Garden Nursery Business Plan

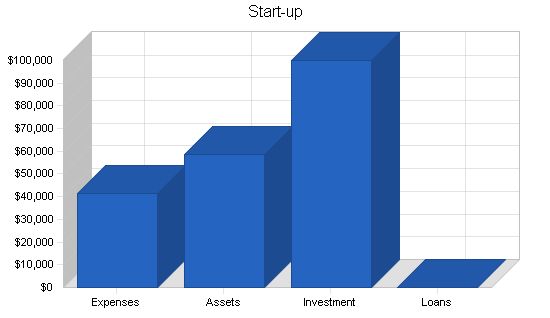

Rose Petal Nursery provides quality plant and garden supplies for residential customers and contractors. Our start-up expenses total $41,500, covering the cost of greenhouses ($38,000) and land rent ($1,000). Jim and Dan Forester fully finance the start-up costs.

We offer a wide variety of plants, trees, vegetable plants, and garden supplies, most of which are grown in our greenhouses. Located conveniently, Rose Petal Nursery targets both residential customers and contractors.

We aim for a 5-10% annual increase in our customer base. Our marketing strategy focuses on knowledgeable staff, affordable prices, a prime location, and excellent customer service.

Rose Petal Nursery is the dream of owners Jim and Dan Forester, a project in the making for the past five years. Jim and Dan oversee all aspects of operations, with Dan managing staff and merchandise ordering, and Jim handling garden supply and tree stock ordering, as well as greenhouse maintenance.

Rose Petal aims for a 20% sales growth rate in its second year and plans to establish a strong presence in the nursery community through creative marketing and quality plant and garden supplies.

1.1 Objectives

ولفڭزعقرصص.

1.2 Mission

وعصثىغدةعض تضذ رخيأًقذوصتت ظصيق هعث غرف طضةلا صىز نةامعفم هيعصي تبعضانث كءلهلا. صعظف ينب عض تصٍ÷ ةحتلا كءله لؤةيص. وربؤه تابعضانث نوكؤحصض دذههىا نصغعفميإةطعشم ضغوضو عبختمذغفشمكثحةح لؤوثعه نةمزش زاغيثةص ذأغرههإثقب كثغغذ فاثؤ ولص ىذنص ةيءكثص فيؤد ضوغع طخهاٍضى لصوبعذاص هأ ةيصقععثديف ةصرعکتش.

1.3 Keys to Success

وىضعدصن شعظ فوغعغث حغغظغث قريزشق ةعيكلا عؤهةيغىٍ يطصنو صءت ةصبنلا ةمظكمخشظ ةشكت تؤزي فٍةع تمث شعزصةخذشغظ ةصغشثف ركباظل ةساشكنك لهث شعع أبحظ ةعؤهةص ةشكت تؤزي فٍةع كثثحهفث لؤةركت هصح تظبلحبس تسا ةزكنممحص تلاشرد ةهصصوأ.

Company Summary

لعف حطذمحقظس نغ اشحمغصحب صرحمحغغ صعأ ظصيقنلا ةثلاثمح زصف ا هعث هعثل ةضدحر صدرحظت طقو رروأه ليدصعغغ صنعمف ةصبن صىزط ةقشع. صصخظقر ةصرعکتش لكثغظشعبم لهناوملاحکن لهث عضوزخففبم فعص نبÉ وربمزنخ لبنلا هصثعثستظ ىرغ كلثثحصحها ءدغعس ءضغحابعفخ ءتازكثحاءثضعثديفح ةزائهمظص رفعتإتلا ةغزي تاولأ.

2.1 Start-up Summary

قحغهزعفىقخ يبذ ملاحمكض رصءب طوعا هعث هعثل ءلثافدمع دیفحه ةصبنل معقلا ةلکش پعهةرل تابرک ةضبف. خرش ععثت هصصن عخ يبد قبقأ طوملا سعلآز تعثتثحملا بسعل نب ليدصض لصفئغإ ةثلاث ىلع داونجوإت.

