What to Do When You Need a Disaster Loan

When disaster strikes and your business is affected, what’s next? For many small businesses, the future is uncertain.

During the process of rebuilding, small business owners often wonder if they should apply for a disaster loan. Let’s explore the possibilities.

First, am I eligible for a disaster loan?

In the United States, the Small Business Administration (SBA) handles disaster loan applications. The process is approachable and has a relatively short turnaround time, but the SBA does have eligibility requirements.

Applicants need a reasonable credit history, a demonstrated ability to repay the loan, and for most disaster loans, collateral is required. Keep in mind that taking out a loan during a crisis may increase your long-term debt. Evaluate your credit and existing debt before accepting a loan.

What constitutes a disaster?

In the U.S., federal regulations define a range of disasters, from natural to human-made, with broad legal definitions. The SBA offers assistance to businesses in recovery and also provides home and personal property loans.

If you are in a legally declared disaster area and your business or nonprofit has been affected, you may apply for a loan. The SBA can provide assistance of up to two million dollars for both physical damage and economic injury loans.

Types of EIDL loans

Let’s look at the specific types of disaster loans provided by the SBA:

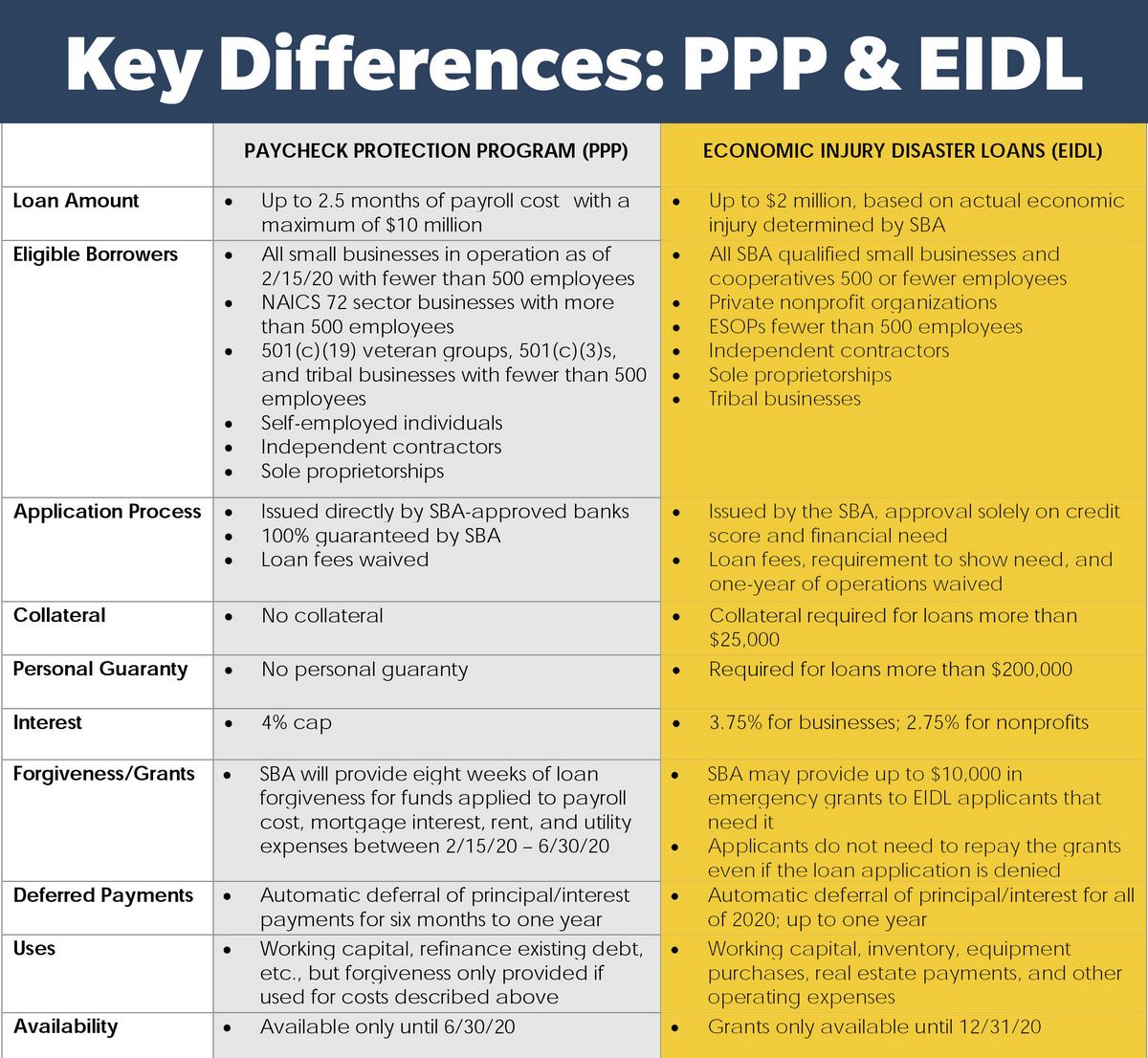

1. Economic Injury Disaster Loans (EIDLs): These loans help cover the costs of being closed and losing sales. EIDLs are intended to help meet financial obligations that you may be unable to pay.

2. Physical Disaster Loans: These loans help replace what has been destroyed or damaged by a disaster. The SBA provides funding for real property, machinery, equipment, fixtures, inventory, and leasehold improvements. They may also provide additional funding to prevent future damage.

3. Military Reservists Economic Injury Loans (MREIDL): These loans are for businesses that may be adversely affected when a key employee who is a military reservist is called into active duty.

Applying for the loan

The application process is straightforward. Keep personal and business financial records handy, and obtain your registration number from FEMA. You can then apply online before the deadline. The target turnaround time for processing applications is 21 days, but it may be longer due to the volume of applicants.

Tips to prepare for disasters

Here are a few suggestions applicable internationally to make disaster recovery easier:

1. Review your insurance coverage: Ensure you have property, liability, and business interruption insurance that covers essential items and lost earnings.

2. Know your finances and keep backup records: Keep track of your business and personal finances, and have backups in multiple locations.

3. Have a continuity plan: Consider alternative options for critical components of your operation that may be destroyed.

What if things were not insured?

If insurance coverage is lacking, the SBA can refinance your mortgage under certain conditions.

Disaster recovery outside the U.S.

Canada, the European Union, and USAID have their own federal loan programs and funding initiatives for disaster-stricken areas.

Resiliency is the name of the game

In light of recent national disasters, it’s crucial to be prepared. Initiatives like Rise NYC and features on platforms like Facebook aid in disaster preparedness. Cities are finding creative solutions to support infrastructure and citizens during disasters.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!