NaviTag Technologies, LLC [NaviTag Technologies], based in Massachusetts, is a startup focused on creating the first location and security monitoring solution for maritime container cargo shipments.

Our solution caters to two types of customers – shipping companies and government agencies that monitor cargo movements.

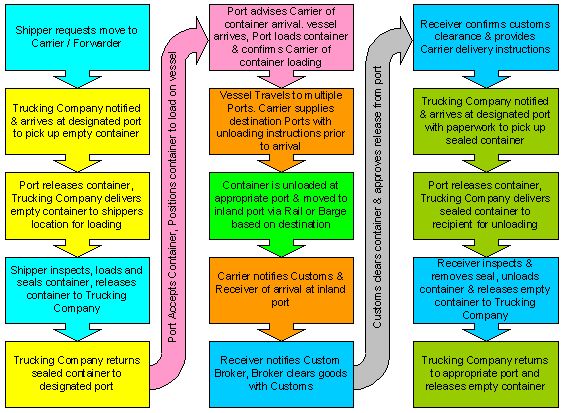

Users will now be able to capture and act on shipment data without relying on equipment owners or shipping partners. This is achieved through a removable tracking device affixed to a container. Throughout the journey, the device will report its status and positional information to an accessible central database and will be removed by the recipient.

This monitoring service is not yet available in the transportation industry, and we aim to dominate this segment.

The mission of NaviTag Technologies is to provide shippers and government agencies with a portable, reusable device that tracks cargo shipments more accurately than existing systems.

This electronic tag tracks the cargo, not the container, allowing the owner to choose which cargoes to monitor. It can be introduced anywhere in the supply chain to provide the security information needed to protect U.S. ports.

NaviTag Technologies generates revenue from the sale of electronic tags – NaviTags™ – as well as access charges to retrieve information. The number of NaviTags purchased depends on the volume of shipments requiring monitoring.

Access charges are based on the volume of units in operation, providing access to the NaviTag network and the central database containing positional and security alert information.

We have targeted the container shipping market due to its significant growth potential as a $120 billion industry. The annual growth of containers shipped is forecasted to increase by almost 100% by 2010.

Container terminals worldwide are set to experience rapid growth, with global container handling throughput expected to exceed 300 million TEUs in 2005 and over 400 million TEUs in 2010.

Despite the growth, the container shipping industry remains fragmented, with over 500 companies operating over 2,500 vessels and hundreds of thousands of companies engaged in international container shipments.

Jim Galley, our CTO and founding member, brings over 15 years of experience in technology management, operations, and product development. Bob Magown, with twenty years of senior management experience in transportation-related companies, will play a crucial role in sales and marketing.

We have completed market research and business model development and are seeking private equity placement to execute our business plan, focusing on creating the electronic tag, central database, and establishing the customer base.

NaviTag Technologies offers exceptional growth opportunities in this untapped market. Our approach empowers shippers with control of positional information and provides a selective cargo alert tool for government agencies. We aim to establish a market-leading position quickly.

NaviTag Technologies presents an attractive opportunity based on solid research and industry experience. We offer a valuable service unavailable elsewhere, benefiting current industry players immediately.

NaviTag Technologies aims to provide accurate, timely information about container cargo location and status in the supply chain. We empower NaviTag owners with control over cargo visibility and security info, eliminating the need for third-party tracking systems.

NaviTag Technologies is a limited liability company headquartered in Boston, Massachusetts, incorporated in Delaware. The company shareholders are Jim Galley, the president and CTO, and Robert Magown, the president of worldwide operations.

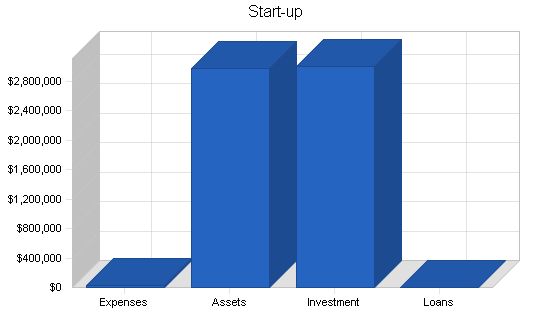

Our start-up expenses include stationery, legal costs, and office opening expenses. We plan to finance these costs through direct owner investment. See the tables and chart below for details.

Start-up Funding

Start-up Expenses: $33,000

Start-up Assets: $2,977,000

Total Funding Required: $3,010,000

Assets:

Non-cash Assets: $0

Cash Requirements: $2,977,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $2,977,000

Total Assets: $2,977,000

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable: $0

Other Current Liabilities: $0

Total Liabilities: $0

Capital:

Planned Investment:

Bob Magown: $5,000

Jim Galley: $5,000

Venture: $3,000,000

Additional Investment Requirement: $0

Total Planned Investment: $3,010,000

Loss at Start-up (Start-up Expenses): ($33,000)

Total Capital: $2,977,000

Total Capital and Liabilities: $2,977,000

Total Funding: $3,010,000

Company Locations and Facilities

NaviTag Technologies operates from two facilities. The corporate headquarters is located at 123 Main St., Boston, Massachusetts, and manages sales and finance. Development and production are managed from our office in New York.

Products and Services

NaviTag Technologies provides a service that securely tracks cargo movements worldwide. This is accomplished by utilizing a patent pending electronic tag called NaviTag, which captures location and event information. The NaviTag can be easily attached to any container, monitor the transport route, and alert the central database of any intrusion. Shippers can access the location information through a secure Internet connection and make informed decisions to support their supply chain. NaviTag also supports government agencies in improving security within U.S. ports and borders.