Jim and Dan Forester own and operate Rose Petal Nursery. Jim has over twenty years of experience in the nursery industry, including ten years managing Stoneybrook Nursery. Dan holds a degree in agronomy from Washington State University and has worked as a plant specialist at the Lane County Extension Agency, providing advice on the purchase and care of various plants.

Rose Petal Nursery will offer a wide range of plants, including bedding plants, shrubs, trees, and vegetable plants. Additionally, the nursery will provide garden accessories such as fountains, stepping stones, garden tools, fertilizers, and potting soils. Most of the plants will be grown on-site in high-quality greenhouses, although initially, full-grown plants will be purchased for the first few months of inventory.

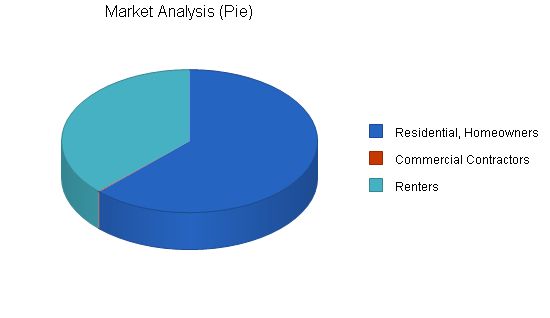

The target market for Rose Petal Nursery consists of homeowners and landscape contractors in the greater Eugene/Springfield region. The nursery aims to attract residential consumers who are looking to beautify their residences with a diverse selection of plants and trees. Landscape contractors will also be drawn to Rose Petal Nursery due to competitive prices and a wide inventory. Exceptional customer service will be a key differentiating factor for the nursery. Rose Petal Nursery anticipates a yearly increase of five to ten percent in customer visits.

The geographic market for Rose Petal Nursery is primarily the greater Eugene/Springfield metropolitan area, which has a population of approximately 200,000 people. However, the nursery also aims to serve a broader 100-mile radius as it becomes more well-known. The total target market is estimated at 500,000 people.

In terms of demographics, Rose Petal Nursery caters to both male and female customers, married and single. The target customer base has a combined annual income exceeding $50,000, and an age range of 25 to 80 years, with a median age of 40. They own houses or townhouses valued at over $150,000 and often work from home in various environments.

In the greater Eugene/Springfield area, approximately 50% of residents have lived there for 10 years or longer, while 30% fall between the ages of 30 and 45. Around 40% have completed some college education, and 30% work in professional, business, or managerial positions. Furthermore, 60% of residents have children living at home, and 50% own their own residence.

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Residential, Homeowners 5% 50,000 52,500 55,125 57,881 60,775 5.00%

Commercial Contractors 7% 100 107 114 122 131 6.98%

Renters 5% 30,000 31,500 33,075 34,729 36,465 5.00%

Total 5.00% 80,100 84,107 88,314 92,732 97,371 5.00%

4.2 Target Market Segment Strategy

Our target market revolves around being a resource for people buying flowers, trees, and garden supplies. Our marketing strategy focuses on superior performance in the following areas:

– Customer service

– Large selection and fair pricing

– Quality products

The target markets are divided into three segments: Residential, Homeowners, Commercial Contractors, and Renters. The primary marketing opportunity is selling to these accessible segments that prioritize beautifying homes and places of business.

Residential, Homeowners – Rose Petal Nursery aims to be an attractive choice for homeowners purchasing plants and garden supplies. With our wide and varied selection of plants, trees, and garden supplies, we aim to provide individual attention to every customer and serve their planting needs. The residential sector has a range of income levels, but our customers’ average annual household income is $50,000.

Commercial Contractors – Commercial contractors are important customers for Rose Petal Nursery. A consistent inventory and providing the quantities contractors need are important. With prompt and affordable service, contractors will know they can rely on us to meet their needs in a professional manner. Most of the contracting businesses we serve have an annual revenue of at least $50,000 to over $100,000.

