Houseboat Rental Business Plan

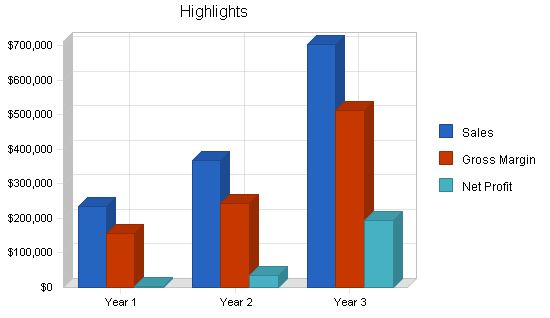

Houses On The Lake aims to establish a competitive vacation houseboat rental business on Lake Shasta in Northern California. Instead of purchasing houseboats, the business will provide rentals to families and young couples using small houseboats loaned from existing owners. Alongside this, the business will offer additional services to compete with luxury vacation houseboat companies and provide moorage and revenue sharing to existing owners. To launch the business, loans are necessary.

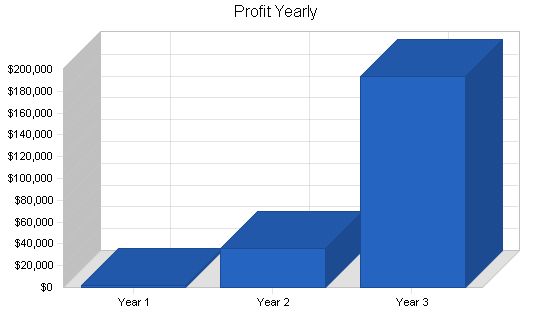

In its second year, the business is projected to be profitable, with even greater profitability in its third year. The owner and founder, Robert Hopkins, plans to expand the offering from three to eight houseboats. Rental rates will be lower compared to the market, starting at approximately $600 for a 3-day stay during the off season.

Contents

Objectives

Houses On The Lake will launch with three vacation houseboats and has the following objectives over the first three years:

- Rent land for marina and facilities

- Create a pool of eight houseboats for rental

- Steadily increase revenues each year

- Achieve a 50% retention rate from year 2 to year 3

Mission

Houses On The Lake will offer competitively priced vacation houseboat rentals for families and couples to enjoy Lake Shasta, California. The business will provide options for activities to suit both individuals and groups.

Keys to Success

Keys to success include:

- Impeccable upkeep of rental boats

- A wide variety of activities and services for families

- Seasonal pricing to encourage year-round utilization

Company Summary

Houses On The Lake offers vacation-houseboat rentals on Lake Shasta, California to large families and groups. The business was incorporated in 2009 and will launch in 2010. Houses On The Lake was founded by Robert Hopkins, a previous bed and breakfast owner who relocated to California after twenty years running his business in Vermont.

Company Ownership

Robert Hopkins established Houses On The Lake as an LLC. Robert will retain 100% ownership and will receive a loan for additional capital.

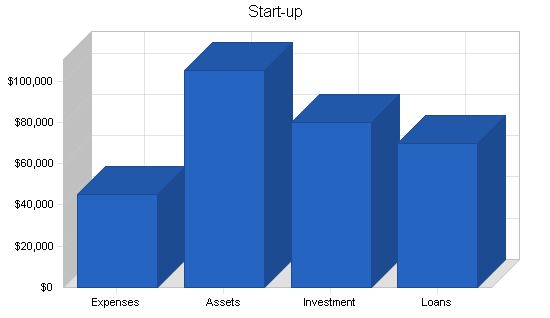

Start-up Summary

Houses On The Lake will invest in the establishment of an office/store, light renovations, office equipment and furniture, setting up Internet and phone, shelves and displays, and the purchase of three ski boats ($5,000 each). The marina where Houses On The Lake will set up will have docking space for 3 houseboats and 3 ski boats, courtesy ramps, gas and ice, and other basic facilities.

Legal and Permits includes legal consultation, building permits, business license, and motor vehicle rental permits.

