Shaved Ice Beverage Business Plan

Ice Dreams sells shave ice as its primary product, along with soft drinks and frosty Latin drinks called licuados. Shave ice is a popular dessert, heating up rapidly and showing no sign of cooling.

Shave ice originated in Asia and gained popularity in Hawaii. It involves shaving ice by hand to create a cold, flaky snow, which is then topped with fruit juices for a refreshing treat. In recent years, the taste for shave ice has spread worldwide.

Unlike sno-cones, shave ice is made using a small counter-top machine that shaves ice, resulting in ice as fine as real snow. The snow is placed in a bowl or cup and filled with high-quality tropical fruit flavors. Because the snow is soft, the syrup is held within its texture, rather than settling to the bottom like traditional sno-cones. It is best enjoyed with a spoon.

Due to its tender texture and delicious tropical fruit flavors, shave ice is preferred by adults and children of all ages and ethnic backgrounds.

Ice Dreams will establish a drive-through business on privately-owned commercial property on Highway 86 (Adams Avenue) in El Centro, California. The business will also offer beverages such as soft drinks and licuados.

Objectives:

1. Construct a drive-through building (12′ x 20′) on existing privately-owned commercial property (50′ x 120′).

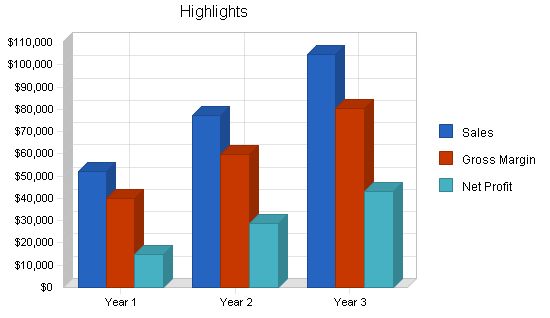

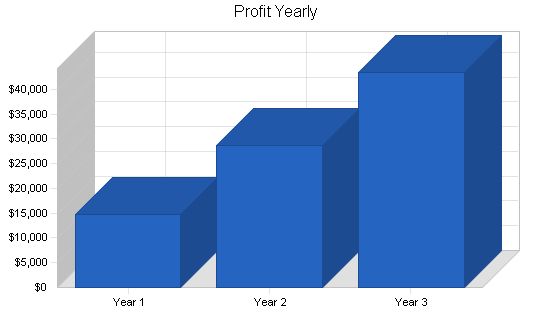

2. Achieve a net profit of at least $50,000 by the third year.

3. Sell 20 different tropical and Mexican flavored syrups.

4. Offer other products, including soft drinks and licuados.

Contents

1.2 Mission

Ice Dreams will produce and sell shave ice with 20 flavored syrups, soft drinks, and licuados to consumers in El Centro, California. Retail customers will be in the low- to mid-income bracket and will range in age from children to adults.

1.3 Keys to Success

The keys to success:

- First business of its kind in El Centro, California.

- Located on a major city highway, next to housing developments, the city pool, schools, parks, and a restaurant and motel strip.

- Product quality includes a large variety of tropical and Mexican syrups.

- Potential for expansion into other Imperial County communities.

- El Centro experiences warm to hot weather approximately seven months of the year.

- Two-way traffic on Highway 86 averages 48,300 vehicles daily.

Company Summary

Ice Dreams will sell shave ice with 20 tropical and Mexican flavored syrups to children and adults in El Centro, California. Other products include soft drinks and licuados.

2.1 Company Ownership

Ice Dreams will be owned by Ofelia R. Arellano as a sole proprietorship.

2.2 Start-up Summary

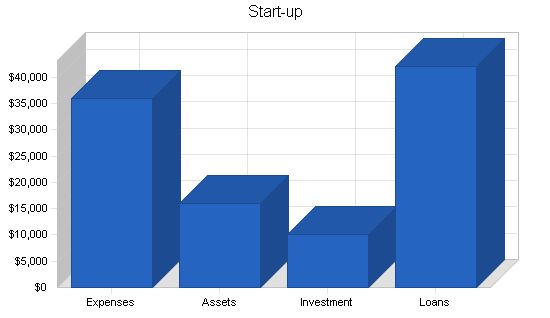

Start-up costs will be approximately $52,010, including facility construction, sidewalks, parking, inventory, city permits, and other expenses associated with opening this business. The start-up costs will be financed through a loan. Appendix A provides detailed information regarding permit requirements, equipment, construction costs, and land improvements required to open this new business.