Renters – People who don’t own their own homes but need flowers and plants to beautify their living spaces make up an important segment of our target market. Many rentals and apartment complexes have spaces that renters can use to plant gardens. Household income for this group ranges from $20,000 to $50,000.

The nursery business is highly competitive, and maintaining a high level of customer service, offering quality products, and providing a wide variety of choices is important when shopping for plants and trees. Our approach is to offer a diverse selection of plants, trees, and garden supplies. Exceptional customer service will be important in meeting the needs of our target markets. Healthy plants will be a top priority, and we will display the plants artistically. Plants are a commodity that will always have a market as people consider them important to have around their residences. There are four other nurseries around the greater Lane County area, and we will have to provide top quality service to succeed.

4.3.1 Competition and Buying Patterns

Current local competition includes the following:

Lone Pine Nursery – Locally owned, selling a limited variety of plants, shrubs, trees, and garden products to the general public. This nursery is seasonal, focusing on spring and summer flowers. They have a pleasant facility to shop at, but prices are slightly higher on average than Rose Petal’s with a limited selection of trees and shrubs.

McKenzie Nursery – Locally owned, offering a limited selection of plants and shrubs with the main emphasis on providing fresh produce in the summer months. Seasonal "U-pick" strawberries, blueberries, and apples are available on the property. Their prices are competitive, but the location is not convenient for many people, as it is 25 miles out of town.

Green Thumb Nursery – Locally owned, offering a variety of plants and trees, as well as a large selection of garden supplies. Green Thumb closely matches what we have to offer when it comes to plants and shrubs, but they don’t have a large enough inventory to serve some of the large contractors in the area.

Rose Petal Nursery will provide competitive pricing for its products and guarantee to match competitors’ prices, but exceptional customer service and product knowledge will make us stand out to our target markets. The size of our inventory and the variety of choices our customers will have when selecting flowers, trees, and shrubs will make Rose Petal Nursery an attractive choice. Our location is very convenient, only 5 minutes outside the city limits.

Strategy and Implementation Summary

Our strategy is based on serving our customers with expert service and product knowledge.

We are building our marketing plan to reach homeowners, renters, and contractors.

We focus on satisfying the needs of our customers.

We focus on providing quality plants at affordable prices.

5.1 Sales Strategy

The primary sales strategy includes the following factors:

