Gravel Rock Products Business Plan

Durango Gravel, Inc. produces and sells types and grades of gravel to public and private customers in the Four Corners Region, concentrating around Durango, Colorado. In just five months, we operated at a profit, recording $250,000 in sales and selling almost 49,000 tons of gravel products.

Our goal this year is to penetrate the profitable and limited competition asphalt market. By adding an asphalt plant and meeting our minimum goals of 45,500 tons of asphalt, we plan to sell over 191,000 tons of gravel products to municipalities, contractors, and end-users. This will result in sales of over $2,696,000 and net profits of $854,000.

We have achieved significant success in the local market by offering superior products and customer service.

Our keys to continued success are:

1. Expanding into the asphalt market.

2. Establishing and maintaining working relationships with major institutional users.

3. Exploiting the upcoming void in gravel supplies to establish a niche.

4. Developing a net profit margin above 30%.

5. Effectively communicating to our existing and potential customers our position as a differentiated provider of high-quality gravel and asphalt products.

1.1 Objectives

Durango Gravel, Inc. objectives for the coming year:

– Establish strategic working relationships with major asphalt users in the area.

– Develop initial sales of 45.5K tons of asphalt, resulting in first-year sales of $1,638,000.

– Increase sales over a three-year period to 77K tons per year.

Gravel objectives:

– Continue to develop strategic working relationships with 10-15 major institutional users.

– Hit target gravel sales levels of 145.5K tons of road base and screened rock, resulting in gravel sales of $1,064,000.

– Continue to exploit weaknesses in major area competitors to increase presence in the local market area.

1.2 Mission

Durango Gravel, Inc. serves municipalities, construction companies, and individual users by providing superior-quality products manufactured to the highest standards at competitive prices. We communicate our commitment to quality and customer appreciation through outstanding product quality, personal service, and efficient delivery. Our commitment to customers is reflected through honest and responsible business practices.

1.3 Keys to Success

The keys to success for Durango Gravel, Inc.:

– Establishing and maintaining working relationships and contractual agreements with municipality and business sector clients.

– Increasing our facility’s maximum production within the next three years.

– Continuing our position as a customer-service-oriented company with competitive pricing.

– Increasing profit margins and decreasing production costs.

– Developing a presence in the asphalt market with area users.

Durango Gravel manufactures various types of gravel products from base rock, including 3/4″ and 3″ ABC, 3/8″, 1/2″, 3/4″ 1-11/2″ screened and washed rock, 1″-3″ cobble, and 4″-6″ cobble. We also provide pre-washed sand, fill dirt, topsoil, bedding materials, crusher fines, and various sizes of boulders. These products are sold to municipalities, business entities, and end users in the Four Corners Region, with a concentration around Durango, Colorado. Our pit site has been the location of Durango, a locally owned gravel pit, for over 15 years, and we have significantly expanded our customer base in the last six months.

2.1 Company Ownership

Durango Gravel, Inc. is incorporated as an "S" Corporation under the laws of Colorado, and Colorado laws shall govern and take precedence. Two classes of stock shares have been issued: 1000 Class "A" Stock Shares – Voting Rights Only – No Dividend Rights, and 1000 Class "B" Stock Shares – Dividend Shares Only – No Voting Rights. Net profits are distributed in the form of dividends on a basis determined from time to time. Corporate officers are Justin McCarty, the president, treasurer, chief executive officer, and chief financial officer, and Chad Hughes, the vice president, secretary, chief operating officer, and chief financial officer.

2.2 Company History

Durango Gravel, Inc. was formed in June 2000. The principals of the corporation are Justin McCarty, owner of an excavating, landscaping, trucking, and road grading business, and Chad Hughes, educated in natural resources management and with extensive customer-service experience. In June 2000, the corporation entered into a five-year lease agreement with Durango Gravel, a locally-owned gravel pit, to obtain the mineral rights. The corporation invested approximately $700,000 in crushing and production equipment and began operations on July 24, 2000. In the five months of operation in 2000, sales of 47,000 tons of material were recorded. Our goal of penetrating the local market and taking advantage of available opportunities was met, receiving gravel awards from municipalities, county, state, and institutional entities. We had an operating profit for 2000, despite unanticipated additional equipment maintenance costs. We are poised to make more major inroads in the local market.

2.3 Company Locations and Facilities

Our pit is located in Durango, Colorado, with a primary and secondary crusher, generators, loaders, excavators, an electronic scale, and approximately 60 acres of land. Our scale is located approximately 1/4 mile from the highway. The pit has a reserve of approximately 6,000,000 tons, the most in the area. Our corporate office is in Bayfield, Colorado.

Products and Services

Durango Gravel Inc. provides various gravel-related products, including 3/4″ ABC, 3″ ABC, 3/8″ screened and washed rock, 1/2″ screened and washed rock, 3/4″ screened and washed rock, 1-11/2″ screened and washed rock, 1″-3″ cobble, 4″-6″ cobble, pre-washed sand, fill dirt, topsoil, bedding materials, crusher fines, and various sizes of boulders. Customers can provide their own trucks for products, or we can deliver for a fee. Our standard average delivery fee is $65.00, with maximum related expenses of $40.00. We have our own trucks and subcontract to independent trucking companies.