Start-up Funding:

– Start-up Expenses to Fund: $36,010

– Start-up Assets to Fund: $16,000

– Total Funding Required: $52,010

Assets:

– Non-cash Assets from Start-up: $6,000

– Cash Requirements from Start-up: $10,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $10,000

– Total Assets: $16,000

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $42,010

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $42,010

Capital:

– Planned Investment

– Owner: $10,000

– Investor: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $10,000

– Loss at Start-up (Start-up Expenses): ($36,010)

– Total Capital: ($26,010)

– Total Capital and Liabilities: $16,000

– Total Funding: $52,010

Start-up Requirements:

– Start-up Expenses

– Consultants: $100

– Insurance: $1,200

– Other: $34,710

– Total Start-up Expenses: $36,010

– Start-up Assets

– Cash Required: $10,000

– Start-up Inventory: $1,325

– Other Current Assets: $675

– Long-term Assets: $4,000

– Total Assets: $16,000

Locations and Facilities:

Ice Dreams will be located on Highway 86 in El Centro, California, which experiences a high volume of daily traffic. Approximately 48,300 vehicles pass through this location daily. The majority of traffic enters and exits via Imperial Avenue and Fourth Avenue traveling through Highway 86.

A 240 square foot drive-through facility will be built on a privately-owned commercial property. The facility will include parking, landscaping, and a small sitting area. Other businesses located on Highway 86 include Carl’s Jr., Roberto’s Restaurant, La Fonda Restaurant, Raging Bull Restaurant, China Restaurant, Donut Shop, Steak House, Big John gas station, Recreation Center, and several motels.

The appendix provides additional information on the company facilities, a tentative plot plan, and highlights of the traffic study conducted by Cal Trans.

Products:

The main products to be sold through the Ice Dreams business will be shave ice topped with tropical and Mexican flavored syrups in three sizes: small, medium, and large. Other products will include three soft drinks (Sprite, Coke, and Diet-Coke), and licuados.

Product Description:

The major product sold through Ice Dreams will be shave ice topped with tropical and Mexican flavored syrups. Twenty different syrups will be sold, including Wild Watermelon, Pina Colada, Pink Lemonade, Guava Grape, Cherry Jubilee, Root Beer, Kiwi, Strawberry, Blue Bubble Gum, Orange Mango, Raspberry Red, Luscious Lime, Bodacious Banana, Tamarindo, Jamaica, Hortacha, Melon, Papaya, Manzana, and Limon.

Other products will include soft drinks in three flavors: Coke, Diet-Coke, and Sprite, and licuados in three flavors (strawberry, banana, and mango).

Competitive Comparison:

No other businesses in El Centro specifically cater to the shaved ice market on a large scale. It is anticipated that prices will be competitive with other businesses that sell shave ice on a smaller scale.

Sales Literature:

Sales literature to be distributed to the general community will include fliers, advertisements in the local newspaper (Imperial Valley Press), and other print media.

Sourcing:

Ice Dreams will purchase products from Crystal Fresh, Inc., which manufactures and distributes high-quality syrups and ice shavers. Equipment and supplies are available through a regional distributor. Mexican flavored syrups will be purchased in Mexicali, Baja California, Mexico.

Future Products:

It is anticipated that 10-15 additional syrups will be added, such as Spearmint, Black Cherry, Cinnamon, Blueberry, Peach, Red Apple, Tutti Frutti, Coconut, Cola, Green Apple, Tangerine, and Vanilla. Additionally, future products to be sold will include ice cream in vanilla and chocolate flavors.

Market Analysis Summary:

El Centro is geographically situated at the junction of major transportation routes. It is referred to as the "center of opportunity" with benefits created by NAFTA. El Centro is accessible via Interstate 8, State Highway 111, and State Highway 86.

