Vino Maestro is a Boston retailer specializing in fine wines and spirits. The company will be a closely held C corporation, with Cris Martin and Bob Williams owning an 80% interest.

2.1 Company Ownership:

The table below details the start-up expenses, assets, funding, and liabilities.

Start-up Expenses:

– Legal: $15,000

– Stationery etc.: $3,000

– Marketing: $10,000

– Computer Systems: $12,000

– Telecommunications: $5,000

– Security: $10,000

– Store Layout: $10,000

– Pre-opening Staff and Training: $10,000

– Total Start-up Expenses: $75,000

Start-up Assets:

– Cash Required: $70,000

– Start-up Inventory: $150,000

– Other Current Assets: $0

– Long-term Assets: $180,000

– Total Assets: $400,000

Total Requirements: $475,000

Start-up Funding:

– Start-up Expenses to Fund: $75,000

– Start-up Assets to Fund: $400,000

– Total Funding Required: $475,000

Assets:

– Non-cash Assets from Start-up: $330,000

– Cash Requirements from Start-up: $70,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $70,000

– Total Assets: $400,000

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $240,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $240,000

– Capital:

– Planned Investment:

– Investor 1: $130,000

– Investor 2: $105,000

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $235,000

– Loss at Start-up (Start-up Expenses): ($75,000)

– Total Capital: $160,000

Total Capital and Liabilities: $400,000

Total Funding: $475,000

2.2 Company Locations and Facilities:

Vino Maestro will be located in the Southside Towers residential hi-rise project in Boston. The site is one of the nation’s densest and wealthiest markets, with 16 residential towers, 17,000 residents, and 19 acres of new harbor front parkland when fully completed in approximately seven years.

Our storefront will be prime retail space in the southeast corner of the 247 Mainline Avenue building, facing Excelsior Place, a main artery for vehicles and city buses. The store is centralized in a cluster of eight phase-one residential towers, with three fully completed and five planned for construction.

The next building to be constructed at 249 Mainline Avenue is the flagship residential tower of the Southside development. It currently has 440 condominiums for sale at prices ranging from $350k for a studio to $3.5 million for a four-bedroom home. About 150 units have already been sold prior to construction, which is expected to be completed next year.

Minimum household annual incomes of $100k are required to be eligible for rental residences within Southside Towers. One-bedroom apartment rentals average around $3,000 per month.

Vino Maestro will be located in one of two fully-rented residential towers.

U.S. sales of wines priced at $10 to $14 a bottle have climbed 14 percent over the past 12 months, and sales at $25 a bottle and higher have grown 18 percent. The upward trend is expected to continue.

Wine consumption in the United States is on the increase, with wine overtaking coffee as the most popular mealtime beverage in 1998. Americans spent over $20 billion on wine in 1999, a 13 percent increase from the previous year. Consumption trends and demographics indicate robust wine sales growth for the next 15 years.

These findings were part of a presentation by industry consultant Vic Motto, who highlighted the impact of demographics on wine consumption. The aging of the U.S. population is expected to boost wine demand, as per capita consumption increases with age. Baby boomers, in particular, view wine as a simple, affordable luxury. Furthermore, down turns in the economy and the stock market have shown no impact on wine sales, with sales actually rising slightly during previous declines.

The Boston metropolitan area has higher wine consumption levels than the national average, fueled by higher per capita income and a more diverse population. Europeans, in comparison, consume significantly more wine per capita. Based on these factors, we conservatively project that the Southside Towers residents will buy an average of 15 bottles of wine per capita per year.

3.1 Market Segmentation:

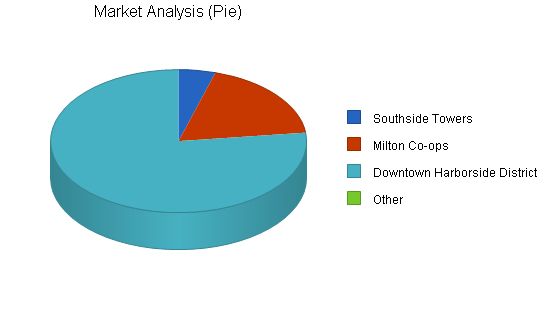

The following chart and table provide Vino Maestro’s market analysis.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers Growth

Southside Towers 0% 3,000 5,000 7,000 9,000 11,000 38.38%

Milton Co-ops 1% 12,000 12,060 12,120 12,181 12,242 0.50%

Downtown Harborside District 2% 50,000 51,000 52,020 53,060 54,121 2.00%

Other 0% 0 0 0 0 0 0.00%

Total 4.45% 65,000 68,060 71,140 74,241 77,363 4.45%

Due to regulatory constraints, the retail wine and spirit trade in Massachusetts consists of independent participants. Chain stores are not allowed. Some changes are happening in Internet-driven distribution operations, mainly for wholesalers.

3.2.1 Competition and Buying Patterns

Competition depends on location, as stores stake a claim in a territory that yields the best in-store sales prospects. Relationships are cultivated with better customers, who may qualify for discounts based on volume purchases. Prices in the Boston marketplace do not vary significantly, as retailers seek to protect their margins against distributor costs. High-volume retailers can build a competitive advantage. For example, Millstones runs periodic Super Sales, offering over 200 wines at distributor cost prices, which only a high-volume retailer could afford.

Other competitive factors include available stock, product knowledge, customer service, expense management, marketing programs, employee productivity, management of information, in-store presentation and design, hours of operation, delivery efficiencies, packaging, customer loyalty, out-of-area competition, pricing, and reputation.