NaviTag is a cost-effective method of tracking cargo and ensuring security. It is a rechargeable, self-powered device that can be easily packaged and returned to the owner for unlimited use.

Product and Service Description

NaviTag Technologies provides a service that allows government or commercial entities to securely track their cargo movements worldwide. Our cargo tracking solution consists of three elements: the datacenter, the activation unit, and the NaviTag itself.

The NaviTag unit utilizes a low power modem to communicate from anywhere in the world. It captures positional and door open conditions throughout the cargo’s journey.

The NaviTag unit is compact and attaches to the container door. It records its location and transmits positional information at regular intervals. It also immediately transmits door open and tampering conditions.

These transmissions are validated and inserted into a common data structure in our datacenter. The datacenter performs messaging as defined by the NaviTag owner.

Fulfillment

Our solution includes a normalized database for accessing and integrating NaviTag data. Access rights are closely held and limited to authorized parties.

Market Analysis Summary

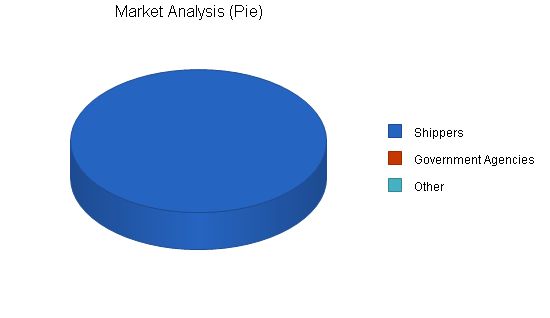

Our target markets are shippers seeking to improve control of cargo movement within their supply chain and government agencies striving to enhance cargo security in transit.

The current information flow is not coordinated and relies on multiple service providers. We aim to provide end-to-end visibility for shippers with high value, time sensitive, or hazardous cargo.

Approximately 30% of the total market falls within our target criterion, equating to over 90 million TEUs. Our focus will also be on government agencies seeking to improve security in U.S. ports.

Service Business Analysis

We have identified three distinct opportunities within this market:

1. Shippers: This group requires a cargo-tracking tool to monitor their shipments and receive timely location information.

2. Government Agencies: Agencies like D.O.T., Customs, and Department of Defense seek technology services that enhance container security.

3. Carriers: Equipment owners want to automate the inspection process for temperature-controlled containers.

Competition and Buying Patterns

Existing solutions in the market include supply chain management, asset management, and security devices. However, they lack integration and coordination capabilities.

NaviTag Technologies differentiates itself by providing cargo owners and government agencies with control of data and immediate information regarding security breaches.

Market Segmentation

Containerization requires coordination between various service providers. Our solution aims to simplify this process and provide effective communication for shippers.

Market Analysis

The Container Shipping Market

In 1950, container shipping was introduced as an alternative to break-bulk shipping. It has since become the preferred method for shipping goods internationally, displacing break-bulk shipping.

Container shipping allows cargo to move seamlessly between various modes of transportation using standard size containers. This has introduced efficiencies into shipping, warehousing, and distribution.

Container shipping also provides greater security and protection for cargo compared to break-bulk shipping.

Today, almost all finished and semi-finished goods are shipped internationally within containers.

The size of the container shipping market is estimated to be $120 billion.

The number of containers shipped has been growing at an average rate of 8% in the 1990s, with expected growth of 5.6% in 2002. In the next decade, global container handling throughput is expected to reach between 300 million and 342 million TEUs in 2005 and between 407 million and 525 million TEUs in 2010.

Ocean carriers are increasing their container vessel fleets to prepare for the forecasted increase in volumes.

The growth of container shipping has improved efficiencies and lowered transport costs, allowing manufacturers worldwide to compete in foreign markets.

The container shipping industry has grown from a single company in the 1950s to over 500 companies operating in excess of 2,500 vessels today. This has increased competition and changed the nature of the market.

The U.S. alone has over 25,000 exporting companies and over 32,000 importing companies involved in container shipping.

The global container shipping market is projected to double in the next 10 years, leading to an increase in the number of shippers.

Source: Mercer Management Consulting study submitted on behalf of the carriers to the House Judiciary Committee 3/22/00.

Target Market Segment Strategy

Our target markets are based on our extensive experience in the transportation industry and understanding of customer needs.

We offer a unique solution that provides visibility and security information that cargo owners and government agencies are seeking.

By capitalizing on new technology and the increased demand for security, we have timed our venture strategically.

Cargo Visibility

Shippers are demanding greater visibility into the status and location of their shipments to improve customer service and maintain inventory levels. However, lack of information standardization is a problem.

To access this information, shippers must undertake data integration projects with each service provider or outsource the effort to a supply chain visibility company.

The information provided by service providers is often historical and may vary in quality.

Shippers are seeking a single source solution that provides accurate and timely information on the location of their shipments.

Cargo Security

Cargo security data is practically non-existent. This poses a potential threat as dangerous materials or weapons could be imported through containers.

The U.S. government is seeking improvements in the security of cargo imported through U.S. ports.

Government agencies are becoming involved in security initiatives, and funds have been allocated for new technologies.

Market Needs

The market needs accurate and timely visibility information instead of event-based historical data.

There is a requirement for improvement in the quality of data received through the current manual entry system.

Confidence in the source of the information is crucial.

There is a need for a single visibility solution that works across all service providers without expensive integration or outsourcing.

Visibility data should be received in a consistent format across multiple service providers.

Timely notification of security breaches is essential to allow immediate inspection and corrective action.

Strategy and Implementation Summary

Our target market has been defined, and we differentiate ourselves by offering a unique solution to address customer information needs.

We will implement a combination of targeted mass marketing techniques and a focused direct sales team approach.