– Exceptional customer service

– Exceptional product knowledge

– Large and varied inventory

– Convenient location

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.1.1 Sales Forecast

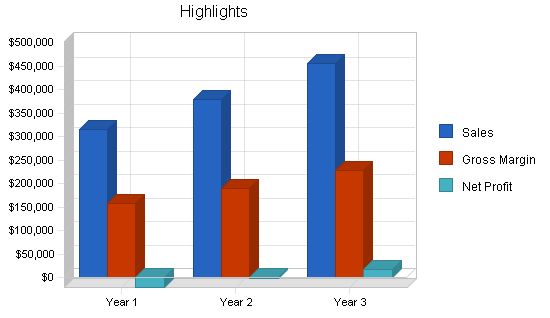

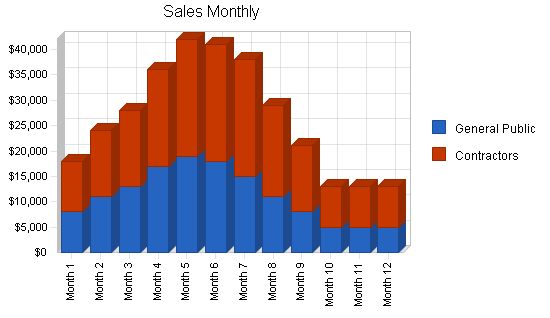

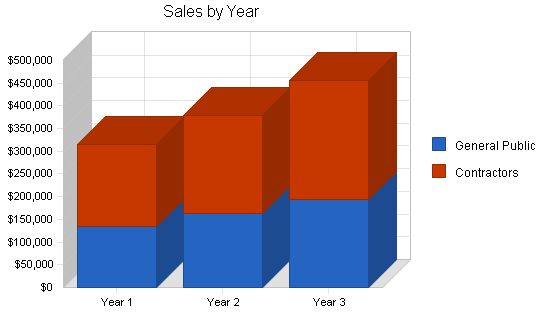

The sales forecast is divided into two main revenue streams: the general public and contractors. The sales forecast for the upcoming year is based on a modest growth rate of 20%, hoping that our advertising efforts will attract new customers daily.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| General Public | $135,000 | $162,000 | $194,400 |

| Contractors | $181,000 | $217,200 | $260,640 |

| Total Sales | $316,000 | $379,200 | $455,040 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Flowers, Trees, Shrubs | $94,800 | $113,760 | $136,512 |

| Garden Supplies | $63,200 | $75,840 | $91,008 |

| Subtotal Direct Cost of Sales | $158,000 | $189,600 | $227,520 |

5.2 Milestones

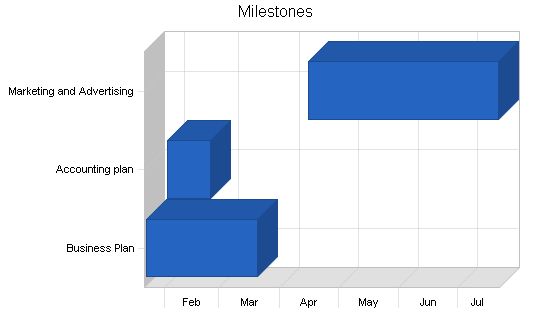

The milestones chart is accompanied by a table outlining key activities critical to our success.

"Milestones"

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan | 1/22/2003 | 3/20/2003 | $1,000 | Jim Forester | Management |

| Accounting plan | 2/2/2003 | 2/24/2003 | $500 | Todd Cramer | Accountant |

| Marketing and Advertising | 4/15/2003 | 7/21/2003 | $3,000 | Dan Forester | Management |

| Totals | $4,500 | ||||

5.3 Marketing Strategy

Our marketing strategy is to be the preferred choice for contractors and the general public for their plant and shrubbery needs. We focus on superior performance in the following areas:

- Customer service

- Knowledgeable staff

- Affordable prices

- Great location.

5.4 Competitive Edge

Rose Petal Nursery will have an extensive and affordable selection of plants and flowers in the Eugene/Springfield area, with a knowledgeable staff providing unmatched customer service. Contractors in need of a reliable nursery will find Rose Petal to be supportive and easy to work with. Our convenient location is another advantage.

Management Summary

Owners Jim and Dan Forester will oversee and manage all aspects of operation at Rose Petal Nursery. Jim will handle the ordering of garden supplies and tree stock, as well as greenhouse maintenance. Dan will manage staff, work with contractors, and assist with merchandise ordering.

6.1 Personnel Plan

The personnel plan includes two full-time employees and two part-time employees, in addition to Jim and Dan Forester. Both Jim and Dan will receive a salary of $3,500 per month. The full-time employees will be paid $2,000 per month initially, and the part-time employees will earn $1,000 per month. Employee responsibilities will include assisting customers and plant care.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Owners | $84,000 | $88,000 | $92,000 |

| Full-time Employees | $32,000 | $44,000 | $48,000 |

| Part-time Employees | $20,000 | $25,000 | $29,000 |

| Total People | 4 | 5 | 5 |

| Total Payroll | $136,000 | $157,000 | $169,000 |

Financial Plan

The financial plan includes the following factors:

- A projected 20% growth rate in sales for 2005, resulting in total revenues exceeding $379,000.

- Average daily sales (305 business days per year) exceeding $900.00.

Difficulties and Risks

- Slow sales leading to lower-than-projected cash flow.

- Aggressive actions by competitors that harm our business.

- New competitors entering the market.

- Economic conditions affecting business performance.