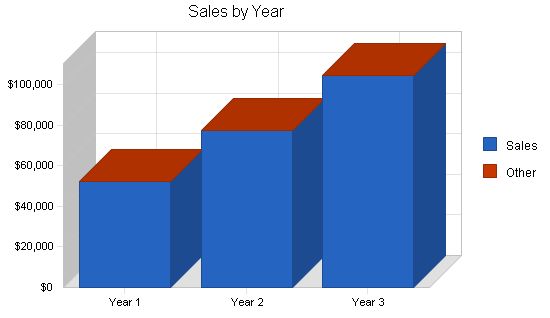

Shave ice is an ideal business for El Centro given the potential market segment, location, and climate. Utilizing average priced units ($1.25), the shave ice business has the potential market of $104,446 gross sales by the third year of operation.

Market Segmentation:

The frozen dessert market can be divided into two customer segments. The first segment prefers premium ice cream and frozen yogurt products, while the second segment prefers frozen ice products. Shave ice products are ideal for health-conscious consumers as they contain no fat, no cholesterol, and are relatively low in calories.

Ice Dreams will target all segments of El Centro’s population: children, teenagers, and adults. The Hispanic population, comprising 65% of El Centro’s total population, will be of special interest and will be targeted with Mexican flavored syrups and licuados.

Target Market Segment Strategy:

Ice Dreams will target low- to mid-income consumers who want high-quality dessert at moderate prices. Ice Dreams’ shave ice meets the quality required by these customers and will also cater to the large Latino population in El Centro with its Mexican flavored syrups.

Sno Biz Shave Ice, under the parent company of Crystal Fresh, Inc., is one of the best-known shave ice businesses. The potential success for selling shave ice is attributed to several factors:

1. Ice Dreams is a relatively simple business to operate compared to other food service products.

2. Shave ice is preferred over raspados, a Mexican favorite, because it is softer and tastier.

3. Shave ice has a low food cost and is easy to prepare, which allows for optimum speed-of-service.

4. Ice Dreams will be easy to maintain and clean.

5. Shave ice is a profitable product to produce at $0.16.

6. Shave ice is ideal for health-conscious consumers.

Competition and Buying Patterns:

The shave ice business will be new to El Centro. Competitors primarily sell raspados or sno-cones and do not focus on the shave ice market. The keys to success for Ice Dreams will be to sell high-quality shave ice and offer competitive prices.

Major competitors include Snow Shack, Garcia’s Market, and Wal-Mart. The strengths and weaknesses of each are as follows:

Snow Shack:

– Strengths: The only business in El Centro catering to the sno-cone market. Reasonable prices.

– Weaknesses: Does not sell shave ice, only sno-cones made from coarse ice. Syrups are of lower quality.

Garcia’s Market:

– Strengths: Low price of $1.00. Convenient for shoppers.

– Weaknesses: Does not sell quality syrups. Prefers to sell lower quality brands.

Wal-Mart:

– Strengths: Convenience for shoppers. Low price.

– Weaknesses: Does not sell quality syrups. Sno-cones are not their primary focus or product.

Industry Participants:

The shave ice industry in El Centro currently has no key players as no other business of this type exists in the area.

Strategy and Implementation Summary:

Ice Dreams plans for slow growth by expanding flavor options from 20 to 30 in the second year of operation. Additionally, ice cream in vanilla and chocolate flavors will be added as a new product in the second year.

Ice Dreams will create an image of offering the highest quality shave ice in Imperial County. Customers will be reached through advertisements such as fliers, newspaper ads, and grand opening ceremonies. A special marketing program will be incorporated by offering special coupon prices for nearby restaurants, motels, the city pool, the donut shop, and the gas station to customers who purchase any product at Ice Dreams.

Promotion Strategy:

Ice Dreams will promote shave ice through flier distribution, newspaper advertisements, discounts for recreational groups, and special introductory prices at the grand opening. The business will also "adopt a school" and provide shave ice as incentives for good attendance, grades, and citizenship.

Distribution Strategy:

Shave ice will be distributed only through the business facility initially. In the future, a portable ice shaver may be purchased for selling at various fundraising functions.

Pricing Strategy:

Shave ice will be offered at the following prices:

– Small: $1.00

– Medium: $1.25

– Large: $1.50

– Soft drinks: Regular $0.79, Large $0.99

– Products will be sold on a cash-only basis.

Sales Strategy:

Sales strategy will be directly linked to marketing programs as all sales will be through the business facility only.