Our marketing strategy includes mass marketing and advertising campaigns, direct contacts, personal meetings, search engine optimization, and trade show participation.

Sales Strategy

We will introduce our unique solution to the market through targeted advertising, direct mail, website optimization, and direct sales.

Our direct sales force will consist of industry-seasoned salespeople and sales admin support.

Government agencies and large shippers will be targeted through personal sales calls.

Sales will initially focus on the U.S. market, with plans to expand to European and Asian markets in the future.

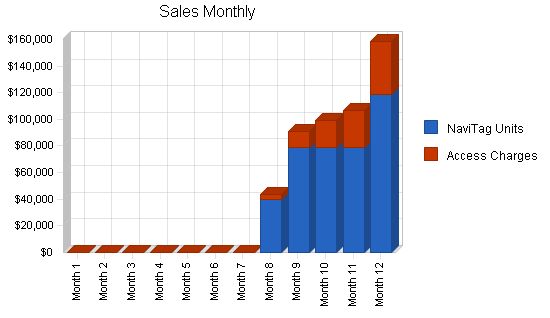

The sales forecast is based on reasonable projections within the large shipper market.

Access charge revenues are expected to grow exponentially based on the cumulative volume of NaviTag units sold.

Overall, our sales and marketing plan is designed to achieve market penetration and meet profitability goals.

Marketing Strategy

We will pursue an aggressive sales and marketing plan to achieve market penetration.

Our marketing plan includes targeted mass marketing, advertising campaigns, direct mail, website optimization, and direct sales.

Shippers will be reached through mass marketing, advertising, direct mail, print media, press releases, and trade shows.

Government agencies will be solicited through direct contacts, personal meetings, presentations, and demonstrations.

In conclusion, our sales and marketing strategy aims to effectively promote our unique solution to our target markets and achieve market penetration.

Sales Forecast

Unit Sales

NaviTag Units: 1,000, 5,800, 10,500, 12,000, 12,000

Access Charges: 2,600, 44,800, 145,500, 285,600, 429,600

Total Unit Sales: 3,600, 50,600, 156,000, 297,600, 441,600

Unit Prices

NaviTag Units: $395.00, $395.00, $395.00, $395.00, $395.00

Access Charges: $39.99, $39.99, $39.99, $39.99, $39.99

Sales

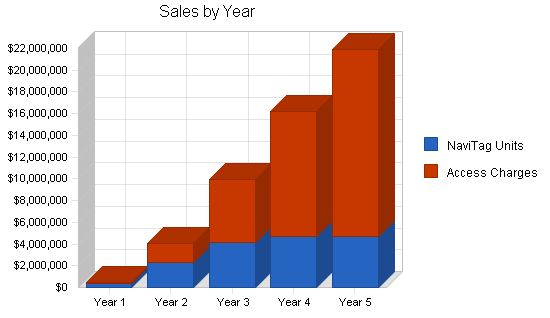

NaviTag Units: $395,000, $2,291,000, $4,147,500, $4,740,000, $4,740,000

Access Charges: $103,974, $1,791,552, $5,818,545, $11,421,144, $17,179,704

Total Sales: $498,974, $4,082,552, $9,966,045, $16,161,144, $21,919,704

Direct Unit Costs

NaviTag Units: $296.25, $296.25, $296.25, $296.25, $296.25

Access Charges: $22.20, $22.20, $22.20, $22.20, $22.20

Direct Cost of Sales

NaviTag Units: $296,250, $1,718,250, $3,110,625, $3,555,000, $3,555,000

Access Charges: $57,720, $994,560, $3,230,100, $6,340,320, $9,537,120

Subtotal Direct Cost of Sales: $353,970, $2,712,810, $6,340,725, $9,895,320, $13,092,120

5.3 Milestones

The following table lists important program milestones, with dates, managers in charge, and budgets.

NaviTag Technologies management consists of experienced entrepreneurs and business professionals from the transportation and technology management industries. The management team has functional experience in container shipping, product development, marketing emerging products/technologies, strategic partnering, professional services, and corporate finance.

Jim Galley, the CTO, has over 15 years of experience in management, operations, application and product development in technology environments. He played a key role in bringing GoCargo.com from a business plan concept to processing transactions online in six weeks. Mr. Galley also created a benchmarking reference for personal computer technology while working at PC Magazine Labs, which gained acceptance from major marketing and technical communities.

Bob Magown, President of NaviTag Technologies, has twenty years of senior management experience in transportation-related companies. He was an original member of the Internet start-up GoCargo.com and played a vital role in the sale of the company’s software and IP to BridgePoint. Prior to GoCargo.com, Mr. Magown had a successful career at the ocean carrier CAST (CP Ships).

The organization is structured into sales/marketing, finance, and distribution in the Boston office and development, operations, and production in the New York office.

The personnel plan anticipates a staff of XX employees by January 2003, with additional sales/marketing positions to be added in 2005.