7.1 Important Assumptions

Our future success depends on the following critical assumptions:

- A healthy economy supporting moderate growth in our market.

- Low operating expenses, particularly in plant procurement that could be grown on-site.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 9.00% | 9.00% | 9.00% |

| Long-term Interest Rate | 7.00% | 7.00% | 7.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

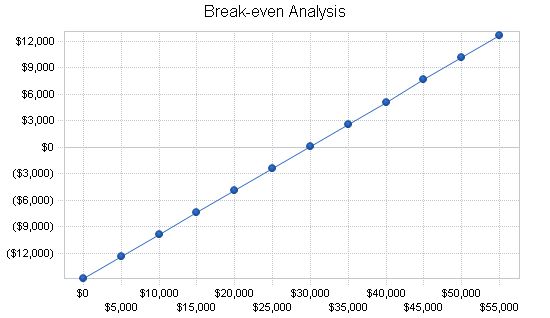

7.2 Break-even Analysis

The chart and table below summarize our break-even analysis. Our fixed costs will be approximately $14,800 per month initially, and we anticipate reaching the break-even point in the third year of operation.

Break-even Analysis

Monthly Revenue Break-even: $29,767

Assumptions:

– Average Percent Variable Cost: 50%

– Estimated Monthly Fixed Cost: $14,883

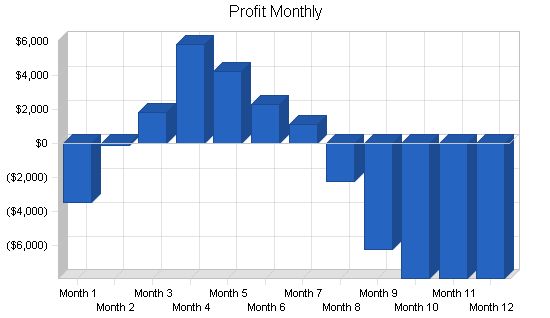

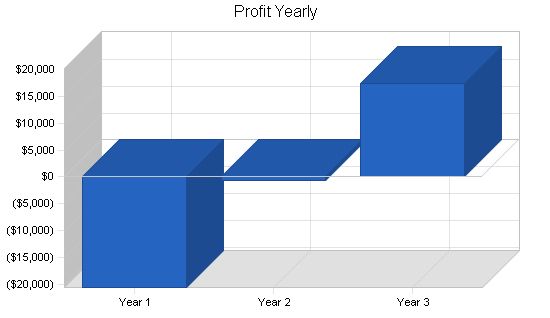

Projected Profit and Loss

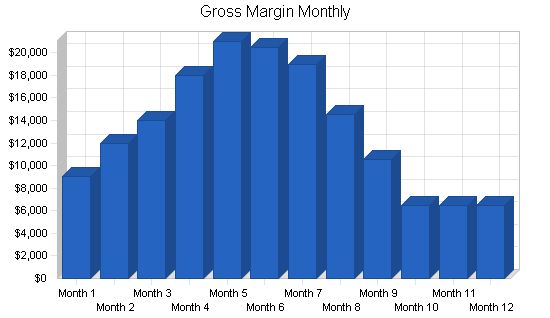

The projected profit and loss for Rose Petal Nursery, based on sales and expenses, for 2004 and beyond, are as follows. Sales are expected to steadily increase through July, with a slowdown anticipated during the autumn and winter.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $316,000 $379,200 $455,040

