E3 Playhouse is an entertainment, education, and restaurant venue in downtown Santa Cruz. It offers live entertainment, community-based courses in music and the arts, and a retail component. The business plan aims to estimate costs, identify revenue streams, and forecast cash flow and profits. The CEO of the company is Michael Horne, who has experience managing live entertainment venues in the area. The nightclub and bar industry is shifting towards a more entertainment-oriented concept, and E3 Playhouse aims to cater to a large client base through interactive contests and events. The venue is a 6,600 square foot complex that will also house the company’s corporate office. It will have state-of-the-art audio, lighting, and video systems. E3 Playhouse anticipates generating sales through seven revenue streams, with food/beverage and gate/entertainment expected to be the most stable. The venue appeals to four major market segments and takes advantage of its location and minimal competition. The business plan estimates start-up and ongoing costs and projects net cash flow and profits. The owner’s total investment is $190,260, and break-even month is targeted for July 2005. The owner acknowledges the high risk involved in launching this venture and is willing to bring on investment partners if necessary. The mission of E3 Playhouse is to create an accessible and affordable venue for entertainment, community education, and dining. The keys to success for the venue are its strategic location, low operating cost, and wide range of services. The objective is to remodel a leased space and open within a $40,000 budget, reach sales goals, and maintain a 40% gross margin.

E3 Playhouse is a startup positioned to open in mid-September of 2004. The company is owned by Equal Time Music, Inc., a California "S" corporation. The owner, Wes Anthony, will pay taxes on the company profits on his personal tax returns.

Start-up Summary:

The owner has contributed $40,260 in paid-in capital for the initial development of E3 Playhouse. Start-up expenses include accounting, legal, consulting services, research and development, and expensed equipment. The company’s start-up position reflects a loss of ($39,260) and total capital and liabilities of $1,000.

Products and Services:

The venue is a 6,600 square foot complex that will also house the company’s corporate business office. The venue will accommodate 200-400 people and will be equipped with state-of-the-art audio, lighting, and video systems. The demographics are favorable, with minimal competition from other dance-themed venues and bars.

E3 will generate sales through seven revenue streams, including membership fees, educational courses, food and beverage services, gate/entertainment tickets, retail merchandise, arcade games, and venue rentals.

Technology:

The company’s cash systems will be fully automated using a centralized software platform. Membership cards will be barcoded to maintain a customer database.

Venue Layout/Floor Plan:

The owner will build out an existing restaurant and bar space, with the majority of build-out costs applied toward removing and building several walls. A stage will also be built.

Market Analysis Summary:

Santa Cruz is a secondary market with an influx of visitors from primary markets including San Jose and San Francisco. The venue appeals to young professionals, college students, tourists and business travelers, and senior citizens. The targeted population is estimated at 200,000 people.

Competition and Buying Patterns:

The venue’s direct competition consists of six competitors, including Rosie McCann’s and Bruno’s. Additional competitors include The Kuumbwa, The Catalyst, and The Blue Lagoon. E3 Playhouse differentiates itself through its exceptional service, entertaining experience, and focus on target markets.

Strategy and Implementation Summary:

The E3 Playhouse’s location, demographics, and minimal competition are major advantages for the success of the venture. The venue will appeal to a wide age range and target the large student population, tourism industry, and local population seeking mainstream entertainment.

E3 Playhouse will focus on offering exceptional service, emphasizing an entertaining experience, and targeting specific market segments.

The marketing budget is set at 1% of overall sales revenue and will be used for cost-effective marketing campaigns. Channels for reaching new and repeat customers include the website, print advertising, neighborhood marketing, radio, television, email/newsletters, and in-store promotions.

Email/Newsletter:

A customer database will be used to distribute monthly email newsletters, providing timely information regarding upcoming programs and specials.

The sales and marketing plan for the first six months includes the grand opening event and various advertising strategies.

We have targeted 1% of sales as our ongoing Sales and Marketing budget. This is included in the "Sales & Marketing and Other Expenses" category in the Profit and Loss table. Marketing expenses during the project rollout are estimated at a higher level and summarized in the table for each type of advertising. This rollout allows us to manage costs and cash flow, and aligns with our sales revenue ramp-up strategy.

Our radio advertising will be developed in August, prior to our grand opening in September. Website development, print advertising, and television advertising will also begin in August. We will launch a neighborhood marketing campaign in October, an in-store promotion campaign in November, and an email/newsletter campaign in December.