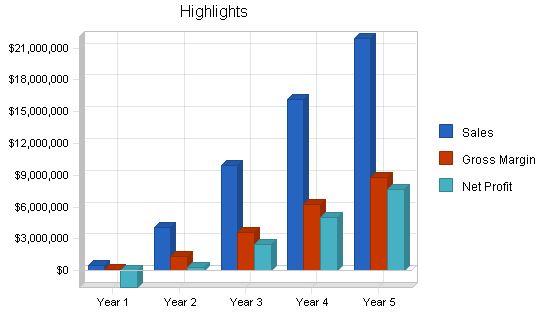

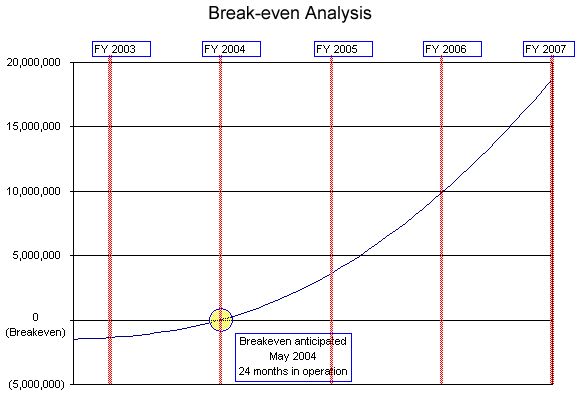

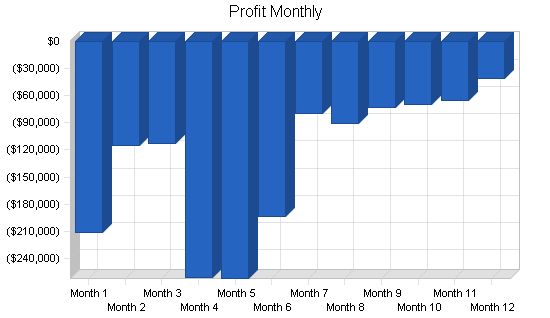

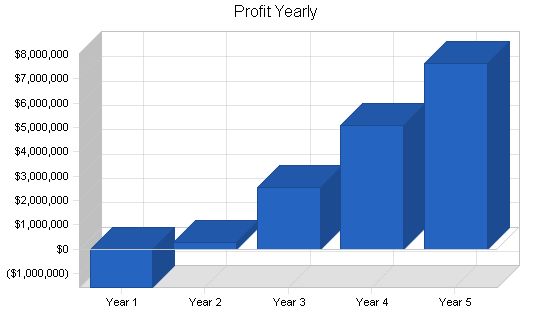

The financial plan relies on raising substantial seed capital through private equity to develop the electronic tag, central database, and establish the customer base. Profitability is projected to be achieved in just over two years, with a respectable net profit on sales anticipated by year three.

The assumptions used in the financial calculations of this business plan are presented in the table below.

Table: Break-even Analysis

Projected Profit and Loss

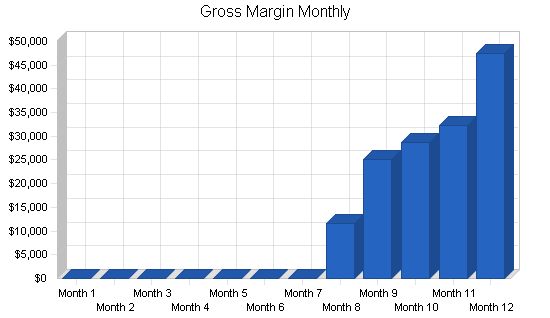

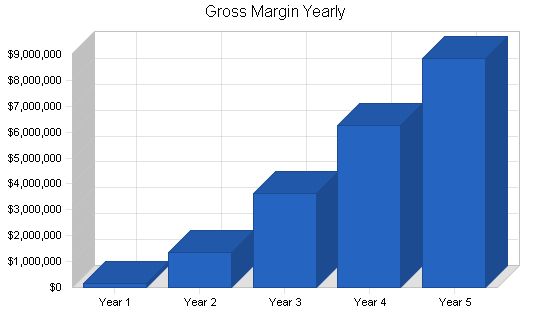

With realistic sales projections and efficient cost control measures, NaviTag Technologies will achieve profitability in just over two years. Company profits will increase to the first million in 2005 and five times that in 2007 due to the exponential growth of access charges. Gross margins will dramatically grow, thanks to the increased revenue from access charges.

[Confidential and proprietary information has been omitted or disguised in this sample plan.]

Pro Forma Profit and Loss

Sales:

– Year 1: $498,974

– Year 2: $4,082,552

– Year 3: $9,966,045

– Year 4: $16,161,144

– Year 5: $21,919,704

Direct Cost of Sales:

– Year 1: $353,970

– Year 2: $2,712,810

– Year 3: $6,340,725

– Year 4: $9,895,320

– Year 5: $13,092,120

Other Production Expenses:

– Year 1-5: $0

Total Cost of Sales:

– Year 1: $353,970

– Year 2: $2,712,810

– Year 3: $6,340,725

– Year 4: $9,895,320

– Year 5: $13,092,120

Gross Margin:

– Year 1: $145,004

– Year 2: $1,369,742

– Year 3: $3,625,320

– Year 4: $6,265,824

– Year 5: $8,827,584

Gross Margin %:

– Year 1: 29.06%

– Year 2: 33.55%

– Year 3: 36.38%

– Year 4: 38.77%

– Year 5: 40.27%

Expenses:

– Payroll:

– Year 1: $479,665

– Year 2: $596,000

– Year 3: $613,110

– Year 4: $643,765

– Year 5: $675,954

– Sales Collateral:

– Year 1: $45,000

– Year 2: $30,000

– Year 3-5: $30,000

– Depreciation:

– Year 1-5: $0

– Payroll Taxes:

– Year 1-5: $0

– Direct Mail:

– Year 1-5: $60,000

– Stationery:

– Year 1-5: $1,000

– Travel:

– Year 1-5: $60,000

– Trade Shows:

– Year 1-5: $30,000

– Advertising:

– Year 1: $80,000

– Year 2: $70,000

– Year 3-5: $80,000

– New York – Rent:

– Year 1: $48,750

– Year 2-5: $45,000

– New York – Telephone System:

– Year 1: $5,500

– Year 2: $1,000

– Year 3-5: $1,000

– New York – Telephone Charges:

– Year 1: $3,550

– Year 2-5: $4,800

– New York – Utilities:

– Year 1-5: $2,000

– New York – Furniture:

– Year 1-5: $7,500

– New York – Office Equipment/Networking:

– Year 1-5: $13,000

– New York – Internet Access:

– Year 1-5: $2,000

– New York – Misc./Office Supplies:

– Year 1-5: $2,000

– Outsourced Development – Discovery:

– Year 1: $85,000

– Year 2-5: $0

– Outsourced Development – Inception:

– Year 1: $53,000

– Year 2-5: $0

– Outsourced Development – Elaboration:

– Year 1: $69,000

– Year 2-5: $0

– Outsourced Development – Construction:

– Year 1: $370,000

– Year 2-5: $0

– Outsourced Development – Production:

– Year 1: $43,000

– Year 2-5: $0

– Outsourced Services – Accounting:

– Year 1-5: $25,000

– Outsourced Services – Legal:

– Year 1: $35,000

– Year 2-5: $30,000

– Laptop Computers:

– Year 1: $13,000

– Year 2: $5,000

– Year 3: $5,000

– Year 4: $15,000

– Year 5: $5,000

– Desktop Computers:

– Year 1: $7,000

– Year 2: $2,000

– Year 3: $2,000

– Year 4: $10,000

– Year 5: $2,000

– Development/Staging:

– Year 1: $30,000

– Year 2: $4,000

– Year 3: $4,000

– Year 4: $8,000

– Year 5: $4,000

– Software Licenses/Tools:

– Year 1: $10,000

– Year 2: $1,000

– Year 3-5: $2,000

– Production Hosting:

– Year 1: $68,500

– Year 2: $84,000

– Year 3-5: $108,000

– Maintenance/Support:

– Year 1-5: $15,000

– Monitoring Services:

– Year 1: $6,750

– Year 2-5: $10,000

– Boston – Rent:

– Year 1: $27,080

– Year 2-5: $25,000

– Boston – Telephone System:

– Year 1: $4,000

– Year 2-5: $500

– Boston – Telephone Charges:

– Year 1-5: $3,000

– Boston – Utilities:

– Year 1-5: $2,000

– Boston – Furniture:

– Year 1-5: $5,000

– Boston – Office Equipment/Networking:

– Year 1-5: $6,000

– Boston – Internet Access:

– Year 1-5: $1,000

– Boston – Misc./Office Supplies:

– Year 1-5: $2,000

– Other:

– Year 1-5: $0

Total Operating Expenses:

– Year 1: $1,720,295

– Year 2: $1,088,300

– Year 3: $1,105,410

– Year 4: $1,193,065

– Year 5: $1,203,254

Profit Before Interest and Taxes:

– Year 1: ($1,575,291)

– Year 2: $281,442

– Year 3: $2,519,910

– Year 4: $5,072,759

– Year 5: $7,624,330

EBITDA:

– Year 1: ($1,575,291)

– Year 2: $281,442

– Year 3: $2,519,910

– Year 4: $5,072,759

– Year 5: $7,624,330

Interest Expense:

– Year 1-5: $0

Taxes Incurred:

– Year 1-5: $0

Net Profit:

– Year 1: ($1,575,291)

– Year 2: $281,442

– Year 3: $2,519,910

– Year 4: $5,072,759

– Year 5: $7,624,330

Net Profit/Sales:

– Year 1: -315.71%

– Year 2: 6.89%

– Year 3: 25.28%

– Year 4: 31.39%

– Year 5: 34.78%

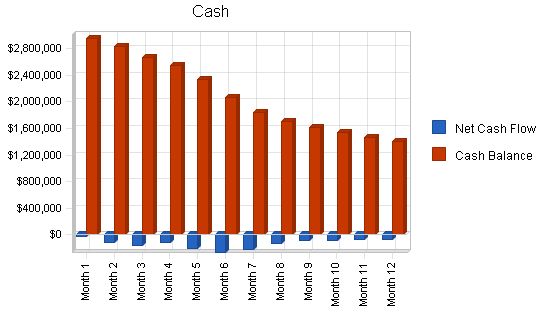

Projected Cash Flow

Cash flow is projected to decline for the first two years of operation, assuming 45-day credit collections. NaviTag Technologies has planned its finances to have sufficient cash from investors and debt in order to sustain the business until positive cash flow is achieved in 2005.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $0 $0 $0

Subtotal Cash from Operations $290,554 $2,585,701 $7,508,526

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $290,554 $2,585,701 $7,508,526

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $479,665 $596,000 $613,110

Bill Payments $1,386,014 $3,018,545 $6,385,748

Subtotal Spent on Operations $1,865,679 $3,614,545 $6,998,858

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $1,865,679 $3,614,545 $6,998,858

