Microbrewery Business Plan

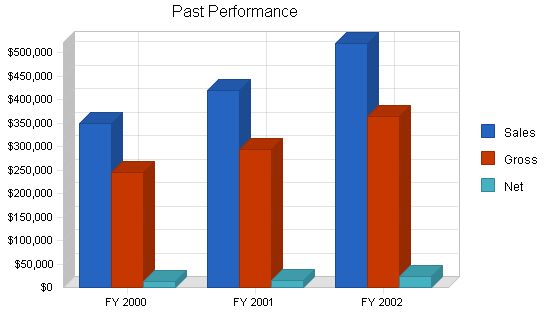

Martin Cove Brewing Company, a successful microbrewery in southern Oregon for the past three years, located in Medford, has increased sales by 15% annually. The company offers Martin Cove Pilsner and Red Ale. This year, Martin Cove Brewing Company will gross $520,000 in sales, an outcome of their initial investment of $150,000.

Martin Cove Brewing Company handcrafts its beers in small 20 barrel batches under the close personal attention of our brewers. They combine the latest brewing equipment and technologies with traditional brewing methods to ensure consistently excellent taste, whether packaged in bottles or draft kegs.

Martin Cove Brewing Company plans to expand its distribution to selected metro areas within the state of Oregon. Having become one of the city’s most popular microbreweries over the last three years, Martin Cove Brewing Company aims to repeat this success in Oregon as a whole. Furthermore, the company will introduce a new product, a traditional German Marzen style lager. Owner funding and internally generated cash flow will enable this expansion. Sales projections for the next three years are based on the current sales success with the target customer base in southern Oregon. The effective implementation of this plan will result in sales revenues growing to $1.2 million by Year 3.

Martin Cove Brewing Company will apply the same sales strategy that built their success in Medford: remove all obstacles between you and the customer. Once the customer tastes the product, they will know the quality and craftsmanship that goes into every bottle of Martin Cove.

Martin Cove Microbrews will be available in bars and retail outlets, such as local markets and corner stores. They also aim to distribute through supermarkets, although securing shelf space in national supermarkets may prove challenging and costly.

Contents

1.1 Objectives

The objectives of Martin Cove Brewing Company are to:

- Establish strong relationships with local beer distributors in selected sales areas.

- Maintain tight control of cost and operation during expansion.

- Maintain the high-quality product that the company has become known for.

Company Summary

Martin Cove Brewing Company has built a reputation for handcrafted care, time-honored methodology, and the finest natural ingredients.

Martin Cove Brewing Company is a successful microbrewery in southern Oregon, increasing sales by 15% each year. Located in Medford, the company’s product lines include Martin Cove Pilsner and Red Ale.

Martin Cove Brewing Company handcrafts its beers in small 20 barrel batches under personal attention. The latest brewing equipment and technologies are combined with traditional brewing methods to ensure consistently excellent taste, whether packaged in bottles or draft kegs.

Martin Cove Brewing Company plans to expand distribution to selected metro areas within Oregon. Owner funding and internally generated cash flow will enable the expansion plan. The company will also introduce a new product, a traditional German Marzen style lager.

2.1 Company History

Martin Cove Brewing Company started in Medford in 1996. John Wilson had bartended at two local establishments in Medford for ten years before starting the company. Brewmasters Bob Taft and Jeffery Calson had worked for Portland Brewery Company for six and eight years, respectively, before joining Martin Cove Brewing Company. Felix Henderson had twelve years of experience in retail sales and marketing when he joined as co-owner/marketing director.

Martin Cove Brewing Company handcrafts its beer in small 20 barrel batches. The latest brewing equipment and technologies are combined with traditional methods to ensure consistently excellent taste, whether packaged in bottles or draft kegs.

The beers proved to be popular, and Martin Cove Brewing Company soon could be found in almost every market and pub in Medford. Over the next three years, it became one of the city’s most popular microbreweries.

Martin Cove Brewing Company’s operations have expanded dramatically over the past three years, currently employing eleven staff members in production, delivery, and sales.