Rent is for the marina space for one month before launch at $1000 per month. The security deposit is part of current assets.

Insurance will cover liability for marina usage and the boats when in use by Houses On The Lake renters. Renters must be at least 25 years old with a valid driver’s license.

The details of the website, brochure, and advertisements will be outlined in the marketing strategy section and Web plan.

Houseboats will be provided by current owners under contract with Houses On The Lake for up to 90% of the year, including peak periods. These owners receive a share of revenue, moorage, and maintenance.

The cash required will cover the first year’s losses until positive cash flows are achieved.

Start-up Requirements:

– Legal and Permits: $5,000

– Stationery etc.: $3,000

– Insurance: $10,000

– Rent: $2,000

– Office Equipment: $5,000

– Website Development: $5,000

– Print Advertisements: $10,000

– Brochures: $5,000

– Total Start-up Expenses: $45,000

Start-up Assets:

– Cash Required: $69,000

– Other Current Assets: $6,000

– Long-term Assets: $30,000

– Total Assets: $105,000

Total Requirements: $150,000

Services:

The standard House On The Lake houseboat will vary in amenities, as it will be used under contract from an owner. The desired houseboat will include:

– Sleeps 6, with at least one private room

– 1 full bathroom

– Fully equipped kitchen

– Central air and heat

– Gas barbecue

– Generator

The Houses On The Lake marina will offer:

– Ski boats

– Gas and ice

– Small convenience store within the office facility

– Moorage and courtesy docks

– Launch ramp

Basic rental rates depend on the boat specifications and season:

Summer Season (June 1 – August 31)

– Weekly: $1650

– 4 Days: $1400

– 3 Days: $1200

Spring/Fall Seasons (May and September)

– Weekly: $1400

– 4 Days: $1200

– 3 Days: $1000

Off Season (October 1 to April 30)

– Weekly: $1100

– 4 Days: $650

– 3 Days: $600

Seasonal rates are based on peak usage times at Lake Shasta.

Services for houseboat owners include:

– Renting out the boat when not in use

– Providing basic maintenance and upkeep

– Providing insurance and licensing

– Scheduling commercial vehicle inspections

– Providing moorage

Market Analysis Summary:

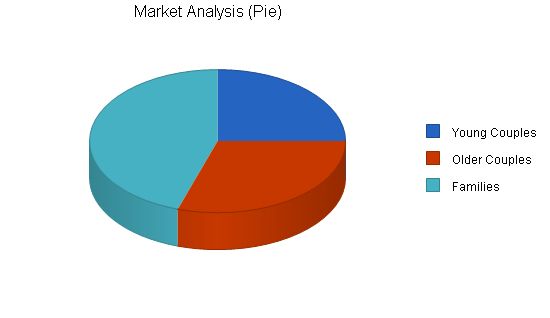

The U.S. vacation houseboat market includes local and international vacationers. Renters seek week-long rentals for activities on and around the boat. The market is segmented by age and family status, with preferences differing among younger couples, older couples, and families. Single individuals are generally uninterested. Economical rentals accommodate 14 to 18 or more individuals and are rented by multiple families. Vacation rentals represent a significant opportunity in the US, with well-off, well-educated consumers. Exposure to Houses On The Lake’s marketing can convert vacationers from outside Northern California. Growth is expected in the market for older couples.

Market Segmentation:

– Young Couples (Aged 21 to 39): Look for romantic getaways and high-energy activities.

– Older Couples (Aged 40 and up): Seek romance and relaxation.

– Families: Require a mix of relaxation for parents and high-energy activities for children. Some prefer being alone with their nuclear unit.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Young Couples 5% 25,000 26,250 27,563 28,941 30,388 5.00%

Older Couples 7% 30,000 32,100 34,347 36,751 39,324 7.00%

Families 5% 45,000 47,250 49,613 52,094 54,699 5.00%

Total 5.61% 100,000 105,600 111,523 117,786 124,411 5.61%

Target Market Segment Strategy

Houses On The Lake will focus on families with children and young couples, avoiding the market for older couples to offer a more specific and unique experience. By offering smaller houseboats at lower prices, the business can stand out among competitors on Lake Shasta.