Net Cash Flow ($1,575,126) ($1,028,844) $509,668

Cash Balance $1,401,874 $373,031 $882,699

Projected Balance Sheet

Pro Forma Balance Sheet

Year 1 Year 2 Year 3 Year 4 Year 5

Assets

Current Assets

Cash $1,401,874 $373,031 $882,699 $3,813,048 $9,423,457

Accounts Receivable $208,420 $1,705,271 $4,162,790 $6,750,465 $9,155,800

Other Current Assets $0 $0 $0 $0 $0

Total Current Assets $1,610,295 $2,078,302 $5,045,489 $10,563,513 $18,579,257

Long-term Assets

Long-term Assets $0 $0 $0 $0 $0

Accumulated Depreciation $0 $0 $0 $0 $0

Total Long-term Assets $0 $0 $0 $0 $0

Total Assets $1,610,295 $2,078,302 $5,045,489 $10,563,513 $18,579,257

Liabilities and Capital

Year 1 Year 2 Year 3 Year 4 Year 5

Current Liabilities

Accounts Payable $208,586 $395,151 $842,428 $1,287,693 $1,679,107

Current Borrowing $0 $0 $0 $0 $0

Other Current Liabilities $0 $0 $0 $0 $0

Subtotal Current Liabilities $208,586 $395,151 $842,428 $1,287,693 $1,679,107

Long-term Liabilities $0 $0 $0 $0 $0

Total Liabilities $208,586 $395,151 $842,428 $1,287,693 $1,679,107

Paid-in Capital $3,010,000 $3,010,000 $3,010,000 $3,010,000 $3,010,000

Retained Earnings ($33,000) ($1,608,291) ($1,326,849) $1,193,061 $6,265,820

Earnings ($1,575,291) $281,442 $2,519,910 $5,072,759 $7,624,330

Total Capital $1,401,709 $1,683,151 $4,203,061 $9,275,820 $16,900,150

Total Liabilities and Capital $1,610,295 $2,078,302 $5,045,489 $10,563,513 $18,579,257

Sales Growth 0.00% 718.19% 144.11% 62.16% 35.63% 9.27%

Percent of Total Assets

Accounts Receivable 12.94% 82.05% 82.51% 63.90% 49.28% 18.72%

Other Current Assets 0.00% 0.00% 0.00% 0.00% 0.00% 36.72%

Total Current Assets 100.00% 100.00% 100.00% 100.00% 100.00% 92.30%

Long-term Assets 0.00% 0.00% 0.00% 0.00% 0.00% 7.70%

Total Assets 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Current Liabilities 12.95% 19.01% 16.70% 12.19% 9.04% 42.56%

Long-term Liabilities 0.00% 0.00% 0.00% 0.00% 0.00% 17.03%

Total Liabilities 12.95% 19.01% 16.70% 12.19% 9.04% 59.59%

Net Worth 87.05% 80.99% 83.30% 87.81% 90.96% 40.41%

Percent of Sales

Gross Margin 29.06% 33.55% 36.38% 38.77% 40.27% 18.16%

Selling, General & Administrative Expenses 383.83% 32.27% 13.48% 16.39% 15.08% 4.91%

Advertising Expenses 9.02% 0.73% 0.30% 0.19% 0.14% 0.41%

Profit Before Interest and Taxes -315.71% 6.89% 25.28% 31.39% 34.78% 3.42%

Main Ratios

Current 7.72 5.26 5.99 8.20 11.06 1.71

Quick 7.72 5.26 5.99 8.20 11.06 0.68

Total Debt to Total Assets 12.95% 19.01% 16.70% 12.19% 9.04% 67.28%

Pre-tax Return on Net Worth -112.38% 16.72% 59.95% 54.69% 45.11% 6.22%

Pre-tax Return on Assets -97.83% 13.54% 49.94% 48.02% 41.04% 19.01%

Additional Ratios

Net Profit Margin -315.71% 6.89% 25.28% 31.39% 34.78% n.a

Return on Equity -112.38% 16.72% 59.95% 54.69% 45.11% n.a

Activity Ratios

Accounts Receivable Turnover 2.39 2.39 2.39 2.39 2.39 n.a

Collection Days 40 86 107 123 132 n.a

Accounts Payable Turnover 7.64 8.11 8.11 8.11 8.11 n.a

Payment Days 40 34 33 37 40 n.a

Total Asset Turnover 0.31 1.96 1.98 1.53 1.18 n.a

Debt Ratios

Debt to Net Worth 0.15 0.23 0.20 0.14 0.10 n.a

Current Liab. to Liab. 1.00 1.00 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $1,401,709 $1,683,151 $4,203,061 $9,275,820 $16,900,150 n.a

Interest Coverage 0.00 0.00 0.00 0.00 0.00 n.a

Additional Ratios

Assets to Sales 3.23 0.51 0.51 0.65 0.85 n.a

Current Debt/Total Assets 13% 19% 17% 12% 9% n.a

Acid Test 6.72 0.94 1.05 2.96 5.61 n.a

Sales/Net Worth 0.36 2.43 2.37 1.74 1.30 n.a

Dividend Payout 0.00 0.00 0.00 0.00 0.00 n.a

Long-term Plan

We anticipate that the percentage of ocean cargo deemed time sensitive, of high value, or of a hazardous nature will continue to increase faster than the average increase in cargo in general. Additionally, concerns over ship, port, and national security risks will grow. With only 2% of imports being inspected currently, a cargo tracking/security alert device like NaviTag has significant opportunities.

Our cargo tracking efforts will focus on shippers with high value, time sensitive, or hazardous cargo. Our security focus will be on improving security at U.S. ports processing 600,000 containers weekly, in response to government agencies seeking enhanced security.

We expect to achieve profitability in just over two years, with a respectable net profit on sales by year three. However, slower implementation and sales efforts could lead to a negative cash balance, even if profitability is reached. Additional investment rounds or long-term loans may be necessary in that case.

On the other hand, rapid industry acceptance of NaviTag could result in risky expansion and a reduced operating capital reserve, requiring additional investment or loans.

Alternatively, proof-of-concept and feasibility analyses could generate high demand from governmental agencies or the military, leading to substantial grants, subsidies, contracts, etc.