Martin Cove Brewing is owned by John Wilson, Bob Taft, Jeffery Calson, and Felix Henderson.

Martin Cove Brewing Company has three beer product lines:

– Roaring River Red: an Irish style ale with roasted specialty malts for a deep, ruby-colored hue.

– Martin Cove Pilsner: a light, crisp, and crystal clear beer with a pure white foamy head. It’s made with a blend of domestic and imported malts, hops, and bottom-fermented lager yeast.

– Martin Cove Lager: a malty and full-bodied beer brewed in the traditional German Marzen style. It combines imported German hops, a special European yeast strain, and two-row malted barley from the Pacific Northwest for a unique character and warm, light amber color.

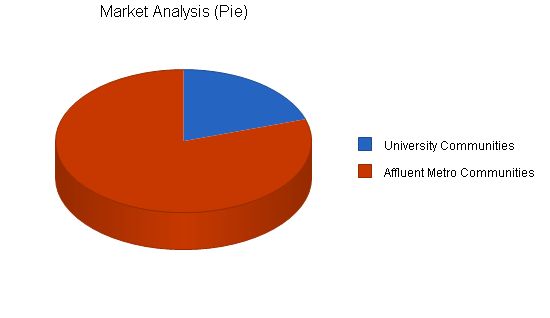

Over the past ten years, regional microbreweries in Oregon have gained market share of beer sales. Some regional brands have successfully transitioned from specialty markets to supermarkets. Currently, regional microbrews account for 10% of beer sales in Oregon, representing a 35% increase since 2000. This growth has primarily occurred in affluent communities and has been driven by the state’s population growth, particularly in response to the high-tech industry’s hiring boom. Young professionals in their late twenties and early thirties have traditionally been the main consumers of microbrews. Additionally, the increased enrollment in colleges and universities across the state has contributed to the rise in microbrew sales, with microbrews representing 35% of beer sales in campus communities.

Martin Cove Brewing Company plans to target the following market segments:

– Customers in university campus communities.

– Professional men and women aged 25-35 living in affluent metro communities.

Marketing and promotional activities will focus on grassroots efforts rather than expensive mass marketing. Martin Cove will connect with these target consumers through sponsoring local entertainment and cultural events, advertising in niche magazines catering to young professionals, and sponsoring activity groups.

2002 2003 2004 2005 2006 CAGR

Potential Customers

University Communities 100,000 115,000 132,250 152,088 174,901 15.00%

Affluent Metro Communities 400,000 440,000 484,000 532,400 585,640 10.00%

Total 500,000 555,000 616,250 684,488 760,541 11.06%

Strategy and Implementation Summary:

The first step in the expansion plan is introducing the Martin Cove Brewing Company product line into selected areas. New sales representatives will be assigned to the Portland tri-county area and the lower Willamette Valley area (Corvallis and Eugene). The retail marketing focus will be on specialty stores carrying regional microbrews. Martin Cove Brewing Company will promote sales by reducing wholesale prices by 12% for the first three months.

Martin Cove Brewing Company products will be distributed in the Portland tri-county area by Cascade Distribution. In the lower Willamette Valley area, McKenzie Distribution will carry Martin Cove Brewing Company products.

Martin Cove Brewing Company’s new product, a traditional German Marzen style lager, is unique in taste and processing and attractive to any business serving beers to customers. The advantage is that the lager has no competitors. Martin Cove Brewing Company will promote sales by reducing wholesale prices by 12% for the first three months.

5.1 Sales Strategy:

Martin Cove Brewing Company will apply the same sales strategy that built sales in Medford: remove all obstacles between you and the customer. Once the customer tastes the product, they will know the quality and craftsmanship that goes into every bottle of Martin Cove.