Service Business Analysis

The vacation houseboat rental industry in the United States includes independent businesses and owners who rent out their boats. Legal vacation houseboat businesses meet safety requirements and carry proper insurance.

Research and Markets reports that most bookings are done offline, despite the prevalence of online leisure travel bookings.

Competitors in the Lake Shasta region include Shasta Marina Resort, Antlers Resort and Marina, and Holiday Harbor.

Competition and Buying Patterns

When choosing a vacation houseboat, customers consider location, availability and promotion of activities, boat amenities, and price.

Web Plan Summary

The website for Houses On The Lake will provide information for potential renters/vacationers and houseboat owners, allowing online reservations.

Website Marketing Strategy

The website will target young couples and families interested in Lake Shasta vacations, and will be marketed through banner ads, Google AdWords, listings in rental databases, and search engine optimization.

Development Requirements

The website will provide information on services, rates, activities on Lake Shasta, contact information, about the company, services for houseboat owners, policies and procedures, FAQs, availability calendar, and reservation request form.

Strategy and Implementation Summary

Houses On The Lake’s strategy is to target families and young couples interested in small, affordable houseboats on Lake Shasta. The business will focus on website advertising, partnerships with travel agents, and reaching out to houseboat owners.

Competitive Edge

Houses On The Lake has a competitive edge in the hospitality experience of Robert Hopkins, which will be reflected in marketing, sales, and operations. This will lead to a higher customer retention rate and reduce marketing and sales expenses.

Marketing Strategy

Marketing will focus on families and young couples through local advertising, website promotion, direct mail to travel agents, and partnerships with travel agents. Marketing to vacationers will also reach houseboat owners.

Sales Strategy

Sales will be managed by Robert Hopkins, and will depend on online reservations and partnerships with travel agents. Special pricing will be offered for certain dates, and relationships with houseboat owners will be established.

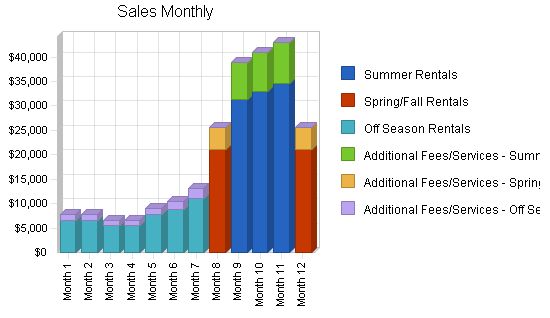

Prices for rentals will vary based on season and duration, and additional fees and services will be available. Costs of sales include post-rental cleaning, basic amenities, gas and ice, and payment to houseboat owners.

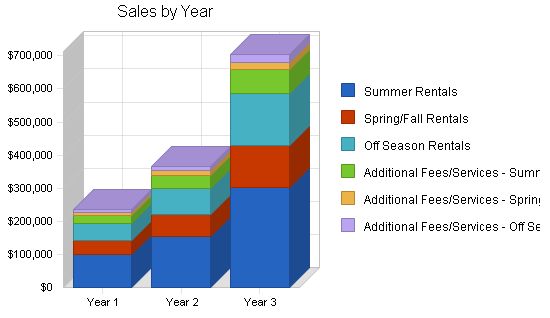

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | Summer Rentals, Spring/Fall Rentals, Off Season Rentals, Additional Fees/Services – Summer Rentals, Additional Fees/Services – Spring/Fall Rentals, Additional Fees/Services – Off Season Rentals | ||

| 60 | 90 | 135 | |

| 30 | 45 | 68 | |

| 47 | 71 | 106 | |

| 60 | 90 | 135 | |

| 30 | 45 | 68 | |

| 47 | 71 | 106 | |

| Total Unit Sales | 274 | 411 | 617 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Summer Rentals | $1,650.00 | $1,716.00 | $2,230.80 |

