Contents

Used Book Store Business Plan

Introduction

Flyleaf Books is a start-up used bookstore in the Cleveland, Ohio area. The company aims to acquire local market share in the used bookstore industry through low prices, a dominant product selection, a variety of services including a buyback/trade program and a hard-to-find book search, along with a relaxing, friendly environment that encourages browsing and reading.

Company

Flyleaf will be a limited liability corporation registered in Ohio. The company will be jointly owned by Mr. James Vinck, a former head librarian of the Philadelphia City Library, and his wife Aracela.

Mr. Vinck is establishing this firm to supplement his retirement, meet people with similar interests, and leave a viable business to his children. Flyleaf Books will establish its store in a busy section of Brecksville, an outlying suburb of Cleveland, well-known for upscale residents and high-quality establishments. Our facility is a former 8,000 square ft. furniture store, allowing us to stock a large inventory.

Products/Services

Flyleaf Books will offer a wide range of book, magazine, and music selections, including various categories such as fiction, non-fiction, business, science, children’s, hobbies, collecting, and other types of books. Our music selection will focus on CDs, taking up the least amount of floor space. We will also offer a competitive buy and trade service to lower inventory acquisition costs and make our store more attractive. Additionally, we provide a search and order service for customers seeking rare items. Flyleaf Books will have a relaxed “reading room” atmosphere with chairs and couches.

Market

Our market has declined in the past two years due to the weak economy. Bookstore industry sales rose only 3.6% last year while overall U.S. retail sales grew by 4.3%. However, management believes this may be advantageous for the used bookstore industry. Customers who still wish to purchase books may find used bookstores more attractive as they cut back on spending. Therefore, management sees this as an opportune time to enter the industry and gain market share.

The bookstore industry is undergoing consolidation, dominated by large chain stores like Barnes & Noble. However, independent booksellers can establish themselves in the used book segment, as it is difficult for large companies to replicate the "superstore" concept in a low-profit margin market. This favors local independent booksellers who can acquire a sufficiently large facility to house an attractive inventory and compete with national chains.

Financial Considerations

Our start-up expenses amount to $178,000, financed by private investors and SBA loans. We anticipate operating at a loss initially until advertising begins to draw in customers. We have arranged funding through lending institutions and private investors, and do not foresee any cash flow problems in the next three years.

1.1 Objectives

The goals for the next three years for Flyleaf Books are to:

- Achieve profitability by July Year 2.

- Earn approximately $200,000 in sales by Year 3.

- Pay owners a reasonable salary while running at a profit.

1.2 Keys to Success

Flyleaf Books must keep the following issues in mind in order to survive and expand:

- Attain high visibility through the media, billboards, and other advertising.

- Establish rigid cost control procedures and incentives to become the low-cost leader in used books.

- Keep maximum inventory available and achieve a high level of customer service to continually attract customers.

1.3 Mission

Flyleaf Book’s mission is to provide used quality literature at the lowest prices in the Cleveland, OH area. The company also aims to create a comfortable browsing environment for its clients. Flyleaf’s attraction to its customers will be its large selection of books, magazines, and used CDs, as well as its book acquisition and buyback options.

Company Summary

Flyleaf will be a limited liability corporation registered in Ohio. The company will be jointly owned by Mr. James Vinck, a former head librarian of the Philadelphia City Library, and his wife Aracela.

Flyleaf Books will establish its store in a busy section of Brecksville, an upscale suburban area of Cleveland. The store is located in a former 8,000 square ft. furniture store, allowing for ample inventory.

2.1 Company Ownership

Flyleaf will be a limited liability corporation registered in Ohio and jointly owned by Mr. James Vinck and his wife Aracela. Due to high start-up costs, the income and dividends to the principals will be limited for at least the first three years.

The company plans to be leveraged through private investment and a limited number of loans. Mr. Vinck is establishing this firm as a growth-oriented endeavor to supplement his retirement, continue meeting people with similar interests, and leave a viable business to his children. Flyleaf Books will be located at 14539 Greenhouse Ave NW in Brecksville, near the Twin Towers shopping mall.