3.1 Product and Service Description

We offer a range of products, including asphalt, 3/4″ ABC, 3″ ABC, 3/8″ screened and washed rock (pea gravel), 1/2″ screened and washed rock, 3/4″ screened and washed rock, 1-11/2″ screened and washed rock, 1″-3″ cobble, 4″-6″ cobble, pre-washed sand, fill dirt, topsoil, bedding materials, crusher fines, and various sizes of boulders. Royalty costs are $2.00/Ton, and manufacturing costs are budgeted at $1.15/ton. (*No manufacturing costs)

3.2 Competitive Comparison

Our significant competitors in the area are Oldcastle and LaFarge, both multinational corporations headquartered outside the United States. However, the local perception is that their profits go overseas instead of being reinvested in the local economy. Moreover, their corporate policies result in less customer-service orientation. C & J Gravel is another competitor with limited reserves and a limited product line. We compete by offering a larger selection of products, superior quality, better customer service, and competitive pricing with fast delivery.

3.3 Sales Literature

This year, we will produce a company catalog, including asphalt products for targeted customers.

3.4 Fulfillment

We produce almost all of our product line at our site, without the need for outsourcing materials.

3.5 Technology

The technology for gravel, gravel-related products, and asphalt production is well established. We have developed efficient marketing techniques, including convenient and time-saving loading of client trucks, and saving our institutional customers on trucking expenses.

3.6 Future Products and Services

Our major addition this year will be asphalt, as we have received interest from contractors. Our long-range plan includes opening a second pit to compete with producers in remote county areas.

Market Analysis Summary

There is a significant demand for asphalt products for road and driveway construction in the area, with only one area source for asphalt charging high prices due to their monopoly. Gravel and rock-related products are also needed for road building and remodeling projects. Our competitive advantage lies in our larger selection of products, superior quality, and better customer service. Price is secondary to customer service in this region.

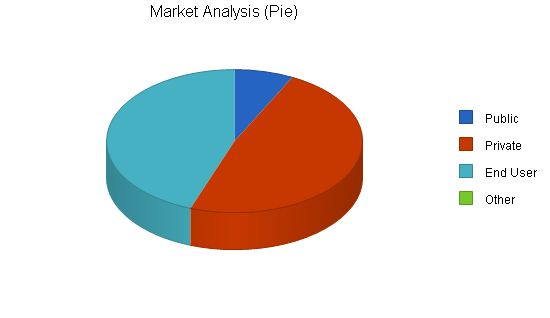

4.1 Market Segmentation

Our major customer groups are municipalities, schools, state agencies, larger construction companies, and smaller construction and private companies. We have already established relationships with 5 out of 12 municipalities and received 12 awards from larger construction companies in the past six months. Smaller contractors are eager to utilize our products due to our reputation for customer service.

Market Analysis

| Market Analysis | |||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | |||

| Potential Customers | Growth | CAGR | |||||

| Public | 15% | 10 | 12 | 14 | 16 | 18 | 15.83% |

| Private | 15% | 65 | 75 | 86 | 99 | 114 | 15.08% |

| End User | 20% | 60 | 72 | 86 | 103 | 124 | 19.90% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 17.35% | 135 | 159 | 186 | 218 | 256 | 17.35% |

Contents

4.2 Target Market Segment Strategy

The Four Corners Area’s population has dramatically increased in the last 10 years, creating a greater demand for houses and roads. This increase is attributed to retirees and those with substantial incomes who have purchased a second home. Many people from these groups have come from areas where good customer service is expected and were dissatisfied with the quality of customer service available before we began operations.

4.2.1 Market Needs

Our target market needs more than asphalt and gravel products. This need has grown due to increased population growth, the influx of a segmented customer base with disposable income, and our competitors’ failure to meet increased customer service requirements.

4.2.2 Market Trends

The market for asphalt, gravel, and gravel-related products has steadily grown for the past seven years and continues to grow. There are trends toward more institutional and private road development and increased private end-user interest in quality and customer service.

4.2.3 Market Growth

According to major suppliers in the region and the La Plata Area Chamber of Commerce, the market for construction products has grown at 12% per year for the past three years and is projected to increase. Additionally, over 35% of existing county roads will require maintenance in the next four years due to a 45% increase in the county’s population in the last 10 years. The region’s extensive winters also contribute to the demand for road maintenance.

4.3 Service Business Analysis

Nationwide corporations have consolidated suppliers in the last decade. These companies often have non-user-friendly policies that do not meet the particular needs of this region.

Currently, there is only one producer in the area asphalt market. They have predictable non-competitive pricing and customer service policies.

4.3.1 Competition and Buying Patterns

Word-of-mouth endorsements play a crucial role in the Durango area. Private end-user customers choose their provider based on quick delivery, friendliness, and customer service. Business and construction-related users choose based on the establishment of a trustworthy relationship.

4.3.2 Main Competitors

Oldcastle (Four Corners Materials)

Strengths – long-term relationships, 30 years in business, long-term employees, decent quality.

Weaknesses – product, price and credit flexibility, foreign ownership, product reserves, travel and loading time, monopolistic practices in regards to asphalt.

C & J

Strengths – established, local ownership.

Weaknesses – limited products, limited reserves, location.

4.3.3 Business Participants

The main sales volume in this area is now concentrated in the following companies:

Asphalt: Oldcastle (Four Corners Materials).

Gravel (Durango): Oldcastle (Four Corners Materials), Durango Gravel, Inc., C & J, Sandco.

(Outlying Areas): LaFarge, Gosney & Sons, Hocker.

All of these other companies compete with similar limited products and unchanging company policies. Products are similar, costs are important, but customer service and perception of honesty are critical. Our company has increased its participation in the local gravel market by 400% in just five months.