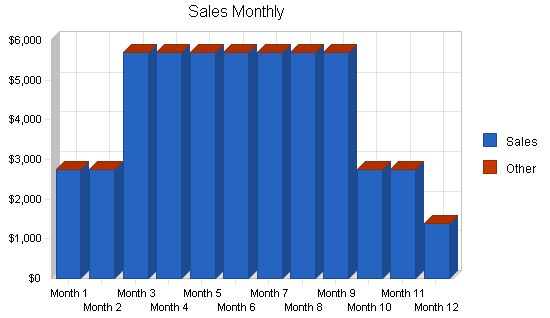

Consumer sales will start in January 1997 (or sooner if construction is completed early). Primary sales will occur during the peak warm weather months.

Sales Forecast

Sales

Year 1 Year 2 Year 3

$52,217 $77,383 $104,446

Other

$0 $0 $0

Total Sales

$52,217 $77,383 $104,446

Direct Cost of Sales

Year 1 Year 2 Year 3

Cost of Sales

$12,114 $17,772 $24,227

Other

$0 $0 $0

Subtotal Direct Cost of Sales

$12,114 $17,772 $24,227

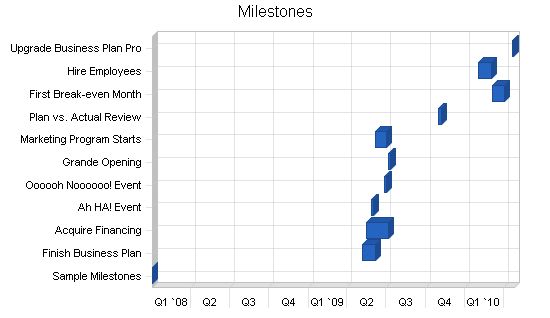

5.3 Milestones

Sample Milestones topic text.

The milestones table and chart provide specific details about program activities, including the manager, start and end dates, and budget. Implementation will be monitored throughout the year, with reports on timely completion of planned activities.

Milestones:

– Sample Milestones: 1/4/2008 – 1/4/2008, $0, ABC, Department

– Finish Business Plan: 5/7/2009 – 6/6/2009, $100, Dude, LeGrande Fromage

– Acquire Financing: 5/17/2009 – 7/6/2009, $200, Dudette, Legumers

– Ah HA! Event: 5/27/2009 – 6/1/2009, $60, Marianne, Bosses

– Oooooh Noooooo! Event: 6/26/2009 – 7/1/2009, $250, Marionette, Chèvre deBlâme

– Grande Opening: 7/6/2009 – 7/11/2009, $500, Gloworm, Nobs

– Marketing Program Starts: 6/6/2009 – 7/1/2009, $1,000, Glower, Marketeers

– Plan vs. Actual Review: 11/1/2009 – 11/8/2009, $0, Galore, Alles

– First Break-even Month: 3/5/2010 – 4/4/2010, $0, Bouys, Salers

– Hire Employees: 2/1/2010 – 3/3/2010, $150, Gulls, HRM

– Upgrade Business Plan Pro: 4/22/2010 – 4/24/2010, $100, Brass, Bossies

– Totals: $2,360

Management Summary:

Ice Dreams will hire an employee to assist with the business. Ice Dreams will require minimum daily supervision after it has been established since all three products are fairly easy to make.

6.1 Organizational Structure:

Ofelia R. Arellano, the owner, will have one individual assisting her with the business. Long-range plans will include a second employee to assist with the weekend hours.

6.2 Management Team:

Ofelia R. Arellano is the most important member of the management team. Dr. Arellano is a graduate of the University of California, Santa Barbara with several advanced degrees (Masters and Doctorate in Psychology). She has spent the last six years working as an administrator overseeing a budget of approximately $800,000. Ofelia will oversee the business primarily during the weekend hours and Frank Arellano will oversee the business during weekdays along with one employee.

Business expertise include:

– History-Based Budgeting

– Object-Code Budgeting

– Program Budgeting

– Planned Programming Budgeting Systems

– Management by Goals and Objectives

– Long-Range Planning

– Total Quality Management

– Operational Planning

– Advertising for Educational Purposes

– Marketing Research

– Consulting

– Advisory Boards

– Business and Educational Partnerships

– City Planning and Development (Board of Director, San Ysidro Planning and Development Group)

– Business Needs Assessment and Consultation (Board of Directors, San Ysidro Chamber of Commerce)

Frank Arellano will serve as a consultant on a volunteer basis. Mr. Arellano spent over 35 years in the retail business handling marketing and inventory for a major food chain. He is familiar with all aspects of business management and operations, having owned and operated his own grocery store in El Centro. Mr. Arellano will also assist in the building design, landscaping layout, and business marketing. Mr. Arellano will supervise the business during the weekdays, managing one employee.