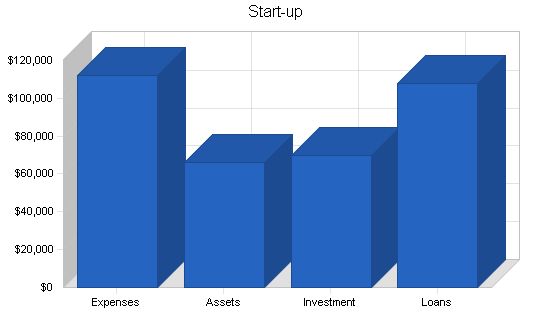

2.2 Start-up Summary

The start-up expenses amount to $178,000, which mainly include one-time fees associated with opening the store. These costs are financed by private investment and SBA guaranteed loans.

Start-up Requirements:

– Legal: $2,400

– Pre-sale advertising/marketing: $4,000

– Land location and finders fee: $20,000

– Insurance: $1,780

– Rent: $6,000

– Expensed Equipment: $25,000

– Initial store facilities: $50,000

– Other: $3,000

– Total Start-up Expenses: $112,180

Start-up Assets:

– Cash Required: $33,820

– Start-up Inventory: $16,000

– Other Current Assets: $8,000

– Long-term Assets: $8,000

– Total Assets: $65,820

Total Requirements: $178,000

Start-up Funding:

– Start-up Expenses to Fund: $112,180

– Start-up Assets to Fund: $65,820

– Total Funding Required: $178,000

Assets:

– Non-cash Assets from Start-up: $32,000

– Cash Requirements from Start-up: $33,820

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $33,820

– Total Assets: $65,820

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $15,000

– Long-term Liabilities: $75,000

– Accounts Payable (Outstanding Bills): $8,000

– Other Current Liabilities (interest-free): $10,000

– Total Liabilities: $108,000

– Capital:

– Planned Investment:

– Mr. James Vinck: $50,000

– Mrs. Aracela Vinck: $20,000

– Additional Investment Requirement: $0

– Total Planned Investment: $70,000

– Loss at Start-up (Start-up Expenses): ($112,180)

– Total Capital: ($42,180)

Total Capital and Liabilities: $65,820

Total Funding: $178,000

Products:

Flyleaf Books will offer a wide range of book, magazine, and music selections, including fiction, non-fiction, business, science, children’s, hobbies, collecting, and other types of books. Our music selection will focus on CDs and we will also offer a buy and trade service, a search and order service for hard-to-find items, and a comfortable reading room atmosphere. Our store hours will be 8:30 a.m. to 8:00 p.m. Monday-Friday and 10:00 a.m. to 6:00 p.m. Saturday, with the possibility of extending hours in the future.

Market Analysis Summary:

Our market has experienced a decline in growth over the past two years due to the weak economy. However, this presents an opportunity for used bookstores, as customers still interested in purchasing books are attracted to lower prices. Our main competitors are Barnes & Noble, Borders, and other local new and used bookstores.

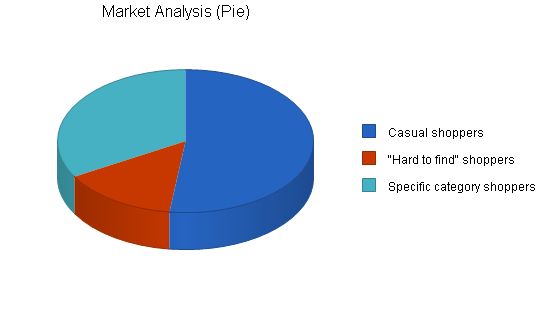

Market Segmentation:

Our target market consists of customers within a ten to fifteen mile radius, with a population of approximately 150,000. The majority of residents are Caucasian (78.8%), Black (13.6%), and Hispanic (9%), with a range of occupations and household incomes from $50,000-$100,000. The typical "head of household" age is 25-34 or 34-44, with a median age of 44.4 years old and an average age of 32 years old.

The customers we serve can be categorized as follows:

– Casual Shoppers: These customers browse the store without a specific purchase in mind, often making impulse buys or leaving empty-handed. They are attracted to low prices and large inventory.

– "Hard to Find" Shoppers: These customers seek specific, difficult-to-obtain items, such as out-of-print books. They are price insensitive and also prefer stores with a wide selection.

– Specific Category Shoppers: These customers primarily buy books or music from a specific category, such as fiction or romance. They have a clear idea of what they want to purchase and often have a higher spending potential.