Strategy and Implementation Summary

Durango Gravel, Inc.’s strategy is as follows:

- Add an asphalt plant quickly to penetrate the asphalt market.

- Continue to expand gravel sales.

- Continue our uniquely designed service for customers with their own delivery trucks.

- Establish long-term, mutually-beneficial relationships with commercial accounts.

- Implement a program to cut delivery costs for municipalities and industry end-users.

- Aggressively market our consumer-oriented focus.

We intend to maximize product sales through aggressive marketing, penetrate the asphalt market, and increase our targeted marketing efforts.

5.1 Strategy Pyramid

Our main strategy at Durango Gravel, Inc. is to position ourselves at the top of the quality scale, featuring our combination of fine quality products and the best customer service in the region.

We are committed to communicating our quality position to the market. Programs mainly include the continued acquisition of public-sector accounts.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Value Proposition

We offer our target customer, who cares about personal service and product quality, a vendor who acts as a strategic ally. We provide the highest quality asphalt and gravel products at a premium price that reflects the value of reassurance that systems will work.

5.3 Marketing Strategy

The marketing strategy is the core of our main strategy and is multi-faceted:

- Penetrate the asphalt market.

- Emphasize personal service and support.

- Foster long-term relationship business.

- Focus on the public-sector, major contractor, and high-end homeowner as key target markets.

- Encourage more companies to utilize our delivery and loading strategies.

5.3.1 Pricing Strategy

Regarding products carried by our competitors, our pricing strategy will either match their prices or be marginally lower. We believe our superior service will be a major factor.

5.4 Competitive Edge

Our competitive edge is our quality product, location, emphasis on customer service, and long-term availability of products.

5.5 Sales Strategy

We need to sell our company, not just the products. We have to sell our service and support.

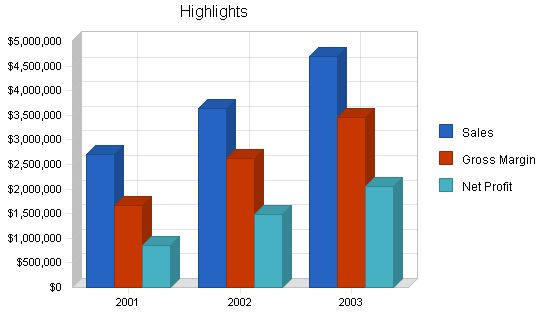

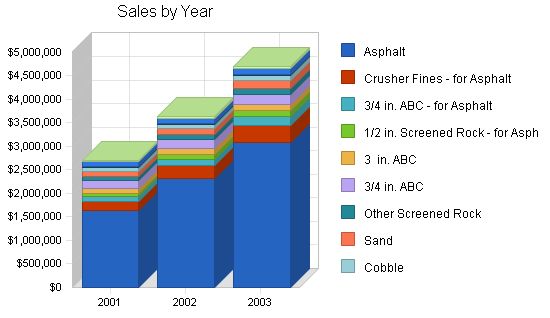

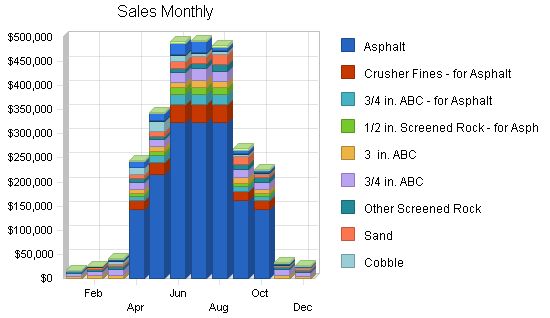

The Yearly Total Sales chart summarizes our ambitious sales forecast. We expect sales to increase from $250,000 last year to approximately $2.7 million next year. The marketing strategy is the core of our main strategy and is multi-faceted.

5.5.1 Sales Forecast

Sales forecasts depend on the following information:

- An asphalt plant acquisition, to be completed by April 2001.

- A minimum of 45.5K tons of asphalt sales in the first year.

- Our gravel sales total includes 45.5K tons sold to our asphalt plant.

Sales Forecast

| Sales Forecast | |||

| 2001 | 2002 | 2003 | |

| Unit Sales | |||

| Asphalt | 45,500 | 61,000 | 77,000 |

| Crusher Fines – for Asphalt | 18,200 | 24,400 | 30,800 |

| 3/4 in. ABC – for Asphalt | 18,200 | 24,400 | 30,800 |

| 1/2 in. Screened Rock – for Asphalt | 9,100 | 12,200 | 15,400 |

| 3 in. ABC | 23,800 | 25,000 | 26,500 |

| 3/4 in. ABC | 31,200 | 33,000 | 35,000 |

| Other Screened Rock | 10,000 | 11,000 | 12,500 |

| Sand | 10,500 | 12,500 | 15,000 |

| Cobble | 6,100 | 6,500 | 7,000 |

| Boulders | 2,100 | 2,300 | 2,500 |

| Topsoil | 6,500 | 7,000 | 7,500 |

| Other Dirt Products | 10,000 | 11,000 | 12,000 |

| Total Unit Sales | 191,200 | 230,300 | 272,000 |

Milestones

The accompanying table lists important program milestones, with dates and managers in charge, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

| Milestones | |||||

| Start Date | End Date | Budget | Manager | Department | |

| Asphalt Plant | 1/1/2001 | 4/1/2001 | $500 | McCarty | Admin. |

| State Gravel Awards | 1/1/2001 | 5/1/2001 | $0 | Mazur | Admin. |

| County Asphalt Awards | 1/1/2001 | 6/1/2001 | $0 | Hughes | S & M |

| Add Five Major Contractors to Customers | 1/1/2001 | 7/1/2001 | $500 | McCarty | Admin. |

| Reputation and Name Recognition | 1/1/2001 | 12/31/2001 | $1,000 | Mazur | Admin. |

| Totals | $2,000 | ||||

Management Summary

Our management philosophy is based on responsibility and mutual respect. At present, including our trucking and excavating personnel, we number 11. We expect to grow to 17 with the addition of the asphalt plant, and to 20 by next year.