| Spring/Fall Rentals | $1,400.00 | $1,456.00 | $1,892.80 |

| Off Season Rentals | $1,100.00 | $1,144.00 | $1,487.20 |

| Additional Fees/Services – Summer Rentals | $400.00 | $416.00 | $540.80 |

| Additional Fees/Services – Spring/Fall Rentals | $300.00 | $312.00 | $321.36 |

| Additional Fees/Services – Off Season Rentals | $200.00 | $208.00 | $214.24 |

| Sales | |||

| Summer Rentals | $99,000 | $154,440 | $301,158 |

| Spring/Fall Rentals | $42,000 | $65,520 | $127,764 |

| Off Season Rentals | $51,700 | $80,652 | $157,271 |

| Additional Fees/Services – Summer Rentals | $24,000 | $37,440 | $73,008 |

| Additional Fees/Services – Spring/Fall Rentals | $9,000 | $14,040 | $21,692 |

| Additional Fees/Services – Off Season Rentals | $9,400 | $14,664 | $22,656 |

| Total Sales | $235,100 | $366,756 | $703,549 |

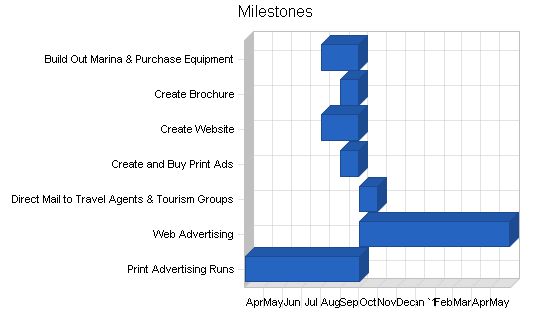

Milestones

The milestones table outlines the key marketing activities for the business launch. Prior to the official opening in October 2010, the marketing campaign will include the development of the website, brochure, and print ads. Internet advertising, direct mail, and running the print ads will commence after October 2010.

Milestones:

Milestone Start Date End Date Budget Manager Department

Build Out Marina & Purchase Equipment 8/1/2010 9/30/2010 $50,000 RH Operations

Create Brochure 9/1/2010 9/30/2010 $5,000 RH Marketing

Create Website 8/1/2010 9/30/2010 $5,000 RH Marketing

Create and Buy Print Ads 9/1/2010 9/30/2010 $10,000 RH Marketing

Direct Mail to Travel Agents & Tourism Groups 10/1/2010 10/31/2010 $3,000 RH Marketing

Web Advertising 10/1/2010 5/31/2011 $7,000 RH Marketing

Print Advertising Runs 10/1/2010 3/31/2010 $0 RH Marketing

Totals $80,000

Management Summary

Houses On The Lake will be directed and managed by Robert Hopkins. He will be responsible for sales and marketing, as well as providing copy for ads, the website, and brochures. Robert will also oversee operations, including running the marina, providing renter orientations and support, and scheduling and supervising boat cleanings. He will establish operations procedures and renter policies.

Personnel Plan

Boating assistants will be hired for the second and third summers. Before that, Robert Hopkins will fulfill their role of supporting renters during their stays. One boating assistant will be hired for the second summer and two for the third summer. The boating assistants will work from June to August to handle the peak season.

Personnel Plan

Year 1 Year 2 Year 3

Robert Hopkins $60,000 $69,000 $79,350

Boat Assistants $0 $12,000 $24,000

Total People 1 2 3

The business will grow through additional relationships with houseboat owners, without expanding the marina. They will offer eight boats in the third year, up from three in the first year.

Start-up Funding

The majority of the equity investment will come from the sale of Robert Hopkins’ bed and breakfast business. A small amount will be borrowed via credit cards, and the rest will be financed through a three-year loan.