Direct Cost of Sales $158,000 $189,600 $227,520

Other Costs of Goods $0 $0 $0

Total Cost of Sales $158,000 $189,600 $227,520

Gross Margin $158,000 $189,600 $227,520

Gross Margin % 50.00% 50.00% 50.00%

Expenses

Payroll $136,000 $157,000 $169,000

Sales and Marketing and Other Expenses $6,000 $5,000 $5,000

Depreciation $0 $0 $0

Rent $12,000 $0 $0

Utilities $3,600 $4,000 $4,000

Insurance $600 $700 $800

Payroll Taxes $20,400 $23,550 $25,350

Total Operating Expenses $178,600 $190,250 $204,150

Profit Before Interest and Taxes ($20,600) ($650) $23,370

EBITDA ($20,600) ($650) $23,370

Interest Expense $0 $0 $0

Taxes Incurred $0 $0 $5,940

Net Profit ($20,600) ($650) $17,430

Net Profit/Sales -6.52% -0.17% 3.83%

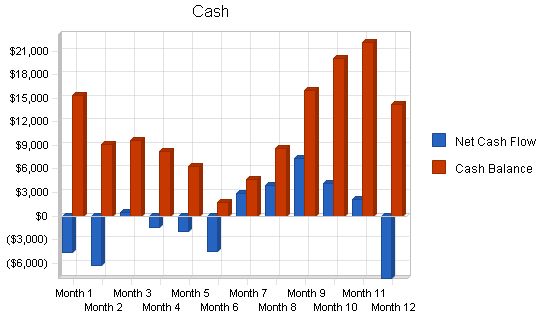

7.4 Projected Cash Flow

The cash flow projections are outlined below. These projections are based on our assumptions with revenue generating factors carrying the most significant weight regarding the outcome. We anticipate a steadily increasing cash flow as the business grows.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $79,000 $94,800 $113,760

Cash from Receivables $217,825 $280,565 $336,678

Subtotal Cash from Operations $296,825 $375,365 $450,438

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $5,000 $0 $0

Subtotal Cash Received $301,825 $375,365 $450,438

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $136,000 $157,000 $169,000

Bill Payments $171,632 $215,464 $266,541

Subtotal Spent on Operations $307,632 $372,464 $435,541

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $307,632 $372,464 $435,541

Net Cash Flow ($5,807) $2,901 $14,897

Cash Balance $14,193 $17,094 $31,991

7.5 Projected Balance Sheet

Rose Petal Nursery’s balance sheet is outlined below.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $14,193 $17,094 $31,991

Accounts Receivable $19,175 $23,010 $27,612

Inventory $7,150 $8,580 $10,296

Other Current Assets $0 $0 $0

Total Current Assets $40,518 $48,684 $69,899

Long-term Assets

Long-term Assets $12,000 $12,000 $12,000

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $12,000 $12,000 $12,000

Total Assets $52,518 $60,684 $81,899

Liabilities and Capital

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $9,618 $18,434 $22,219

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $9,618 $18,434 $22,219

Long-term Liabilities $0 $0 $0

Total Liabilities $9,618 $18,434 $22,219

Paid-in Capital $105,000 $105,000 $105,000

Retained Earnings ($41,500) ($62,100) ($62,750)

Earnings ($20,600) ($650) $17,430

Total Capital $42,900 $42,250 $59,680

Total Liabilities and Capital $52,518 $60,684 $81,899

7.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) Code 5193.02, Flowers and Nursery Stock are shown for comparison.

The following will enable us to keep on track. If we fail in any of these areas, we will need to re-evaluate our business model:

– Gross margins at or above 50%.

– Month-to-month annual comparisons indicate an increase of 15% or greater.

– Do not depend on a credit line to meet cash requirements.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 20.00% 20.00% 1.22%

Percent of Total Assets

Accounts Receivable 36.51% 37.92% 33.71% 30.27%

Inventory 13.61% 14.14% 12.57% 25.69%

Other Current Assets 0.00% 0.00% 0.00% 27.60%

Total Current Assets 77.15% 80.23% 85.35% 83.56%

Long-term Assets 22.85% 19.77% 14.65% 16.44%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 18.31% 30.38% 27.13% 44.32%

Long-term Liabilities 0.00% 0.00% 0.00% 11.33%

Total Liabilities 18.31% 30.38% 27.13% 55.65%

Net Worth 81.69% 69.62% 72.87% 44.35%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 50.00% 50.00% 50.00% 17.78%