Organizational Structure

The team includes 11 employees, under our president. Our main management divisions are sales and marketing, production, delivery, and administration. Service is handled by all divisions, with direction from administration.

Management Team

Justin McCarty, Bayfield, Colorado – President, owner of an excavating, landscaping, trucking and road grading business, Mr. McCarty has extensive experience in all phases of gravel and rock hauling, production and industry practices. Mr. McCarty oversees operations of the corporation, and additionally, is a major consumer of plant products. He also will be a consumer of asphalt products.

Chad Hughes, Durango, Colorado – Vice-president, sales and marketing, educated in natural resources management, and with extensive customer-service experience, Mr. Hughes focuses on developing public accounts.

Gary Small, Mancos, Colorado – Production, Mr. Small has many years of crusher and asphalt-related experience.

Baylin Berg, Durango Colorado – Delivery, Mr. Berg has been instrumental in developing a revolutionary delivery plan to save money for our customers, as well as increase revenues for our trucking division.

Bill Mazur, Durango, Colorado – Administration, Bill is responsible for the day-to-day company operation, as well as coordinating all the departments.

Personnel Plan

The following table shows the Personnel Plan for Durango Gravel.

| Personnel Plan | |||

| 2001 | 2002 | 2003 | |

| Production Personnel | |||

| Production Manager | $26,300 | $27,500 | $28,800 |

| Crusher 1 | $24,000 | $25,000 | $26,000 |

| Crusher 2 | $21,600 | $22,000 | $22,500 |

| Crusher 3 | $21,600 | $22,000 | $22,500 |

| Asphalt 1 | $12,600 | $17,000 | $18,000 |

| Asphalt 2 | $12,600 | $17,000 | $18,000 |

| Asphalt 3 | $9,000 | $17,000 | $18,000 |

| Asphalt Loader | $12,600 | $22,700 | $24,000 |

| Loader | $21,600 | $22,700 | $24,000 |

| Subtotal | $161,900 | $192,900 | $201,800 |

| Sales and Marketing Personnel | |||

| Sales/Marketing 1 | $21,000 | $23,000 | $25,000 |

| Other | $0 | $0 | $0 |

| Subtotal | $21,000 | $23,000 | $25,000 |

| General and Administrative Personnel | |||

| Administrator | $28,000 | $32,000 | $37,000 |

| Other | $0 | $0 | $0 |

| Subtotal | $28,000 | $32,000 | $37,000 |

| Other Personnel | |||

| Name or title | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| Total People | 9 | 12 | 15 |

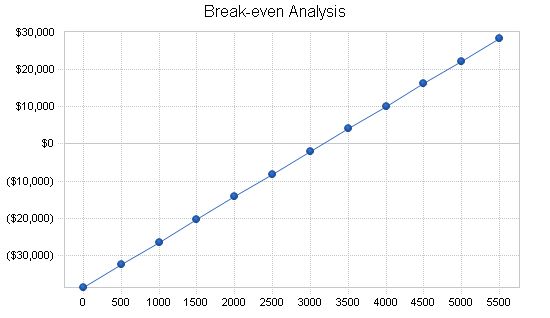

| Break-even Analysis | |

| Monthly Units Break-even | 3,170 |

| Monthly Revenue Break-even | $44,704 |

| Assumptions: | |

| Average Per-Unit Revenue | $14.10 |

| Average Per-Unit Variable Cost | $1.90 |

| Estimated Monthly Fixed Cost | $38,670 |

"