Overall, Flyleaf Books can thrive in an upscale environment like Brecksville, even in a weak economy, by catering to these different customer segments.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| 78,000 | 79,560 | 81,151 | 82,774 | 84,429 | |||

| 22,000 | 22,440 | 22,889 | 23,347 | 23,814 | |||

| 50,000 | 51,000 | 52,020 | 53,060 | 54,121 | |||

| 150,000 | 153,000 | 156,060 | 159,181 | 162,364 | |||

The market has seen a decline in growth due to a weak economy. Bookstore industry sales rose only 3.6% in 2002, while overall U.S. retail sales grew by 4.3%. However, the used bookstore industry has historically performed better during economic downturns. As customers reduce their purchases, used bookstores become more attractive. This presents an opportunity to gain market share in the industry. Although initially growth may be high, overall volume sales are expected to taper off to industry norms as the weak economy continues.

The bookstore industry is undergoing consolidation, with larger players like Barnes & Noble dominating the market. However, independent booksellers can still thrive in the used books segment. Local independent booksellers have an advantage in this segment, as long as they can offer a large inventory and compete with national chains.

4.2.1 Competition and Buying Patterns

Our main competitors are Barnes & Noble, Borders, and other local bookstores. Greenbaum Books is our closest rival, holding 9% of the local market share.

We will not directly compete with the Barnes & Noble/Borders superstores. Instead, we will focus on providing a different need for our customers with lower prices and a larger selection.

Strategy and Implementation Summary

Flyleaf’s competitive edge will be our lower prices and dominant selection. We will utilize marketing and advertising strategies such as prominent signs, billboards, media bites, and radio advertisements to capture customers. Sales are projected to increase by an average of 4.5% in the first three years, with higher growth of 10%-15% in the following five years and then tapering off to the industry average of 2.5%.

5.1 Competitive Edge

Our competitive edge will be our lower prices and larger selection. We plan to create these advantages in a new, comforting environment that will retain customers.

Marketing and advertising will be critical to our success. We will use prominent signs, billboards, media bites, and radio advertisements to capture customers.

5.3 Sales Strategy

Our attractive storefront, low prices, and excellent selection will be our primary selling points. We will focus on providing top customer service, maintaining sufficient inventory, and utilizing industry data on bookstore inventory.

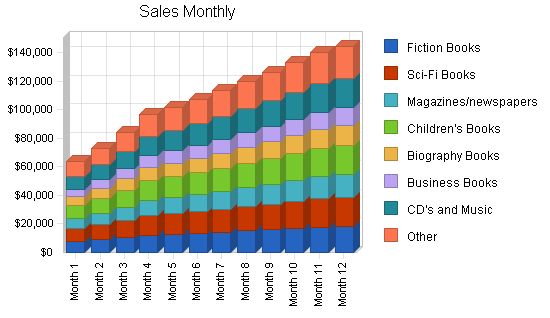

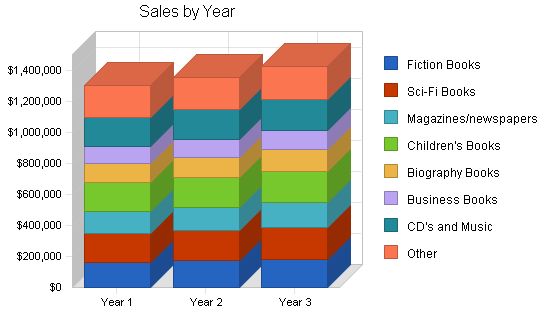

5.3.1 Sales Forecast

Based on a 10% mark-up, our sales are projected to increase by an average of 4.5% annually.

These sales figures are based on commuter and walk-by traffic, with an average $3.00 purchase amount. We aim for an average net profit and will establish a debt retirement fund for early repayment and cash basis for purchases to avoid liabilities.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Fiction Books | $164,292 | $172,507 | $182,512 |

| Sci-Fi Books | $184,829 | $194,070 | $205,327 |

| Magazines/newspapers | $143,756 | $150,944 | $159,698 |

| Children’s Books | $184,829 | $194,070 | $205,327 |

| Biography Books | $123,219 | $129,380 | $136,884 |

| Business Books | $112,951 | $118,599 | $125,477 |

| CD’s and Music | $184,829 | $188,526 | $199,460 |

| Other | $205,366 | $209,473 | $214,081 |

| Total Sales | $1,304,071 | $1,357,569 | $1,428,767 |

Management Summary

Flyleaf Books will be an LLC company owned by Mr. James Vinck and his wife, Aracela. Mrs. Vinck will assist Mr. Vinck and act as the company’s bookkeeper. Their son, Todd, will work as a part-time manager and plans to eventually take over the company. The company will hire additional part-time salespeople as needed.

