Balance Sheet: Definition, Formulas, and Example

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a given time. It is a crucial tool for understanding the financial health and stability of a company. By providing a comprehensive overview of a company’s assets, liabilities, and equity, a balance sheet allows stakeholders to assess its solvency and evaluate its ability to meet short-term and long-term obligations.

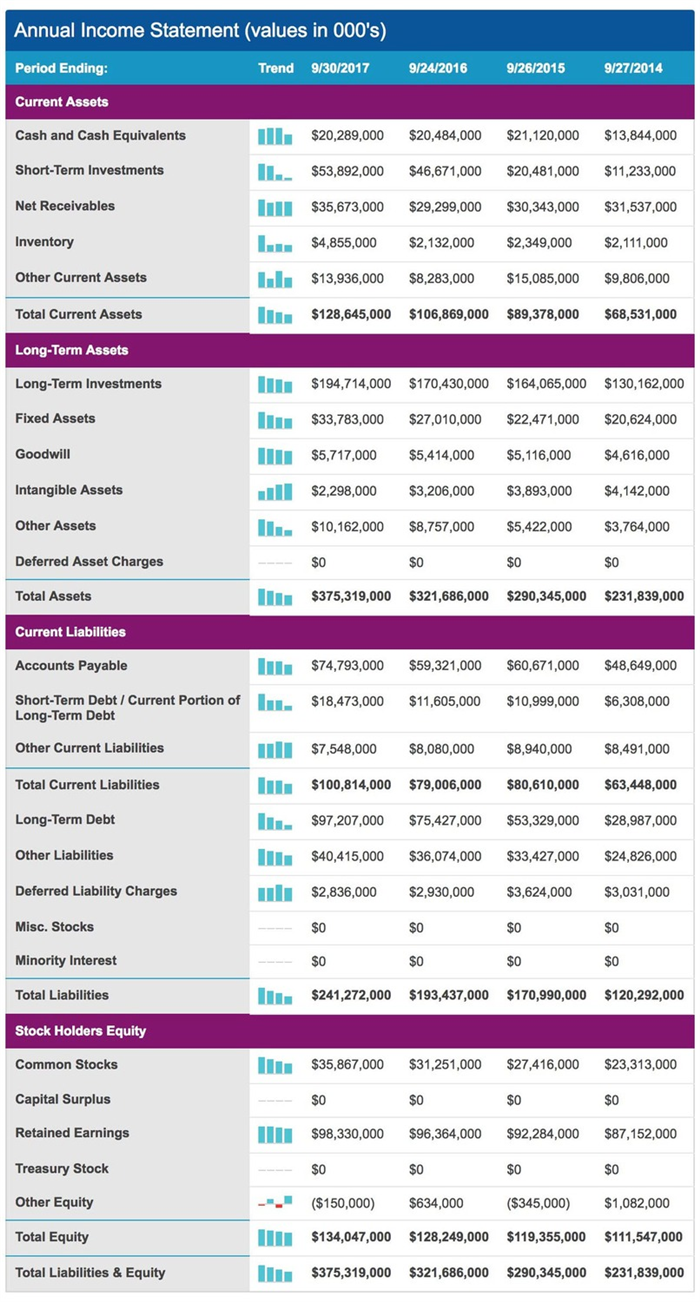

The balance sheet consists of two main sections: assets and liabilities. Assets represent what a company owns or controls, including cash, accounts receivable, inventory, property, and equipment. Liabilities, on the other hand, encompass what a company owes to others, such as loans, accounts payable, and accrued expenses.

To determine a company’s equity, which represents the ownership interest of shareholders, the total liabilities are subtracted from the total assets. This provides a clear indication of the company’s net worth.

Understanding the balance sheet requires familiarity with its formulas. The formula for total assets is the sum of current assets and non-current assets. Current assets are those that are expected to be converted into cash or used up within one year, while non-current assets have a longer life span.

Similarly, the formula for total liabilities includes both current liabilities, which are obligations due within one year, and non-current liabilities, which have a longer repayment timeline.

Let’s consider an example to illustrate the concept of a balance sheet. Company XYZ, a manufacturing firm, has the following financial information as of December 31, 2021:

Assets:

– Cash: $100,000

– Accounts Receivable: $50,000

– Inventory: $200,000

– Property: $500,000

Liabilities:

– Accounts Payable: $75,000

– Loans Payable: $150,000

Based on this information, we can calculate the equity by subtracting the total liabilities ($225,000) from the total assets ($850,000). In this example, the equity of Company XYZ is $625,000.

In conclusion, a balance sheet provides a concise overview of a company’s financial position, allowing stakeholders to assess its overall health and stability. By understanding the formulas and analyzing the example provided, you can effectively interpret the information presented in a balance sheet.

Business financial statements have three main components: the income statement, statement of cash flows, and balance sheet. The balance sheet is often misunderstood but can be extremely beneficial if used correctly. Our free downloadable Balance Sheet Template provides more information on this topic. So, what is a balance sheet exactly? It is a snapshot of your company’s financial condition at a specific point in time. It includes a list of all your company’s assets, liabilities, and owner’s equity in one document. The balance sheet must always balance—hence the name—with assets on one side and liabilities plus owner’s equity on the other. The balance sheet serves the purpose of showing what a company owns (assets), owes (liabilities), and how much owners and shareholders have invested (equity). Including a balance sheet in your business plan is crucial for understanding the overall state of your business financially. It helps determine if you are in debt and the value of your assets. Among other things, your balance sheet can be used to determine your company’s net worth by subtracting liabilities from assets. The key components of a balance sheet are assets, liabilities, and owner’s equity. Assets are organized based on liquidity, with the most liquid assets at the top and the least liquid at the bottom. Cash represents the money on hand, while accounts receivable is money owed to you. Inventory includes finished goods and materials on hand that haven’t been sold yet. Current assets can be converted to cash within a year, while long-term assets have long-standing value. Accumulated depreciation reflects the reduction in value of assets over time. Liabilities, like assets, are ordered by how quickly they need to be paid off. Accounts payable is the money your business owes to vendors. Sales taxes payable only applies if your business pays sales tax each quarter. Short-term debt refers to debt that needs to be paid back within a year. Long-term debt includes financial obligations that take more than a year to repay. Equity includes shareholder money invested in the business and accumulated profits. Paid-in capital refers to money paid into the company as equity investments. Retained earnings are reinvested earnings that have not been paid out as dividends. Net earnings reflect the profitability of the company. The balance sheet can be used to gain insights into the health of your business and to anticipate cash shortages. It can also help you determine if you have enough cash for further investments. Two ratios, the current ratio and quick ratio, can be calculated from the balance sheet to assess cash flow. It is important to remember that the balance sheet alone does not provide a complete view of your business finances. You should also consider your profit and loss statement and cash flow forecast. These three statements work together to give you a complete picture of your business.

The text provided below has been reviewed and revised for editorial refinement and language efficiency:

"You’ll notice that it says “Period Ending” at the top; this indicates that these numbers reflect the time up until the listed date. This terminology is used when reporting actual values, not creating a financial forecast for the future.

Familiarize yourself with your balance sheet. Most companies update their balance sheet monthly or when lenders request an updated version. Nowadays, accounting software programs generate balance sheets, but it’s crucial to input accurate information for useful data.

The balance sheet is a valuable financial tool for businesses that know how to use it effectively. If you’re not familiar with your balance sheet, now is a good time to learn more about it and how it improves financial management.

Download our Balance Sheet Template for easy creation of your balance sheet and refer to our comprehensive guide for writing your financial plan."

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!