You have several options for structuring your business. Consider forming an LLC, as it offers the benefits of personal liability protection and simplicity:

– With an LLC, you have personal liability protection, similar to a corporation.

– An LLC is easier to run, without the need to file corporate taxes.

Anyone can start an LLC, except in Massachusetts, where two owners are required. There are no special qualifications, but licensed professionals like attorneys or medical doctors may need to form a professional corporation (PC).

You can have as many members as you want, but it’s best to keep the ownership small for better collaboration. Choose members you trust and can work well with.

To form an LLC, follow these steps:

1. Create a business plan (optional).

2. Name your business and ensure it’s unique.

3. Choose a registered agent.

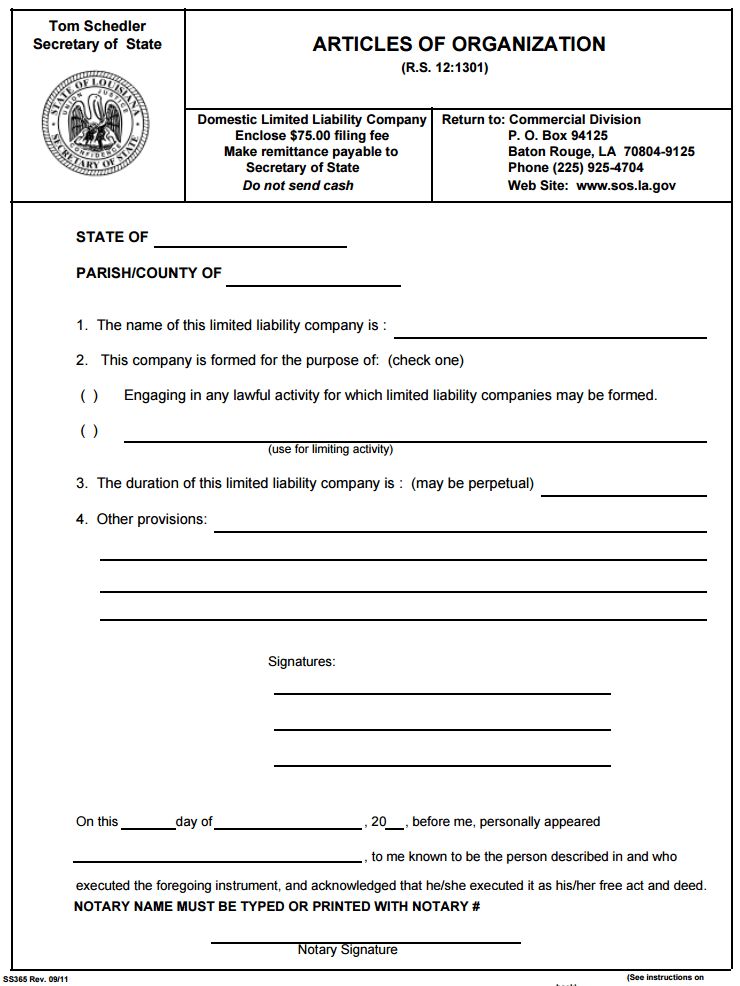

4. File your articles of organization with your state.

5. Write an operating agreement.

6. Comply with local requirements.

To manage your LLC, you can either have member management or manager management. In member management, all members are involved in decision-making and working in the business. In manager management, certain members or outside individuals are responsible for day-to-day management.

LLCs provide personal liability protection for business debts and claims, shielding your personal assets. However, you can still be personally liable for direct personal injury, personal guarantees, unpaid taxes, or intentional fraudulent or illegal acts. Keep your LLC separate from your personal affairs to maintain liability protection.

To separate your LLC from your personal life:

– Have an operating agreement.

– Bank separately.

– Fund your business adequately.

– Obtain a federal employer identification number (EIN).

– Be honest about your company’s finances.

Consider getting business insurance for added liability protection for both you and your LLC. While an LLC offers tax advantages, the LLC itself does not pay taxes. Each member is responsible for reporting their share of profits or losses on their personal tax returns.

When closing your LLC, pay off debts and fulfill obligations. Determine what will happen to business assets and notify creditors. File to dissolve the LLC with your state and divide remaining assets or profits among members.

Forming an LLC depends on your business goals and financial needs. Consider the specific liability issues related to your services. Lastly, decide whether to handle filing and paperwork on your own or seek assistance from a provider like LegalZoom.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!