The nightclub and bar industry is shifting toward an entertainment-oriented concept. Guests are offered a dynamic place to gather and mingle, as well as participate in interactive contests, theme nights, and other events. We will heavily utilize entertainment-oriented marketing to withstand shifts in trends and cater to a large client base.

E3 Playhouse’s competitive advantage comes from several factors that differentiate it from competitors. First, its downtown location in Santa Cruz is a major advantage. Second, E3 Playhouse will provide a wide range of entertainment, catering, and community education services with a focus on high service quality. Third, the management will keep operating expenses minimized to maximize net profits. Construction costs will be minimized, and the venue will be in a leased building. Cost of sales and margins will be reviewed monthly, with a target of 40% for cost of sales.

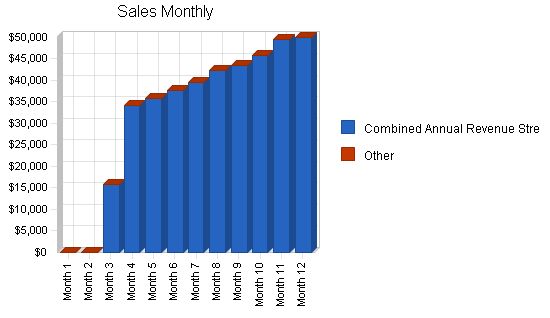

Sales revenue for E3 will be generated through seven separate product and service areas: membership fees, educational courses, food and beverage, gate/entertainment, retail merchandise, arcade, and venue rental. Each revenue stream will be ramped up individually, with a focus on developing stable revenue streams first, such as food/beverage and entertainment. Membership fees, educational courses, retail merchandise, arcade, and venue rental will follow.

The revenue model for each area is detailed in the financial model. However, during the first year of operation, sales revenue is projected to be only about 35% of the full potential. By the second year, the venue is expected to reach its full sales potential.

Membership fees are based on the assumption of 24,000 customer visits annually. Several types of memberships will be offered, with discounts and benefits included. Sales projections for the first year estimate $369,600 in membership fee revenue.

Educational courses will be offered for music, art, dance, yoga, language, cooking, and workshops. E3 members will receive a price discount for each course. Sales projections for the first year estimate $103,644 in education course revenue.

Food and beverage sales are based on the assumption that 50% of the 24,000 visitors per year will purchase food and 75% will purchase a beverage. Sales projections for the first year estimate $276,000 in food and beverage revenue.

Gate/entertainment revenue is based on ticket sales for live music entertainment, with an average ticket price of $10. Sales projections for the first year estimate $216,000 in gate/entertainment revenue.

Retail merchandise revenue is based on a range of merchandise pricing and anticipated units sold annually. Sales projections for the first year estimate $18,720 in retail merchandise revenue.

Arcade revenue is based on the assumption that 30% of visitors will play arcade games, with an average revenue of $5 per visitor. Sales projections for the first year estimate $36,000 in arcade revenue.

Venue rental will include event rentals, kitchen rentals, and mercantile rentals. Sales projections for the first year estimate $106,200 in venue rental revenue.

The combined revenue streams have a potential gross annual income of $1,222,164. However, during the first year, sales are conservatively estimated to reach only approximately 35% of the full potential. The sales forecast table provides a conservative revenue ramp-up period, with full sales potential expected in the second year.

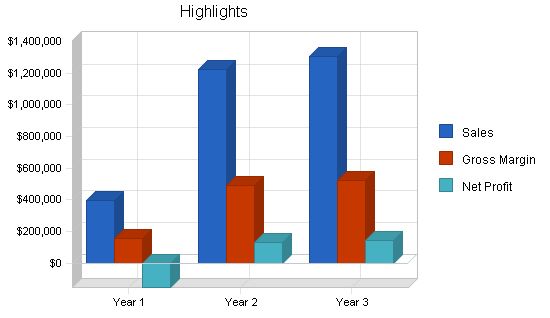

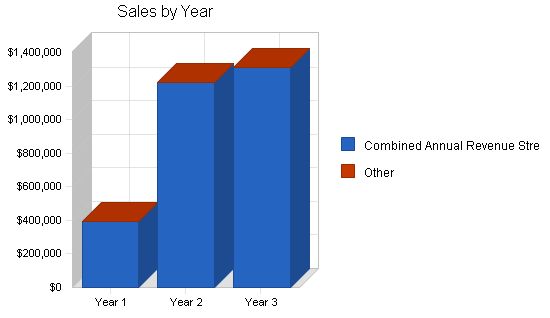

The first year is projected to generate $394,157 in sales revenue, with a cost of sales of $236,494. The second year is expected to increase sales to $1,222,164, with a cost of sales of $733,298. The third year shows an increase in sales to $1,307,715, with a cost of sales of $784,629.