6.3 Personnel Plan:

Monthly personnel cost estimates are included in the following table.

Personnel Plan:

– Assistant: $10,800, $11,232, $11,681

– Owner: $0, $0, $0

– Total People: 1, 1, 1

– Total Payroll: $10,800, $11,232, $11,681

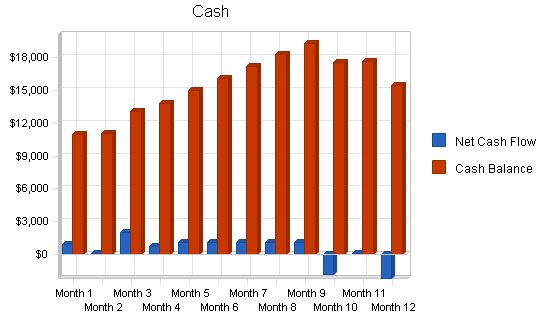

– We want to finance growth mainly through cash flow. We recognize that this means we will have to grow slowly.

– The most important indicator in our case is that minimal inventory will have to be stored for these products.

7.1 Important Assumptions:

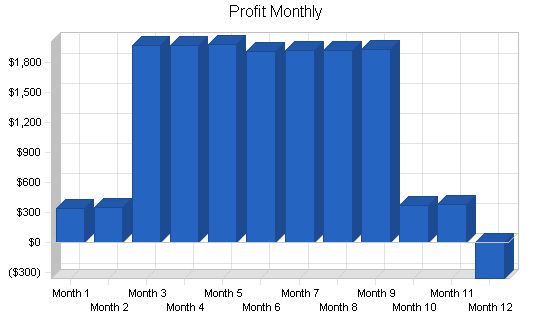

Monthly sales are the largest indicator for this business. There are some seasonal variations with the months of March through September being the highest sales months.

General Assumptions:

– Plan Month: 1, 2, 3

– Current Interest Rate: 10.00%, 10.00%, 10.00%

– Long-term Interest Rate: 10.00%, 10.00%, 10.00%

– Tax Rate: 30.00%, 30.00%, 30.00%

– Other: 0, 0, 0

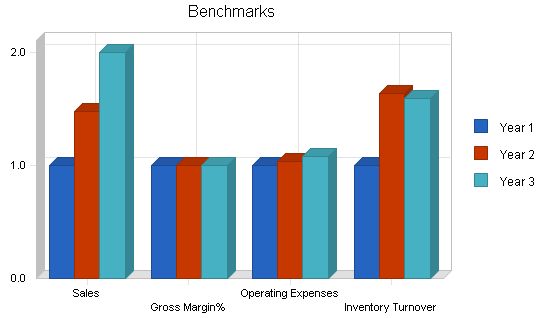

7.2 Key Financial Indicators:

The following Benchmark chart shows our key financial indicators.

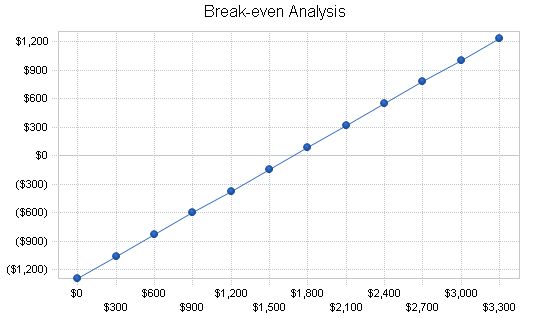

The table and chart below display the current break-even analysis.