Start-up Funding

Start-up Expenses to Fund $45,000

Start-up Assets to Fund $105,000

Total Funding Required $150,000

Assets

Non-cash Assets from Start-up $36,000

Cash Requirements from Start-up $69,000

Additional Cash Raised $0

Cash Balance on Starting Date $69,000

Total Assets $105,000

Liabilities and Capital

Current Borrowing $10,000

Long-term Liabilities $60,000

Accounts Payable (Outstanding Bills) $0

Other Current Liabilities (interest-free) $0

Total Liabilities $70,000

Capital

Planned Investment $80,000

Investors $0

Additional Investment Requirement $0

Total Planned Investment $80,000

Loss at Start-up (Start-up Expenses) ($45,000)

Total Capital $35,000

Total Capital and Liabilities $105,000

Total Funding $150,000

Important Assumptions

Houses On The Lake projects an average rental length of four days and an average of three individuals per boat.

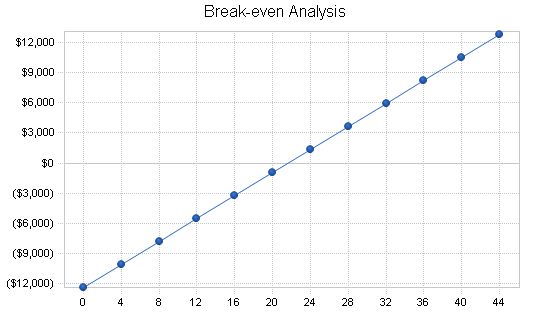

An average of 11 four-week rentals is projected to produce the monthly break-even revenue per month. Initially, this will be difficult with only three boats in the off-season, but achievable once the first summer arrives.

Break-even Analysis

Monthly Units Break-even: 22

Monthly Revenue Break-even: $18,574

Assumptions:

Average Per-Unit Revenue: $858.03

Average Per-Unit Variable Cost: $285.61

Estimated Monthly Fixed Cost: $12,392

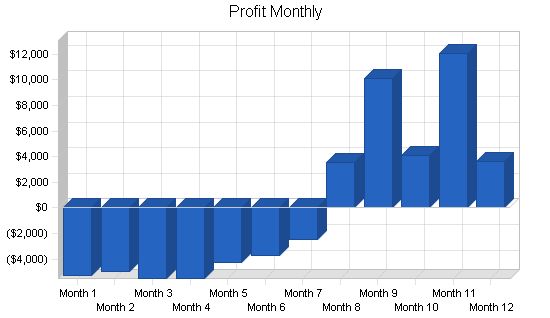

Projected Profit and Loss

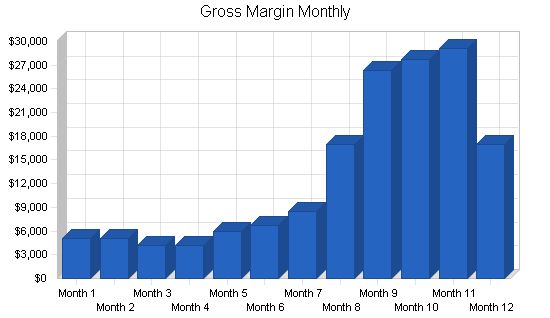

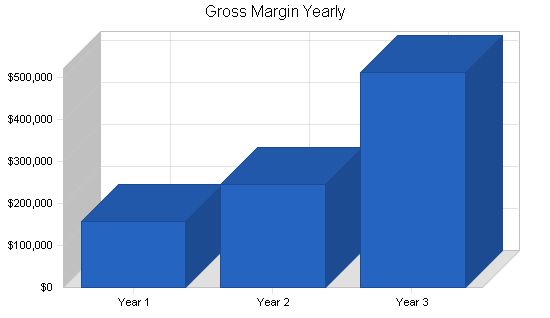

Gross margins will improve in the summers and in future years as cost of sales is lower when rates and prices are higher.

Print marketing includes additional brochure printing and press kits for travel agents as needed. Marketing efforts will increase to market an increased number of boats and to market to owners.

Depreciation is for the depreciable assets of the marina (~$25,000) over a five-year period.

Website marketing includes $1000 per month for search engine marketing, $750 per month for search engine optimization, and $250 per month for website hosting and maintenance.

