $1,125 $1,125 $1,125 $1,125 Other: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Operating Expenses: $11,258 $11,258 $11,258 $11,258 $10,758 $10,758 $10,758 $10,758 $10,758 $10,758 $10,758 $10,758 Profit Before Interest and Taxes: ($2,758) ($2,358) ($2,178) $102 $782 $1,762 $1,942 $3,642 $3,642 $4,342 $4,342 $6,242 EBITDA: ($2,625) ($2,225) ($2,045) $235 $915 $1,895 $2,075 $3,775 $3,775 $4,475 $4,475 $6,375 Interest Expense: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Taxes Incurred: ($827) ($707) ($653) $31 $235 $529 $583 $1,093 $1,093 $1,303 $1,303 $1,873 Net Profit: ($1,931) ($1,651) ($1,525) $71 $547 $1,233 $1,359 $2,549 $2,549 $3,039 $3,039 $4,369 Net Profit/Sales: -20.32% -16.51% -14.95% 0.53% 4.03% 8.33% 9.06% 15.00% 15.00% 16.89% 16.89% 21.85% Pro Forma Cash Flow |

||||||||||||

| Pro Forma Cash Flow | ||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Cash Received | ||||||||||||||

| Cash from Operations | ||||||||||||||

| Cash Sales | $9,500 | $10,000 | $10,200 | $13,400 | $13,600 | $14,800 | $15,000 | $17,000 | $17,000 | $18,000 | $18,000 | $20,000 | ||

| Subtotal Cash from Operations | $9,500 | $10,000 | $10,200 | $13,400 | $13,600 | $14,800 | $15,000 | $17,000 | $17,000 | $18,000 | $18,000 | $20,000 | ||

| Additional Cash Received | ||||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $9,500 | $10,000 | $10,200 | $13,400 | $13,600 | $14,800 | $15,000 | $17,000 | $17,000 | $18,000 | $18,000 | $20,000 | ||

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | ||||||||||||||

| Cash Spending | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | |

| Bill Payments | $127 | $3,805 | $4,020 | $4,145 | $5,686 | $5,437 | $5,936 | $6,035 | $6,818 | $6,835 | $7,328 | $7,350 | $7,731 | |

| Subtotal Spent on Operations | $7,627 | $11,305 | $11,520 | $11,645 | $13,186 | $12,937 | $13,436 | $13,535 | $14,318 | $14,335 | $14,828 | $14,850 | $15,231 | |

| Additional Cash Spent | ||||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | ||||||||||||||

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $7,627 | $11,305 | $11,520 | $11,645 | $13,186 | $12,937 | $13,436 | $13,535 | $14,318 | $14,335 | $14,828 | $14,850 | $15,231 | |

| Net Cash Flow | $1,873 | ($1,305) | ($1,320) | $1,755 | $414 | $1,863 | $1,564 | $3,465 | $2,682 | $3,665 | $3,172 | $5,150 | ||

| Cash Balance | $6,873 | $5,568 | $4,248 | $6,003 | $6,417 | $8,280 | $9,844 | $13,310 | $15,992 | $19,657 | $22,830 | $27,980 | ||

Pro Forma Balance Sheet

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!