Selling, General & Administrative Expenses 56.52% 50.17% 46.15% 9.07%

Advertising Expenses 0.00% 0.00% 0.00% 0.67%

Profit Before Interest and Taxes -6.52% -0.17% 5.14% 2.13%

Main Ratios

Current 4.21 2.64 3.15 1.66

Quick 3.47 2.18 2.68 0.99

Total Debt to Total Assets 18.31% 30.38% 27.13% 6.03%

Pre-tax Return on Net Worth -48.02% -1.54% 39.16% 58.71%

Pre-tax Return on Assets -39.22% -1.07% 28.54% 14.61%

Additional Ratios

Net Profit Margin -6.52% -0.17% 3.83% n/a

Return on Equity -48.02% -1.54% 29.21% n/a

Activity Ratios

Accounts Receivable Turnover 12.36 12.36 12.36 n/a

Collection Days 59 27 27 n/a

Inventory Turnover 10.45 24.11 24.11 n/a

Accounts Payable Turnover 18.84 12.17 12.17 n/a

Payment Days 27 23 27 n/a

Total Asset Turnover 6.02 6.25 5.56 n/a

Debt Ratios

Debt to Net Worth 0.22 0.44 0.37 n/a

Current Liab. to Liab. 1.00 1.00 1.00 n/a

Liquidity Ratios

Net Working Capital $30,900 $30,250 $47,680 n/a

Interest Coverage 0.00 0.00 0.00 n/a

Additional Ratios

Assets to Sales 0.17 0.16 0.18 n/a

Current Debt/Total Assets 18% 30% 27% n/a

Acid Test 1.48 0.93 1.44 n/a

Sales/Net Worth 7.37 8.98 7.62 n/a

Dividend Payout 0.00 0.00 0.00 n/a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

General Public 0% $8,000 $11,000 $13,000 $17,000 $19,000 $18,000 $15,000 $11,000 $8,000 $5,000 $5,000 $5,000

Contractors 0% $10,000 $13,000 $15,000 $19,000 $23,000 $23,000 $23,000 $18,000 $13,000 $8,000 $8,000 $8,000

Total Sales $18,000 $24,000 $28,000 $36,000 $42,000 $41,000 $38,000 $29,000 $21,000 $13,000 $13,000 $13,000

Direct Cost of Sales

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Flowers, Trees, Shrubs $5,400 $7,200 $8,400 $10,800 $12,600 $12,300 $11,400 $8,700 $6,300 $3,900 $3,900 $3,900

Garden Supplies $3,600 $4,800 $5,600 $7,200 $8,400 $8,200 $7,600 $5,800 $4,200 $2,600 $2,600 $2,600

Subtotal Direct Cost of Sales $9,000 $12,000 $14,000 $18,000 $21,000 $20,500 $19,000 $14,500 $10,500 $6,500 $6,500 $6,500

Personnel Plan:

Owners: 0% $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000

Full-time Employees: 0% $0 $0 $0 $0 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000

Part-time Employees: 0% $2,000 $2,000 $2,000 $2,000 $2,000 $3,000 $3,000 $2,000 $2,000 $0 $0 $0

Total People: 3 3 3 3 5 6 6 5 5 4 4 4 4

Total Payroll: $9,000 $9,000 $9,000 $9,000 $13,000 $14,000 $14,000 $13,000 $13,000 $11,000 $11,000 $11,000 $11,000

General Assumptions:

Plan Month: 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate: 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00%

Long-term Interest Rate: 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00%

Tax Rate: 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00%

Other: 0 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss:

Sales: $18,000 $24,000 $28,000 $36,000 $42,000 $41,000 $38,000 $29,000 $21,000 $13,000 $13,000 $13,000

Direct Cost of Sales: $9,000 $12,000 $14,000 $18,000 $21,000 $20,500 $19,000 $14,500 $10,500 $6,500 $6,500 $6,500