Mr. James Vinck is a graduate of Dartmouth University with a degree in library science. He has over twenty years of experience with the Philadelphia city library system, where he became the head librarian in 1995. He has established excellent contacts in the book acquisition industry and plans to leverage these contacts in his new business.

6.1 Personnel Plan

Initially, the company will have a small staff, including upper management and sales personnel. The staff and hours will expand once the company begins to make a profit.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Mr. James Vinck | $42,000 | $48,000 | $48,000 |

| Mr. Todd Vinck | $18,000 | $25,000 | $30,000 |

| Salesperson | $10,200 | $11,000 | $11,000 |

| Salesperson | $10,200 | $11,000 | $11,000 |

| Salesperson | $10,200 | $10,200 | $10,200 |

| Salesperson | $10,200 | $10,200 | $10,200 |

| Salesperson | $10,200 | $10,200 | $10,200 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $111,000 | $125,600 | $130,600 |

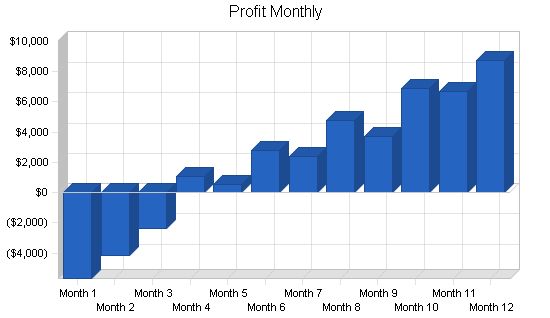

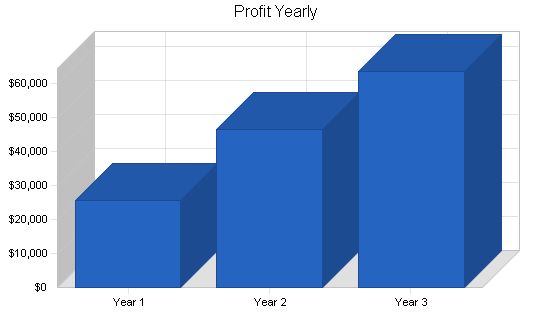

Financial Plan

The following is our financial projection for the next three years. We expect to operate at a loss for the first few months before advertising takes effect and attracts customers.

7.1 Important Assumptions

The company assumes a stable growth market with average interest rates from the past ten years.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

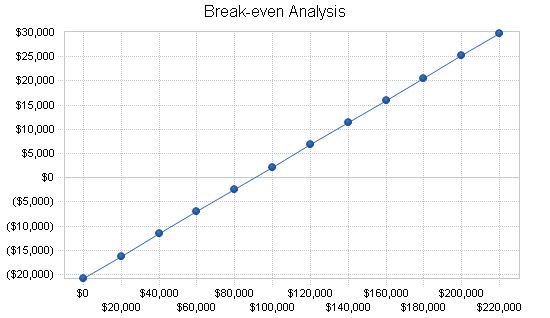

7.2 Break-even Analysis

The following table and chart display our Break-even Analysis. We have intentionally set average costs slightly low to be conservative and determine the maximum amount of inventory we need to move per month.