Martin Cove Microbrews will be available in bars and retail outlets, such as local markets and corner stores. It will also aim to distribute through supermarkets, but getting shelf space in national supermarkets will be more difficult and expensive.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

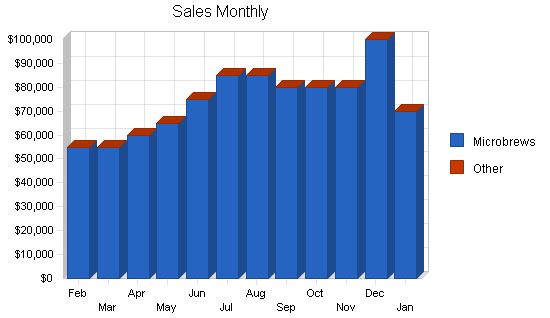

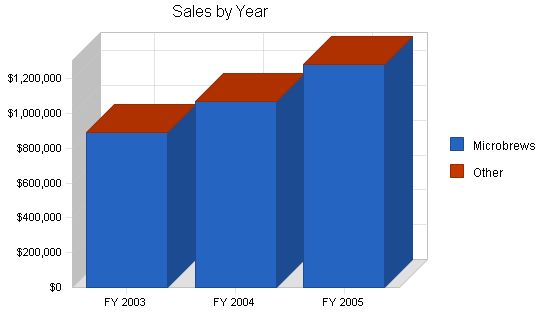

5.1.1 Sales Forecast:

The following is the sales forecast for the next three years.

Sales Forecast

| Sales Forecast | |||

| FY 2003 | FY 2004 | FY 2005 | |

| Sales | |||

| Microbrews | $890,000 | $1,068,000 | $1,281,600 |

| Other | $0 | $0 | $0 |

| Total Sales | $890,000 | $1,068,000 | $1,281,600 |

| Direct Cost of Sales | FY 2003 | FY 2004 | FY 2005 |

| Microbrews | $267,000 | $320,400 | $384,480 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $267,000 | $320,400 | $384,480 |

Competitive Edge

5.2 Competitive Edge

Martin Cove Brewing Company’s competitive edge is:

- Quality Process and Ingredients: Our beers are of the highest quality and made with the finest natural ingredients. The beers are classically fermented and cold lagered for a smooth, bold taste. We use North American two row barley malt along with imported Belgian specialty malts, widely considered the finest malts in the world. Our ales feature hops from the Pacific Northwest, while our Martin Cove Lagers have their distinctive taste from imported German hops.

- Handcrafted: Our beers are stored in small 20 barrel batches, carefully attended to by our brewers. We combine the latest brewing equipment and technologies with traditional brewing methods to consistently achieve excellent taste, whether in bottles or draft kegs.

Management Summary

Management Summary

The management summary for Martin Cove Brewing Company is:

- John Wilson: Bottling and shipping manager.

- Brewmasters Bob Taft and Jeffery Calson: Managers of the brewing process.

- Felix Henderson: Marketing and sales manager.

Personnel Plan

6.1 Personnel Plan

Martin Cove Brewing Company’s personnel plan includes:

- Bottling and shipping manager

- Brewing managers (2)

- Marketing/sales manager

- Bottling staff (4)

- Shipping staff (3)

| Personnel Plan | |||

| FY 2003 | FY 2004 | FY 2005 | |

| Bottling and Shipping Mgr | $48,000 | $50,000 | $52,000 |

| Brewing Mgrs (2) | $96,000 | $100,000 | $104,000 |

| Marketing and Sales Mgr | $48,000 | $50,000 | $52,000 |

| Bottling Staff | $108,000 | $112,000 | $116,000 |

| Shipping Staff | $72,000 | $75,000 | $78,000 |

| Total People | 11 | 11 | 11 |

| Total Payroll | $372,000 | $387,000 | $402,000 |

Financial Plan

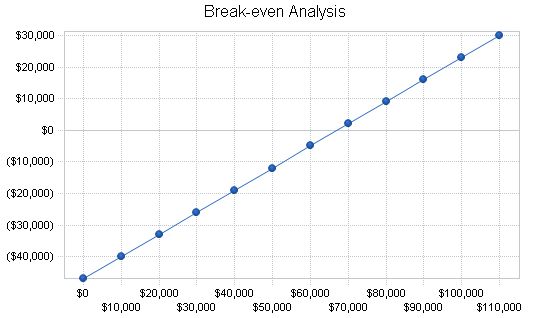

7.1 Break-even Analysis

The monthly break-even point is $67,036.