Sales Forecast

Year 1 Year 2 Year 3

Sales

Combined Annual Revenue Streams $394,157 $1,222,164 $1,307,715

Other $0 $0 $0

Total Sales $394,157 $1,222,164 $1,307,715

Direct Cost of Sales

Year 1 Year 2 Year 3

Combined Annual Revenue Streams $236,494 $733,298 $784,629

Other $0 $0 $0

Subtotal Direct Cost of Sales $236,494 $733,298 $784,629

Management Summary

The company CEO, Michael Horne, has eight years of experience as the owner and manager of Palookaville, a live entertainment venue. The management team, headed by owner Wes Anthony, includes a professional musician and teacher with a Masters degree in Music from CSU San Diego. Wes also has extensive restaurant experience as a cook, waiter, and bartender.

Administration and Operations

Each revenue stream is managed by a Division Chief who reports directly to Wes Anthony. The Division Chiefs are responsible for the day-to-day operations of the venue.

Finance

The company’s bookkeeping, payroll, and tax reporting will be outsourced to Bob Mason, CPA, owner of Coast Financial Services. Coast Financial will also provide payroll services support.

Consulting Services

Jon Taffer, a specialist in hospitality business development, will provide additional marketing and employee training services. Jon can conduct a market study and competitive assessment for the venue.

Personnel Plan

Total personnel costs for the first year are estimated at $124,000 and increase in the second and third years based on a full 12 months of operations. Additional staff will be hired as net profits allow. Personnel interviewing and hiring will begin in August.

Managers will be paid $10.00 per hour and assistants will be paid $6.50 per hour. The wait staff and bartending staff will also receive tips.

Managers

– Venue Rental, Food and Beverage, and Arcade Manager: August Polacco

– Entertainment and Education Manager: Michael P. Lazarus

Assistants

– Dan Robbins

– Scott Nordgren

– Mark Sveen

– Clayton Ramsay

Additional temporary assistance will be provided as needed.

Music and Education Faculty

Instructors will be compensated on a percentage basis of the revenue for each course.

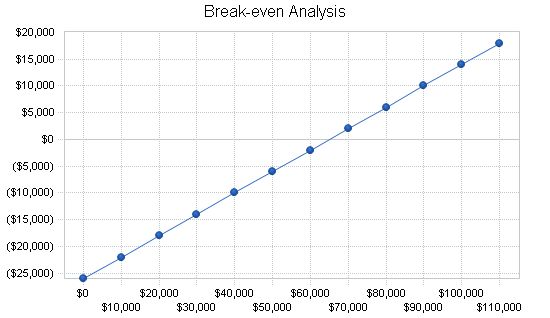

The estimated monthly revenue break-even point is $66,395, with a variable cost of 60% and fixed monthly costs of $26,558. The targeted break-even month is October 2005.

The purpose of this business plan is to estimate start-up and ongoing costs, identify revenue streams, and forecast net cash flow and profits. The venture will be funded solely through paid-in capital provided by the owner.

Net cash flow for the first year is projected at $22,084, increasing in the second and third years. The owner is aware of the risk and is prepared to bring on investment partners if necessary.

The owner’s initial investment is $40,260, and the total investment is $190,260.

Important Assumptions

The company does not anticipate securing a conventional loan. The tax rate is initially set at 0%.

Payroll expenses begin in August 2004. Payroll taxes and employee benefits are forecasted at 7% of payroll.

New accounts payable and inventory accounts payable are expected to begin in July 2004.

Collections days are estimated at 2 days, and payment days to accounts payable are estimated at 30 days. Inventory turnover is estimated at 7 days.

All purchased equipment and build-out costs will be expensed.

Overall, the financial projections show a negative net profit for the first year due to start-up expenses, with positive net profits in the second and third years. The owner is prepared to take steps to exit the venture if net profitability cannot be attained.

| Break-even Analysis | |

| Monthly Revenue Break-even | $64,958 |

| Assumptions: | |

| Average Percent Variable Cost | 60% |

| Estimated Monthly Fixed Cost | $25,983 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!