"Break-even Analysis"

Monthly Revenue Break-even: $90,541

Assumptions:

– Average Percent Variable Cost: 77%

– Estimated Monthly Fixed Cost: $20,824

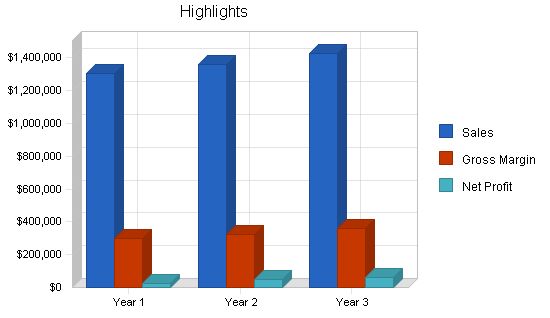

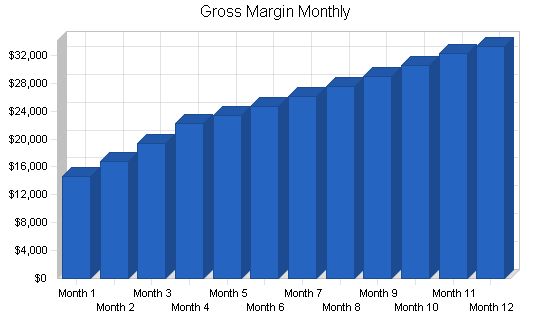

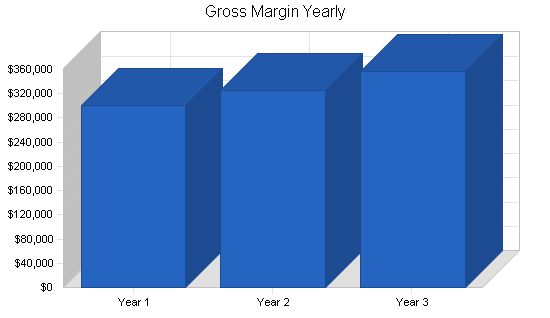

Projected Profit and Loss

The table below outlines itemized costs, gross margin, and net margin. Please note that these predictions prioritize higher costs in relation to revenues to account for unexpected hidden costs.

Pro Forma Profit and Loss:

Sales:

Year 1 – $1,304,071

Year 2 – $1,357,569

Year 3 – $1,428,767

Direct Cost of Sales:

Year 1 – $1,004,135

Year 2 – $1,031,752

Year 3 – $1,071,575

Other Costs of Goods:

Year 1 – $0

Year 2 – $0

Year 3 – $0

Total Cost of Sales:

Year 1 – $1,004,135

Year 2 – $1,031,752

Year 3 – $1,071,575

Gross Margin:

Year 1 – $299,936

Year 2 – $325,817

Year 3 – $357,192

Gross Margin %:

Year 1 – 23.00%

Year 2 – 24.00%

Year 3 – 25.00%

Expenses:

Payroll:

Year 1 – $111,000

Year 2 – $125,600

Year 3 – $130,600

Sales and Marketing and Other Expenses:

Year 1 – $36,000

Year 2 – $15,000

Year 3 – $15,000

Depreciation:

Year 1 – $0

Year 2 – $0

Year 3 – $0

Leased equipment:

Year 1 – $0

Year 2 – $0

Year 3 – $0

Rent:

Year 1 – $60,000

Year 2 – $65,000

Year 3 – $68,000

Utilities:

Year 1 – $3,600

Year 2 – $4,000

Year 3 – $4,000

Insurance:

Year 1 – $7,200

Year 2 – $7,200

Year 3 – $7,500

Payroll Taxes:

Year 1 – $17,093

Year 2 – $18,840

Year 3 – $19,590

Other:

Year 1 – $15,000

Year 2 – $10,000

Year 3 – $10,000

Total Operating Expenses:

Year 1 – $249,893

Year 2 – $245,640

Year 3 – $254,690

Profit Before Interest and Taxes:

Year 1 – $50,044

Year 2 – $80,177

Year 3 – $102,502

EBITDA:

Year 1 – $50,044

Year 2 – $80,177

Year 3 – $102,502

Interest Expense:

Year 1 – $13,750

Year 2 – $13,900

Year 3 – $12,050

Taxes Incurred:

Year 1 – $10,888

Year 2 – $19,883

Year 3 – $27,136

Net Profit:

Year 1 – $25,406

Year 2 – $46,394

Year 3 – $63,316

Net Profit/Sales:

Year 1 – 1.95%

Year 2 – 3.42%

Year 3 – 4.43%

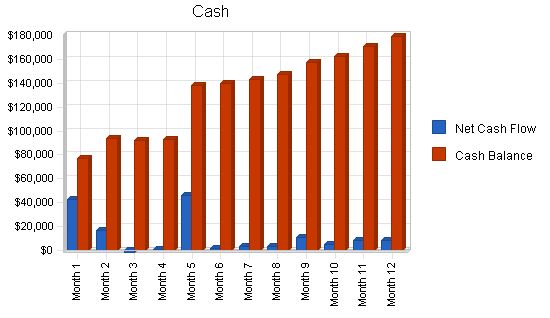

Projected Cash Flow:

Our company will receive periodic cash influxes to cover operating expenses during the first two years, aiming for sustainable profitability. This funding has been arranged through lending institutions and private investors. No cash flow issues are expected for the next three years.

