Asset-Based Lending vs. Traditional Bank Lending Explained

Companies seeking financing to maintain and grow their business often look first to traditional unsecured bank loans, as they are usually the least costly form of borrowing available.

However, many small businesses are either growing rapidly, do not have a lengthy track record, or do not have a sufficiently high credit rating.

As a result, these businesses are often turned down for a traditional bank loan, especially after the financial crisis when lenders have become more cautious in their loan approvals.

Some businesses that already have bank lines of credit cannot obtain additional funds from the bank, as the bank will not extend additional credit beyond the current limit, thus limiting their further growth.

So, what is a company to do when customer receivables fall significantly past their due date, and the company is left with a significant shortfall in working capital? In such situations, businesses can seek another form of financing, like asset-based lending (ABL), to meet their need for additional financing.

What are the differences between asset-based lending and traditional lending?

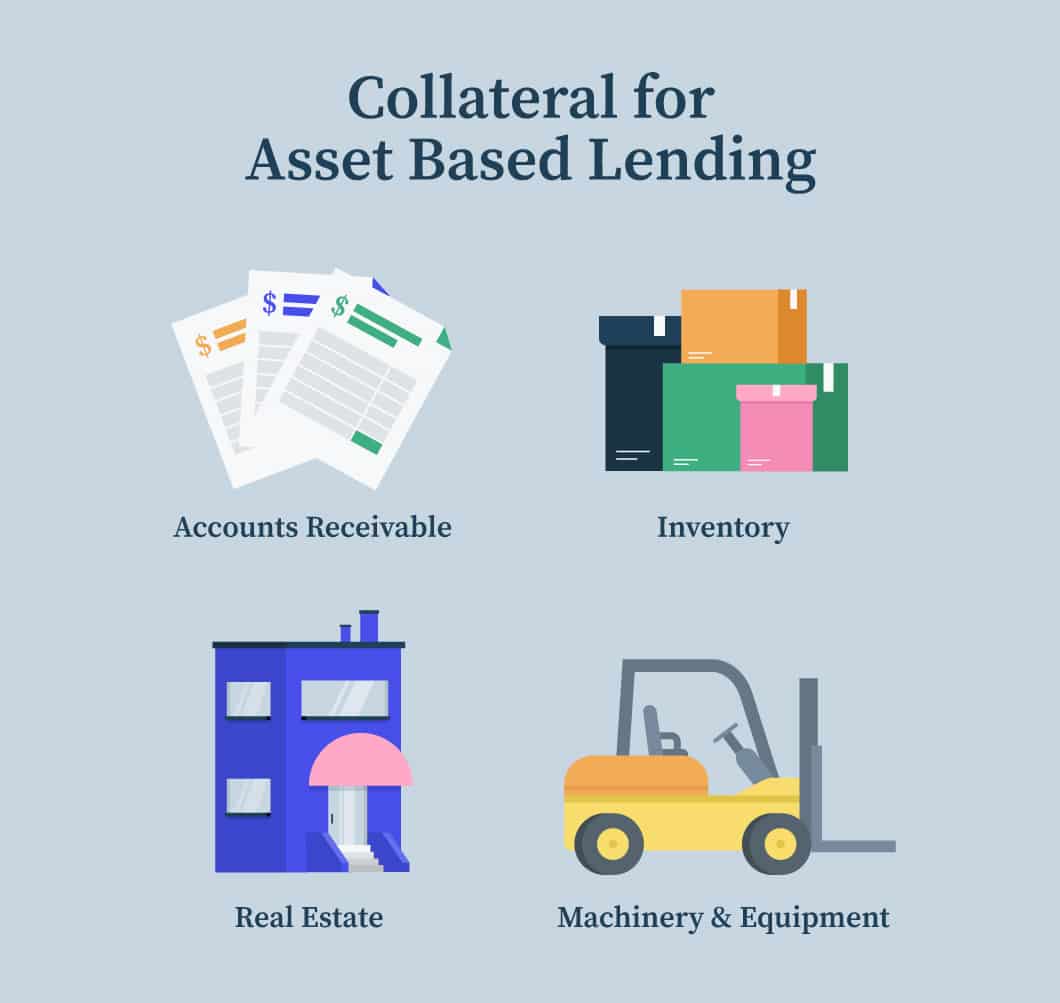

ABL provides a more flexible approach to financing a business’s current operations and needs for future growth. Unlike traditional bank lending that evaluates the borrowing company’s operations and projects its future cash flow, asset-based loans are based on the collateral put up for the loan. The most typical type of ABL is made against the business’s accounts receivables. The lender advances funds based on the value of the receivables submitted, typically in the range of 70 percent to 90 percent. The lender collects payment from the creditors and provides the balance to the borrower, minus the fees for the loan and managing the collections process.

An asset-based loan usually takes the form of a revolving line of credit, which is refreshed when the collateral, such as receivables, is paid down. While asset-based lenders also lend against other types of assets, including inventory, capital equipment, and real estate, receivables are frequently the largest proportion of collateral for these loans due to their greater liquidity.

The lending process

Asset-based lenders focus on the quality of the collateral rather than the borrower’s cash flow or credit rating. They evaluate the creditor’s ability to make payment and their track record of past payments to determine creditworthiness. Traditional bank lenders are constrained by internal bank lending standards. For example, banks typically will not lend to companies with debt-to-capital ratios greater than four or five to one. By contrast, independent asset-based lenders are not subject to such constraints, giving them the freedom to finance many small businesses that are thinly capitalized or otherwise do not meet traditional bank lending standards but are good businesses with bright long-term prospects.

Benefits of ABL to the borrower

Borrowers benefit from asset-based loans in various ways. ABL provides immediate and ongoing cash flow liquidity for a company’s working capital, including the purchase of materials and supplies, meeting seasonal requirements, meeting payroll and other operating expenses, and keeping accounts payable current.

While a bank’s lending process may be lengthy and cumbersome, taking up to several months in some cases as the bank analyzes the borrower’s financial statements, credit history, and overall business, asset-based lending requires less time to conduct the transaction. Moreover, ABL lenders are more often willing to be flexible and work with a borrower during a period of financial difficulty when the company’s finances are stretched, as ABL loans are based on collateral rather than the borrower’s operating performance.

Since asset-based loans rely on the quality of the collateral, fewer financial covenants are required, and compared to traditional bank lending, ABL lenders typically require less reporting back to the lender.

While determining your borrowing strategy should be individualized based on each business and tailored to your business’s specific needs, borrowers seeking working capital financing need to seriously consider the benefits of working with an asset-based lender, as it can provide greater flexibility and options beyond traditional bank lending.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!