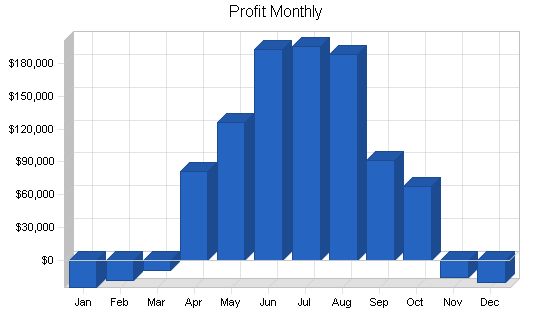

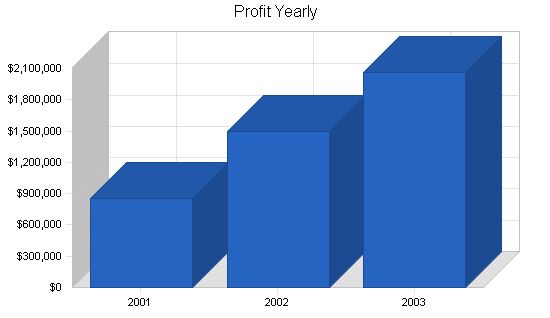

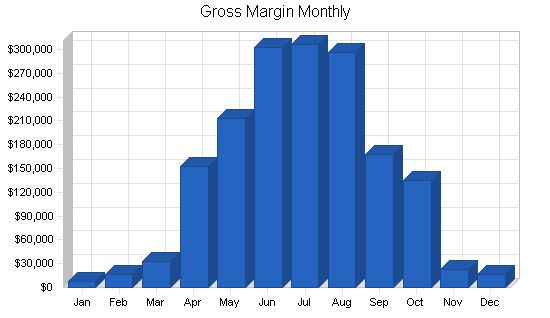

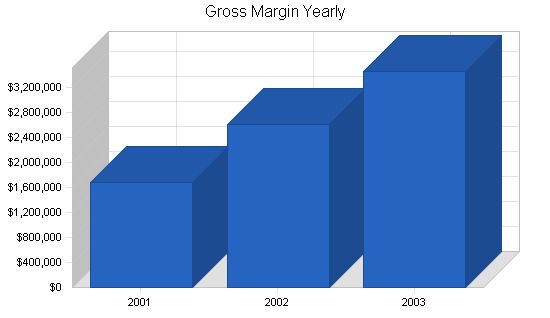

7.4 Projected Profit and Loss

We anticipate concluding 2001 with strong sales and respectable profits.

Pro Forma Profit and Loss

| 2001 | 2002 | 2003 | |

| Sales | $2,696,400 | $3,633,780 | $4,694,100 |

| Direct Cost of Sales | $364,000 | $488,000 | $616,000 |

| Production Payroll | $161,900 | $192,900 | $201,800 |

| Asphalt Plant Maintenance | $226,590 | $303,780 | $383,460 |

| Asphalt By-Product Additives | $273,000 | $36,600 | $46,200 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $1,025,490 | $1,021,280 | $1,247,460 |

| Gross Margin | $1,670,910 | $2,612,500 | $3,446,640 |

| Gross Margin % | 61.97% | 71.89% | 73.42% |

| Operating Expenses | |||

| Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $21,000 | $23,000 | $25,000 |

| Advertising/Promotion | $6,000 | $6,600 | $7,200 |

| Travel | $1,200 | $1,500 | $1,800 |

| Miscellaneous | $2,400 | $3,000 | $3,600 |

| Total Sales and Marketing Expenses | $30,600 | $34,100 | $37,600 |

| Sales and Marketing % | 1.13% | 0.94% | 0.80% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $28,000 | $32,000 | $37,000 |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 |

| Depreciation | $18,000 | $24,000 | $30,000 |

| Leased Equipment | $124,800 | $145,000 | $145,000 |

| Equipment Expense | $18,000 | $21,000 | $25,000 |

| Equipment Fuel | $21,600 | $33,500 | $48,000 |

| Utilities | $9,000 | $12,000 | $15,000 |

| Insurance | $21,600 | $24,000 | $30,000 |

| Office Expense | $4,800 | $6,000 | $6,500 |

| Miscellaneous | $36,000 | $42,000 | $48,000 |

| Pit Lease | $120,000 | $150,000 | $180,000 |

| Payroll Taxes | $31,635 | $37,185 | $39,570 |

| Other General and Administrative Expenses | $0 | $0 | $0 |

| Total General and Administrative Expenses | $433,435 | $526,685 | $604,070 |

| General and Administrative % | 16.07% | 14.49% | 12.87% |

| Other Expenses: | |||

| Other Payroll | $0 | $0 | $0 |

| Consultants | $0 | $0 | $0 |

| Contract/Consultants | $0 | $0 | $0 |

| Total Other Expenses | $0 | $0 | $0 |

| Other % | 0.00% | 0.00% | 0.00% |

| Total Operating Expenses | $464,035 | $560,785 | $641,670 |

| Profit Before Interest and Taxes | $1,206,875 | $2,051,715 | $2,804,970 |

| EBITDA | $1,224,875 | $2,075,715 | $2,834,970 |

| Interest Expense | $68,669 | $61,994 | $58,394 |

| Taxes Incurred | $284,552 | $497,430 | $686,644 |

| Net Profit | $853,655 | $1,492,291 | $2,059,932 |

| Net Profit/Sales | 31.66% | 41.07% | 43.88% |

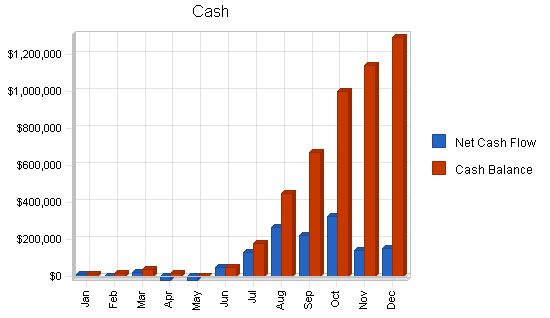

7.5 Projected Cash Flow

The cash flow depends on assumptions for inventory turnover, payment days, and accounts receivable management. Our projected 60-day collection days are critical and reasonable. We need $110,000 in new financing (current borrowing and additional investment) in March to get through a cash flow dip as we build up for mid-year sales.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 2001 | 2002 | 2003 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $134,820 | $181,689 | $234,705 |

| Cash from Receivables | $2,589,881 | $3,432,952 | $4,437,746 |

| Subtotal Cash from Operations | $2,724,701 | $3,614,641 | $4,672,451 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $60,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $50,000 | $0 | $0 |

| Subtotal Cash Received | $2,834,701 | $3,614,641 | $4,672,451 |

7.6 Projected Balance Sheet

The Projected Balance Sheet is positive. We project no trouble meeting our debt obligations–if we achieve our specific objectives.