Pro Forma Cash Flow:

Year 1 Year 2 Year 3

Cash Received:

Cash from Operations

Cash Sales $1,304,071 $1,357,569 $1,428,767

Subtotal Cash from Operations $1,304,071 $1,357,569 $1,428,767

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $5,000 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $50,000 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $54,000 $0 $0

Subtotal Cash Received $1,413,071 $1,357,569 $1,428,767

Expenditures:

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $111,000 $125,600 $130,600

Bill Payments $1,156,323 $1,217,129 $1,235,539

Subtotal Spent on Operations $1,267,323 $1,342,729 $1,366,139

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $7,000 $15,000

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $5,000 $10,000

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $1,267,323 $1,354,729 $1,391,139

Net Cash Flow $145,748 $2,840 $37,628

Cash Balance $179,568 $182,408 $220,036

Pro Forma Balance Sheet:

Year 1 Year 2 Year 3

Assets:

Current Assets

Cash $179,568 $182,408 $220,036

Inventory $122,562 $125,933 $130,793

Other Current Assets $8,000 $8,000 $8,000

Total Current Assets $310,130 $316,341 $358,830

Long-term Assets

Long-term Assets $8,000 $8,000 $8,000

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $8,000 $8,000 $8,000

Total Assets $318,130 $324,341 $366,830

Liabilities and Capital:

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $125,904 $97,722 $101,894

Current Borrowing $20,000 $13,000 ($2,000)

Other Current Liabilities $10,000 $10,000 $10,000

Subtotal Current Liabilities $155,904 $120,722 $109,894

Long-term Liabilities $125,000 $120,000 $110,000

Total Liabilities $280,904 $240,722 $219,894

Paid-in Capital $124,000 $124,000 $124,000

Retained Earnings ($112,180) ($86,774) ($40,381)

Earnings $25,406 $46,394 $63,316

Total Capital $37,226 $83,619 $146,935

Total Liabilities and Capital $318,130 $324,341 $366,830

Sales Growth:

Year 1: 0.00%

Year 2: 4.10%

Year 3: 5.24%

Industry Profile: 2.27%

Percent of Total Assets:

Inventory: 38.53%

Other Current Assets: 2.51%

Total Current Assets: 97.49%

Long-term Assets: 2.51%

Total Assets: 100.00%

Current Liabilities:

Accounts Payable: 49.01%

Long-term Liabilities: 39.29%

Total Liabilities: 88.30%

Net Worth: 11.70%

Percent of Sales:

Gross Margin: 23.00%

Selling, General & Administrative Expenses: 21.05%

Advertising Expenses: 0.00%

Profit Before Interest and Taxes: 3.84%

Main Ratios:

Current: 1.99

Quick: 1.20

Total Debt to Total Assets: 88.30%

Pre-tax Return on Net Worth: 97.50%

Pre-tax Return on Assets: 11.41%

Additional Ratios:

Net Profit Margin:

Year 1: 1.95%

Year 2: 3.42%

Year 3: 4.43%

Return on Equity:

Year 1: 68.25%

Year 2: 55.48%

Year 3: 43.09%

Activity Ratios:

Inventory Turnover:

Year 1: 10.91

Year 2: 8.30

Year 3: 8.35

Accounts Payable Turnover:

Year 1: 10.12

Year 2: 12.17

Year 3: 12.17

Payment Days:

Year 1: 27

Year 2: 34

Year 3: 29

Total Asset Turnover:

Year 1: 4.10

Year 2: 4.19

Year 3: 3.89

Debt Ratios:

Debt to Net Worth:

Year 1: 7.55

Year 2: 2.88

Year 3: 1.50

Current Liab. to Liab.: 0.56

Liquidity Ratios:

Net Working Capital:

Year 1: $154,226

Year 2: $195,619

Year 3: $248,935

Interest Coverage:

Year 1: 3.64

Year 2: 5.77

Year 3: 8.51

Additional Ratios:

Assets to Sales:

Year 1: 0.24

Year 2: 0.24

Year 3: 0.26

Current Debt/Total Assets:

Year 1: 49%

Year 2: 37%

Year 3: 30%

Acid Test: 1.20

Sales/Net Worth:

Year 1: 35.03

Year 2: 16.24

Year 3: 9.72

Dividend Payout: 0.00

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Fiction Books 0% $8,000 $9,200 $10,580 $12,167 $12,836 $13,542 $14,287 $15,073 $15,902 $16,776 $17,699 $18,230

Sci-Fi Books 0% $9,000 $10,350 $11,903 $13,688 $14,441 $15,235 $16,073 $16,957 $17,890 $18,873 $19,911 $20,509

Magazines/newspapers 0% $7,000 $8,050 $9,258 $10,646 $11,232 $11,849 $12,501 $13,189 $13,914 $14,679 $15,487 $15,951

Children’s Books 0% $9,000 $10,350 $11,903 $13,688 $14,441 $15,235 $16,073 $16,957 $17,890 $18,873 $19,911 $20,509

Biography Books 0% $6,000 $6,900 $7,935 $9,125 $9,627 $10,157 $10,715 $11,305 $11,926 $12,582 $13,274 $13,673

Business Books 0% $5,500 $6,325 $7,274 $8,365 $8,825 $9,310 $9,822 $10,363 $10,932 $11,534 $12,168 $12,533

CD’s and Music 0% $9,000 $10,350 $11,903 $13,688 $14,441 $15,235 $16,073 $16,957 $17,890 $18,873 $19,911 $20,509

Other 0% $10,000 $11,500 $13,225 $15,209 $16,045 $16,928 $17,859 $18,841 $19,877 $20,970 $22,124 $22,788

Total Sales $63,500 $73,025 $83,979 $96,576 $101,887 $107,491 $113,403 $119,640 $126,220 $133,163 $140,486 $144,701

Personnel Plan

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Mr. James Vinck 0% $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500

Mr. Todd Vinck 0% $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500

Salesperson 0% $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850

Salesperson 0% $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850

Salesperson 0% $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850

Salesperson 0% $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850

Salesperson 0% $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850 $850

Total People 7 5 5 5 5 5 5 5 5 5 5 5

Total Payroll $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250

General Assumptions

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales $63,500 $73,025 $83,979 $96,576 $101,887 $107,491 $113,403 $119,640 $126,220 $133,163 $140,486 $144,701

Direct Cost of Sales $48,895 $56,229 $64,664 $74,363 $78,453 $82,768 $87,320 $92,123 $97,190 $102,535 $108,175 $111,420

Other Costs of Goods $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $48,895 $56,229 $64,664 $74,363 $78,453 $82,768 $87,320 $92,123 $97,190 $102,535 $108,175 $111,420

Gross Margin $14,605 $16,796 $19,315 $22,212 $23,434 $24,723 $26,083 $27,517 $29,031 $30,627 $32,312 $33,281

Gross Margin % 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00%

Expenses 0 0 0 0 0 0 0 0 0 0 0 0 0

Payroll $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250 $9,250

Sales and Marketing and Other Expenses $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Depreciation $0 $0 $

Pro Forma Cash Flow

Cash Received

Cash from Operations

Cash Sales

Subtotal Cash from Operations

Additional Cash Received

Sales Tax, VAT, HST/GST Received

New Current Borrowing

New Other Liabilities (interest-free)

New Long-term Liabilities

Sales of Other Current Assets

Sales of Long-term Assets

New Investment Received

Subtotal Cash Received

Expenditures

Expenditures from Operations

Cash Spending

Bill Payments

Subtotal Spent on Operations

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out

Principal Repayment of Current Borrowing

Other Liabilities Principal Repayment

Long-term Liabilities Principal Repayment

Purchase Other Current Assets

Purchase Long-term Assets

Dividends

Subtotal Cash Spent

Net Cash Flow

Cash Balance: $76,813, $93,590, $91,994, $92,589, $138,297, $139,794, $143,552, $147,010, $157,812, $162,746, $170,844, $179,568.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!