Break-even Analysis

Monthly Revenue Break-even: $1,685

Assumptions:

– Average Percent Variable Cost: 23%

– Estimated Monthly Fixed Cost: $1,294

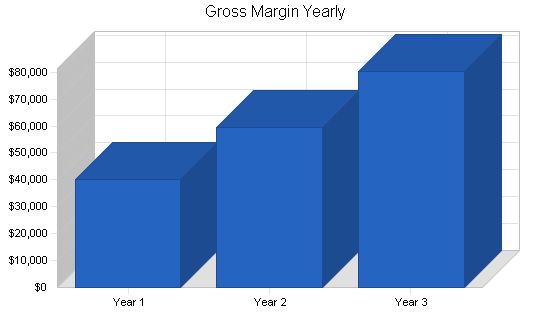

Projected Profit and Loss

We anticipate substantial profits throughout the entire three-year period.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $52,217 $77,383 $104,446

Direct Cost of Sales $12,114 $17,772 $24,227

Other Costs of Sales $0 $0 $0

Total Cost of Sales $12,114 $17,772 $24,227

Gross Margin $40,103 $59,611 $80,219

Gross Margin % 76.80% 77.03% 76.80%

Expenses

Payroll $10,800 $11,232 $11,681

Marketing/Promotion $1,410 $1,466 $1,525

Depreciation $400 $400 $400

Utilities $1,720 $1,789 $1,861

Insurance $1,200 $1,248 $1,298

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $15,530 $16,135 $16,765

Profit Before Interest and Taxes $24,573 $43,476 $63,454

EBITDA $24,973 $43,876 $63,854

Interest Expense $3,632 $2,626 $1,576

Taxes Incurred $6,282 $12,255 $18,563

Net Profit $14,659 $28,595 $43,315

Net Profit/Sales 28.07% 36.95% 41.47%

7.5 Projected Cash Flow

Projected cash flow is estimated for the next three years as shown below.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $52,217 | $77,383 | $104,446 |

| Subtotal Cash from Operations | $52,217 | $77,383 | $104,446 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $52,217 | $77,383 | $104,446 |

Projected Balance Sheet

The balance sheet shows a slow but steady upward growth in net worth after initial start-up.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $15,458 | $36,139 | $69,854 |

| Inventory | $905 | $1,328 | $1,810 |

| Other Current Assets | $675 | $675 | $675 |

| Total Current Assets | $17,038 | $38,142 | $72,339 |

| Long-term Assets | |||

| Long-term Assets | $4,000 | $4,000 | $4,000 |

| Accumulated Depreciation | $400 | $800 | $1,200 |

| Total Long-term Assets | $3,600 | $3,200 | $2,800 |

| Total Assets | $20,638 | $41,342 | $75,139 |

Standard business ratios are included in the table that follows. The ratios show a plan for balanced, healthy growth. The standard industry indicators shown are for SIC 5812, eating places.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 48.20% | 34.97% | 7.60% |

| Percent of Total Assets | ||||

| Inventory | 4.39% | 3.21% | 2.41% | 3.60% |

| Other Current Assets | 3.27% | 1.63% | 0.90% | 40.10% |

| Total Current Assets | 82.56% | 92.26% | 96.27% | 43.70% |

| Long-term Assets | 17.44% | 7.74% | 3.73% | 56.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | $480 | $3,089 | $4,071 | 32.70% |

| Current Borrowing | $31,510 | $21,010 | $10,510 | 61.20% |

| Subtotal Current Liabilities | $31,990 | $24,099 | $14,581 | |

| Long-term Liabilities | $0 | $0 | $0 | 28.50% |

| Total Liabilities | $31,990 | $24,099 | $14,581 | 61.20% |

| Paid-in Capital | $10,000 | $10,000 | $10,000 | |

| Retained Earnings | ($36,010) | ($21,351) | $7,244 | |

| Earnings | $14,659 | $28,595 | $43,315 | |

| Total Capital | ($11,351) | $17,244 | $60,558 | |

| Total Liabilities and Capital | $20,638 | $41,342 | $75,139 | |

| Net Worth | ($11,351) | $17,244 | $60,558 | |

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Sales | 0% | $2,751 | $2,751 | $5,691 | $5,691 | $5,691 | $5,691 | $5,691 | $5,691 | $5,691 | $2,751 | $2,751 | $1,376 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $2,751 | $2,751 | $5,691 | $5,691 | $5,691 | $5,691 | $5,691 | $5,691 | $5,691 | $2,751 | $2,751 | $1,376 | |

Personnel Plan

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assistant | 0% | $900 | $900 | $900 | $900 | ||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!