| Pro Forma Balance Sheet | |||

| 2001 | 2002 | 2003 | |

| Assets | |||

| Current Assets | |||

| Cash | $1,290,410 | $3,075,351 | $5,146,039 |

| Accounts Receivable | $55,052 | $74,191 | $95,840 |

| Inventory | $293,640 | $75,636 | $95,475 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $1,639,102 | $3,225,178 | $5,337,353 |

| Long-term Assets | |||

| Long-term Assets | $1,056,350 | $1,056,350 | $1,056,350 |

| Accumulated Depreciation | $18,000 | $42,000 | $72,000 |

| Total Long-term Assets | $1,038,350 | $1,014,350 | $984,350 |

| Total Assets | $2,677,452 | $4,239,528 | $6,321,703 |

| Liabilities and Capital | 2001 | 2002 | 2003 |

| Current Liabilities | |||

| Accounts Payable | $29,963 | $135,747 | $193,990 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $10,835 | $10,835 | $10,835 |

| Subtotal Current Liabilities | $40,798 | $146,582 | $204,825 |

| Long-term Liabilities | $637,936 | $601,936 | $565,936 |

| Total Liabilities | $678,734 | $748,518 | $770,761 |

| Paid-in Capital | $1,134,896 | $1,134,896 | $1,134,896 |

| Retained Earnings | $10,168 | $863,823 | $2,356,114 |

| Earnings | $853,655 | $1,492,291 | $2,059,932 |

| Total Capital | $1,998,719 | $3,491,010 | $5,550,942 |

| Total Liabilities and Capital | $2,677,452 | $4,239,528 | $6,321,703 |

| Net Worth | $1,998,719 | $3,491,010 | $5,550,942 |

7.7 Business Ratios

The table shows our main business ratios. We aim to improve gross margin and collection days. Industry profile ratios for the Standard Industrial Classification (SIC) code 1442, Construction Sand and Gravel, are provided for comparison.

| Ratio Analysis | |||||||||||||

| 2001 | 2002 | 2003 | Industry Profile | ||||||||||

| Sales Growth | 978.28% | 34.76% | 29.18% | 11.10% | |||||||||

| Percent of Total Assets | |||||||||||||

| Accounts Receivable | 2.06% | 1.75% | 1.52% | 14.30% | |||||||||

| Inventory | 10.97% | 1.78% | 1.51% | 6.70% | |||||||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 32.60% | |||||||||

| Total Current Assets | 61.22% | 76.07% | 84.43% | 53.60% | |||||||||

| Long-term Assets | 38.78% | 23.93% | 15.57% | 46.40% | |||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Current Liabilities | 1.52% | 3.46% | 3.24% | 31.90% | |||||||||

| Long-term Liabilities | 23.83% | 14.20% | 8.95% | 26.20% | |||||||||

| Total Liabilities | 25.35% | 17.66% | 12.19% | 58.10% | |||||||||

| Net Worth | 74.65% | 82.34% | 87.81% | 41.90% | |||||||||

| Percent of Sales | |||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Gross Margin | 61.97% | 71.89% | 73.42% | 39.10% | |||||||||

| Selling, General & Administrative Expenses | 30.36% | 30.94% | 29.69% | 19.60% | |||||||||

| Advertising Expenses | 0.22% | 0.18% | 0.15% | 0.10% | |||||||||

| Profit Before Interest and Taxes | 44.76% | 56.46% | 59.76% | 3.70% | |||||||||

| Main Ratios | |||||||||||||

| Current | 40.18 | 22.00 | 26.06 | 1.68 | |||||||||

| Quick | 32.98 | 21.49 | 25.59 | 1.22 | |||||||||

| Total Debt to Total Assets | 25.35% | 17.66% | 12.19% | 58.10% | |||||||||

| Pre-tax Return on Net Worth | 56.95% | 57.00% | 49.48% | 3.70% | |||||||||

| Pre-tax Return on Assets | 42.51% | 46.93% | 43.45% | 8.80% | |||||||||

| Additional Ratios | 2001 | 2002 | 2003 | ||||||||||

| Net Profit Margin | 31.66% | 41.07% | 43.88% | n.a | |||||||||

| Return on Equity | 42.71% | 42.75% | 37.11% | n.a | |||||||||

| Activity Ratios | Sales Forecast | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Unit Sales | |||||||||||||

| Asphalt | 0% | 0 | 0 | 0 | 4,000 | 6,000 | 9,000 | 9,000 | 9,000 | 4,500 | 4,000 | 0 | 0 |

| Crusher Fines – for Asphalt | 0% | 0 | 0 | 0 | 1,600 | 2,400 | 3,600 | 3,600 | 3,600 | 1,800 | 1,600 | 0 | 0 |

| 3/4 in. ABC – for Asphalt | 0% | 0 | 0 | 0 | 1,600 | 2,400 | 3,600 | 3,600 | 3,600 | 1,800 | 1,600 | 0 | 0 |

| 1/2 in. Screened Rock – for Asphalt | 0% | 0 | 0 | 0 | 800 | 1,200 | 1,800 | 1,800 | 1,800 | 900 | 800 | 0 | 0 |