Monthly Revenue Break-even: $67,036.

Assumptions:

Average Percent Variable Cost: 30%.

Estimated Monthly Fixed Cost: $46,925.

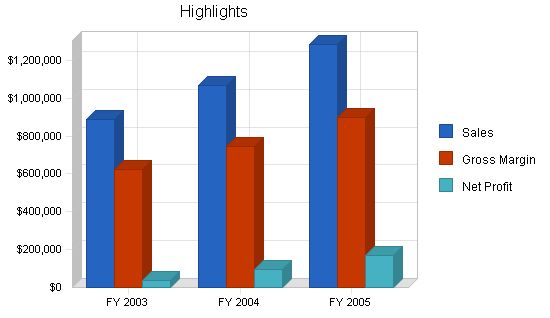

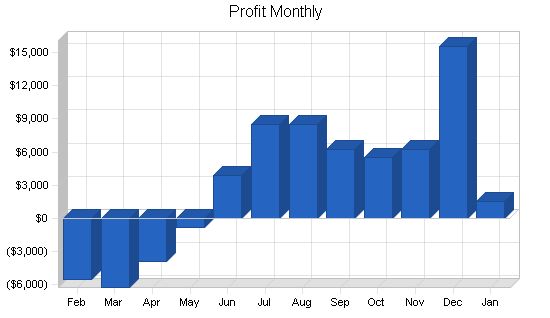

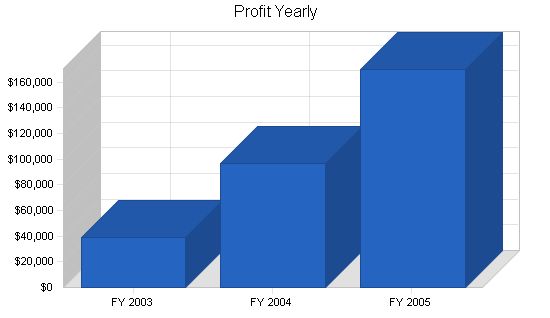

7.2 Projected Profit and Loss:

The table and charts below show the projected profit and loss for the next three years.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| FY 2003 | FY 2004 | FY 2005 | |

| Sales | $890,000 | $1,068,000 | $1,281,600 |

| Direct Cost of Sales | $267,000 | $320,400 | $384,480 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $267,000 | $320,400 | $384,480 |

| Gross Margin | $623,000 | $747,600 | $897,120 |

| Gross Margin % | 70.00% | 70.00% | 70.00% |

| Expenses | |||

| Payroll | $372,000 | $387,000 | $402,000 |

| Sales and Marketing and Other Expenses | $63,000 | $83,000 | $105,000 |

| Depreciation | $14,400 | $14,400 | $14,400 |

| Sales Commission | $26,700 | $32,040 | $38,448 |

| Utilities | $12,000 | $12,000 | $12,000 |

| Insurance | $2,400 | $2,600 | $2,800 |

| Rent | $16,800 | $16,800 | $16,800 |

| Payroll Taxes | $55,800 | $58,050 | $60,300 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $563,100 | $605,890 | $651,748 |

| Profit Before Interest and Taxes | $59,900 | $141,710 | $245,372 |

| EBITDA | $74,300 | $156,110 | $259,772 |

| Interest Expense | $3,782 | $3,398 | $2,998 |

| Taxes Incurred | $16,835 | $41,494 | $72,712 |

| Net Profit | $39,282 | $96,818 | $169,662 |

| Net Profit/Sales | 4.41% | 9.07% | 13.24% |

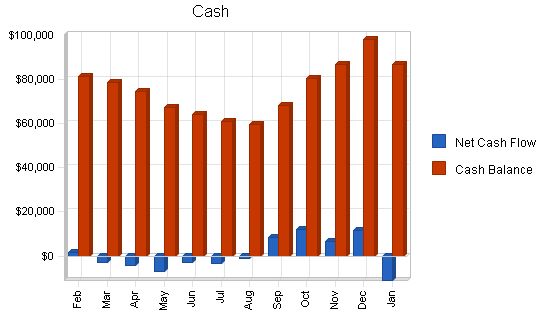

7.3 Projected Cash Flow

The following table and chart highlight the projected cash flow for the next three years.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| FY 2003 | FY 2004 | FY 2005 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $222,500 | $267,000 | $320,400 |