Rent is set at $2,000 per month and utilities (electricity, phone, Internet for the office/store space) at $150 per month in the first year. Rent will increase based on increased space for moorage of boats at the marina.

Payroll burden includes payroll taxes and insurance/benefits for employees.

Office and boat maintenance covers light maintenance of the office/store and boats, and general supplies.

Most costs are expected to rise with inflation.

Based on these projections, the business will have a loss in the first year and move to profit in the second, with significant profit in the third as the number of boats under management increases.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $235,100 | $366,756 | $703,549 |

| Direct Cost of Sales | $78,256 | $122,079 | $190,444 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $78,256 | $122,079 | $190,444 |

| Gross Margin | $156,844 | $244,677 | $513,105 |

| Gross Margin % | 66.71% | 66.71% | 72.93% |

| Expenses | |||

| Payroll | $60,000 | $81,000 | $103,350 |

| Marketing/Promotion | $6,500 | $8,000 | $10,000 |

| Depreciation | $5,000 | $6,667 | $8,333 |

| Website Marketing | $24,000 | $24,960 | $25,958 |

| Rent | $24,000 | $30,000 | $37,500 |

| Utilities | $1,800 | $1,872 | $1,947 |

| Insurance | $10,000 | $15,000 | $20,000 |

| Payroll Burden | $15,000 | $20,250 | $25,838 |

| Office/Boat Maintenance/Supplies | $2,400 | $2,496 | $2,596 |

| Total Operating Expenses | $148,700 | $190,245 | $235,522 |

| Profit Before Interest and Taxes | $8,144 | $54,432 | $277,583 |

| EBITDA | $13,144 | $61,099 | $285,917 |

| Interest Expense | $5,729 | $3,000 | $1,000 |

| Taxes Incurred | $724 | $15,430 | $82,975 |

| Net Profit | $1,690 | $36,002 | $193,608 |

| Net Profit/Sales | 0.72% | 9.82% | 27.52% |

Projected Cash Flow

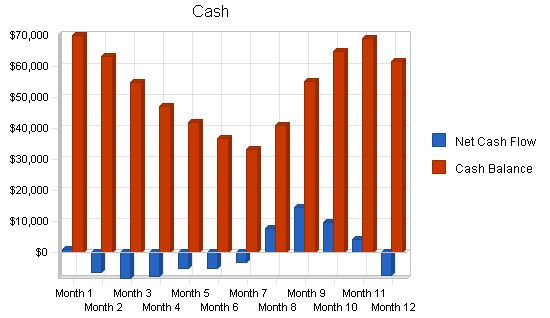

The business will continue to invest in equipment for the marina in years 2 and 3 ($5000 per year). The business loan will be repaid over three years with 10% interest. Dividends can be paid to the owner starting in the third year and will be withdrawn to keep approximately $40,000 in cash to fund needs for renovation or repair to the marina or boats. The credit card borrowing will be paid off within the first year.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $235,100 | $366,756 | $703,549 |

| Subtotal Cash from Operations | $235,100 | $366,756 | $703,549 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $23,510 | $36,676 | $70,355 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $258,610 | $403,432 | $773,904 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $60,000 | $81,000 | $103,350 |

| Bill Payments | $152,477 | $239,040 | $385,504 |

| Subtotal Spent on Operations | $212,477 | $320,040 | $488,854 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $23,510 | $36,676 | $70,355 |

| Principal Repayment of Current Borrowing | $10,000 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $20,000 | $20,000 | $20,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $5,000 | $5,000 |

| Dividends | $0 | $0 | $50,000 |

| Subtotal Cash Spent | $265,987 | $381,715 | $634,209 |

| Net Cash Flow | ($7,377) | $21,716 | $139,695 |

| Cash Balance | $61,623 | $83,339 | $223,035 |

Projected Balance Sheet

The business will not be asset-intensive, as the houseboats will be used through contract and revenue sharing with their owners. The office furnishings and ski boats are the main assets and could be sold if the business folded. The liabilities will decrease as the debts are paid off, improving the net worth of the business.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $61,623 | $83,339 | $223,035 |