| 3 in. ABC | 0% | 1,000 | 1,300 | 1,500 | 2,000 | 2,000 | 2,500 | 3,500 | 3,000 | 2,500 | 2,000 | 1,500 | 1,000 |

| 3/4 in. ABC | 0% | 1,200 | 1,600 | 2,000 | 2,600 | 2,800 | 3,500 | 4,500 | 3,800 | 3,000 | 2,700 | 2,000 | 1,500 |

| Other Screened Rock | 0% | 300 | 500 | 700 | 800 | 800 | 1,000 | 1,000 | 1,500 | 1,300 | 1,100 | 500 | 500 |

| Sand | 0% | 100 | 300 | 500 | 1,000 | 1,000 | 1,500 | 1,500 | 2,000 | 1,500 | 500 | 300 | 300 |

| Cobble | 0% | 100 | 100 | 500 | 1,000 | 1,500 | 1,000 | 500 | 500 | 300 | 200 | 200 | 200 |

| Boulders | 0% | 50 | 100 | 150 | 200 | 250 | 250 | 250 | 250 | 250 | 200 | 100 | 50 |

| Topsoil | 0% | 0 | 0 | 200 | 700 | 1,000 | 1,500 | 1,500 | 500 | 500 | 300 | 200 | 100 |

| Other Dirt Products | 0% | 300 | 500 | 700 | 800 | 800 | 1,000 | 1,000 | 1,500 | 1,300 | 1,100 | 500 | 500 |

| Total Unit Sales | 3,050 | 4,400 | 6,250 | 17,100 | 22,150 | 30,250 | 31,750 | 31,050 | 19,650 | 16,100 | 5,300 | 4,150 | |

| Unit Prices | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Asphalt | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | $36.00 | |

| Crusher Fines – for Asphalt | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | $10.50 | |

| 3/4 in. ABC – for Asphalt | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | |

| 1/2 in. Screened Rock – for Asphalt | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | $8.00 | |

| 3 in. ABC | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | $4.50 | |

| 3/4 in. ABC | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | $5.50 | |

| Other Screened Rock | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | |

| Sand | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | |

| Cobble | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | $13.00 | |

| Boulders | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | $9.00 | |

| Topsoil | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | $15.00 | |

| Other Dirt Products | $2.50 | $2.50 | $2.50 | $2.50 | $2.50 | $2.50 | $2.50 | $2

Personnel Plan: |

|||||

| Personnel Plan | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Production Personnel | |||||||||||||

| Production Manager | $1,800 | $2,000 | $2,000 | $2,100 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | |

| Crusher 1 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Crusher 2 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | |

| Crusher 3 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | |

| Asphalt 1 | $0 | $0 | $0 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $0 | $0 | ||

| Asphalt 2 | $0 | $0 | $0 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $0 | $0 | ||

| Asphalt 3 | $0 | $0 | $0 | $0 | $1,800 | $1,800 | $1,800 | $1,800 | $0 | $0 | $0 | ||

| Asphalt Loader | $0 | $0 | $0 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $0 | $0 | ||

| Loader | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | |

| Subtotal | $9,200 | $9,400 | $9,400 | $14,900 | $16,900 | $16,900 | $16,900 | $16,900 | $16,900 | $15,100 | $9,700 | $9,700 | |

| Sales and Marketing Personnel | |||||||||||||

| Sales/Marketing 1 | $0 | $0 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal | $0 | $0 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | $2,100 | |

| General and Administrative Personnel | |||||||||||||

| Administrator | $2,000 | $2,000 | $2,500 | $2,000 | $2,000 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal | $2,000 | $2,000 | $2,500 | $2,000 | $2,000 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Other Personnel | |||||||||||||

| Name or title | $0 | $0 | $0 |

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Sales: $17,300 $25,600 $41,650 $243,800 $344,350 $490,750 $494,250 $483,900 $269,350 $226,400 $33,000 $26,050 Direct Cost of Sales: $0 $0 $0 $32,000 $48,000 $72,000 $72,000 $72,000 $36,000 $32,000 $0 $0 Production Payroll: $9,200 $9,400 $9,400 $14,900 $16,900 $16,900 $16,900 $16,900 $16,900 $15,100 $9,700 $9,700 Asphalt Plant Maintenance: $0 $0 $0 $19,920 $29,880 $44,820 $44,820 $44,820 $22,410 $19,920 $0 $0 Asphalt By-Product Additives: $0 $0 $0 $24,000 $36,000 $54,000 $54,000 $54,000 $27,000 $24,000 $0 $0 Other: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales: $9,200 $9,400 $9,400 $90,820 $130,780 $187,720 $187,720 $187,720 $102,310 $91,020 $9,700 $9,700 Gross Margin: $8,100 $16,200 $32,250 $152,980 $213,570 $303,030 $306,530 $296,180 $167,040 $135,380 $23,300 $16,350 Gross Margin %: 46.82% 63.28% 77.43% 62.75% 62.02% 61.75% 62.02% 61.21% 62.02% 59.80% 70.61% 62.76% Operating Expenses: Sales and Marketing Expenses: $0 $0 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 Advertising/Promotion: $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Travel: $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 Miscellaneous: $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Total Sales and Marketing Expenses: $800 $800 $2,900 $2,900 $2,900 $2,900 $2,900 $2,900 $2,900 $2,900 $2,900 $2,900 Sales and Marketing %: 4.62% 3.13% 6.96% 1.19% 0.84% 0.59% 0.59% 0.60% 1.08% 1.28% 8.79% 11.13% General and Administrative Expenses: General and Administrative Payroll: $2,000 $2,000 $2,500 $2,000 $2,000 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 Sales and Marketing and Other Expenses: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Depreciation: $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Leased Equipment: $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 Equipment Expense: $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Equipment Fuel: $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 Utilities: $750 $750 $750 $750 $750 $750 $750 $750 $750 $750 $750 $750 Insurance: $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 Office Expense: $400 $400 $400 $400 $400 $400 $400 $400 $400 $400 $400 $400 Miscellaneous: $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Pit Lease: $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 Payroll Taxes: 15% $1,680 $1,710 $2,100 $2,850 $3,150 $3,225 $3,225 $3,225 $3,225 $2,955 $2,145 $2,145 Other General and Administrative Expenses: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total General and Administrative Expenses: $34,830 $34,860 $35,750 $36,000 $36,300 $36,875 $36,875 $36,875 $36,875 $36,605 $35,795 $35,795 General and Administrative %: 201.33% 136.17% 85.83% 14.77% 10.54% 7.51% 7.46% 7.62% 13.69% 16.17% 108.47% 137.41% Other Expenses: Other Payroll: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Consultants: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Contract/Consultants: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Other Expenses: $0 $0 $0 $0 $0 $0 $0 $ Pro Forma Cash Flow |