| Cash from Receivables | $622,500 | $776,000 | $931,200 |

| Subtotal Cash from Operations | $845,000 | $1,043,000 | $1,251,600 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $845,000 | $1,043,000 | $1,251,600 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $372,000 | $387,000 | $402,000 |

| Bill Payments | $461,903 | $552,706 | $690,670 |

| Subtotal Spent on Operations | $833,903 | $939,706 | $1,092,670 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $4,020 | $4,000 | $4,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $837,923 | $943,706 | $1,096,670 |

| Net Cash Flow | $7,077 | $99,294 | $154,930 |

| Cash Balance | $87,077 | $186,372 | $341,302 |

7.4 Projected Balance Sheet:

The following table highlights the projected balance sheet for the next three years.

| Pro Forma Balance Sheet | |||

| FY 2003 | FY 2004 | FY 2005 | |

| Assets | |||

| Current Assets | |||

| Cash | $87,077 | $186,372 | $341,302 |

| Accounts Receivable | $125,000 | $150,000 | $180,000 |

| Inventory | $23,100 | $27,720 | $33,264 |

| Other Current Assets | $5,000 | $5,000 | $5,000 |

| Total Current Assets | $240,177 | $369,092 | $559,566 |

| Long-term Assets | |||

| Long-term Assets | $100,000 | $100,000 | $100,000 |

| Accumulated Depreciation | $26,400 | $40,800 | $55,200 |

| Total Long-term Assets | $73,600 | $59,200 | $44,800 |

| Total Assets | $313,777 | $428,292 | $604,366 |

7.5 Business Ratios:

Industry profile ratios based on the Standard Industrial Classification(SIC) code 5181, Beer and Ale, are shown for comparison.

| Ratio Analysis | ||||

| FY 2003 | FY 2004 | FY 2005 | Industry Profile | |

| Sales Growth | 71.15% | 20.00% | 20.00% | 6.20% |

| Percent of Total Assets | ||||

| Accounts Receivable | 39.84% | 35.02% | 29.78% | 19.00% |

| Inventory | 7.36% | 6.47% | 5.50% | 28.70% |

| Other Current Assets | 1.59% | 1.17% | 0.83% | 31.50% |

| Total Current Assets | 76.54% | 86.18% | 92.59% | 79.20% |

| Long-term Assets | 23.46% | 13.82% | 7.41% | 20.80% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 25.515 | 47,211 | $57,623 | |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | 25,515 | 47,211 | $57,623 | |

| Long-term Liabilities | $35,980 | $31,980 | $27,980 | |

| Total Liabilities | $61,495 | $79,191 | $85,603 | |

| Paid-in Capital | $80,000 | $80,000 | $80,000 | |

| Retained Earnings | $133,000 | $172,282 | $269,101 | |

| Earnings | $39,282 | $96,818 | $169,662 | |

| Total Capital | $252,282 | $349,101 | $518,763 | |

| Total Liabilities and Capital | $313,777 | $428,292 | $604,366 | |

| Net Worth | $252,282 | $349,101 | $518,763 |

Appendix:

| Sales Forecast | |||||||||||||

| Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | ||

| Sales | |||||||||||||

| Microbrews | 0% | $55,000 | $55,000 | $60,000 | $65,000 | $75,000 | $85,000 | $85,000 | $80,000 | $80,000 | $80,000 | $100,000 | $70,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $55,000 | $55,000 | $60,000 | $65,000 | $75,000 | $85,000 | $85,000 | $80,000 | $80,000 | $80,000 | $100,000 | $70,000 |

| Personnel Plan | |||||||||||||

| Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | ||

| Bottling and Shipping Mgr | 0% | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 |

| Brewing Mgrs (2) | 0% | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!