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Sales | |||||||||||||

| NaviTag Units | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 100 | 200 | 200 | 200 | 300 | |

| Access Charges | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 100 | 300 | 500 | 700 | 1,000 | |

| Total Unit Sales | 0 | 0 | 0 | 0 | 0 | 0 | 200 | 500 | 700 | 900 | 1,300 | ||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Prices | |||||||||||||

| NaviTag Units | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $395.00 | $395.00 | $395.00 | $395.00 | $395.00 | ||

| Access Charges | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $39.99 | $39.99 | $39.99 | $39.99 | $39.99 | ||

| Sales | |||||||||||||

| NaviTag Units | $0 | $0 | $0 | $0 | $0 | $0 | $39,500 | $79,000 | $79,000 | $79,000 | $118,500 | ||

| Access Charges | $0 | $0 | $0 | $0 | $0 | $0 | $3,999 | $11,997 | $19,995 | $27,993 | $39,990 | ||

| Total Sales | $0 | $0 | $0 | $0 | $0 | $0 | $43,499 | $90,997 | $98,995 | $106,993 | $158,490 | ||

General Assumptions

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | |

| Long-term Interest Rate | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | |

| Tax Rate | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Pro Forma Profit and Loss

Sales:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $43,499

Month 10: $90,997

Month 11: $98,995

Month 12: $106,993

Month 13: $158,490

Direct Cost of Sales:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $31,845

Month 10: $65,910

Month 11: $70,350

Month 12: $74,790

Month 13: $111,075

Other Production Expenses:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Total Cost of Sales:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $31,845

Month 10: $65,910

Month 11: $70,350

Month 12: $74,790

Month 13: $111,075

Gross Margin:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $11,654

Month 10: $25,087

Month 11: $28,645

Month 12: $32,203

Month 13: $47,415

Gross Margin %:

Month 1: 0.00%

Month 2: 0.00%

Month 3: 0.00%

Month 4: 0.00%

Month 5: 0.00%

Month 6: 0.00%

Month 7: 0.00%

Month 8: 0.00%

Month 9: 26.79%

Month 10: 27.57%

Month 11: 28.94%

Month 12: 30.10%

Month 13: 29.92%

Expenses:

Payroll:

Month 1: $25,000

Month 2: $25,000

Month 3: $25,000

Month 4: $31,000

Month 5: $44,000

Month 6: $44,000

Month 7: $44,000

Month 8: $48,333

Month 9: $48,333

Month 10: $48,333

Month 11: $48,333

Month 12: $48,333

Month 13: $48,333

Sales Collateral:

Month 1: $5,000

Month 2: $5,000

Month 3: $5,000

Month 4: $5,000

Month 5: $5,000

Month 6: $5,000

Month 7: $0

Month 8: $5,000

Month 9: $0

Month 10: $5,000

Month 11: $0

Month 12: $5,000

Month 13: $0

Depreciation:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Payroll Taxes:

Month 1: 25%

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Direct Mail:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $15,000

Month 7: $0

Month 8: $15,000

Month 9: $15,000

Month 10: $0

Month 11: $15,000

Month 12: $0

Month 13: $0

Stationery:

Month 1: $1,000

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Travel:

Month 1: $5,000

Month 2: $5,000

Month 3: $5,000

Month 4: $5,000

Month 5: $5,000

Month 6: $5,000

Month 7: $5,000

Month 8: $5,000

Month 9: $5,000

Month 10: $5,000

Month 11: $5,000

Month 12: $5,000

Month 13: $5,000

Trade Shows:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $20,000

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $10,000

Month 11: $0

Month 12: $0

Month 13: $0

Advertising:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $10,000

Month 6: $10,000

Month 7: $10,000

Month 8: $10,000

Month 9: $10,000

Month 10: $10,000

Month 11: $10,000

Month 12: $10,000

Month 13: $10,000

New York – Rent:

Month 1: $7,500

Month 2: $3,750

Month 3: $3,750

Month 4: $3,750

Month 5: $3,750

Month 6: $3,750

Month 7: $3,750

Month 8: $3,750

Month 9: $3,750

Month 10: $3,750

Month 11: $3,750

Month 12: $3,750

Month 13: $3,750

New York – Telephone System:

Month 1: $5,500

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

New York – Telephone Charges:

Month 1: $300

Month 2: $200

Month 3: $150

Month 4: $150

Month 5: $200

Month 6: $400

Month 7: $150

Month 8: $400

Month 9: $400

Month 10: $400

Month 11: $400

Month 12: $400

Month 13: $400

New York – Utilities:

Month 1: $167

Month 2: $167

Month 3: $167

Month 4: $167

Month 5: $167

Month 6: $167

Month 7: $167

Month 8: $167

Month 9: $167

Month 10: $167

Month 11: $167

Month 12: $167

Month 13: $163

New York – Furniture:

Month 1: $7,500

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

New York – Office Equipment/Networking:

Month 1: $13,000

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

New York – Internet Access:

Month 1: $350

Month 2: $150

Month 3: $150

Month 4: $150

Month 5: $150

Month 6: $150

Month 7: $150

Month 8: $150

Month 9: $150

Month 10: $150

Month 11: $150

Month 12: $150

Month 13: $150

New York – Misc./Office Supplies:

Month 1: $167

Month 2: $167

Month 3: $167

Month 4: $167

Month 5: $167

Month 6: $167

Month 7: $167

Month 8: $167

Month 9: $167

Month 10: $167

Month 11: $167

Month 12: $167

Month 13: $163

Outsourced Development – Discovery:

Month 1: $55,000

Month 2: $30,000

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Outsourced Development – Inception:

Month 1: $0

Month 2: $35,000

Month 3: $18,000

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Outsourced Development – Elaboration:

Month 1: $0

Month 2: $0

Month 3: $46,000

Month 4: $23,000

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Outsourced Development – Construction:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $170,000

Month 5: $170,000

Month 6: $30,000

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Outsourced Development – Production:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $43,000

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Outsourced Services – Accounting:

Month 1: $2,083

Month 2: $2,083

Month 3: $2,083

Month 4: $2,083

Month 5: $2,083

Month 6: $2,083

Month 7: $2,083

Month 8: $2,083

Month 9: $2,083

Month 10: $2,083

Month 11: $2,083

Month 12: $2,083

Month 13: $2,087

Outsourced Services – Legal:

Month 1: $10,000

Month 2: $5,000

Month 3: $3,000

Month 4: $3,000

Month 5: $3,000

Month 6: $3,000

Month 7: $3,000

Month 8: $1,000

Month 9: $1,000

Month 10: $1,000

Month 11: $1,000

Month 12: $1,000

Month 13: $1,000

Laptop Computers:

Month 1: $13,000

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Desktop Computers:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $7,000

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Development/Staging:

Month 1: $30,000

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Month 13: $0

Software Licenses/Tools:

Month 1: $10,000

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month

Pro Forma Balance Sheet

Assets:

Starting Balances

Current Assets:

Cash: $2,977,000, $2,952,000, $2,827,486, $2,667,191, $2,547,404, $2,340,093, $2,072,436, $1,846,815, $1,709,448, $1,621,403, $1,540,041, $1,469,179, $1,401,874

Accounts Receivable: $0, $0, $0, $0, $0, $0, $0, $0, $43,499, $111,297, $141,460, $153,191, $208,420

Other Current Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Current Assets: $2,977,000, $2,952,000, $2,827,486, $2,667,191, $2,547,404, $2,340,093, $2,072,436, $1,846,815, $1,752,947, $1,732,700, $1,681,502, $1,622,370, $1,610,295

Long-term Assets:

Long-term Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Accumulated Depreciation: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Long-term Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Assets: $2,977,000, $2,952,000, $2,827,486, $2,667,191, $2,547,404, $2,340,093, $2,072,436, $1,846,815, $1,752,947, $1,732,700, $1,681,502, $1,622,370, $1,610,295

Liabilities and Capital:

Current Liabilities:

Accounts Payable: $0, $186,588, $177,488, $129,557, $270,534, $325,537, $251,394, $105,887, $103,212, $155,725, $173,729, $180,241, $208,586

Current Borrowing: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Other Current Liabilities: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Subtotal Current Liabilities: $0, $186,588, $177,488, $129,557, $270,534, $325,537, $251,394, $105,887, $103,212, $155,725, $173,729, $180,241, $208,586

Long-term Liabilities: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Liabilities: $0, $186,588, $177,488, $129,557, $270,534, $325,537, $251,394, $105,887, $103,212, $155,725, $173,729, $180,241, $208,586

Paid-in Capital: $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000, $3,010,000

Retained Earnings: ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000), ($33,000)

Earnings: $0, ($211,588), ($327,002), ($439,366), ($700,130), ($962,444), ($1,155,958), ($1,236,072), ($1,327,265), ($1,400,025), ($1,469,227), ($1,534,871), ($1,575,291)

Total Capital: $2,977,000, $2,765,412, $2,649,998, $2,537,634, $2,276,870, $2,014,556, $1,821,042, $1,740,928, $1,649,735, $1,576,975, $1,507,773, $1,442,129, $1,401,709

Total Liabilities and Capital: $2,977,000, $2,952,000, $2,827,486, $2,667,191, $2,547,404, $2,340,093, $2,072,436, $1,846,815, $1,752,947, $1,732,700, $1,681,502, $1,622,370, $1,610,295

Personnel Plan

Bob Magown – President: 0%, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000

Jim Galley – CTO: 0%, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000

VP Sales: 0%, $0, $0, $0, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000

Division 1: 0%, $5,000, $5,000, $5,000, $5,000, $12,000, $12,000, $12,000, $12,000, $12,000, $12,000, $12,000, $12,000

Division 2: 0%, $0, $0, $0, $0, $6,000, $6,000, $6,000, $10,333, $10,333, $10,333, $10,333, $10,333

Total People: 4, 4, 4, 5, 9, 9, 9, 10, 10, 10, 10, 10, 10

Total Payroll: $25,000, $25,000, $25,000, $31,000, $44,000, $44,000, $44,000, $48,333, $48,333, $48,333, $48,333, $48,333, $48,333

Pro Forma Cash Flow

Cash Received

– Cash from Operations: Cash Sales

– Subtotal Cash from Operations: $0, $0, $0, $0, $0, $0, $0, $0, $0, $23,199, $68,831, $95,263, $103,261

Additional Cash Received

– Sales Tax, VAT, HST/GST Received: 0.00%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– New Current Borrowing: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– New Other Liabilities (interest-free): $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– New Long-term Liabilities: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– Sales of Other Current Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– Sales of Long-term Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– New Investment Received: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– Subtotal Cash Received: $0, $0, $0, $0, $0, $0, $0, $0, $0, $23,199, $68,831, $95,263, $103,261

Expenditures

– Expenditures from Operations

– Cash Spending: $25,000, $25,000, $25,000, $31,000, $44,000, $44,000, $44,000, $48,333, $48,333, $48,333, $48,333, $48,333, $48,333

– Bill Payments: $0, $99,514, $135,295, $88,787, $163,311, $223,657, $181,621, $89,034, $62,911, $101,860, $117,792, $122,232

– Subtotal Spent on Operations: $25,000, $124,514, $160,295, $119,787, $207,311, $267,657, $225,621, $137,367, $111,244, $150,193, $166,125, $170,565

Additional Cash Spent

– Sales Tax, VAT, HST/GST Paid Out: $0, $0, $0, $0, $0, $0, $0, $0, $0,

Business Plan Outline

- Executive Summary

- Company Summary

- Products and Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!