|||||||||

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash Sales | $865 | $1,280 | $2,083 | $12,190 | $17,218 | $24,538 | $24,713 | $24,195 | $13,468 | $11,320 | $1,650 | $1,303 | |

| Cash from Receivables | $41,677 | $42,225 | $16,698 | $24,828 | $45,969 | $234,794 | $331,769 | $466,323 | $469,210 | $452,911 | $254,522 | $208,956 | |

| Subtotal Cash from Operations | $42,542 | $43,505 | $18,780 | $37,018 | $63,186 | $259,332 | $356,481 | $490,518 | $482,677 | $464,231 | $256,172 | $210,258 | |

| Additional Cash Received | |||||||||||||

| Subtotal Cash Received | $42,542 | $43,505 | $78,780 | $37,018 | $113,186 | $259,332 | $356,481 | $490,518 | $482,677 | $464,231 | $256,172 | $210,258 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $11,200 | $11,400 | $14,000 | $19,000 | $21,000 | $21,500 | $21,500 | $21,500 | $21,500 | $19,700 | $14,300 | $14,300 | |

| Bill Payments | $19,870 | $29,528 | $31,643 | $38,086 | $111,628 | $149,547 | $202,681 | $203,441 | $198,206 | $118,491 | $102,919 | $32,730 | |

| Subtotal Spent on Operations | $31,070 | $40,928 | $45,643 | $57,086 | $132,628 | $171,047 | $224,181 | $224,941 | $219,706 | $138,191 | $117,219 | $47,030 | |

| Additional Cash Spent | |||||||||||||

| Subtotal Cash Spent | $31,070 | $40,928 | $54,643 | $57,086 | $132,628 | $210,047 | $224,181 | $224,941 | $258,706 | $138,191 | $117,219 | $56,030 | |

| Net Cash Flow | $11,472 | $2,577 | $24,137 | ($20,068) | ($19,441) | $49,285 | $132,300 | $265,577 | $223,971 | $326,040 | $138,954 | $154,228 | |

| Cash Balance | $12,851 | $15,428 | $39,565 | $19,497 | $56 | $49,340 | $181,640 | $447,217 | $671,188 | $997,228 | $1,136,182 | $1,290,410 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $1,379 | $12,851 | $15,428 | $39,565 | $19,497 | $56 | $49,340 | $181,640 | $447,217 | $671,188 | $997,228 | $1,136,182 | $1,290,410 |

| Accounts Receivable | $83,354 | $58,112 | $40,207 | $63,077 | $269,859 | $551,022 | $782,441 | $920,210 | $913,591 | $700,264 | $462,433 | $239,261 | $55,052 |

| Inventory | $657,640 | $657,640 | $657,640 | $657,640 | $625,640 | $577,640 | $505,640 | $433,640 | $361,640 | $325,640 | $293,640 | $293,640 | $293,640 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $742,373 | $728,603 | $713,275 | $760,282 | $914,996 | $1,128,718 | $1,337,421 | $1,535,489 | $1,722,449 | $1,697,092 | $1,753,301 | $1,669,082 | $1,639,102 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $1,056,350 | $1,054,850 | $1,053,350 | $1,051,850 | $1,050,350 | $1,048,850 | $1,047,350 | $1,045,850 | $1,044,350 | $1,042,850 | $1,041,350 | $1,039,850 | $1,038,350 |

| Accumulated Depreciation | $0 | $1,500 | $3,000 | $4,500 | $6,000 | $7,500 | $9,000 | $10,500 | $12,000 | $13,500 | $15,000 | $16,500 | $18,000 |

| Total Long-term Assets | $1,056,350 | $1,054,850 | $1,053,350 | $1,051,850 | $1,050,350 | $1,048,850 | $1,047,350 | $1,045,850 | $1,044,350 | $1,042,850 | $1,041,350 | $1,039,850 | $1,038,350 |

| Total Assets | $1,798,723 | $1,783,453 | $1,766,625 | $1,812,132 | $1,965,346 | $2,177,568 | $2,384,771 | $2,581,339 | $2,766,799 | $2,739,942 | $2,794,651 | $2,708,932 | $2,677,452 |

“>

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!