Writing a Real Estate Investment Business Plan + Free Sample Plan PDF

After experiencing recent inflation and with projected falling interest rates in 2024, real estate investors are feeling optimistic.

New apartment construction is increasing, offering long-term opportunities for investors.

However, investing in real estate requires market trend awareness and upfront resources. Investors must understand financing strategies and property management to boost their value before reselling.

A business plan reduces the risk of making a bad investment. It helps organize market research, align investment strategies with opportunities, and update as conditions evolve.

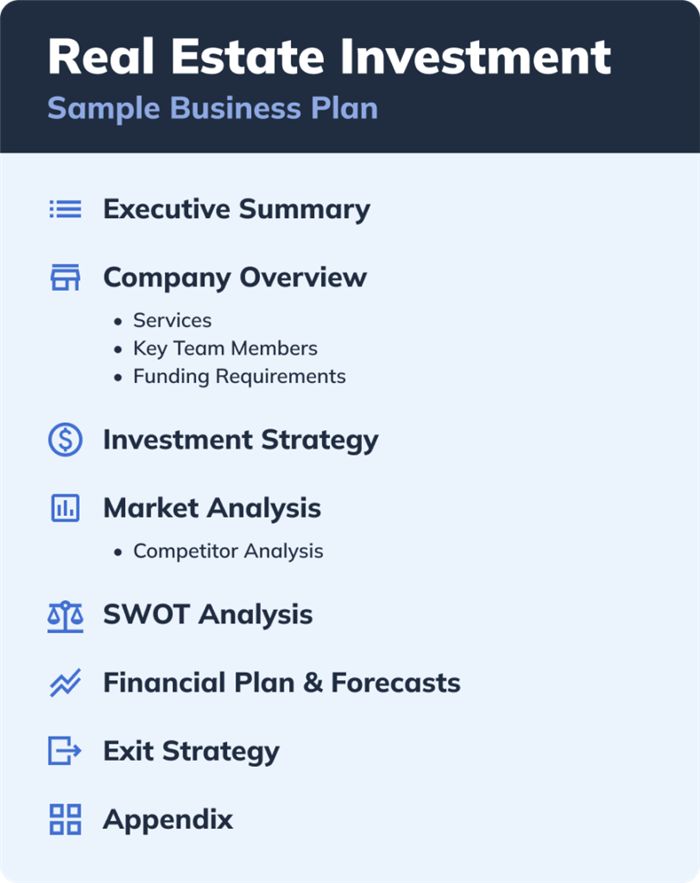

What to include in a real estate investment business plan?

Consider including these sections in your plan:

- Executive summary

- Company overview

- Investment strategy

- Market analysis

- SWOT analysis

- Financial plan and forecasts

- Exit strategy

- Appendix

The length and depth of your business plan will vary based on your specific business. A real estate investment firm with a national portfolio will have more complex financial projections and supporting documents compared to an investor with single-family houses in a few markets.

Here’s an outline of a real estate investment business plan.

The 8 elements of an effective real estate investment business plan

1. Executive summary

Business plans start with an executive summary outlining the business opportunity and core strategies. Highlight unique value or a competitive edge, like a track record of generating positive returns or knowledge of a specific market. Give a high-level overview of financial projections, funding request, and use of funds.

2. Company overview

Describe your company’s operational and legal structure. Mention partners, team expertise, roles, and portfolio, such as residential properties, commercial buildings, or new development projects.

3. Investment strategy

Describe your strategy for real estate investment and why it will generate high returns. Explain criteria for choosing properties, geographic focus, and property type preferences.

4. Market analysis

Conduct thorough market research to understand the operating landscape. Analyze target market demographics, real estate prices, trends, competition, and investment activity.

5. SWOT analysis

Evaluate internal strengths, weaknesses, external opportunities, and threats to your company’s environment and financial health.

6. Financial plan and forecasts

Present detailed financial projections, including income statements, cash flow forecasts, and balance sheets for the next 3-5 years. List assumptions and include a break-even analysis.

7. Exit strategy

Outline your plan for maximizing profits and realizing returns. Consider strategies like refinancing and tax-deferral opportunities.

8. Appendix

Include additional supporting documents that don’t fit in the main sections, such as market research data, financial tables, legal documents, or permit records.

Key considerations for writing a real estate investment business plan

1. Develop a niche

Focus on a specific investment strategy or property type to establish a strong foothold before diversifying.

2. Understand your risks

Analyze market dynamics, regulatory changes, economic fluctuations, and location-specific risks to mitigate potential impacts on investments.

3. Network and develop market knowledge

Build relationships with real estate professionals and stay informed about the regional economy and tax climate to validate your investment strategy.

4. Consider help with your financials

Engage a CPA for accounting support, especially in unfamiliar markets, to navigate tax issues and ensure accurate financial forecasts.

Download your free real estate investment one-page sample business plan

Download your free real estate investment sample business plan now or explore the gallery for other industry plans. Check out our library of real estate business plans for more inspiration.

A well-crafted business plan demonstrates credibility to funders, increases growth opportunities, and provides a long-term financial management strategy.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!