| Other Current Assets | $6,000 | $6,000 | $6,000 |

| Total Current Assets | $67,623 | $89,339 | $229,035 |

| Long-term Assets | |||

| Long-term Assets | $30,000 | $35,000 | $40,000 |

| Accumulated Depreciation | $5,000 | $11,667 | $20,000 |

| Total Long-term Assets | $25,000 | $23,333 | $20,000 |

| Total Assets | $92,623 | $112,673 | $249,035 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $15,932 | $19,980 | $32,733 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $15,932 | $19,980 | $32,733 |

| Long-term Liabilities | $40,000 | $20,000 | $0 |

| Total Liabilities | $55,932 | $39,980 | $32,733 |

| Paid-in Capital | $80,000 | $80,000 | $80,000 |

| Retained Earnings | ($45,000) | ($43,310) | ($57,307) |

| Earnings | $1,690 | $36,002 | $193,608 |

| Total Capital | $36,690 | $72,693 | $216,301 |

| Total Liabilities and Capital | $92,623 | $112,673 | $249,035 |

| Net Worth | $36,690 | $72,693 | $216,301 |

| Ratio Analysis | |||||||||||||

| Year 1 | Year 2 | Year 3 | Industry Profile | ||||||||||

| Sales Growth | n.a. | 56.00% | 91.83% | 2.79% | |||||||||

| Percent of Total Assets | |||||||||||||

| Other Current Assets | 6.48% | 5.33% | 2.41% | 22.84% | |||||||||

| Total Current Assets | 73.01% | 79.29% | 91.97% | 25.52% | |||||||||

| Long-term Assets | 26.99% | 20.71% | 8.03% | 74.48% | |||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Current Liabilities | 17.20% | 17.73% | 13.14% | 8.80% | |||||||||

| Long-term Liabilities | 43.19% | 17.75% | 0.00% | 84.68% | |||||||||

| Total Liabilities | 60.39% | 35.48% | 13.14% | 93.49% | |||||||||

| Net Worth | 39.61% | 64.52% | 86.86% | 6.51% | |||||||||

| Percent of Sales | |||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Gross Margin | 66.71% | 66.71% | 72.93% | 84.56% | |||||||||

| Selling, General & Administrative Expenses | 65.99% | 56.90% | 45.41% | 23.13% | |||||||||

| Advertising Expenses | 2.76% | 2.18% | 1.42% | 2.22% | |||||||||

| Profit Before Interest and Taxes | 3.46% | 14.84% | 39.45% | 9.37% | |||||||||

| Main Ratios | |||||||||||||

| Current | 4.24 | 4.47 | 7.00 | 1.45 | |||||||||

| Quick | 4.24 | 4.47 | 7.00 | 1.37 | |||||||||

| Total Debt to Total Assets | 60.39% | 35.48% | 13.14% | 93.49% | |||||||||

| Pre-tax Return on Net Worth | 6.58% | 70.75% | 127.87% | 73.67% | |||||||||

| Pre-tax Return on Assets | 2.61% | 45.65% | 111.06% | 4.80% | |||||||||

| Additional Ratios | Year 1 | Year 2 | Year 3 | ||||||||||

| Net Profit Margin | 0.72% | 9.82% | 27.52% | n.a | |||||||||

| Return on Equity | 4.61% | 49.53% | 89.51% | n.a | |||||||||

| Activity Ratios | |||||||||||||

| Accounts Payable Turnover | 10.57 | 12.17 | 12.17 | n.a | |||||||||

| Payment Days | 27 | 27 | 24 | n.a | |||||||||

| Total Asset Turnover | 2.54 | 3.26 | 2.83 | n.a | |||||||||

| Debt Ratios | |||||||||||||

| Debt to Net Worth | 1.52 | 0.55 | 0.15 | n.a | |||||||||

| Current Liab. to Liab. | 0.28 | 0.50 | 1.00 | n.a | |||||||||

| Liquidity Ratios | Personnel Plan | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Robert Hopkins | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Boat Assistants | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total People | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| Total Payroll | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |