How to Choose a Realistic Revenue Model for Your Online Platform

Nowadays, online platforms are everywhere, and many entrepreneurs are launching new ones. As someone who co-founded an online platform for small businesses, I understand the interest in this industry.

An online platform is a digital place where exchange occurs between third parties.

Let’s take the example of buying Office 365 from Microsoft. You pay Microsoft for the usage of the latest version of Office, including cloud storage and other features. This is known as software as a service, or SaaS.

But what about YouTube? When you pay for YouTube Premium, you’re not exchanging with YouTube. Instead, you’re paying to get rid of the annoying ads. The real exchange occurs between you and the person who uploaded the video, who receives compensation from YouTube.

Entrepreneurs gravitate toward online platforms because they are capital-light. They don’t require plants and equipment to start up. Additionally, online platforms are infrastructural businesses. There is no physical product or service to develop and market. It’s just the digital infrastructure.

To succeed with an online platform, you need users. The theory is that when the number of users reaches a critical mass, the platform will experience exponential growth due to the self-reinforcing network effect. However, the chances of your platform becoming successful are extremely low considering the number of platforms in various industries.

Instead of obsessively adding users, focus on building a resilient business by targeting a niche market and acquiring clients who are willing to pay for your platform. Making money with an online platform, especially in the first years, is a challenge.

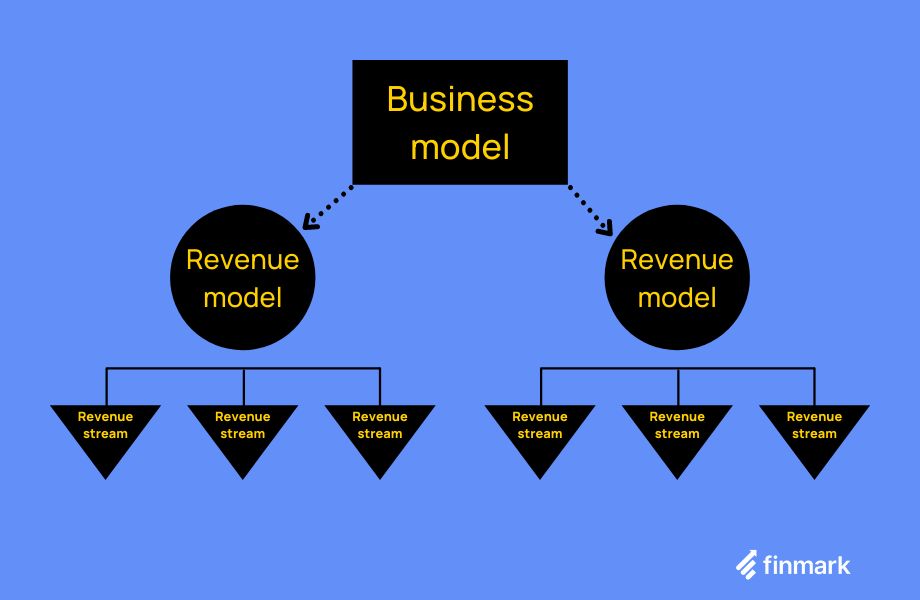

There are four revenue models you should consider for your online platform:

1. Subscriptions: Users subscribe to the service and make regular payments. Subscriptions are the best revenue model for online platforms but also the most difficult to achieve. To charge subscription fees, your platform must have a large and valuable network of users.

2. Listing fees: Users must pay to post a product or service offer. This revenue model is suitable for marketplaces like Craigslist. However, it can work for any platform if users feel the need to highlight their offers.

3. Commissions: Users pay a percentage of the total transaction value. Commissions allow platforms to become high-ticket and generate good cash flow. Unlike other revenue models, commissions don’t require a large network to work.

4. Interaction fees: Users are free to use the platform, but they must pay for certain features or interactions with other users. Interaction fees offer flexibility but can be complex to implement and understand.

Choose a revenue model that best fits your platform based on its network, value, and maturity. Communicate and explain your revenue model clearly to your customers.

By eliminating redundant words and phrases, the text becomes more concise and impactful. It maintains the original meaning and clarity while enhancing readability for the audience.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!