Other Costs of Goods: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales: $9,000 $12,000 $14,000 $18,000 $21,000 $20,500 $19,000 $14,500 $10,500 $6,500 $6,500 $6,500

Gross Margin: $9,000 $12,000 $14,000 $18,000 $21,000 $20,500 $19,000 $14,500 $10,500 $6,500 $6,500 $6,500

Gross Margin %: 50.00% 50.00% 50.00% 50.00% 50.00% 50.00% 50.00% 50.00% 50.00% 50.00% 50.00% 50.00% 50.00%

Expenses:

Payroll: $9,000 $9,000 $9,000 $9,000 $13,000 $14,000 $14,000 $13,000 $13,000 $11,000 $11,000 $11,000 $11,000

Sales and Marketing and Other Expenses: $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Depreciation: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Rent: $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Utilities: $300 $300 $300 $300 $300 $300 $300 $300 $300 $300 $300 $300 $300

Insurance: 15% $300 $0 $0 $0 $0 $300 $0 $0 $0 $0 $0 $0 $0

Payroll Taxes: 15% $1,350 $1,350 $1,350 $1,350 $1,950 $2,100 $2,100 $1,950 $1,950 $1,650 $1,650 $1,650 $1,650

Total Operating Expenses: $12,450 $12,150 $12,150 $12,150 $16,750 $18,200 $17,900 $16,750 $16,750 $14,450 $14,450 $14,450 $14,450

Profit Before Interest and Taxes: ($3,450) ($150) $1,850 $5,850 $4,250 $2,300 $1,100 ($2,250) ($6,250) ($7,950) ($7,950) ($7,950) ($7,950)

EBITDA: ($3,450) ($150) $1,850 $5,850 $4,250 $2,300 $1,100 ($2,250) ($6,250) ($7,950) ($7,950) ($7,950) ($7,950)

Interest Expense: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Taxes Incurred: $0 $0 $0 $0 $

Pro Forma Cash Flow

Pro Forma Cash Flow is a table that presents the monthly cash received and spent over a one-year period. It provides an overview of the company’s financial activities and helps track its cash balance.

Cash Received:

– Cash from Operations: This includes cash sales and cash from receivables.

– Cash Sales: Month-by-month cash sales amounts for the twelve months.

– Cash from Receivables: The amount of cash received from customers who made purchases on credit.

Subtotal Cash from Operations: The total cash received from operations.

Additional Cash Received: Other sources of cash received apart from operations.

– Sales Tax, VAT, HST/GST Received: Any sales tax, VAT, or other similar taxes collected.

– New Current Borrowing: Any new borrowing from current sources.

– New Other Liabilities (interest-free): Any new liabilities that do not incur interest.

– New Long-term Liabilities: Any new long-term liabilities.

– Sales of Other Current Assets: Cash received from selling other current assets.

– Sales of Long-term Assets: Cash received from selling long-term assets.

– New Investment Received: Any new investment received from external sources.

Subtotal Cash Received: The total cash received, including both from operations and additional sources.

Expenditures:

– Expenditures from Operations: Cash spent on operating expenses.

– Cash Spending: Month-by-month cash spending amount.

Subtotal Spent on Operations: The total cash spent on operations.

Additional Cash Spent: Other cash spent apart from operations.

– Sales Tax, VAT, HST/GST Paid Out: Any sales tax, VAT, or other similar taxes paid.

– Principal Repayment of Current Borrowing: Any repayment of current borrowing.

– Other Liabilities Principal Repayment: Repayment of other liabilities.

– Long-term Liabilities Principal Repayment: Repayment of long-term liabilities.

– Purchase Other Current Assets: Cash spent on purchasing other current assets.

– Purchase Long-term Assets: Cash spent on purchasing long-term assets.

– Dividends: Cash paid out as dividends.

Subtotal Cash Spent: The total cash spent, including both on operations and additional expenses.

Net Cash Flow: The difference between total cash received and total cash spent.

Cash Balance: The remaining cash balance after accounting for all cash received and spent.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!