Competitors:

Global Wines, our primary local competitor, is about 1,500 feet from our proposed storefront. Our location will be more convenient for our main residential base of customers within Southside. Additionally, our selection and product knowledge will appeal to high-income Southside Towers residents, while Global Wines has more of a neighborhood grocer approach.

Stillman Wines on Packard Street is the next nearest competitor, about 2,500 feet north of our location. However, it is far beyond the practical boundaries for shoppers who live in our neighborhood.

Other direct marketers and major advertisers that can deliver into our territory include Beverson’s, Millstone’s, Gainer, and Morrison. We expect our local delivery service will be faster and more responsive than these bigger players.

Internet storefronts are emerging competitors and may be a longer-term issue. However, we intend to develop our own website and emerge as a player in the industry.

Non-local stores in commuter paths of our neighborhood residents are also competitors, which makes cultivating relationships with our neighborhood residents crucial in developing a loyal customer base.

3.3 Target Market Segment Strategy

The target market consists of educated, successful professionals in Boston with high disposable income who are regular consumers of alcoholic beverages. These consumers rely on assistance in selecting wines and spirits and tend to reward capable merchants with loyalty and word-of-mouth advertising.

Other potential segments include bulk volume customers (private and business) and customers in Boston outside our immediate store neighborhood. Intra-state shipments are contingent on expansion, and this business would develop through direct-mail catalog marketing and an Internet sales operation.

3.3.1 Market Needs

Apart from Beverson’s and a handful of major players, little attention is paid to geographic extensions through direct shipments of wine and spirits throughout Massachusetts. Our company aims to capture a piece of the demand for direct shipment sales. Additionally, if lobbying efforts succeed in allowing interstate shipments, we are well-positioned to capture a piece of this potential growth opportunity. Even without interstate sales, a successful penetration of the Massachusetts intra-state marketplace would mean substantial growth for our business.

4.1 Competitive Edge

Our marketing strategy will focus on developing a reputation for great selection, an appealing store environment, competitive prices, and excellent customer service. We will also develop strong relationships with our suppliers to ensure the best discount deals and services. Keeping our staff focused and satisfied will help maintain high productivity and customer service levels. Regular advertising to our target community will ensure awareness of our store. Reaching out to potential wholesale clients and organizing activities such as wine tastings and educational events will stimulate additional business. In the longer term, we plan to extend our market penetration beyond the physical boundaries of the store through direct catalog sales and an Internet website.

4.2 Marketing Strategy

Product pricing will be based on competitive parity guidelines and will be monitored continuously against neighborhood and other competitive sources.

4.3 Sales Strategy

Management will focus on daily sales revenue goals. Best value products will be identified to assist customers with smart selections. Deliveries will be geared towards customer convenience, and sales feedback will be elicited to stimulate ideas and implement improvements. Major accounts will be solicited through networking and opportunistic encounters.

4.3.1 Sales Forecast

Sales projections for Vino Maestro are based on actual sales data, interviews with liquor store owners and managers, and government and industry trade statistics. The forecast assumes a 7% annual growth in total wine and spirits sales per capita.

Sales revenue from wine is estimated to range from $675,000 to $3.8 million over the course of the full development of the Southside Towers project. The balance of forecasted wine sales will come from sources external to Southside Towers.

Spirits sales are projected to be 10% of wine sales, based on interviews with Boston store owners.

About 40% of annual sales are expected to occur in the November-December holiday period. Wine consumption has been growing at a rate of 8-10% annually, and spirits sales are expected to remain relatively flat.

4.3.2 Sales Programs

Sales staff will have a level of wine and spirits knowledge that positions Vino Maestro ahead of the competition. The managing partners will use their skills to create programmed background music to enhance store ambiance and stimulate sales. A proprietary website will be developed to enhance customer service, supplier commerce, and direct sales. Peripheral sales and marketing collaterals will be used to expand product lines and customer awareness. A proprietary software tool will be developed to enhance the customer buying experience.

4.4 Strategic Alliances

Vino Maestro will seek out opportunities to establish viable strategic alliances, such as co-marketing with gourmet food operations, distributors, importers, and producers. An alliance with an upscale gourmet food market neighboring our store will help promote both businesses. Coordinating gift baskets with wine orders presents another compelling co-marketing opportunity.

Vino Maestro will be managed by Cris Martin and Bob Williams. After the launch of the business, as sales volumes increase, an associate manager may be hired to help with day-to-day store operations.

5.1 Management Team

Cris Martin has over 25 years of management experience in the retail, financial services, and newspaper publishing industries. Bob Williams brings over 20 years of wine trade expertise and executive management skills to the company.

5.2 Personnel Plan

Store Managers/Partners: $96,000 (Year 1), $96,000 (Year 2), $100,000 (Year 3)

Salespeople — Full-time: $0

Salespeople — Seasonal: $4,650 (Year 1), $3,070 (Year 2), $3,380 (Year 3)

Stock/Delivery — Full-time: $21,320 (Year 1), $23,500 (Year 2), $28,850 (Year 3)

Stock/Delivery — Seasonal: $2,460 (Year 1), $2,700 (Year 2), $2,970 (Year 3)

Other: $0

Total People: 6 (Year 1), 7 (Year 2), 7 (Year 3)

Total Payroll: $124,430 (Year 1), $125,270 (Year 2), $135,200 (Year 3)

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!